AI meme crypto market has grown to a market cap of $2.4 billion, and iDEGEN is set to take its rightful position on the table. After three months in the presale stage, it has hit the public shelves with the same viral momentum.

Its early adopters are set to continue reaping big from the project as the uncensored AI agent revolutionizes the crypto space. In addition to the 300,000% gains already locked in, its value may surge by at least 10X in coming months. This is despite the selling pressure current felt across the crypto majors.

Ripple price chart pattern hints at further selling pressure in the short term

After trading steadily above the support zone of $2.5000 in the past one week, Ripple price has plunged by about 16% since Monday. Similar to other crypto majors, the altcoin is under pressure as extreme fear grips the broader market.

A look at its daily chart points to the formation of a bearish death cross pattern as the short-term 25-day EMA crosses the 50-day EMA to the downside. In the near term, the range between $2.0000 and $2.3357 is worth watching. For a firm trend reversal, the bulls will need to gather enough momentum to rebreak the resistance at $2.5500.

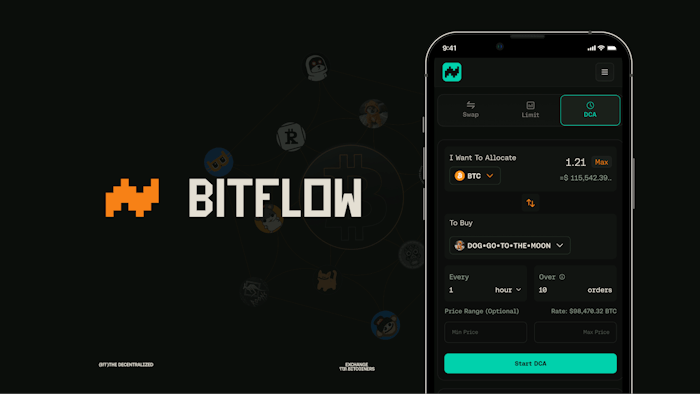

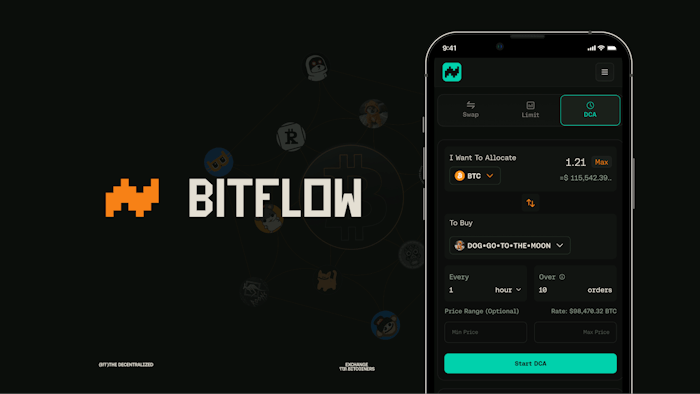

iDEGEN debuts on Raydium with the same viral momentum

iDEGEN has hit the public shelves as promised; ending the three-month-long presale. It has debuted on Raydium, a Solana-based DEX and is set to also list on BitMart on 4th March.

What started on a blank slate ready to learn from the crypto degens on X has grown into an ultra-popular AI crypto with the potential to compete with other AI meme coins like AI16Z, Hamster Kombat, and Fartcoin.

In three months, it has managed to raise $25 million. This has been made possible by its aggressive community, apt timing, and booming AI crypto market. If the presale is anything to go by, its viral momentum is set to yield growth of atleast 10X in the coming months. At its last stage price of $0.038, its early adopters are already enjoying returns of upto 300,000%.

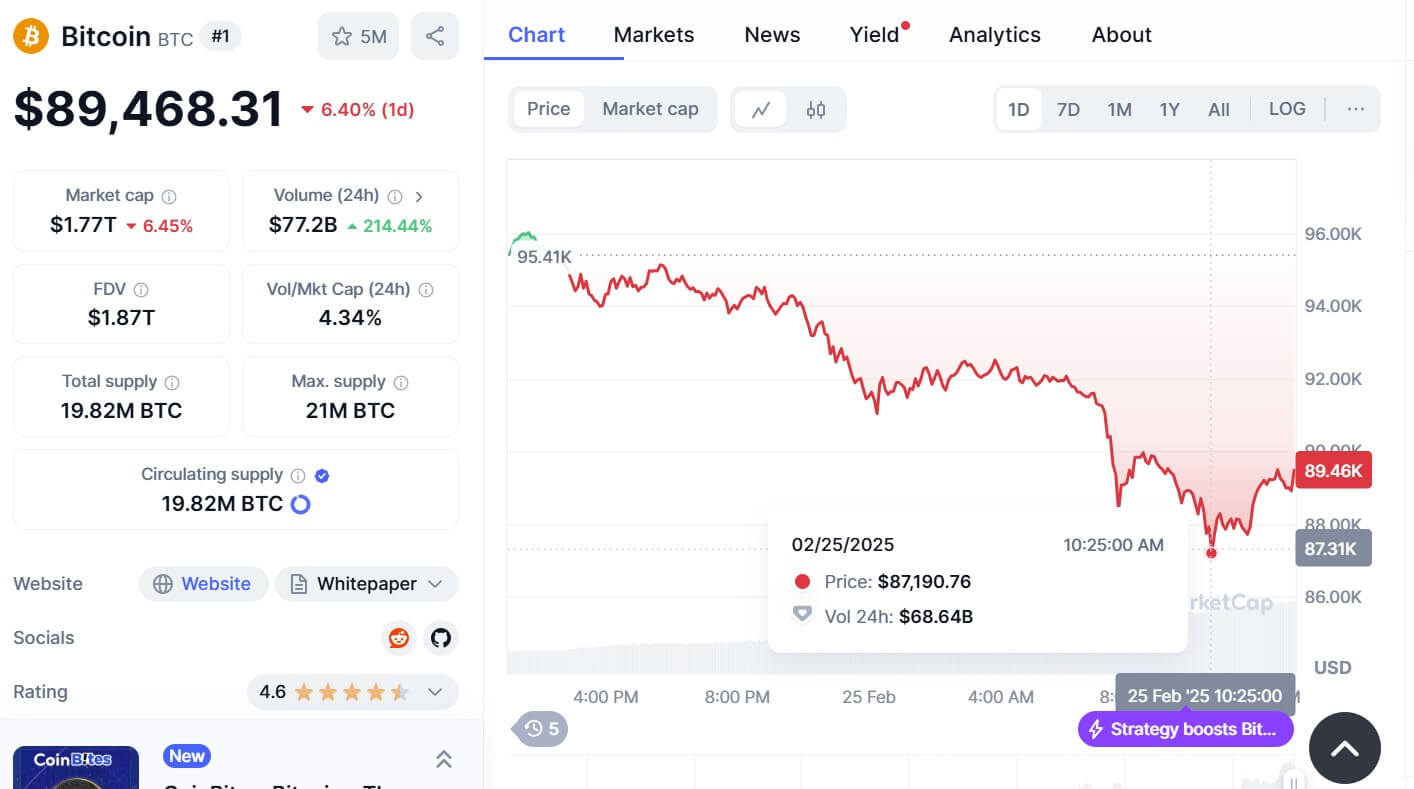

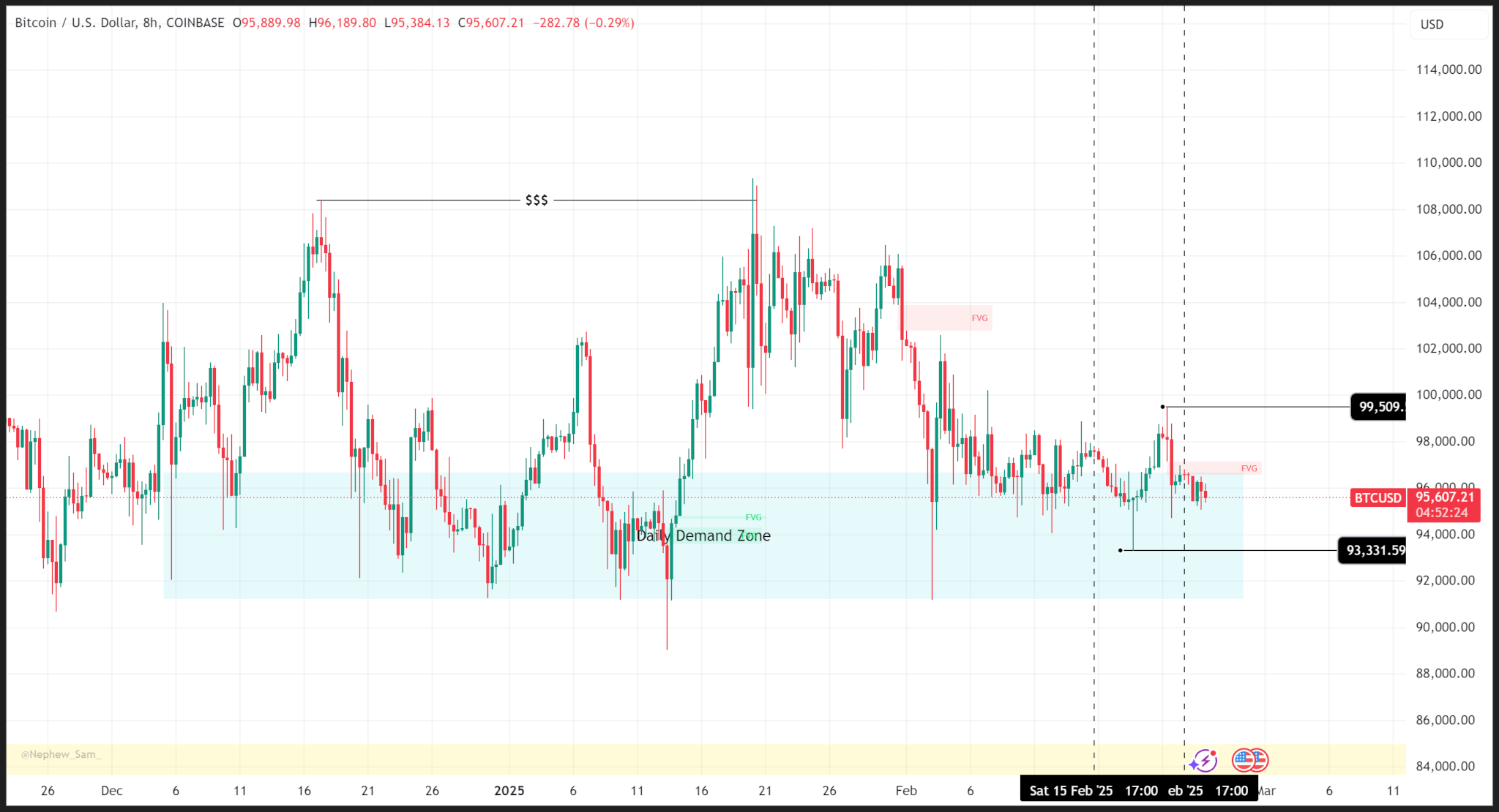

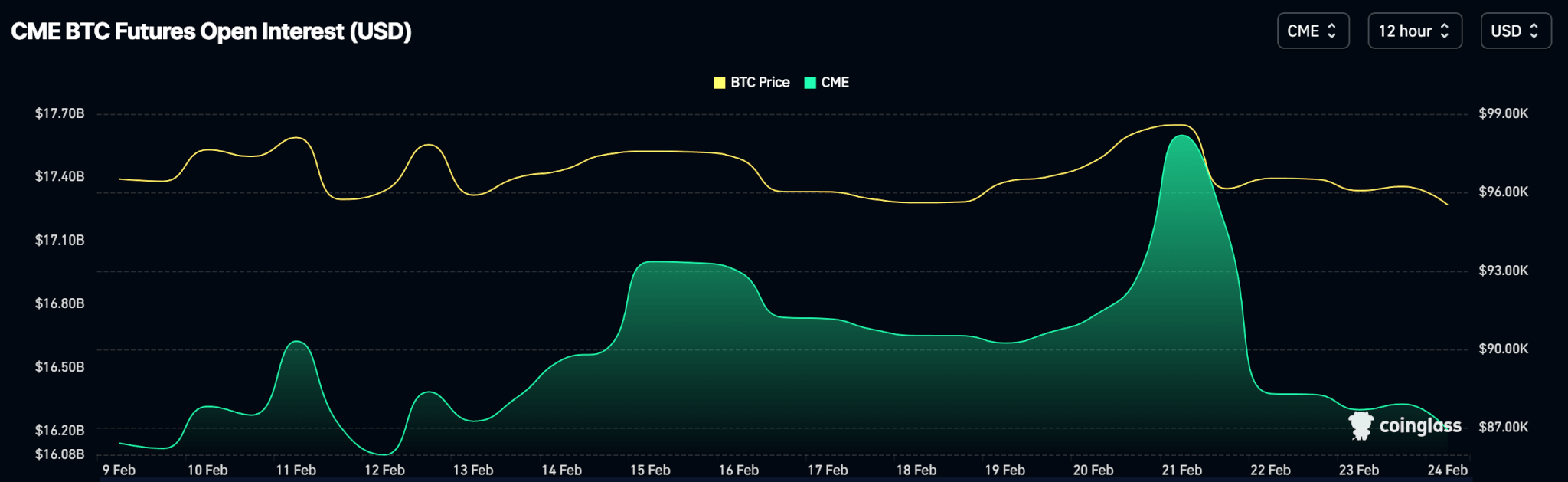

Bitcoin spot ETF records streak of outflows as tariff jitters persist

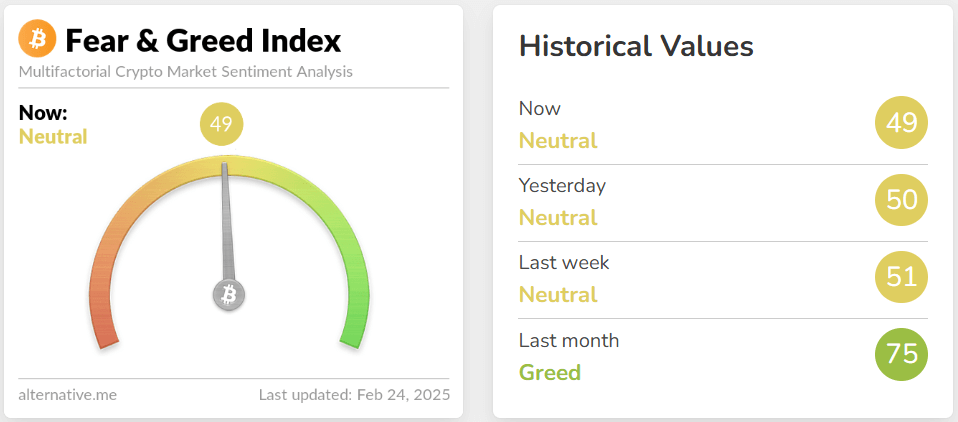

Concerns over the impact that Trump’s trade policies will have on the US economy have triggered a shift in the market sentiment. Compared to last week’s neutral level of 49, the crypto fear & greed index is now at an extreme fear level of 10.

With the resultant plunge in Bitcoin price, Bitcoin spot ETFs have seen persistent outflows as its institutional demand falls. According to SoSoValue, Bitcoin spot ETFs recorded daily total outflows of $754.53 million on Wednesday. Notably, the trend has been on for 7 sessions in a row.

On its daily chart, the bearish death cross pattern points to continued selling pressure in the short term. At its current level, the bulls will be keen on defending the support at $81,600. A subsequent correction may have it rebound past $85,000 to find resistance at $90,000.