Bitcoin (BTC) has been volatile in the past few days but the long-term investors seem to be using the current weakness to buy.

According to Whale Alert and CryptoQuant, about 30,000 BTC left Coinbase and was deposited in an unknown wallet. It is speculated to be a genuine purchase and not an in-house transaction.

Although investors may be bullish for the long term, the short-term picture remains questionable. Stack Funds said in their recent weekly research report that they “expect sideways trading and possibly a potential dip” in the short term due to the increase in inflation and the lack of clarity regarding the conflict in Ukraine.

While Bitcoin has been volatile, gold-backed crypto assets have made a strong showing in 2022 as investors shunned risky assets and sought the protection of safe havens. This has boosted the market capitalization of gold-baked crypto tokens to more than $1 billion.

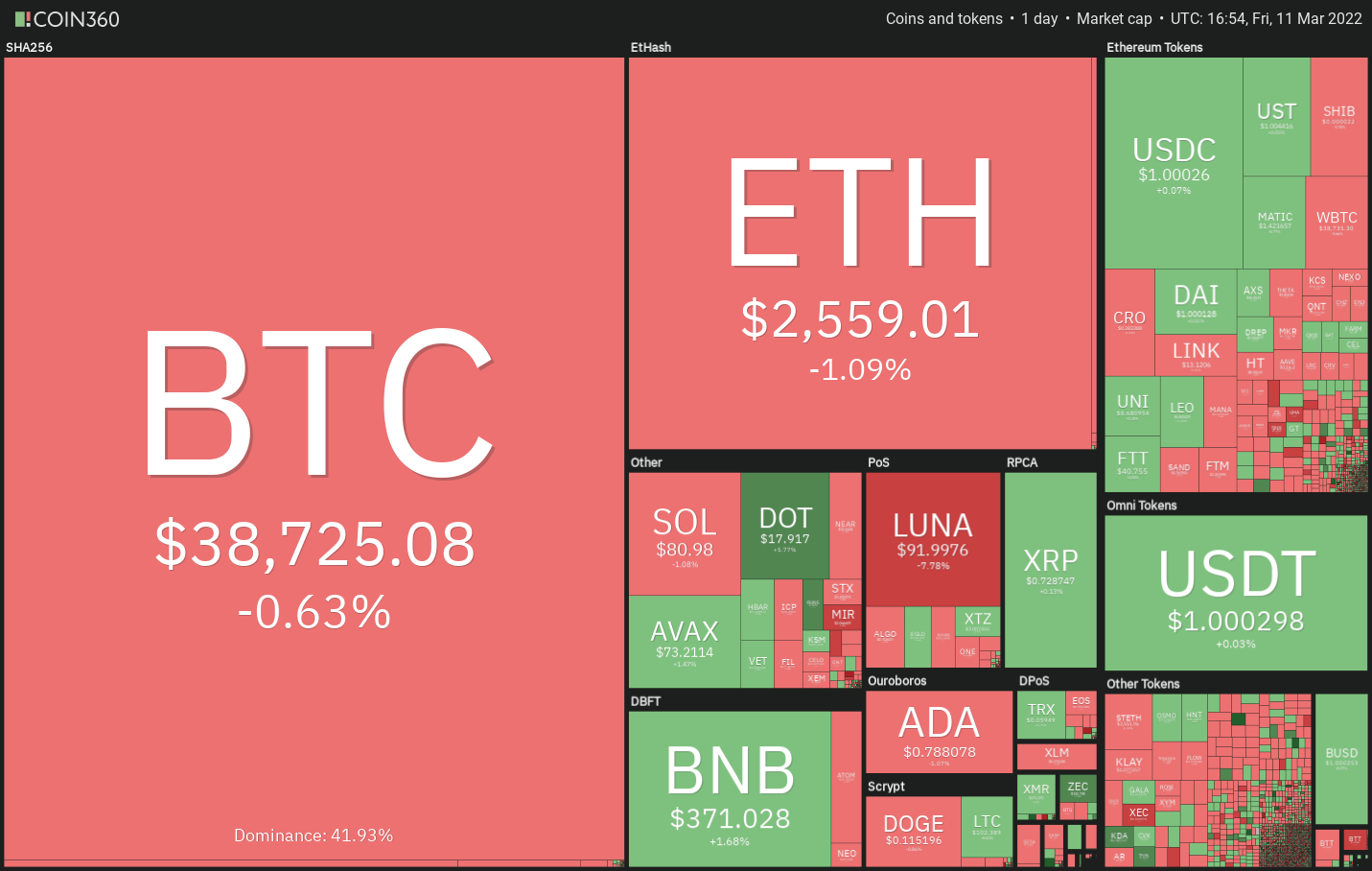

Could Bitcoin and altcoins sustain the recovery or will bears reign supreme? Let’s analyze the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin soared above the moving averages on March 9 but quickly retraced the rally on March 10. The bulls are again attempting to push the price back above the moving averages today. This indicates that bulls are buying on dips while bears are selling on rallies.

Both moving averages are flattening out and the relative strength index (RSI) is just below the midpoint, suggesting a balance between supply and demand.

This equilibrium could tilt in favor of the buyers if they push and sustain the price above $42,594. The BTC/USDT pair could then rise to the overhead zone between $45,000 and the resistance line of the ascending channel.

Alternatively, if the price once again turns down from the moving averages, the bears will try to pull the pair below the immediate support at $37,000. If this level gives way, the pair could challenge the support line of the channel. A break and close below this level will increase the possibility of the resumption of the downtrend.

ETH/USDT

Ether’s (ETH) rebound met with stiff resistance at the 50-day simple moving average ($2,751) on March 9, indicating that bears are not willing to let go of their advantage easily. The price turned down from the moving averages on March 10 but a minor positive is that the bulls are attempting to defend the support line of the symmetrical triangle.

If the price rebounds off the support line, the bulls will again try to drive and sustain the price above the 50-day SMA. If they manage to do that, the ETH/USDT pair could rise to the psychological level at $3,000 and then retest the resistance line of the triangle.

This is an important level for the bears to defend because a break and close above it will signal a potential change in trend. This setup has a pattern target at $4,311 on the upside.

Contrary to this assumption, if the price continues lower and breaks below the support line of the triangle, it could indicate the resumption of the downtrend. The pair could then drop to $2,159.

BNB/USDT

Binance Coin (BNB) rose above the 50-day SMA ($389) on March 9 but the bulls could not sustain the higher levels. The bears took advantage of this situation and pulled the price back below the moving averages on March 10.

If the price sustains below the moving averages, the bears will attempt to pull the BNB/USDT pair to the strong support at $350. This is an important level to keep an eye on because a break below it could clear the path for a decline to $320.

Alternatively, if the price rebounds off the current level, the buyers will again try to propel and sustain the pair above the moving averages. If they do that, the pair could start its northward march toward $445.

XRP/USDT

Ripple (XRP) broke and closed above the downtrend line on March 9 but the bulls could not build upon this strength. The bears pulled the price back below the downtrend line on March 10.

The bulls did not allow the price to break below the 50-day SMA ($0.72), which suggests strong demand at lower levels. This tight range trading is unlikely to continue for long.

If the price breaks and sustains above $0.78, the XRP/USDT pair could pick up momentum and rally toward the overhead resistance at $0.91. A break above this level could clear the path for a rally to the psychological level at $1.

This positive view will invalidate if the price turns down and breaks below $0.69. That could turn the tables in favor of the bears.

LUNA/USDT

Terra’s LUNA token rose to a new all-time high on March 9 but the long wick on the day’s candlestick shows profit-booking at higher levels. The bulls again tried to resume the uptrend on March 10 but the bears had other plans.

The failure to sustain the price above $103 may have attracted profit-booking from the short-term traders. That has pulled the LUNA/USDT pair below the critical level at $94.

If the price sustains below $94, the decline could extend to the 20-day EMA ($80). A break and close below this level will suggest that the bullish momentum may have weakened. The pair could then drop to $70.

Conversely, if the price rebounds off the current level or the 20-day EMA, it will indicate that the sentiment remains positive and traders are buying on dips. The bulls will then again try to push the pair to a new all-time high and toward the target objective at $125.

SOL/USDT

Solana (SOL) has been trading inside a descending triangle pattern, which will complete on a break and close below the crucial support at $81. The bulls tried a recovery on March 9 but could not push the price above the 20-day EMA ($89).

If bears sink and sustain the price below $81, the selling could intensify. The SOL/USDT pair could then resume its downtrend and plunge toward the next support at $66.

The downsloping moving averages suggest that the path of least resistance is to the downside but the positive divergence on the RSI indicates that the sellers need to be careful of a possible bear trap.

If the price rebounds off the current level, the bulls will again try to push and sustain the pair above the downtrend line. If they manage to do that, the pair could rally to $122.

ADA/USDT

Cardano’s (ADA) attempt to recover on March 9 met with strong resistance at the 20-day EMA ($0.88). This suggests that the sentiment remains negative and traders are selling on every minor rally.

The downsloping moving averages and the RSI in the negative territory suggest the path of least resistance is to the downside.

The bears will now again attempt to pull the price below the strong support at $0.74 and resume the downtrend. A close below $0.74 could open the doors for a further decline to the next support at $0.68.

The bulls will have to push and sustain the ADA/USDT pair above the psychological level at $1 to suggest that the bears may be losing their grip.

Related: Here’s how traders were alerted to RUNE’s, FUN’s, WAVES’ and KNC’s big rallies last week

AVAX/USDT

Avalanche (AVAX) failed to climb and sustain above the moving averages on March 9. This suggests that bears are defending the moving averages while the bulls are buying on dips to the uptrend line.

Generally, tight ranges result in sharp trending moves. If bears sink and sustain the price below the uptrend line, the AVAX/USDT pair could start its decline toward the important support at $51. It may not be a straight drop because the bulls will try to arrest the fall in the zone between $64 and $61.

Conversely, if bulls push the price above the moving averages, the pair will again attempt to rise above the downtrend line of the descending channel. A break and close above the channel could signal that the downtrend may be ending.

DOT/USDT

After struggling to stay above the 20-day EMA ($17) on March 9 and 10, Polkadot (DOT) has managed to break the resistance today. The bulls are currently attempting to push and sustain the price above the 50-day SMA ($18).

If they succeed, it will suggest that the downtrend could be ending. The DOT/USDT pair could thereafter rally to the overhead resistance at $23. A break and close above this resistance will signal a potential change in trend.

Contrary to this assumption, if the price turns down from the current level, the bears will try to pull the price below the solid support at $16. If they manage to do that, the pair could retest the next major support at $14.

DOGE/USDT

Dogecoin’s (DOGE) relief rally on March 9 fizzled out at the 20-day EMA ($0.12). This suggests that the bears are not ready to give up and they continue to sell near resistance levels.

The DOGE/USDT pair dropped back below $0.12 on March 10, increasing the possibility of a retest of the critical support at $0.10. This zone is likely to attract strong buying from the bulls. The buyers will have to push and sustain the price above the 50-day SMA ($0.13) to indicate that the downtrend could be weakening.

Conversely, if bears sink the price below $0.10, the selling could accelerate and the pair could plummet to the next support at $0.06.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.