Key Takeaways

- Our Head of Research, Dan Ashmore, digs into Bitcoin’s relationship with stocks

- Correlation between Bitcoin and the Nasdaq is at its lowest point since 2018

- The Nasdaq is up 10% in the last month as stocks have surged off softer forecasts around interest rates and the macro climate

- Bitcoin is down 9% in the same time frame, the US regulatory crackdown spreading fear about crypto’s future in the country

- Ashmore writes that the break in correlation surpasses what was seen in November 2022 amid the FTX collapse, when Bitcoin fell to $15,000 while stocks increased off positive inflation readings

After ten consecutive interest rate hikes, the US Federal Reserve this week paused its rate hiking policy. The move was nearly unanimously anticipated by the market and movement after the meeting was relatively minimal.

However, over the past month, markets have been flying. The S&P 500 is up 6% in the last 30 days, now only 8.8% off an all-time high, despite being 27% below the mark in October. The Nasdaq is up 10% over the same timeframe – that is 15% below its all-time high from November 2021 but a tremendous resurgence considering it shed a third of its value in 2022.

And yet, something is being left behind: Bitcoin.

Bitcoin is now trading below $25,000 for the first time in three months. I put together a deep dive in March analysing the its underlying price movement to show how tightly it trades with the stock market. This was at a time when Bitcoin was rallying and banks were wobbling amid the Silicon Valley Bank fiasco. Suddenly, it was fashionable to declare Bitcoin as decoupling from the stock market. Ultimately, that wasn’t true. However, something very interesting has happened in the last month.

First, take a look at the path of the Nasdaq and Bitcoin since the start of 2022, which roughly coincides with the start of the bear market:

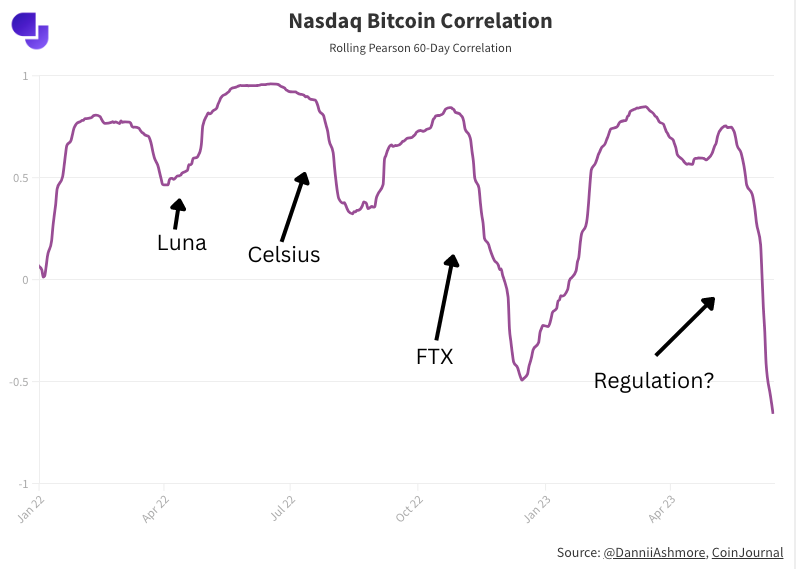

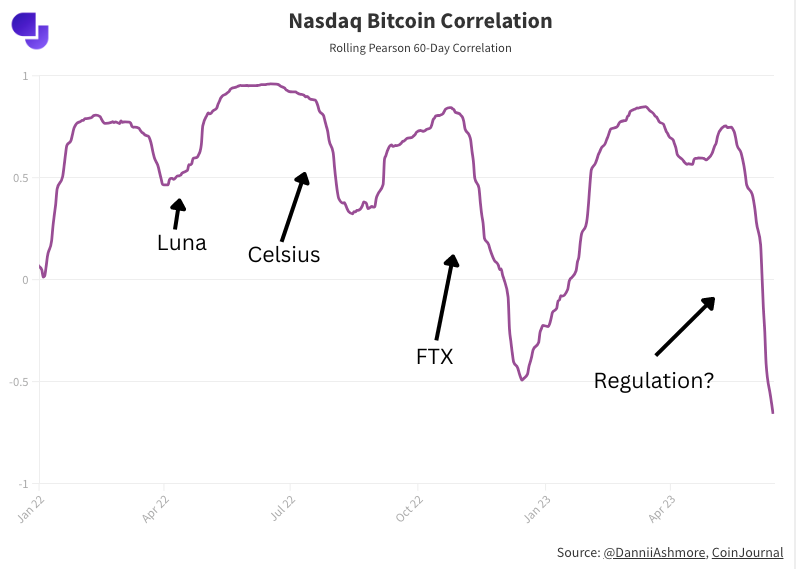

Clearly, the two have moved in lockstep. But two episodes jump out: the first is November 2022, when Bitcoin fell and the Nasdaq surged. The second is this past month. We discussed the 10% jump in the Nasdaq over the last month. However, Bitcoin has fallen 9% in the same timeframe. This marks a clear departure from what we would expect. Plotting the correlation (using 60-Day Pearson) shows this more directly:

I touched on November 2022 above, and the swift fall in correlation can be seen on the chart. This was when FTX collapsed, sending the crypto market into a tailspin. At the same time, however, stocks raced upwards as softer inflation numbers were met by lower expectations around the future path of interest rates.

There were also less dramatic (but equally temporary) decouplings between Bitcoin and stocks in April/May 2022 and June/July 2022. On the chart below, I have pencilled in incidents which occurred during these periods:

Indeed, what is different about November (FTX) and today is that we see a Bitcoin fall happening at the same time as a Nasdaq surge. While the Luna and Celsius incidents hurt crypto immensely, they came as stocks were also struggling and so the effect is not as dramatic in terms of correlation breaks (although is still tangible on the chart).

Indeed, what is different about November (FTX) and today is that we see a Bitcoin fall happening at the same time as a Nasdaq surge. While the Luna and Celsius incidents hurt crypto immensely, they came as stocks were also struggling and so the effect is not as dramatic in terms of correlation breaks (although is still tangible on the chart).

But today, we are seeing the biggest break in the correlation trend over the last couple of years – surpassing even FTX. The 60-Day Pearson currently sits at -0.66, whereas the lowest it hit during the FTX crisis was -0.49.

Regulatory crackdown is suppressing prices

The reason is obvious. The great regulatory crackdown in the US is freaking the market out, and for very good reason. The two biggest crypto companies on the planet, Binance and Coinbase, were both sued last week.

Crypto.com has suspended its institutional exchange, citing weak demand amid the regulatory woes. eToro and Robinhood pulled a bunch of tokens from their platforms following confirmation from the SEC that it viewed them as securities. Liquidity is dropping like a stone.

I wrote in-depth about the concern following the announcement of the Coinbase lawsuit last week, so I won’t rehash it here (that analysis is here). While I believe Bitcoin should be able to weather the storm long-term, the picture appears far murkier for other cryptocurrencies.

Make no mistake about it, the crypto industry faces a massive problem as long as lawmakers continue to turn the screw. The crisis very much feels existential for a lot of the crypto market.

Regarding Bitcoin, enthusiasts dream of a day when it can decouple and claim that title of uncorrelated hedge asset, or a store-of-value, akin to gold. I’ve done a lot of work around what that hypothetical future could look like, or what could lead the market to that point. But for now this remains just that: hypothetical. Because while the correlation is at its lowest point in five years, it is not being driven by fundamentals and thus will inevitably spike back up. This is nothing more than the market reacting to what is a very bearish development around regulation in the US.

It’s not how investors hoped a decoupling would come. But if anyone doubted the market’s fear over the regulatory woes, or questioned why Bitcoin had not fallen more, looking at the break in correlation paints a very clear picture of how detrimental Gary Gensler’s games have been to the cryptocurrency industry.

In truth, it is not hyperbole to say that this is the most out of whack Bitcoin’s correlation has ever been whilst trading as a mainstream financial asset. Because back when it last happened in 2018, Bitcoin traded with such thin liquidity that its price action is largely irrelevant to draw conclusions from going forward.

Share this article

Categories

Tags

Indeed, what is different about November (FTX) and today is that we see a Bitcoin fall happening at the same time as a Nasdaq surge. While the Luna and Celsius incidents hurt crypto immensely, they came as stocks were also struggling and so the effect is not as dramatic in terms of correlation breaks (although is still tangible on the chart).

Indeed, what is different about November (FTX) and today is that we see a Bitcoin fall happening at the same time as a Nasdaq surge. While the Luna and Celsius incidents hurt crypto immensely, they came as stocks were also struggling and so the effect is not as dramatic in terms of correlation breaks (although is still tangible on the chart).