Ethereum Classic (ETC) price climbed on March 22, ignoring a deadly “death cross” on the weekly chart, as traders raised their bets on its potential to become a haven for miners fleeing the rival Ethereum blockchain.

ETC’s price jumped over 15.5% to reach $44 a token for the first time since Dec. 9, 2021. The coin’s intraday gains came as a part of a broader rebound move that saw its price rallying more than 75% eight days after bottoming out near $25.

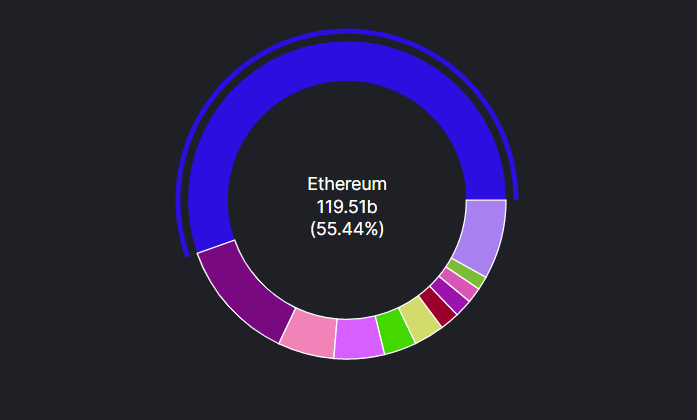

Most of ETC’s course to the upside saw it tracking general crypto market trends. For instance, the Ethereum Classic token showed an extremely higher correlation with Bitcoin (BTC), the leading cryptocurrency by market cap, reaching 0.98 on multiple occasions.

A correlation coefficient reading of 1 between the two assets show that they move completely in lockstep.

But ETC’s 75%-plus gains in the last eight days largely outperformed BTC’s 15.5% returns in the same period. That may have to do with speculations about Ethereum Classic’s ability to attract miners from its rival, Ethereum.

A “viable alternative” to Ethereum miners?

Ethereum Classic, however, failed to attract as many users, leaving the network in the hands of a few miners. This resulted in a double-spend attack worth $1 million on Coinbase in January 2019 and other instances of 51% attacks on the network.

In December 2020, Cardano founder Charles Hoskinson announced that his firm, IOHK, initiated the Mantis project to upgrade Ethereum Classic and support its community.

Last year, the cooperative noted that “Ethereum’s move to proof-of-stake and sharding may disrupt many in the community who prefer proof-of-work and a strong base-layer approach to blockchain security,” adding:

“This is where #EthereumClassic becomes a viable alternative for #Ethereum projects to migrate to.”

As ETC rallies in March, the hash rate has not risen to new all-time highs, suggesting that miners aren’t jumping over just yet. Nevertheless, social media has started to take up the miner exodus mantra, as shown in the tweets below.

#EthereumClassic ( $ETC) is trading higher by 11.73% in the last 24 hrs.

ETC is rising because its tech. indicators turned bullish on 3/18. Also, $ETH will go #PoS in few months, hence #ETC stands to benefit from increased hashrate and security, as miners look for alternatives.

— Weiss Crypto (@WeissCrypto) March 22, 2022

#EthereumClassic $etc is becoming extremely profitable to mine. The miners recognize this, and they are porting over to #etc in mass. #bitcoin

— ETC Sage Capital (@EtcSage) March 20, 2022

No. Miners are not switching over….yet. So calm down. But when they do, the real fireworks start. $ETC pic.twitter.com/l07yFPL56a

— BreakoutRob.ETC (@BreakoutRob) March 21, 2022

And that ETC block reduction

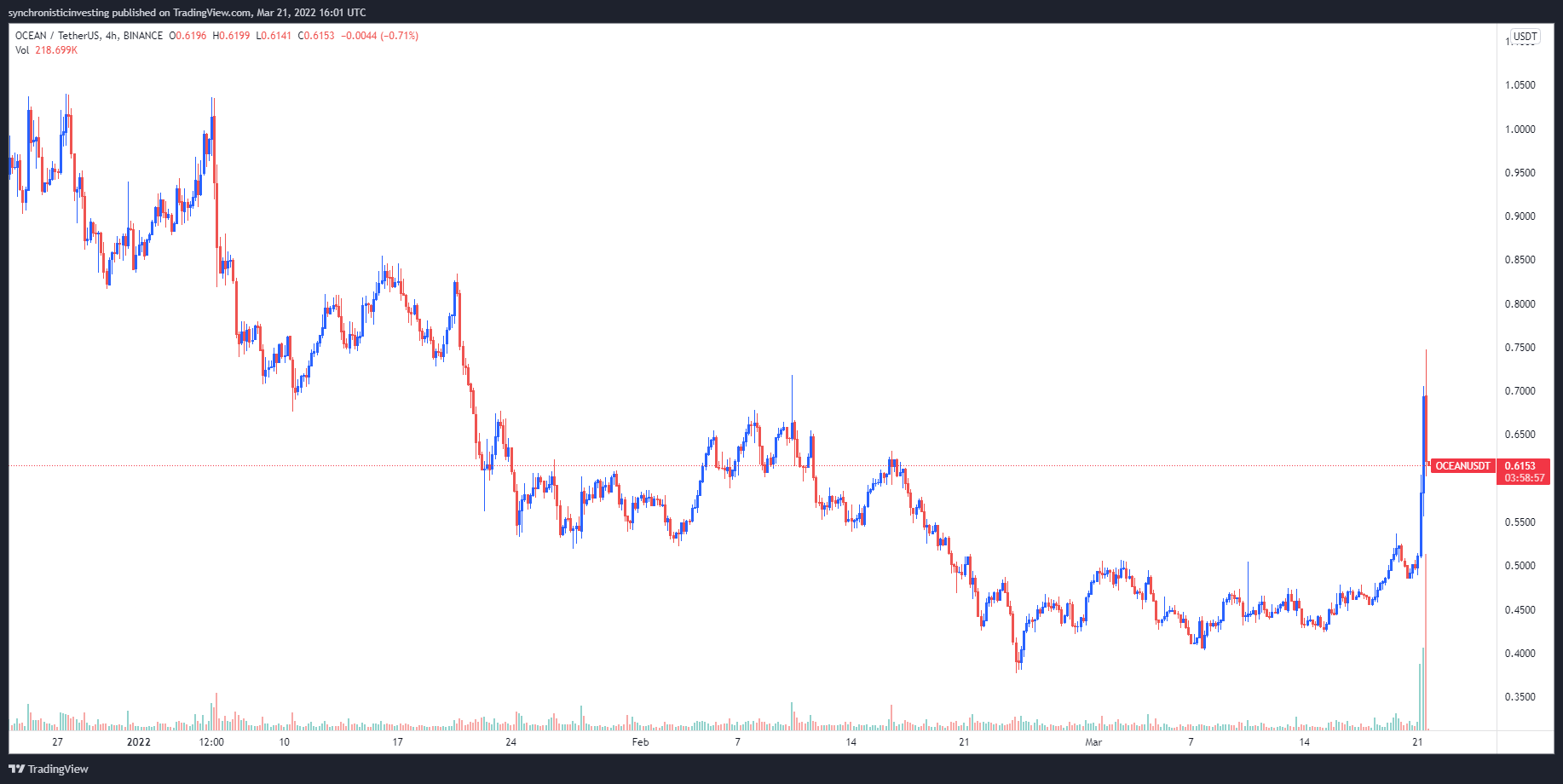

ETC’s price also surged in the run-up to its third block reward reduction, or “fifthening,” expected to arrive on April 15, 2022 at block 15,000,000.

In detail, the Ethereum Classic’s block rewards get cut periodically by 20% every five million blocks (roughly every 2.5 years), following the improvement proposal ECP-1017, launched in 2017.

The last of such events occurred on March 16, 2020, which followed up with ETC rising by more than 350% to date.

We pumping the markets because ETC halving in 40 days? pic.twitter.com/dah4P3YeU4

— 50Sats – maintain your pride (@stacksats42069) March 22, 2022

Related: ETH price hits $3K as major crypto fund adds over $110M Ethereum to Lido’s staking pool

Technically, ETC appears oversold due to its daily relative strength index rising above 70, a sell signal. The ETC/USD pair now tests $44 as its interim resistance, a level with a history of acting as a strong support between July 2021 and December 2021.

As a result, ETC may correct towards its 200-day exponential moving average (200-day EMA) near $37 next. Conversely, a decisive move above $44 could have it eye $50 — a psychological resistance level — as its interim upside target.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.