- EV sales fell 13%, production down 16%, causing 20% segment decline.

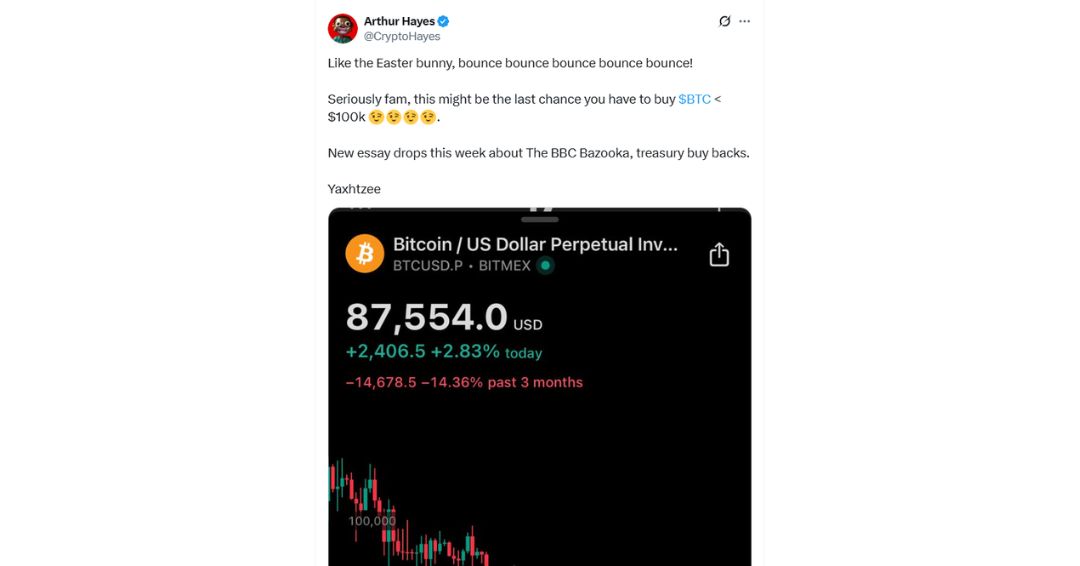

- Bitcoin holdings valued over $1 billion as BTC hits $93,000.

- Tesla holds 11,509 BTC with no transactions this quarter.

Tesla has reaffirmed its strategic bet on Bitcoin despite disappointing quarterly earnings, a plunging stock price, and slowing electric vehicle sales.

As of March 31, 2025, the company holds 11,509 Bitcoin, currently valued at just over $1 billion after a 6% rise in the cryptocurrency’s price to $93,000.

This development comes at a time when Tesla is under pressure from shareholders following a 41% decline in its stock price this year and growing scrutiny around CEO Elon Musk’s political involvement.

Revenue down, deliveries slump

Tesla’s Q1 2025 revenue reached $19.34 billion, falling short of Wall Street’s projection of $21.37 billion.

The shortfall is largely tied to the company’s main business—electric vehicles—which saw a 13% drop in deliveries and a 16% dip in production.

This led to a 20% year-over-year decline in revenue from its core segment.

Tesla’s declining delivery numbers mirror broader industry challenges, but some of the headwinds are unique to the company.

Ongoing protests and concerns around Musk’s dual focus—spanning political appointments and social media commentary—have amplified investor unease.

Despite this, Tesla made no changes to its Bitcoin position during the quarter, signalling a clear intention to maintain it as a long-term asset.

Bitcoin strategy remains unchanged

Tesla’s current holding of 11,509 BTC was first acquired in February 2021, with about 75% of it sold off in July 2022.

The remainder has been left untouched.

At the end of 2024, this stash was worth approximately $1.076 billion. By the close of Q1 2025, Bitcoin’s 12% decline had reduced the value to around $951 million.

However, with Bitcoin prices rebounding to $93,000, the portfolio’s worth has climbed back above the $1 billion mark.

New rules introduced by the Financial Accounting Standards Board (FASB) require companies to mark their digital asset holdings to market value at the end of each quarter.

Under this regime, Tesla previously recorded a $600 million unrealised gain in Q4 2024 due to Bitcoin’s rally.

Tesla’s decision not to buy or sell any Bitcoin in Q1 2025 signals a “HODL” stance—mirroring the strategy of other corporate holders like Strategy and Metaplanet, which also treat Bitcoin as a hedge or strategic reserve.

Musk shifts from DOGE to Tesla

Elon Musk, whose support for Dogecoin (DOGE) has frequently made headlines, announced plans to scale back his involvement with the meme coin.

He said his time allocation would shift in May 2025 as DOGE operations become more self-sufficient.

This renewed focus on Tesla comes as analysts call for urgent strategic moves.

Dan Ives of Wedbush labelled the company’s situation a “code red,” suggesting that Tesla may need to rethink parts of its financial strategy, including how it handles its Bitcoin holdings, if current challenges continue.

Meanwhile, BeInCrypto forecasts that crypto markets will remain unstable until mid-May due to global economic uncertainty and trade pressures.

However, the broader outlook for digital assets, especially Bitcoin, is more bullish for the second half of the year.

Analysts expect a rebound driven by post-halving effects, institutional buying, and regulatory clarity in the US.

As Tesla navigates financial turbulence, its firm stance on Bitcoin indicates that the cryptocurrency is now more than just a side bet—it’s part of a calculated strategy.

Whether that strategy pays off in Q2 and beyond may depend as much on Musk’s leadership as on Bitcoin’s next move.