We’ve had another busy week in the crypto market: Bitcoin hits $109,000, Trump and Melania launch memecoins, Elon Musk’s DOGE agency sued, Circle acquires Hashnote, Trump pardons Silk Road creator Ross Ulbricht, Taiwan is considering allowing banks to issue stablecoins, banks will embrace crypto with clearer regulations, and Trump signs executive order for crypto working group.

Bitcoin hits $109,000

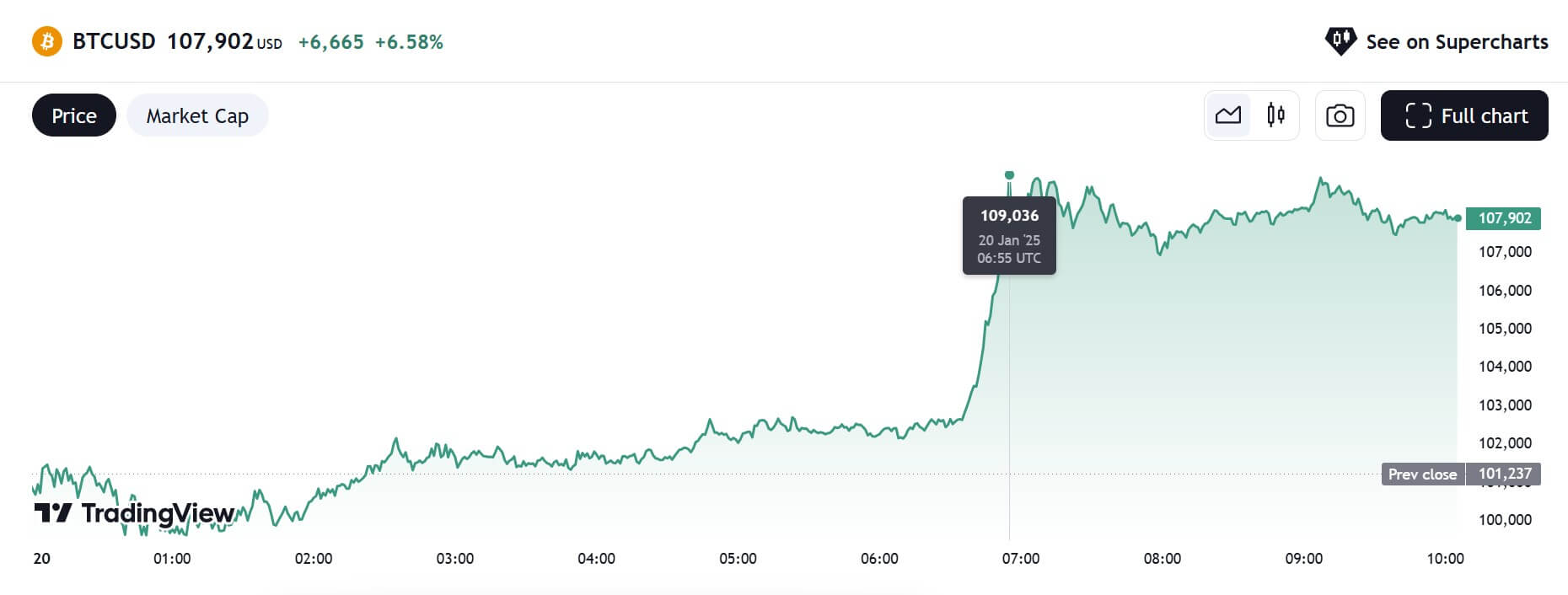

Bitcoin hit a new all-time high of over $109,000 ahead of Donald Trump’s inauguration on Monday.

On January 20, Bitcoin reached a new high as market sentiment remains optimistic about Trump’s plans for the crypto industry. The latest high surpasses its previous record of over $108,000, which it achieved in December.

Trump also mentioned Bitcoin in a Sunday speech, highlighting its record performance since the US election.

“Since the election, the stock market has surged and small business optimism has soared a record 41 points to a 39-year high,” Trump said. “Bitcoin has shattered one record high after another.”

Over the past 90 days, Bitcoin is up nearly 60% and has a market cap value of $2.09 trillion.

Trump and Melania launch memecoins

Ahead of Trump’s inauguration on Monday, January 20, he announced the launch of his $TRUMP memecoin on his Truth Social platform.

Within 24 hours of launching, the meme token rose 580% in value, topping $75, with a market cap of nearly $6 billion.

Following Trump, Melania Trump launched her memecoin, $MELANIA, last Sunday, which saw the token reaching a high of over $13.

At the time of publishing, $TRUMP and $MELANIA are trading at more than $33 and $2.60, according to data from CoinMarketCap.

Elon Musk’s DOGE agency sued

Elon Musk’s Department of Government Efficiency (DOGE) agency reportedly had three lawsuits filed against it within minutes of Trump’s inauguration on Monday.

In a 30-page lawsuit from the National Security Counselors, a public interest law firm, it questions the legality of the agency Trump said he’d create to “dismantle government bureaucracy.”

According to the complaint, DOGE violates the Federal Advisory Committee Act (FACA), which requires advisory committees to follow certain rules, including allowing public involvement.

National Security Counselors state that DOGE meets the requirements to be considered a “federal advisory committee.” Yet, while similar agencies follow a “fairly balanced” representation, keep meeting records, and allow public involvement, as required by law, DOGE doesn’t.

The two other lawsuits were filed by a group that includes the American Federation of Government Employees and the State Democracy Defenders Fund. In another case, the plaintiffs are the Citizens for Responsibility and Ethics in Washington and the American Federation of Teachers.

Despite this, the US government launched the DOGE agency website the following day.

Circle acquires Hashnote

Stablecoin issuer Circle acquired Hashnote for an undisclosed amount earlier this week. As part of the acquisition, Circle is planning to integrate USYC as collateral on crypto exchanges.

In a post on X, Circle said that the move, alongside a strategic partnership with DRW, a global trading firm, “is set to redefine the landscape of digital asset capital markets.”

By integrating USDC, Circle’s stablecoin, and USYC, the platform is enabling interconvertibility between both assets, allowing USYC to be used as preferred collateral on exchanges and brokers.

Trump pardons Silk Road creator Ross Ulbricht

Donald Trump signed an order, giving Ross Ulbricht, the founder of darknet marketplace Silk Road, a full pardon this week.

In a post on his Truth Social platform, Trump wrote:

“I just called the mother of Ross William Ulbricht to let her know that in honor of her and the Libertarian Movement, which supported me so strongly, it was my pleasure to have just signed a full and unconditional pardon of her son, Ross.”

The pardon comes after Ulbricht spent 12 years in prison following his arrest in 2013. Ulbricht created Silk Road in 2011; however, he was given two life sentences plus 40 years in 2015. Upon pardoning Ulbricht, Trump called Ulbricht’s sentence “ridiculous.”

Taiwan is considering allowing banks to issue stablecoins

Taiwan’s financial regulator is to propose legislation enabling local banks to issue stablecoins pegged to the New Taiwan Dollar (NTD).

The draft law from the Financial Supervisory Commission (FSC) is expected to be introduced in June 2025. It aims to bridge the divide between fiat and digital currencies, enhancing investor access to the burgeoning crypto market.

The proposal for banks to issue stablecoins is seen as a pivotal step in this regulatory evolution, providing a more secure and regulated environment for cryptocurrency transactions.

The FSC emphasizes that all stablecoins issued within Taiwan will be under the joint management of the central bank, ensuring their stability and legitimacy.

Zhuang Xiuyuan, director of a Taiwanese bank, has voiced concerns over existing stablecoins like Tether and USDC, criticizing their backing by non-government recognized assets.

To address these issues, any new stablecoin in Taiwan will require explicit approval from the FSC, ensuring they meet specific qualifications regarding issuer credibility and reserve allocations.

Banks will embrace crypto with clearer regulations

Bank of America’s CEO has said that US banks will embrace crypto payments if clearer rules are in place from regulators.

Speaking at the World Economic Forum, Brian Moynihan said that if rules come in and crypto payments are made “real,” then “the banking system will come in hard on the transactional side of it.”

So far, US banks have been cautious about offering retail crypto services, instead focusing on providing institutional products such as US spot Bitcoin exchange-traded funds (ETFs).

Trump signs executive order for crypto working group

Less than a week into entering the White House, Trump has signed an executive order for a crypto working group designed to provide regulatory clarity.

When signing the order, Trump appeared with his AI and crypto czar David Sacks who spoke about the order to the president. Sacks, who will be leading the working group if it’s implemented, said: “we’re going to be forming an internal working group to make America the world capital under your leadership.”

In addition to providing regulatory clarity, the working group seeks to protect the US dollar through the development of lawful dollar-backed stablecoins worldwide. The working group also wants to prohibit “the establishment, issuance, circulation, and use of a [central bank digital currency] within the jurisdiction of the United States.”

Share this article

Categories

Tags