- Shiba Memu is looking to dominate the meme coin sector with a pioneering AI-powered utility token.

- The concept behind this robot meme with a touch of AI genius is what could astound the legacy meme coins space.

- SHMU presale has raised more than $356k in less than a week.

Talk of meme coins today and what’s likely to pop up in front of you would be the latest Shiba Inu dog meme dubbed Shiba Memu (SHMU).

Granted, Dogecoin (DOGE) and Shiba Inu (SHIB) sit pretty in the upper deck of the market cap ranking, their status as top meme dogs not under immediate threat. But is there a hint of investor focus shifting to a new project that promises to bring the best of two technology worlds together in an explosive marketing powerhouse?

The SHMU presale, which can be accessed here, suggests this scenario could indeed surface.

What is Shiba Memu?

Today’s biggest trends are crypto and artificial intelligence (AI) – and raring to go amid the exuberance is Shiba Memu. So the question one might want to ask is ‘what is Shiba Memu?’

As briefly noted earlier, Shiba Memu is a new, revolutionary meme token that combines the power of blockchain and AI. While the meme token possesses all the attributes of memenomics, it comes loaded with “new tricks” that could see it become an unstoppable marketing powerhouse.

It will run on both ERC20 and Binance Smart Chain networks.

How does Shiba Memu work?

AI tools can do wonders when it comes to tapping into machine learning and natural language processing (NLP), the reason it’s such a hot topic even in the mainstream tech industry.

Shiba Memu taps into this to replace the human effort that traditional meme tokens employ to gain traction. Instead, the whitepaper outlines a self-sufficient marketing platform powered by the native SHMU token.

At the heart of all the marketing will be an AI dashboard accessible and visible to all token holders. It will use NLP and ML as well as sentiment analysis, predictive analytics, image and video recognition and personalization (think of how effective ads marketing has become and tinker with that using an AI-powered dog that’s capable of so much).

Some of the things the meme can achieve include creating marketing strategies, writing own PRs, and promoting itself over and over again. Leveraging AI means the project can outperform tabloid newspapers when it comes to getting content across for the purpose of attracting even more attention.

Other than churning “gazillions” of data and marketing details about the project, the robot meme dog will also monitor its own performance and adjust for optimized output. Engaging with users directly is another strategy of this project, the result of which could be increased visibility and trust in the token and potential uptick in specific demand for SHMU.

Shiba Memu presale

The roadmap for Shiba Memu includes the launch of the above-mentioned AI dashboard in Q1, 2024. The platform will also implement user engagement features such as feedback and integrate social media platforms to boost marketing.

Development of the project will continue throughout the first half of the year, with listing on major exchanges expected in Q3, 2024. These future developments are however preceded by a token presale that will see 85% of total supply of 1 billion SHMU available to early investors.

It’s barely a week into that presale and investors have allocated over $356k into the project, with more than 25.7 million SHMU grabbed. Investors know that participating in the presale is one of the ways to get hold of Shiba Memu at greatly discounted prices.

One major difference between the Shiba Memu presale and similar token sales is that this one is open-ended and is scheduled to last 8 weeks. During this time, SHMU’s price will increase every day at 6pm GMT.

The current presale price is $0.012475 and the next uptick will see it rise to $0.0127. It will double from here every time it increases until it reaches $0.0244.

How do you buy Shiba Memu tokens?

There’s only one way to buy SHMU during the presale – visit the project’s website. The project will go live on both the ERC20 and BSC networks. This means buying is available via ETH, USDT, BNB, and BUSD and one will need to have a supported wallet.

Currently, that’s MetaMask for desktop users and Trust Wallet when buying on a smartphone.

After the presale and when tokens go live, earning SHMU will be possible via providing liquidity on a DEX and get rewarded in transaction fees. Another way to get hands on more of these meme tokens would be through buying on exchanges or staking to earn rewards.

Do you want to know more about Shiba Memu? Click here.

Share this article

Categories

Tags

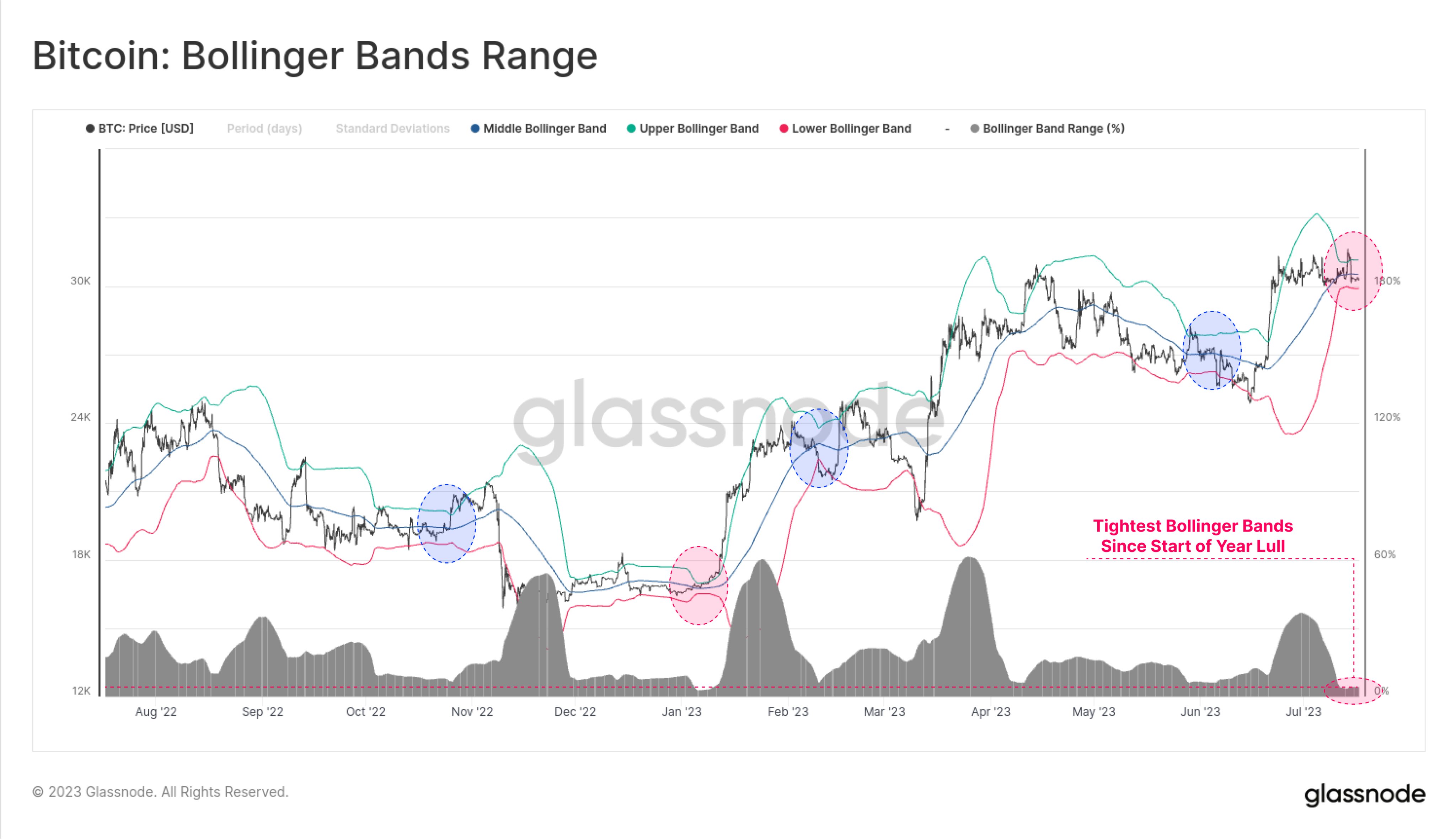

Bitcoin price Bollinger Bands range. Source: Glassnode on Twitter.

Bitcoin price Bollinger Bands range. Source: Glassnode on Twitter.