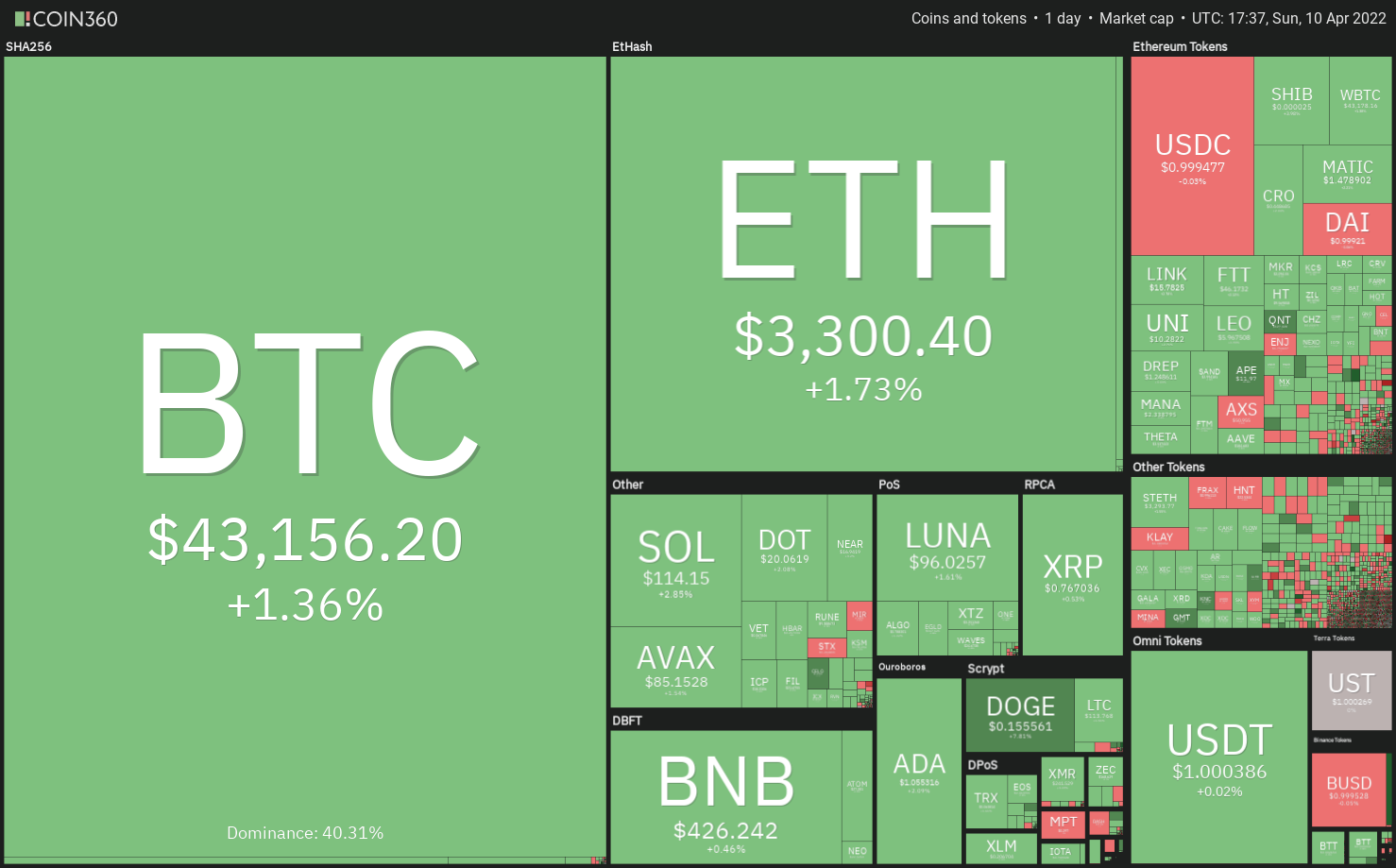

Last year, cryptocurrencies reached a “tipping point,” according to Gemini’s 2022 Global State of Crypto report, “evolving from what many considered a niche investment into an established asset class.”

According to the report, 41% of crypto owners surveyed globally purchased crypto for the first time in 2021, including more than half of crypto owners in Brazil at 51%, Hong Kong at 51% and India at 54%.

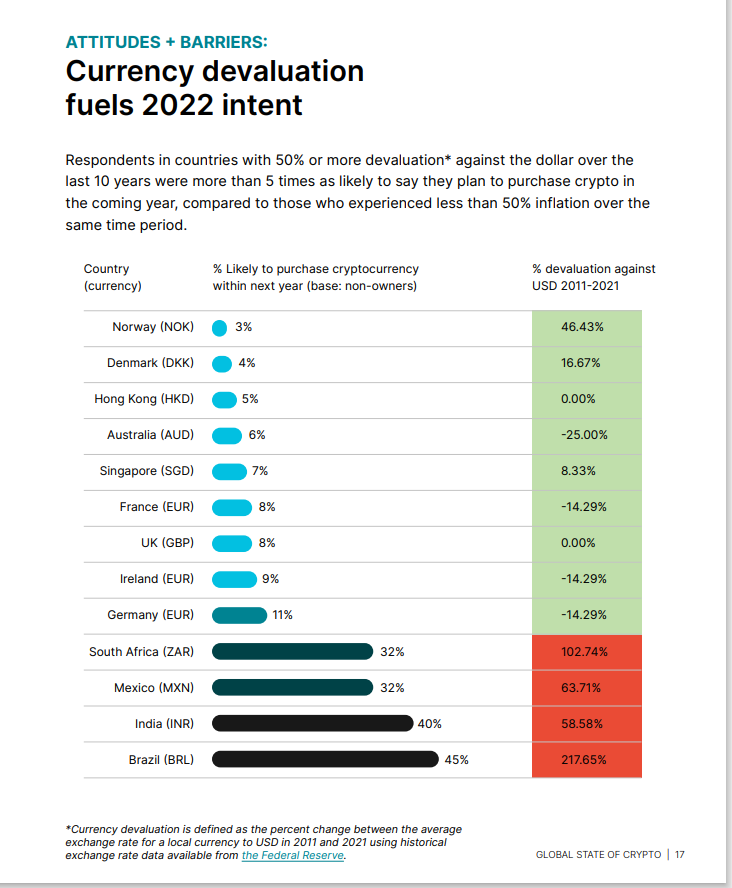

The study, based on a survey of 30,000 adults in 20 countries over six continents, also made a strong case that inflation and currency devaluation are powerful drivers of crypto adoption, especially in emerging market (EM) countries:

“Respondents in countries that have experienced 50% or more devaluation of their currency against the USD over the last 10 years were more than 5 times as likely to say they plan to purchase crypto in the coming year than those in countries that have experienced less than 50% currency devaluation.”

Brazil’s currency, the real, experienced a 218% devaluation — suggesting high inflation — against the United States dollar between 2011 and 2021, and 45% of Brazilians surveyed by Gemini said they planned to purchase crypto in the coming year.

South Africa’s currency, the rand, recorded a 103% devaluation in the past decade — second only to Brazil among the 20 countries in the survey — and 32% of South Africans are expected to be crypto owners in the next year. The third and fourth highest devaluation, or inflationary, countries, Mexico and India, displayed a similar pattern.

By comparison, the currencies of Hong Kong and the United Kingdom experienced no devaluation at all against the U.S. dollar over the past 10 years. Meanwhile, relatively few surveyed in those countries, 5% and 8%, respectively, professed an interest in purchasing crypto.

What conclusions can be drawn from this? Noah Perlman, chief operating officer at Gemini, sees different crypto use cases, often depending upon where one lives. He told Cointelegraph:

“In countries where the local currency has been devalued against the dollar, crypto is viewed as a ‘need to have’ investment, whereas in the developed world it is still largely seen as ‘nice to have.’”

Crypto as currency replacement

Winston Ma, former managing director and head of North America at China Investment Corporation and now adjunct professor at New York University School of Law, makes a key distinction between an asset that works as an inflation hedge and one that is used as a currency replacement.

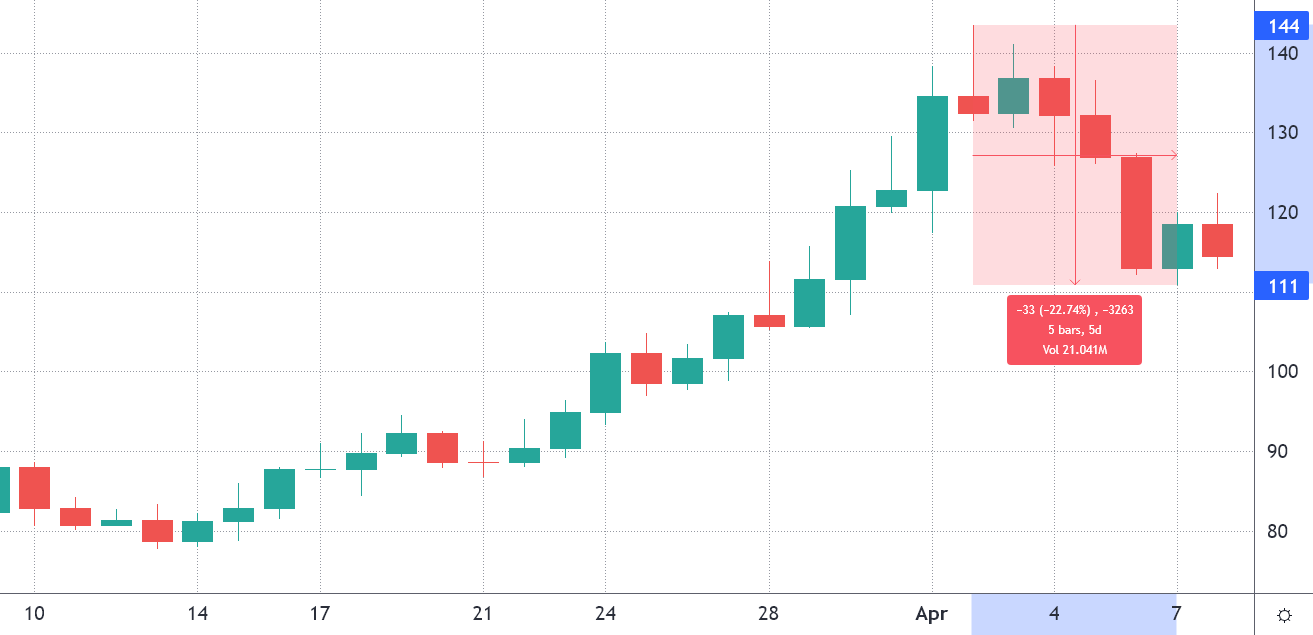

Cryptocurrencies like Bitcoin (BTC) have yet to achieve “inflation hedge” status, unlike gold, in his view. In 2022, they have behaved more like growth stocks. “Bitcoin correlated more tightly to the S&P 500 index — and Ether to NASDAQ — than gold, which is traditionally viewed as an inflation-hedge asset,” he told Cointelegraph. But, things are different in parts of the developing world:

“In the emerging markets like Brazil, India and Mexico that are struggling with inflation, inflation may be a primary driver of cryptocurrencies’ adoption as a ‘currency replacement.’”

“There’s no denying that in early days and still now adoption has been driven by countries where currency stability and/or access to proper banking services has been an issue,” Justin d’Anethan, institutional sales director at the Amber Group — a Singapore-based digital asset firm — told Cointelegraph. Simply put, developing countries are more interested in alternatives to easily debased fiat currencies, he said, adding:

“On a USD notional basis, the larger flows might still come from institutions and more developed countries, but the growing number of actual users will probably come from places like Lebanon, Turkey, Venezuela and Indonesia, among others.”

Sean Stein Smith, assistant professor in the department of economics and business at Lehman College, told Cointelegraph that he was not particularly surprised by the survey’s findings, “since inflation is one of the factors that has and continues to drive adoption of Bitcoin and other crypto assets all over the world.”

But, it remains just one of many factors, and often different regions have separate factors that push adoption, said Stein Smith. “On a fundamental level, investors and entrepreneurs are increasingly recognizing the benefits of crypto assets” as an “instantaneously accessible,” traceable and cost-effective transaction option. In other places, “the potential capital gains and returns of crypto assets” encourage crypto adoption.

There are regulatory questions surrounding cryptocurrencies globally, particularly in the Asia Pacific and Latin America regions where 39% and 37% of survey respondents, respectively, said that “legal uncertainty around cryptocurrency,” tax questions and a general education deficit could affect adoption, the report noted. In Africa, for example, 56% of respondents said more educational resources to explain cryptocurrencies were needed.

“It is not only inflation, it is a bigger issue of empowering our youth to have a better life than their parents and not to have fear of failure or allegiance to the legacy financial markets or products,” Monica Singer, South Africa lead at ConsenSys, told Cointelegraph. In addition, “the issue of dependency on cash and remittances is huge in Africa and the dependency on social grants.”

The future of money?

Overall, Brazil and Indonesia were the top two countries in cryptocurrency ownership in the survey. Forty-one percent of those surveyed in each of those countries said they owned crypto. Comparatively speaking, only 20% of Americans surveyed said they owned cryptocurrency.

People living in inflation-afflicted markets are more likely to view cryptocurrencies as the future of money. According to the survey:

“The majority of respondents in Latin America (59%) and Africa (58%), where many have experienced long-term hyperinflation, say that crypto is the future of money.”

The strongest support for this view was seen in Brazil at 66%, Nigeria at 63%, Indonesia at 61% and South Africa at 57%. The fewest believers were in Europe and Australia, notably Denmark at 12%, Norway at 15% and Australia at 17%.

Will the Ukraine conflict impact adoption?

The survey was conducted before the Ukraine-Russia War. Will that devastating conflict have any long-term impact on global crypto adoption growth?

“The Ukraine-Russia war has certainly led to crypto being thrust directly into the mainstream conversation,” said Stein Smith, “especially since the Ukrainian government has directly solicited over $100 million in crypto donations since the war began,” further adding:

“This real-world demonstration of the power of decentralized money has the potential to turbocharge wider adoption, broader policy debate and increased utilization of crypto as a medium of exchange moving forward.”

But, the war may not affect all parts of the developing world. “The war in Ukraine is of no consequence to the demand for crypto in Africa,” Singer told Cointelegraph. Other factors loom larger. “Inflation, yes, but also the lack of trust in the government in many countries in Africa and the fact that we have a young demographic that is very knowledgeable in using mobile phones and the internet.”

The success of Mpesa in Kenya, for example, has had a big impact on the continent and will arguably help hasten further crypto adoption. It “is directly related to the spirit that exists in Africa of making a plan when everyone that you trust fails you,” she said.

On the other hand, Ma views the Ukraine conflict as a sort of crisis check for cryptocurrencies. “The Ukraine-Russia War has served as a stress test for the payment rail of cryptocurrencies amid global uncertainty, especially for the residents in emerging markets,” he told Cointelegraph, adding:

“We could expect the greatest future gains in crypto adoption to be found in emerging markets like these.”

Inflation along with currency devaluation are enduring concerns in many parts of the world. In such afflicted areas, Bitcoin and other crypto are now seen as candidates for currency replacement — the “future of money.” This is generally not the case in the developed world, though that could change, particularly with more regulatory clarity and education. As d’Anethan told Cointelegraph, “It seems that even Western nations are waking up to inflation and the impact it will have on cash holdings.”