Author: BTCLFGTEAM

-

Bitcoin on-chain metrics are now bullish: Bitfinex

- Bitfinex market report points to bullish metrics for BTC

- Supply in Profit, Bitcoin Realised HODL (RHODL) Multiple and Reserve Risk ratio are all flashing green.

- Bitcoin has traded to above $23k again after slipping on Monday following broader market reaction to economic news.

Bitcoin is trading around $23,360 at the time of writing, about 2.4% up in the past 24 hours as cryptocurrencies flash green on Tuesday amid an improving market sentiment.

For the world’s leading cryptocurrency by market cap, it appears on-chain metrics are ticking further north to suggest a strengthening bullish case.

Supply in Profit up 20%, points to buy signal

According to analysts at Bitfinex, one of Bitcoin’s on-chain metrics suggesting fresh upside momentum is likely the Supply in Profit indicator. Data shows bulls look to have successfully absorbed selling pressure as short-term and some long-term HODLers turn profitable.

An observation of the metric on the 90-day time frame highlights a 20% jump for the “supply in profit” chart in January 2023, the analysts wrote in the report released on Monday.

“This implies that larger and longer-term investors currently hold profitable on-paper spot positions. This is healthy for the latter half of a bear market as a sustained 30-day uptrend after an extensive downtrend on this indicator has historically provided a good buy signal for the following two years,” the Bitfinex team noted.

As far as markets are concerned, the above scenario doesn’t mean that the crypto market is set for an “up-only” move. However, the outlook does suggest bulls have an upper hand in the spot markets, a scenario that’s historically reflective of “late bear and early bull markets.”

The Bitcoin Realised HODL (RHODL) Multiple, historically also bullish, has also been in an uptrend. According to data, the RHODL Multiple has remained positive over a 90-day window, to also suggest profitability for HODLers.

#Bitcoin balance statistics now favour the HODLers! 🙌

On-chain metrics are flipping bullish as we see profitable selling by both short-term & long-term HODLers.

Dive into the details in our latest Bitfinex Alpha:https://t.co/aBJ2teTpVM pic.twitter.com/lBvlb4o43A— Bitfinex (@bitfinex) February 6, 2023

Key metrics suggest a 10x jump for BTC price

Apart from the 90-day EMA, other technical indicators flipping green include the net adjusted Spent Output Profit Ratio. Per on-chain data, the indicator is currently above one, which suggests that net sales across the Bitcoin market are profitable.

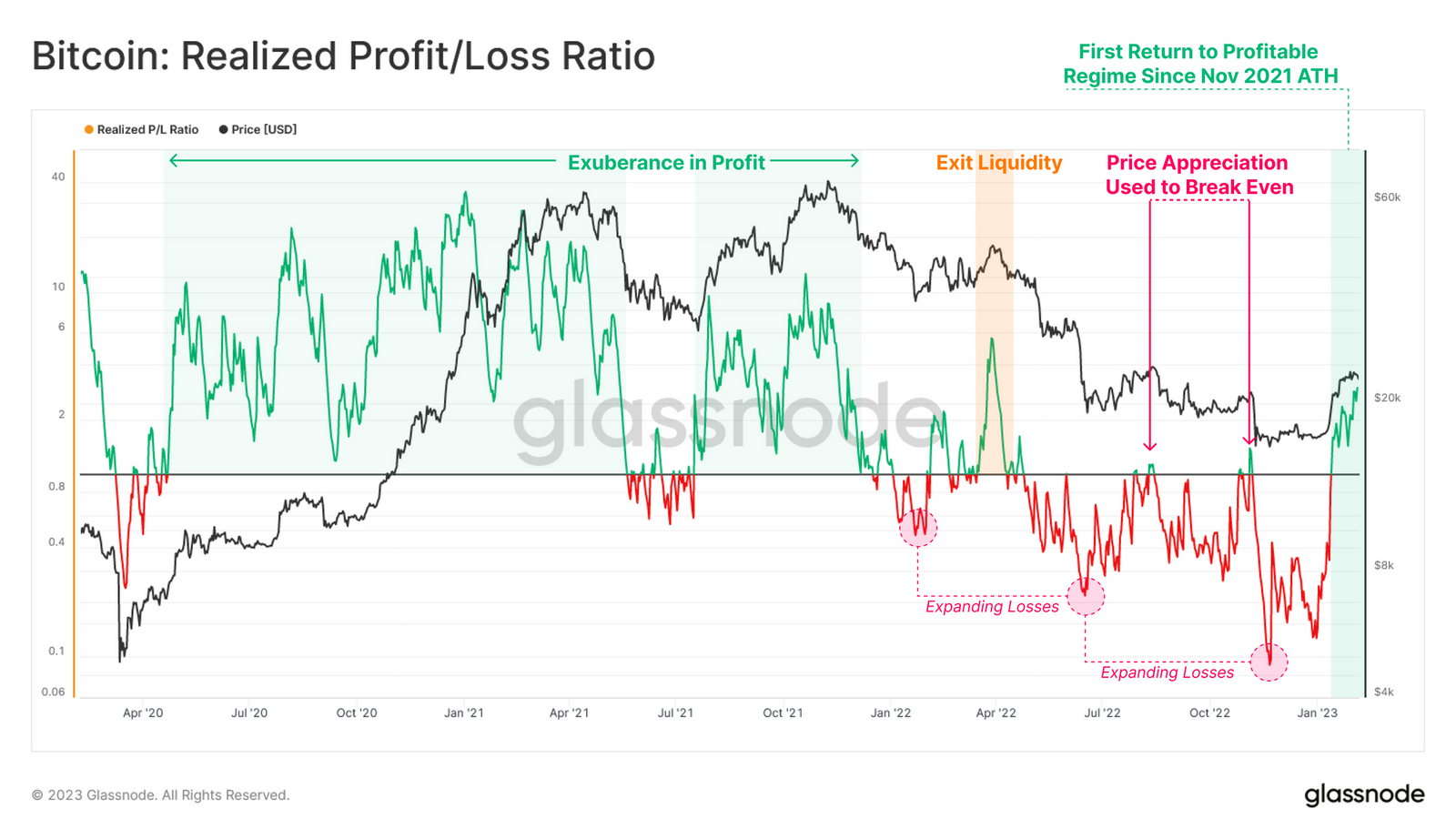

Also, the Realised Profit to Losses (RPLR) ratio is above zero, which also confirms the profitable selling observed in past few weeks. The metric is currently moving towards 0.2, a reading comparable to the RPLR measure when Bitcoin price fell to lows of $3,600 in 2019. After the RPLR hit 0.2, BTC price flipped green and rallied 19x, hitting its all-time high in November 2021.

Bitcoin Realized Profit Loss Ratio chart by Glassnode

Bitcoin Realized Profit Loss Ratio chart by GlassnodeWith the metric approaching this ratio when Bitcoin fell to lows of $16,000, the possibility of another 10x rally could see BTC target highs of $160,000 over the next two-three years.

Bitcoin’s reserve risk ratio suggests HODLer conviction is high

Looking at a longer time frame, Bitcoin’s on-chain metrics are also pointing to a bullish outlook. One odf these technical indicators is the Reserve Risk ratio.

According to on-chain analytics platform Glassnode, Bitcoin’s reserve risk ratio has fallen to its all-time low. This puts the metric lower than when markets bottomed in 2019 or 2020, Bitfinex analysts pointed out.

As the ratio is a cyclical oscillator that highlights price vs. HODLer conviction, with incentive to sell factored against opportunity cost, a very low ratio translates to a higher conviction among investors.

A positive outlook for Bitcoin is also seen in the Market Value Realised Value (MVRV) ratio, which has recovered and has often coincided with historically bullish returns.