Key Takeaways

- Bitcoin has been through many bear markets before, always surging back to higher highs

- Dan Ashmore, our Head of Research, cautions against naive extrapolation of past returns, however

- Until this past year, stock markets had done nothing but rise during Bitcoin’s existence

- Bitcoin was launched in 2009 as the stock markets bottomed, and the bull run afterward was one of the longest in history

- This needs to be considered, cautions Ashmore, whilst sample size of Bitcoin trading with any sort of liquidity is also small

Bitcoin is volatile. Also true: water is wet and the sky is blue.

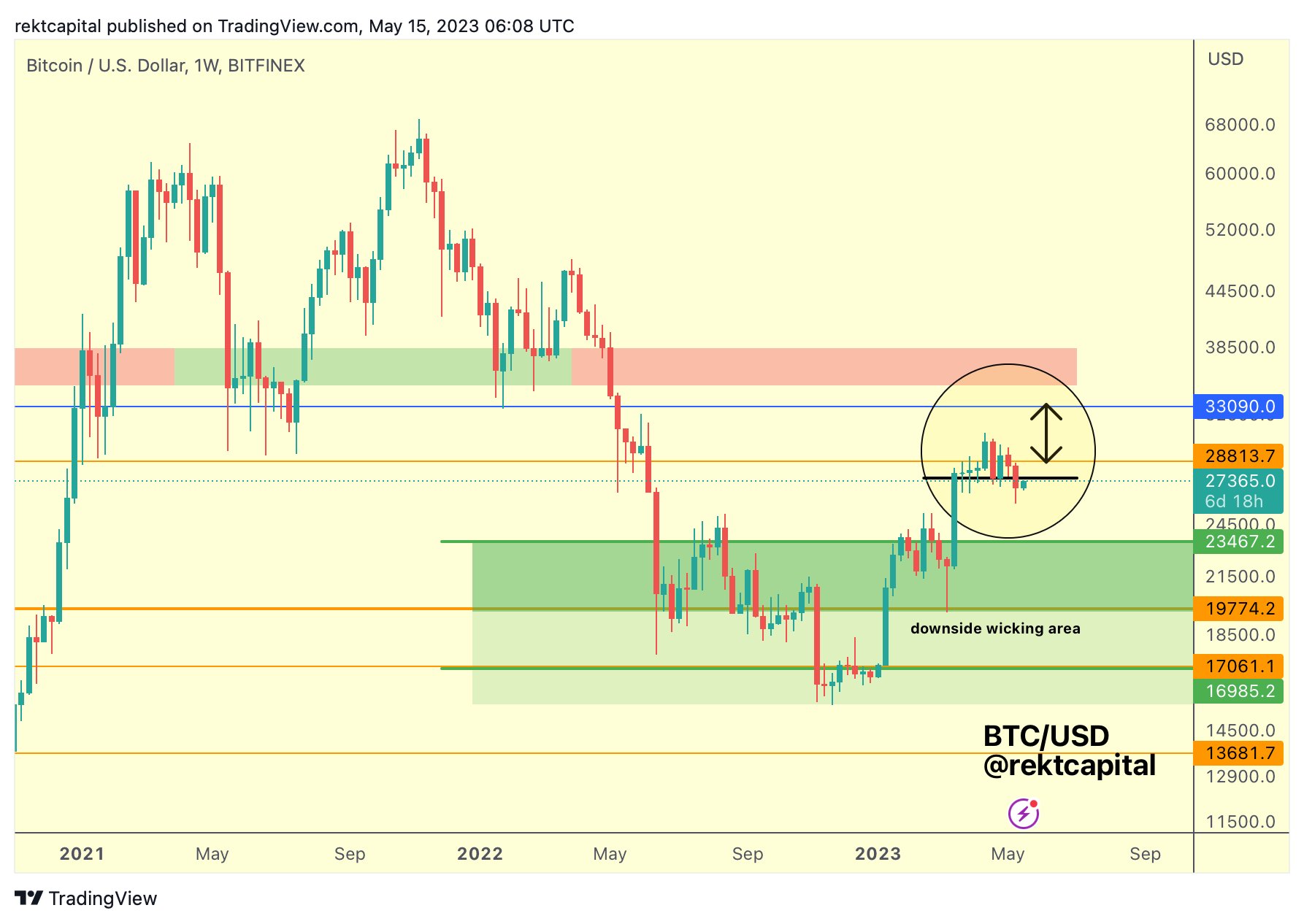

A quick glance at a Bitcoin chart will tell you all you need to know about the meteoric rises and bone crushing pullbacks that the asset has produced over the years. In truth, it should be plotted on a scale, too.

When looking at Bitcoin markets, therefore, it is tempting to jump to the conclusion that “we have been here before”. Bull markets and bear markets, easy come and easy go. Or, as Jeff Bridges put it so poetically in the Big Lebowski, “strikes and gutters, ups and downs”.

While Bitcoin has drawn down many times before and, at least previously, always bounced back, I believe it is naive to extrapolate past resurgences into the present. Because no, we have not been here before.

To be clear, I am not saying Bitcoin will not rise to new heights again. It easily could (I hold Bitcoin as part of my portfolio, albeit via a monitored allocation and obeying the boring all adages of diversification and risk management, but hey – that is for another time). My point, however, is that we have zero point of reference for the current situation. Despite a surge of 75% in the last six months, Bitcoin is 60% off its high in Q4 of 2021, with many investors underwater if they opened positions in the past three years as Bitcoin truly established itself on the mainstream stage.

Let me explain why things are different this time around, and why assuming with blind confidence that Bitcoin will surge upward imminently may be misguided. First, the below are the biggest peak-to-trough drawdowns in Bitcoin history (the recent/current one is highlighted in yellow):

Clearly, Bitcoin has been here before. Right?

Well, no it hasn’t. Look at the dates of the above: all these drawdowns are from 2012 onwards. This is because Bitcoin was only launched in 2009. Indeed, it didn’t really have any sort of liquidity or infrastructure (such as exchanges or a marketplace) until 2012 (and even then, liquidity was extremely thin).

And consider what has happened in the wider economy since Bitcoin was launched in 2009. On March 9th 2009, two months after Bitcoin launched, the Nasdaq hit a low of 1268. The S&P 500 did the same, hitting a nadir of 676.

Since then, markets have enjoyed one of the most remarkable, longest and explosive bull runs in recent history, as basement-level interest rates propelled asset prices to dizzying all-time highs. By late 2021 at their peaks, the Nasdaq hit a level of 16,057, the S&P 500 4,793. Since those aforementioned lows in March 2009, that represents returns of 12.7X and 7.1X respectively. A historic period of gains.

Presenting the returns of both the Nasdaq and S&P 500 since Bitcoin was launched in January 2009 (note – this goes back a couple of months before the trough of the stock market in March of that year and hence the returns are not as empathic as above) shows the run in markets visually throughout Bitcoin’s life:

Or perhaps the next chart is better, showing quite how boisterous the stock market throughout Bitcoin’s life during the period up to and including 2021.

Therefore, every single dip in Bitcoin’s history took place whilst the wider financial markets were humming along swimmingly. This all changed in 2022, of course, when inflation spiralled and the world’s central banks began hiking rates at the fastest rate in recent memory.

Suddenly, for the first time in Bitcoin’s existence, it was ticking along block-by-block while financial markets elsewhere were falling. And they were falling quickly, the S&P 500 shedding nearly 20% in 2022, the Nasdaq losing over a third of its value. Not only were these losses the worst of any period in Bitcoin’s life, they were, aside from minor falls in 2011 and 2018, the only losses it had ever seen.

Therefore, this time is different. Blind faith in Bitcoin bouncing back aggressively because of the simple conclusion that it has done so before is a dangerous assumption to make. Again, Bitcoin could easily do exactly this, but it would be foolish to assume it is a guarantee because it has happened in the past.

The reality is that, until this past year, the world had no idea how Bitcoin would trade outside of the zero-interest rate vacuum that we have been operating in for the past decade. There is no trade history for Bitcoin going back to previous recessions, no chart one can pull up to assess how it weathered inflation in the 1970s, no reference point to anything but a stock market printing green candle after green candle.

Not only did all those previous resurgences come amid a period of cheap money and expanding central bank balance sheets, but Bitcoin markets were also incredibly illiquid. It took barely a drop of capital to move prices, as Bitcoin exploded from a fraction of a cent to thousands of dollars per coin. Bitcoin’s existence has been brief itself, at 14 years, but its status as a financial asset of any sort of liquidity is even briefer again.

So, for one last time: this is not a piece making any forecasts about the future of Bitcoin. I don’t want to wade into such murky waters (not here, anyway!). Rather, it is a piece cautioning that we have such a small sample size to work with when it comes to Bitcoin, and it is important to be cognisant of that when assessing how it trades.

Bitcoin has never experienced a bear market in the wider economy before. Until now. Overlooking that critical fact is a dangerous game to play.

Share this article

Categories

Tags

HOW

HOW