Author: BTCLFGTEAM

-

pattern points to a comeback

-

Bitcoin price has retreated after the Fed decision.

-

The Fed decided to hike rates by 50 basis points.

-

The inverted head & shoulders pattern points to more upside.

Bitcoin price pulled back on Thursday as the market reflected on the latest interest rate decision by the Federal Reserve. After soaring to $18,378 on Wednesday, Bitcoin retreated by 4% to $17,673. It is still substantially higher than the year-to-date low of $15,470.

Central banks downshift

The BTC/USD, BTC/GBP, and BTC/EUR prices declined slightly after central banks started to downshift their policies. On Wednesday, the Federal Reserve decided to hike interest rates by 0.50%, which was lower than the last four hikes of 0.75%.

And on Thursday, other influential central banks decided to lower the size of their rate increases. In the UK, the Bank of England (BoE) decided to hike rates by 0.50%, which was lower than the previous increase of 0.75%. The same happened in the European Union, where the European Central Bank (ECB) increased by 0.50%.

Federal Reserve decision

Bitcoin’s main catalyst was the Fed statement. In it, the bank sounded more hawkish and hinted that it will continue hiking in 2023. Precisely, it guided that it will deliver another 0.75% hike in 2023 before hitting a pause.

As such, it will likely hike interest rates by 0.50% in February following another 0.25% in March. Alternatively, it could deliver three 25 basis point increases, as we wrote in this article.

Still, I believe that the Fed was concerned about the falling bond yields and the signal they were sending. In the past few weeks, bond yields and mortgage rates have been falling. As such, the trend could spur more inflation in the coming months.

Bitcoin also reacted to the latest outflows from key exchanges, which is a signal that many investors are afraid of the industry. This is confirmed by the fear and greed index, which has dropped to 24. Binance has seen outflows worth $5.2 billion in the past 7 days.

Bitcoin price prediction

The 4H chart shows that the BTC price formed a bearish engulfing pattern on Wednesday. In price action analysis, this pattern is usually a bearish sign. A closer look shows that the coin formed an inverted head and shoulders pattern. The neckline of this pattern is at $17,437.

Therefore, I suspect that Bitcoin will form a break-and-retest pattern, which is a bullish sign. If this happens, it will likely resume the bullish trend as investors digest the latest decision. A such, the coin will likely rise to a high of $19,000.

How to buy Bitcoin

eToro

eToro offers a wide range of cryptos, such as Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro users can connect with, learn from, and copy or get copied by other users.

Bitstamp

Bitstamp is a leading cryptocurrency exchange which offers trading in fiat currencies or popular cryptocurrencies.

Bitstamp is a fully regulated company which offers users an intuitive interface, a high degree of security for your digital assets, excellent customer support and multiple withdrawal methods.

-

-

Why has the Grayscale Bitcoin Trust discount hit an all-time high?

Key Takeaways

- Grayscale is the largest Bitcoin fund in the world

- Discount to underlying asset (Bitcoin) has reached record levels, breaching 50%

- Concern about reserves, higher fees and other hurdles explain the discount, which likely won’t close anytime soon

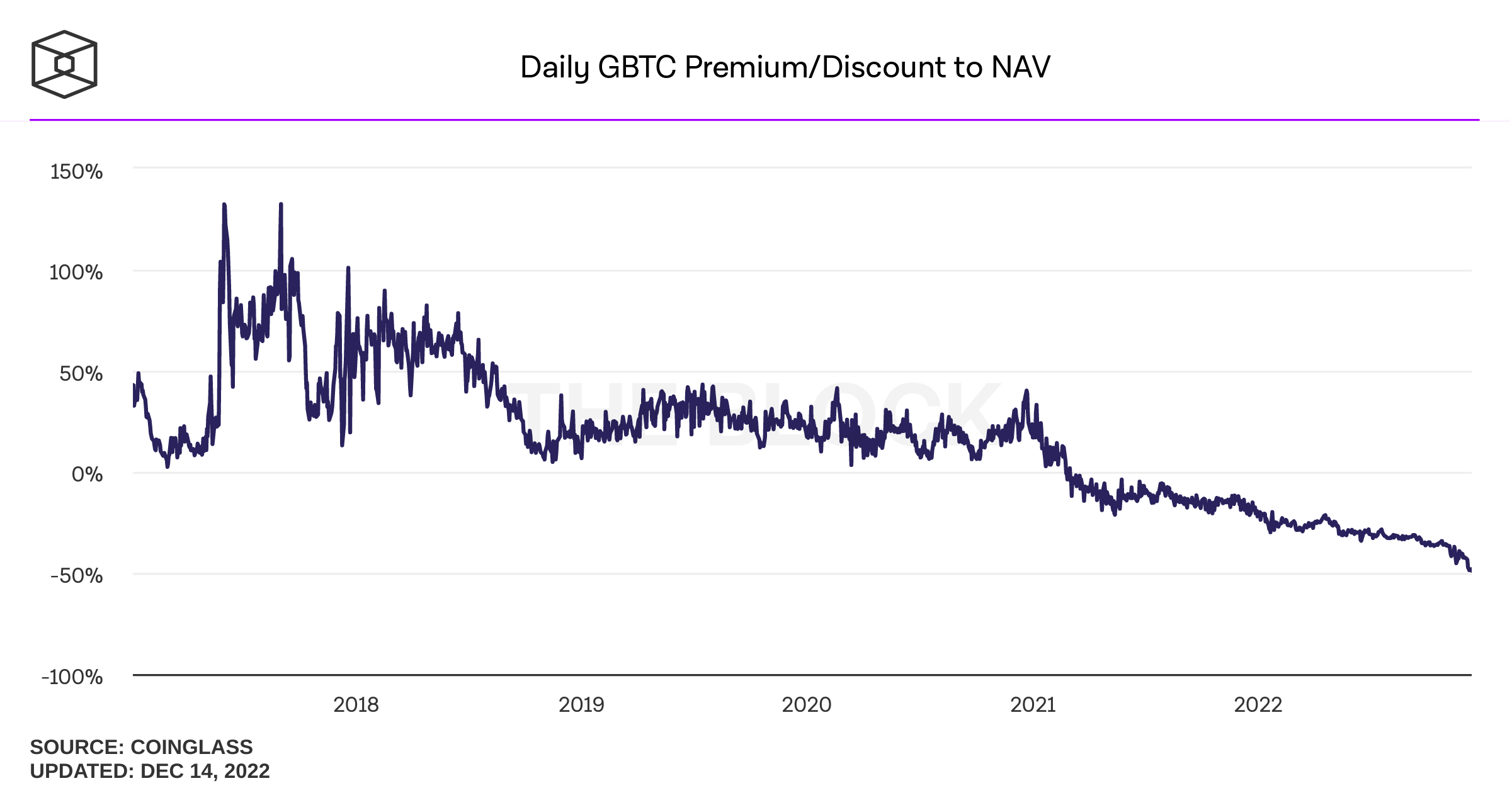

The discount to net asset value of the Grayscale Bitcoin trust is at all-time highs. The discount briefly pushed past 50%, before pulling back slightly to where it currently sits at 48.8%.

This comes off the back of the SEC reaffirming its reasons for denying Grayscale’s application to convert the trust into an exchange-traded fund.

The Grayscale Bitcoin Trust is the largest Bitcoin fund in the world, but it has rarely traded at the same level as its underlying asset, Bitcoin. The above chart shows that it had, until this year, traded at a premium since its launch compared to Bitcoin.

This fund allows accredited investors to gain exposure to Bitcoin without worrying about storing or managing their holdings. It previously traded at a premium as demand for shares surged, with institutions wanting Bitcoin exposure. This convenience does come at a fee, however – and a rather hefty one at 2%.

Demand falls for Grayscale in 2022

Since March, the Grayscale shares have been trading at a discount to Bitcoin. The fund has $10.7 billion in assets under management, a stark 65% fall in the last year, reflecting the bloodbath in the crypto markets.

But the discount to Bitcoin means shareholders are getting hit twice as hard.

“The fact that Grayscale’s Bitcoin Trust is now trading at nearly 50% discount is just awful for holders of GBTC. It really highlights the vast differences in structure quality between different investment vehicles,” Bradley Duke, co-CEO at ETC Group, told CoinDesk last week.

A decline in inflows has been borne out of greater competition as many competitive funds have launched, especially in Europe, as well as multiple filings for Bitcoin ETFs in the US. The discount is also because investors have no way to redeem their holdings for Bitcoin in the trust, but all the while are being charged a 2% fee.

However, these factors have typically been dulled by arbitrage traders taking advantage of the dichotomy in prices. But happenings this year have reduced that, too.

Concern about Grayscale’s reserves

Over the last month, concern has swelled in the market that Grayscale’s parent company, Digital Currency Group (DCG) may file for bankruptcy. This is due to the issues surrounding crypto broker Genesis, whose parent company is also DCG.

Genesis have denied they will imminently file for bankruptcy, but the firm was caught up in the FTX collapse and is currently undergoing restructuring. Genesis halted withdrawals on November 15th.

This concern has been elevated by questions around Grayscale’s reserves. Namely, whether they are true to their word and are holding all the underlying Bitcoin securely. With many major crypto companies publishing proof of reserves in the aftermath of the FTX crisis in order to assuage customer fear, Gray scale refused.

“Due to security concerns, we do not make such on-chain wallet information and confirmation data publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure,” Grayscale wrote in a statement.

7) We know the preceding point in particular will be a disappointment to some, but panic sparked by others is not a good enough reason to circumvent complex security arrangements that have kept our investors’ assets safe for years.

— Grayscale (@Grayscale) November 18, 2022

As I wrote at the time, I really can’t fathom how security concerns are a factor here. The blockchain is built so that this kind of information is available to the public.

Below is really confusing from @Grayscale

Would love elaboration beyond just “security”

Does anyone have suggestions as to how revealing on chain wallet could be a security concern?

Only thing I can think of is quantum concerns (p2pk) but I don’t think that holds here? https://t.co/0QcVO6wV1x

— Dan Ashmore (@DanniiAshmore) November 19, 2022

Final thoughts

All in all, the discount sums up investors’ concern around Grayscale, as well as the extra fees and other hurdles which exist compared to owning the underlying. Arbitrage trades are self-destructive by nature, and hence it is notable that the discount is so large and has persisted for so long.

Then again, there is risk here, as the same thing which I have been writing about for a while now – a lack of transparency – means that it cannot be known for 100% certainty what is going on behind the scenes. And that is why we are seeing a 50% discount.

-

Bitcoin retreats below $18k as Fed raises interest rate to a 15-year high

-

Bitcoin has dropped below the $18k once again following its rally earlier this week.

-

The Federal Reserve raised interest rates by half a point a few hours ago.

-

The total crypto market cap continues to stay above $800 billion.

Federal Reserve raises interest rate once again

The Federal Reserve announced on Wednesday that it had raised its benchmark interest rate to the highest level in 15 years. Thus, indicating that the fight against inflation in the United States is not over.

The interest rate was increased by half a point, taking it to a targeted range between 4.25% and 4.5%. This latest cryptocurrency news put a halt to Bitcoin’s recent rally. The leading cryptocurrency is down by less than 1% in the last 24 hours and is now trading below $18k. At press time, the price of Bitcoin stands at $17,737.

The broader crypto market has also been underperforming, having lost more than 1% of its value in the last 24 hours. The total cryptocurrency market cap now stands at around $860 billion.

Key levels to watch

The BTC/USD 4-hour chart remains bullish despite Bitcoin underperforming over the past 24 hours. In the last seven days, BTC has added more than 5% to its value.

The MACD line remains above the neutral zone, indicating that the bulls have not given up control of the Bitcoin market. The 14-day relative strength index of 54 also shows that Bitcoin has not yet entered the oversold region.

If the bears gain bigger control, Bitcoin could decline below the $17,090 support level over the next few hours. However, the bulls still maintain a level of control, and BTC could recover from this slight dip. If that happens, BTC could be trading above $18k soon again.

Where to buy Bitcoin now

eToro

eToro offers a wide range of cryptos, such as Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro users can connect with, learn from, and copy or get copied by other users.

Bitstamp

Bitstamp is a leading cryptocurrency exchange which offers trading in fiat currencies or popular cryptocurrencies.

Bitstamp is a fully regulated company which offers users an intuitive interface, a high degree of security for your digital assets, excellent customer support and multiple withdrawal methods.

-

-

JP Morgan reports shows 13% of Americans are into crypto

- JP Morgan has released a new report showing that more than 13% of the American population have transferred funds into crypto accounts.

- The research sampled 5 million customers with checking accounts, 600,000 of whom had transferred money into a crypto account.

- Most new investors first fund a crypto account during spikes for Bitcoin price, according to the report.

Nearly 44 million Americans have ever transferred money into a crypto-related account, according to details shared in a new report by JP Morgan.

In a report titled ‘The Dynamics and Demographics of US Household Crypto-Asset Use’, released on 13 December, the financial giant estimates that about 13% of the population has sent money to a crypto account. Per the bank’s data, involvement in crypto by the general population spiked during the COVID-19 pandemic, with more money finding its way into cryptocurrency investments as individuals’ personal savings also increased.

The report covered close to 5 million active checking account users, more than 600,000 of whom were shown to have transferred funds to crypto accounts.

Transfers to crypto accounts tripled between 2020 and 2022

Cryptocurrency adoption across the United States has been steady, with other statistics suggesting similar adoption rates to what’s contained in this latest report.

While JP Morgan says that only a tiny fraction of the US population was in crypto five years ago, its researchers found that the last three years have witnessed a huge jump in adoption. From the sample indicated, the banking giant estimated that crypto users in the US increased from a pre-pandemic population share of less than 3% to almost 15% by mid-2022.

Of those to fund crypto accounts from their checking accounts, the research data shows a 300% spike. Cumulatively, only 3% of the population had transferred funds into a digital asset-related account prior to the pandemic.

That figure more than tripled in the last three years, with the trend seeing more than 43 million Americans, or 13% of the population funding crypto accounts.

New investors increase when Bitcoin price spikes

Another observation from the research is that funding of crypto accounts is that the transfers have largely come at a time when the price of Bitcoin is going up. Large volumes occur during bull markets or sharp rallies, with the trend going back to 2015, JP Morgan said.

For most new users, the deposits span a few days and have coincided with the price of bitcoin seeing a trailing monthly change of +25%. It is this time that many people look to trade Bitcoin and other cryptocurrencies.

Also observable is that most investors only make small transfers to their crypto accounts – less than a month’s pay. Indeed, the median transfer for the majority of investors is $620. Nonetheless, about 15% of individuals transfer more than a month’s worth of income. The share is even higher among high-income individuals.