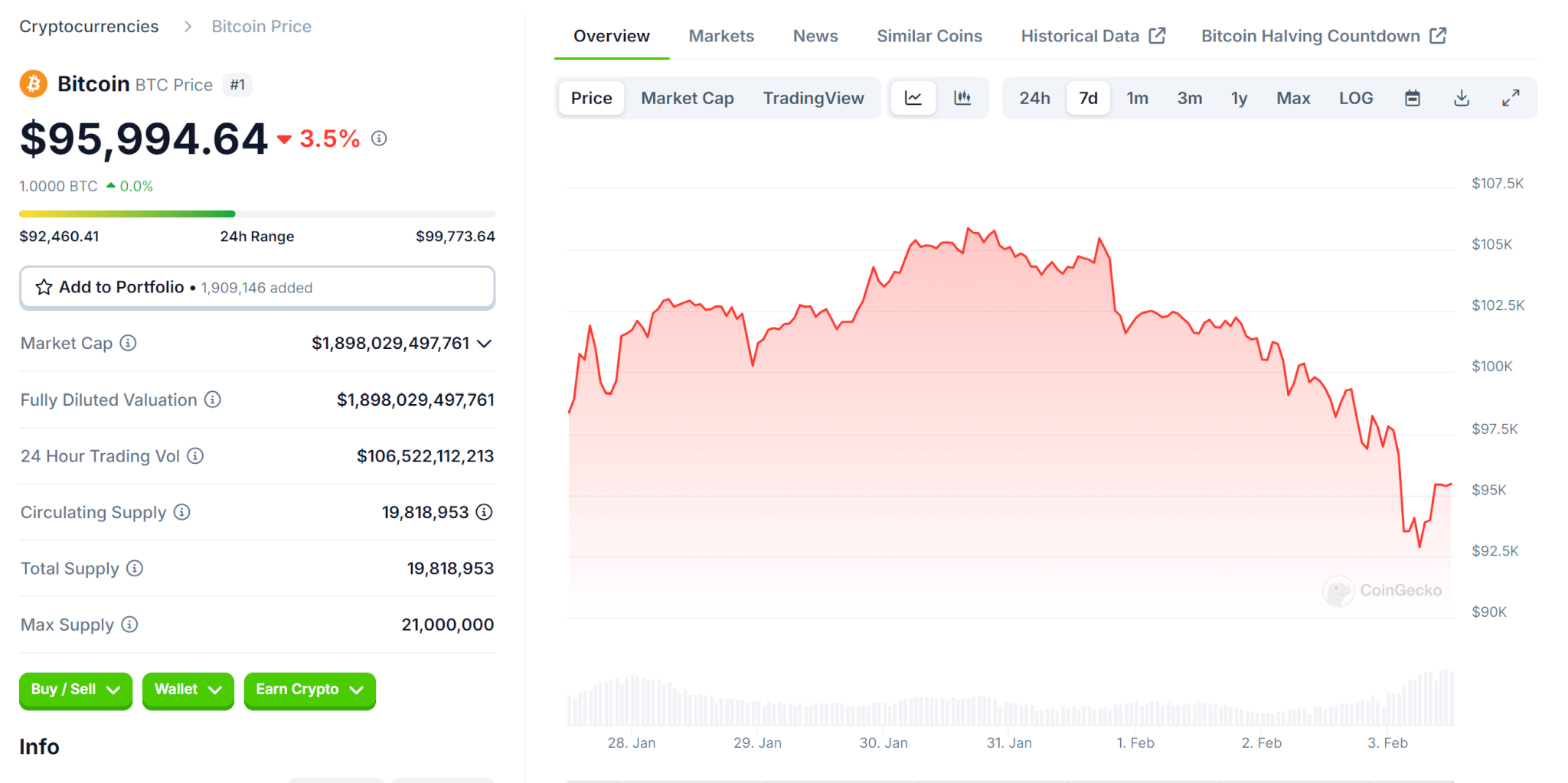

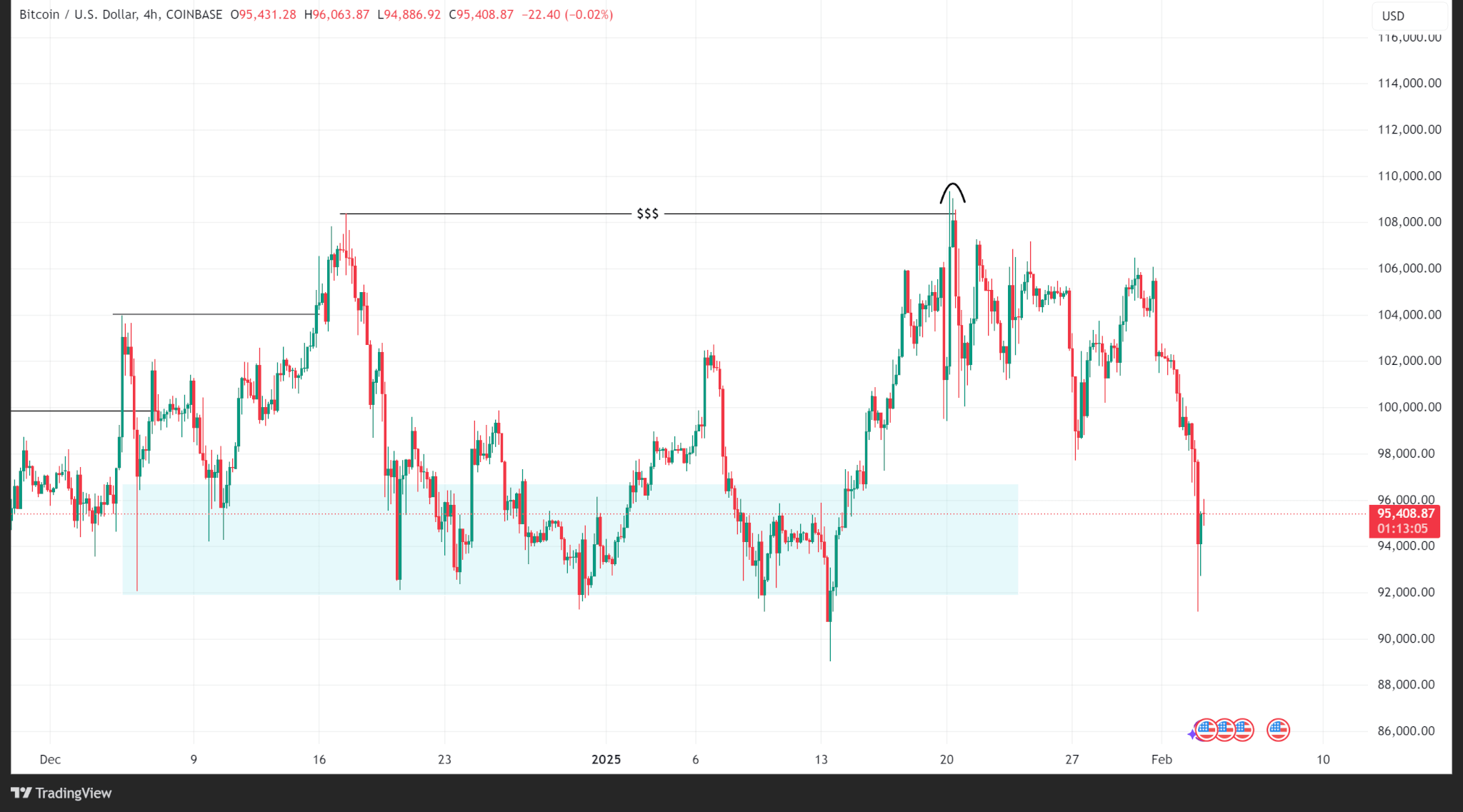

- James Howells claims to have lost a hard drive with 8,000 BTC at a landfill site in 2013.

- The man now wants to buy the landfill site as the search for the lost BTC worth over $784 million continues.

James Howells, the man who has been in search of his lost bitcoin worth over $784 million since 2013 is seeking to buy a landfill.

Howell claims to have mistakenly discarded a hard drive that contained 8,000 BTC and is seeking to buy the landfill site where he lost it in an attempt to recover his fortune.

The man filed a lawsuit in a bid to have the Newport Council dig up the landfill to try and find the lost bitcoin. In over 10 years Newport Council has made no attempts to try to recover the discarded bitcoin.

The quest for lost BTC

James Howells reported that his fiance discarded the hard drive containing cryptocurrency estimated to have a market value of $784 million in the landfill site in 2013. In an attempt to get his crypto assets back, Howells wants to buy the landfill site.

BBC recently reported that Howells has approached various investors with a bid to potentially buy the whole landfill site.

Since 2013, Howells claims that Newport city council have disregarded his plea to be allowed to search for his fortune. The city council has announced plans to have the landfill site converted to a solar farm. They have since acquired planning permission to establish a solar power firm on the site.

Howells had filed a lawsuit against the council seeking legal grounds to hunt for the accidentally discarded bitcoin. In January, a high court judge made a ruling dismissing the case that required Newport council to forcefully allow Howells to search for his bitcoin.

James Howells threw away $750 million of bitcoin accidentally a decade ago and has been trying to recover the hard drive from a landfill ever since. Today, a judge has rejected his latest attempt to search through 110,000 tons of garbage for his digital gold. pic.twitter.com/douIDzDdQO

— Documenting ₿itcoin 📄 (@DocumentingBTC) January 11, 2025

During the hearing, Howells noted that Newport council claimed that granting him a search warrant would have detrimental effects on the people around Newport. Plans to close the landfill were also underway, and that would be soon.

After failed attempts to have the council retrieve the hard drive worth millions for him, Howells offered to buy the whole landfill.

“I have discussed this option recently with investment partners and it is very much on the table,” he said, according to the BBC.