To doxx (oneself) or not to doxx? That is a question faced by many operating in the cryptocurrency and blockchain space, including developers, influencers, and investors. Does one use one’s own name when venturing into the often chaotic and largely unregulated crypto world — or don an alias?

Consider Embrik Børresen, developer of RobinHood Inu — a reflection token that was launched in February. Like many crypto and blockchain founders, he considered using a nom de guerre when starting out. But Børresen, 22, raised in a small town, had also served in the Norwegian military where he says he learned some lessons about the value of trust.

So, when it came time to launch his new coin project, he opted to use his real name. “For me, it is the moral thing — to present yourself as who you are,” he tells Magazine. Many of his peers disagree, however. “Pseudo-anonymity has been a fixture of the internet since it began, and I believe it will remain this way,” Ghostbro, a Generation Z developer for the DogeBonk project, tells Magazine. For Ghostbro (a pseudonym), revealing their true identity — or “doxxing” themselves — makes little sense.

“It would essentially put a target on my back to people who might have lost money trading DogeBonk, or wish to steal from me either online or by actually coming to my house and threatening me or my loved ones.”

They have already received threatening messages, they tell Magazine, and have been subject to some “extremely obsessive behavior from people who genuinely ‘hate’ our cryptocurrency.” They’re in no rush to make themselves “a flesh and blood figurehead these people can mess with.”

It is a debate that has been going on in at least some form since crypto’s beginning: To what extent does one really need to reveal one’s personal identity in a decentralized world? After all, one’s transactions are already on display in the form of a public key for any and all to see. Does one really need to put a bullseye on one’s chest, too? Moreover, aren’t assumed names a part of the crypto ethos going back to Bitcoin inventor Satoshi Nakamoto — who assumed an alias that has never been penetrated?

Has it gone too far?

It may seem that pseudonymity just comes with the turf in the cryptoverse. How many “influencers” on Crypto Twitter use assumed names — e.g., PlanB, Cobie, The Crypto Dog, Rekt Capital? Twitter personality Cobie is actually on their second handle — until 2021, they went as Crypto Cobain.

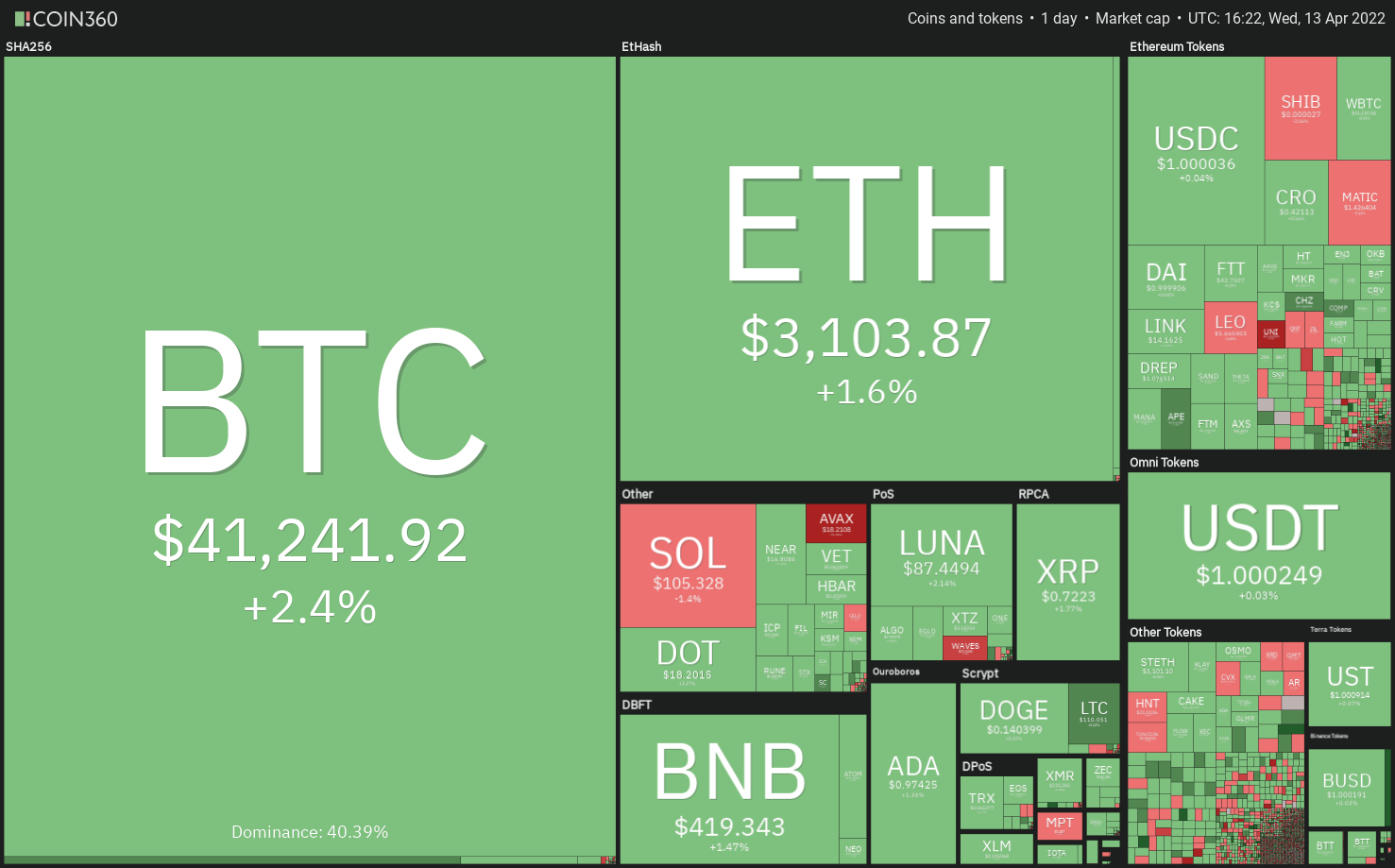

But pseudonymity arguably has some social and economic costs. It can provide cover to “rug pullers,” fraudsters, money launderers and other less-than-trustworthy types. This was nakedly displayed in the recent Wonderland saga where it was revealed that one of the founders of that DeFi protocol, going by the alias Sifu, was actually Michael Patryn, a convicted felon and co-founder of QuadrigaCX, the Canadian crypto exchange, whose collapse under murky circumstances led to a loss of $169 million in user funds.

While the crypto space today has become safer and more user-friendly as it approaches mainstream acceptance, many still believe that anonymous scammers run rampant.

1/ This needs to be shared @0xSifu is the Co-founder of QuadrigaCX, Michael Patryn. If you are unfamiliar that is the Canadian exchange that collapsed in 2019 after the founder Gerald Cotten disappeared with $169m

I have confirmed this with Daniele over messages. pic.twitter.com/qSfWNnQPhr

— zachxbt (@zachxbt) January 27, 2022

“This pseudonymous stuff is so dangerous,” Brian Nguyen, a crypto entrepreneur who lost $470,000 in what might have been a crypto “rug pull,” told CNBC.com. “They could be a good actor today, but they could turn bad in two or three years.”

It makes one wonder what they’re hiding from.

Maybe it’s time then to rethink this pseudo-anonymity thing? “If we want crypto to be taken seriously as a community, then we must start unveiling identities,” Hadar Jabotinsky, a research fellow at the Hadar Jabotinsky Center for Interdisciplinary Research of Financial Markets, Crises and Technology, tells Magazine. It is important because this remains a new, unregulated market, Jabotinsky continues. “It’s based on trust, but it is subject to rumors — so, it’s beneficial to use real names.”

Failure to supply one’s true name is traditionally a cause for suspicion, and it remains so still in many quarters. “If people must be anonymous, it makes one wonder what they’re hiding from,” University of Texas finance professor John Griffin tells Magazine. Meanwhile, Børresen adds, “If someone asks about a person, and they are unable or unwilling to answer, a lot of the time, that indicates some murkiness in what is being presented, even if it is not an outright scam.”

Yes, some project founders choose anonymity to further their fraudulent activities, acknowledges Amy Wu, a well-known venture capitalist who was recently named to head FTX Ventures — a $2-billion VC fund to invest in Web3 projects — tells Magazine, but “this is a tiny percentage of crypto founders.” Still, when they succeed — i.e., execute a scam or rug pull — “it tends to anger many inside as well as outside the community,” she says.

And then what is one to make of the Wonderland fiasco? A serial scammer who had served 18 months in a federal prison for credit card fraud, Patryn (Sifu) was serving as Wonderland’s treasurer. “The lesson is you have to assume the worst,” Aaron Lammer, DeFi specialist at Radkl, tells Magazine.

“Even if most people are well-intentioned in their anonymity, you may be masking a very bad actor.”

Part of the ethos

Asked why many crypto influencers, traders and developers post anonymously on Twitter and other social media, Lammer answers that each has their “distinct” rationale. “For developers and project founders, anonymity can be a shield against regulatory uncertainty. For traders and influencers, there may be security risks. Anonymity is part of the ethos of crypto culture, and I don’t necessarily think that people need to justify it.”

Still, as more institutional investors enter the crypto space and the deals get bigger, anonymity — if not pseudonymity — may lose some of its attractiveness. If one seeks to raise financing from a venture capital firm, it probably wouldn’t help if you go by the handle “Loves2party420,” Justin Hartzman, CEO and co-founder of Toronto-based cryptocurrency exchange CoinSmart, tells Magazine, adding:

“If you are running a multi-million-dollar protocol, it’s not wise to remain anonymous. You need to be visible to ensure that you won’t suddenly rug-pull and get away with it.”

A lot of VC firms won’t invest in a project if the founder remains anonymous, adds Wu, but there are situations where the founder chooses to be publicly anonymous — maybe to keep with the Web3’s spirit of egalitarianism — but the founder is still known by name by those within the more narrow investing community, including the enabling VC firm.

Losing credibility?

Is it even right to assume that one loses credibility when adopting an alias? Can’t one build a trustworthy brand around a nom de plume? Did it do lasting harm to Eric Blair (George Orwell), Samuel Clemens (Mark Twain), Mary Anne Evans (George Eliot), or Theodore Geisel (Dr. Seuss), to name a few? “When people’s line of work becomes wrapped up in a pseudonym, then maintaining credibility there becomes just as important as maintaining credibility with their real name,” says Ghostbro.

Moreover, in the internet age, people’s behavior isn’t always exemplary, particularly online. “The majority of my adult [survey] participants use pseudonyms on social media to avoid scorn from those who might deem their behavior ‘unacceptable,’ both within and outside of fan communities,” notes social media researcher Ysabel Gerrard.

And if pseudonyms help to promote a more democratic spirit, is that necessarily a bad thing? Decentralized project founders often want to downplay their roles, Wu tells Magazine, “They don’t want to let their personality get in the way of the community.” They often prefer to be seen as just another member in a dynamic, new community, and to this end, a pseudonym can help.

“You can still build up a reputation without revealing your identity,” Samson Mow, CEO of Pixelmatic and formerly chief strategy officer of Blockstream, tells Magazine, continuing, “and you can also accomplish and have a great impact on the world, as Satoshi Nakamoto demonstrated. Ideas and code are more important than a name and face.”

Allowed to repeat the same fraud?

On the other hand, it’s difficult to deny that some scam artists are able to hide behind anonymity in order to “repeat the same or different scams repeatedly,” Griffin adds. “A ton of this goes on in crypto.”

Meanwhile, Jabotinsky, who has studied financial failures in traditional markets, adds that anonymity can lead to all manner of market failures, given the asymmetricity of information in the crypto world. It facilitates pump-and-dump schemes, for instance, and other sorts of manipulation.

Then, too, scale matters when playing around with avatars and the like. “When you are at a certain level” — with a corporate treasury holding $1 billion, say — “it is important for you to be visible for people to know exactly who they are dealing with,” says Hartzman.

Still, viewed objectively, the amount of fraud in the crypto world is really quite small, Wu notes, and the number of really big projects — unicorns that have reached $1 billion in market value — while growing fast, are still relatively rare. These circumstances don’t really describe the everyday reality of most projects where pseudonymity might bring useful benefits for the everyday developer or founder, as well as influencers and investors.

Dealing with complaints is tiresome, after all, and investors have been known to lash out when startups falter or fail. “If you are a protocol creator working 20 hours a day, do you really want to waste time and energy dealing with these complaints and, possibly worse, death threats?” asks Hartzman.

Depending on one’s line of work, anonymity could be a wise choice, Hartzman adds. Case in point is Zachxbt, the alias of the investigator who exposed the Sifu–Wonderland deception. “A figure like that probably gets [serious] death threats,” said Hartzman. “Being anon can be a matter of life and death for someone holding that kind of information.”

Protection from regulators

Some founders, too, worry that regulators in their country of origin might come after them at some point — another reason to mask their identity. Canada’s recent executive order with regard to the Ottawa truckers got some people thinking.

“With governments, you really never can tell what’s going to happen,” Mow tells Magazine. Maintaining an alias and a low profile can “certainly help lower the chances of seizure of assets — you never know when there’ll be another Executive Order 6102. If Canada can freeze the accounts of peaceful protesters, then asset seizures in any advanced Western nation is possible.”

Even Børresen, a believer in “radical transparency,” is sympathetic toward his many peers who have elected to mask their identities. “I mainly think they are afraid of being targeted personally, either to protect themselves and their family from being targeted online or in real life.” He can even foresee doxxing himself one day. For instance:

“If RobinHood Inu really takes off, and, say, 10,000 people were aware of me as an individual, this would naturally alter how I interact online. If I was to invest in another project and attaching my name to it would affect it, then I would likely do so anonymously.”

Then, too, the blockchain world really might be a special case given the public nature of its transactions. In traditional finance, people are open about their identities, but the route that money takes is often murky, notes Børresen. Whereas, “In crypto, there is a lot of anonymity of individuals, but every transaction is traceable.”

Ghostbro believes that many people in the sector will continue to maintain a Chinese wall between their online persona and their IRL (in real life) persona, while Lammer goes even further: Pseudonymity isn’t just situational — it is the wave of the future. “Crypto is probably ahead of the curve, and more of the world will operate anonymously in the future.”

Hartzman differs. It’s more likely that a convergence is taking place. “Times have changed,” he tells Magazine. “As things stand, crypto businesses need to work hand-in-hand with regulators to ensure consistent and sustainable, widespread adoption.”

“Visibility is the cornerstone of accountability,” Hartzman concludes, while Børresen, for his part, adds that as decentralized finance becomes more readily available, widespread and accepted, “the perceived need for anonymity will likely lessen.”

Then again, some things don’t really change. Identities and reputation have mattered throughout human history, and as Griffin notes, “People typically want to know who they’re dealing with.” They value relationships, too, and “it’s hard to have a deep relationship when people are anonymous.”

Meanwhile, the blockchain and cryptocurrency industry is maturing, becoming more regulated, and attracting more users from outside the tech community who may not understand some of its more colorful traditions. Also, as more large corporations and institutional investors enter the space, some with fiduciary responsibilities, it might be only inevitable that the sector’s love affair with avatars and assumed names wanes.