- A new era is set for the industry with the appointment of crypto-friendly candidates such as Paul Atkins

- It remains to be seen whether the US will match similar regulatory frameworks like Europe’s MiCA

- The rise of Bitcoin will be shaped by institutional adoption, increased regulatory clarity, and broader macroeconomic and geopolitical trends

US President-elect Donald Trump is taking office today with his incoming administration making significant promises for the crypto industry.

After years of battling with the US Securities and Exchange Commission (SEC) under outgoing US President Joe Biden’s administration, the crypto market is beginning to feel hopeful.

Even before entering the White House, a shift has already taken place with the appointment of crypto-friendly candidates including Paul Atkins as the next SEC Chair and crypto czar David Sacks. Trump is also, reportedly, going to sign an executive order making crypto a priority under his leadership.

“So far, the country has done little to advance a clear crypto regulatory framework,” said Tom Kiddle, co-founder of Palisade, a French-regulated digital asset custodian backed by Ripple, to CoinJournal. “However, Trump’s nomination of pro-crypto Paul Atkins could mark the dawn of a new era for the sector.”

A similar MiCA framework?

While a potentially favorable crypto environment is possible with the likes of Paul Atkins, it remains to be seen whether the new administration will match international frameworks such as Europe’s Markets in Crypto Assets (MiCA) regulations.

According to Kiddle the “US is at a crossroads,” adding that “if the SEC adopts a constructive stance, the country could finally reclaim is position as a global leader in blockchain innovation rather than watching talent and capital drain to emerging economies.”

Several companies, including Bitwise, Coinbase, and Ferrari are already expanding their services into Europe. With a lack of clear crypto regulations, the crypto industry isn’t reaching its full potential in the US.

Under a Trump administration that could soon change.

“It’s unclear how closely the administration intends to match international frameworks such as the EU’s MiCA with its regulatory plans,” said Temujin Louie, CEO of Wanchain to CoinJournal. “By closely monitoring the administration’s policies and adapting accordingly, the blockchain industry can remain focused on developing innovative solutions that promote the mainstream adoption of blockchain technology.”

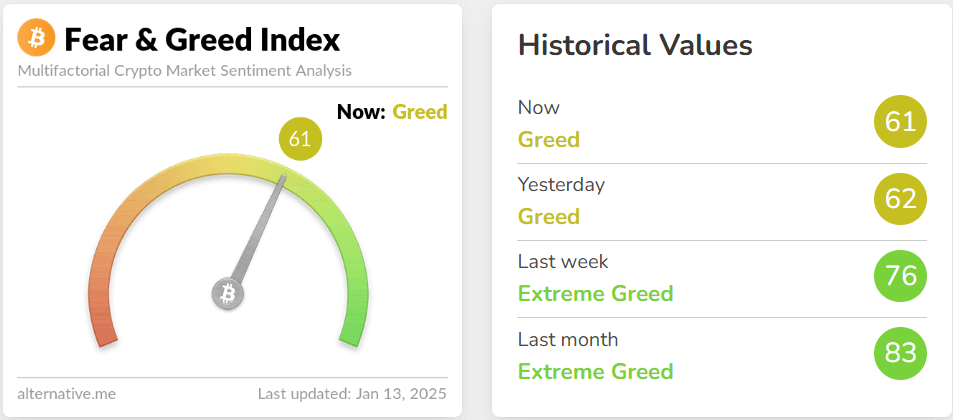

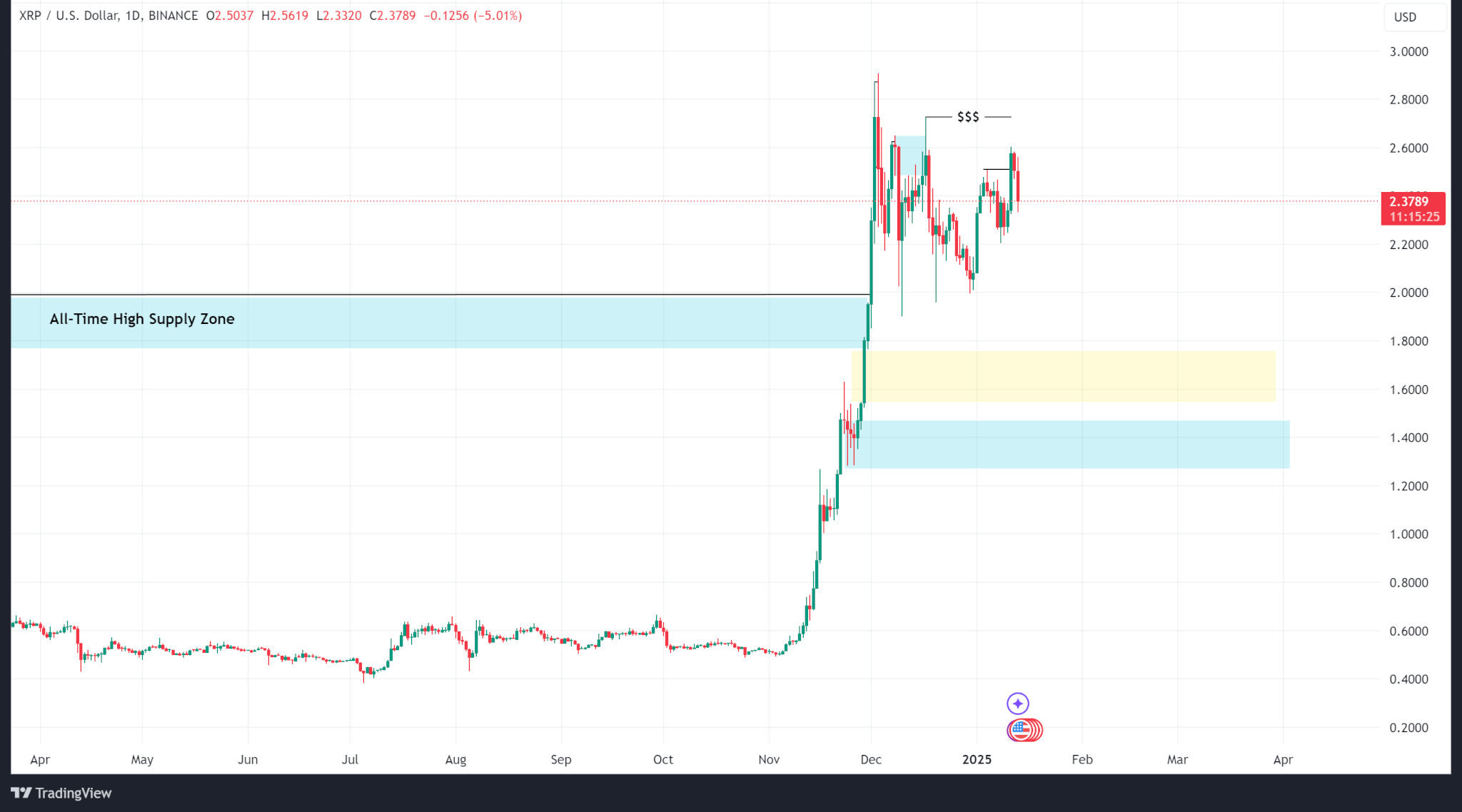

Market sentiment

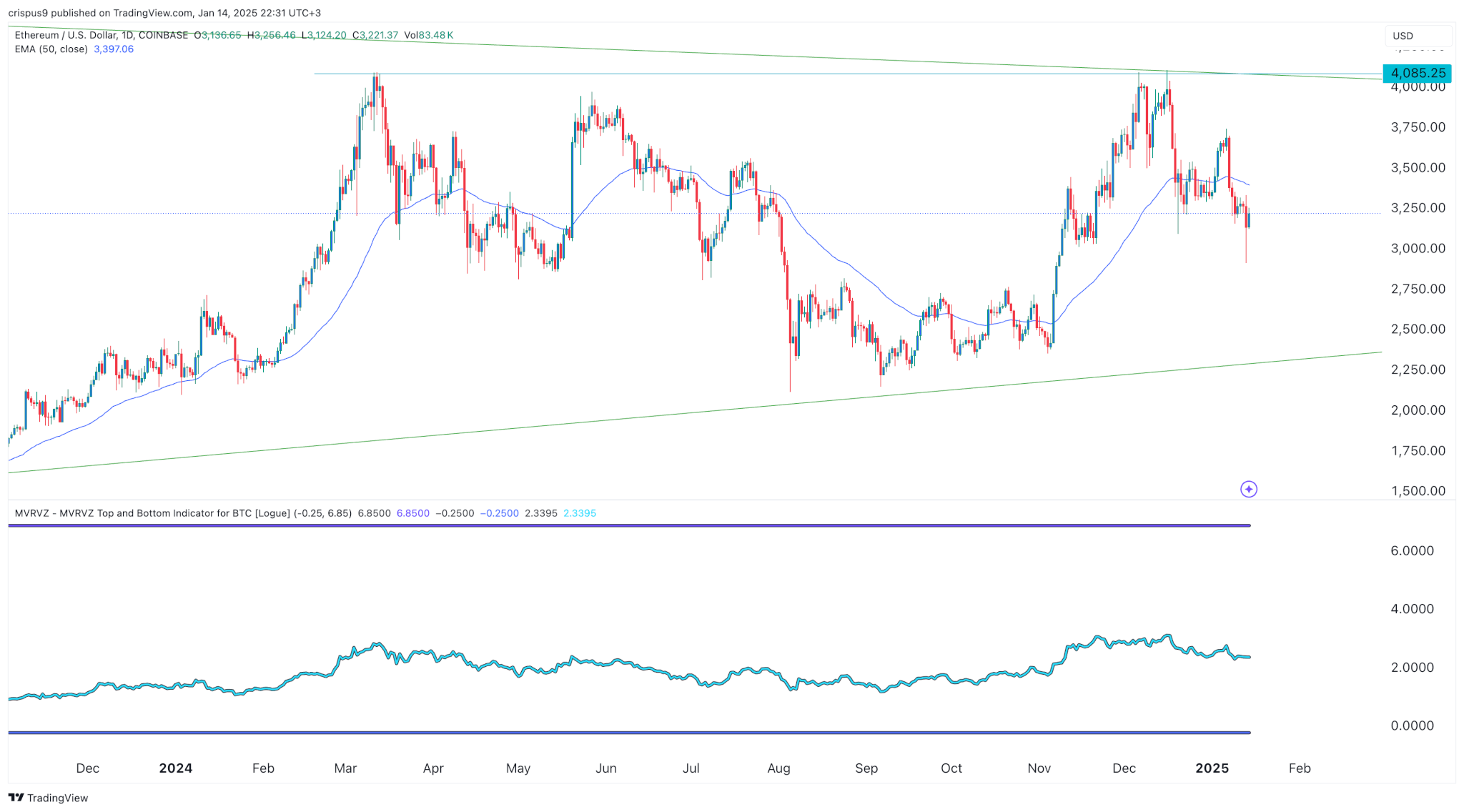

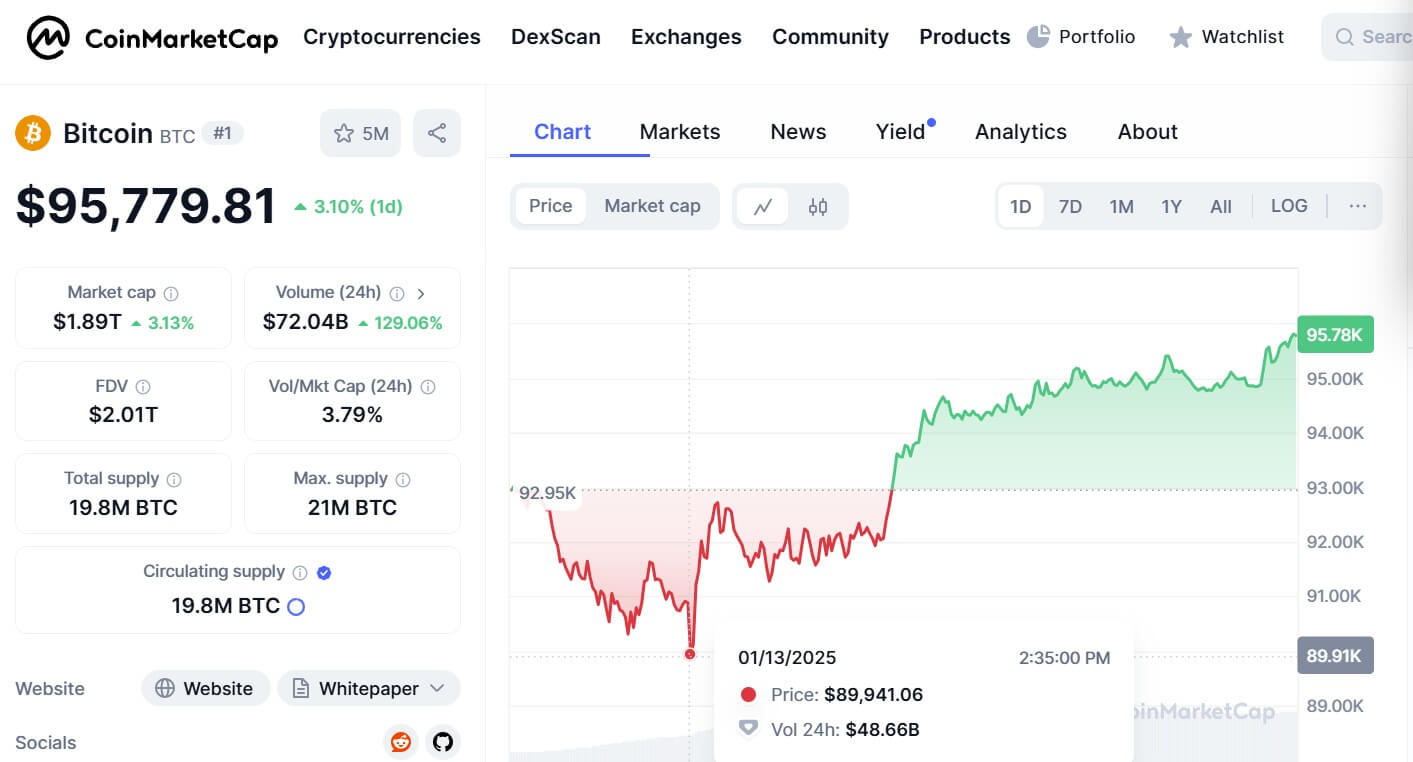

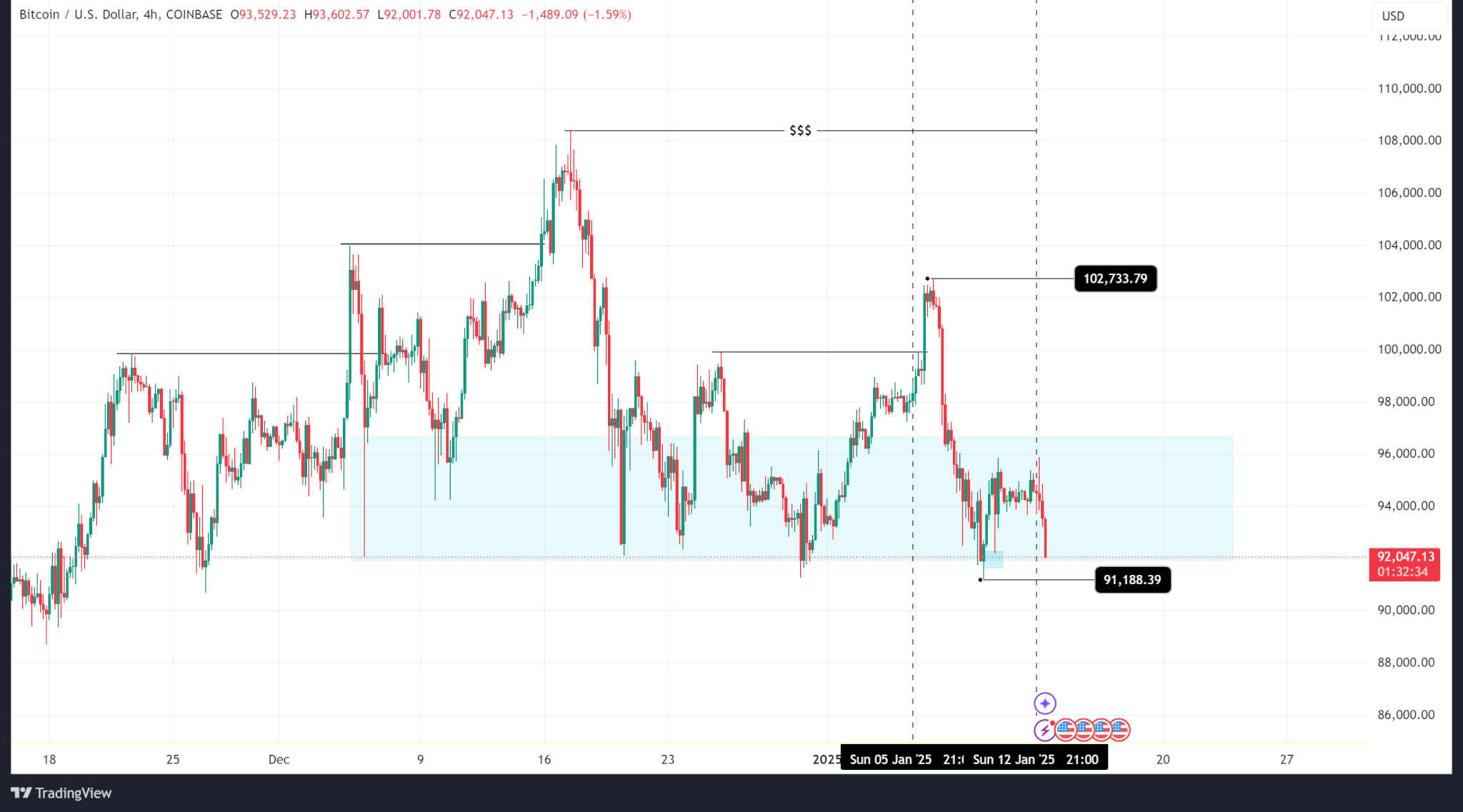

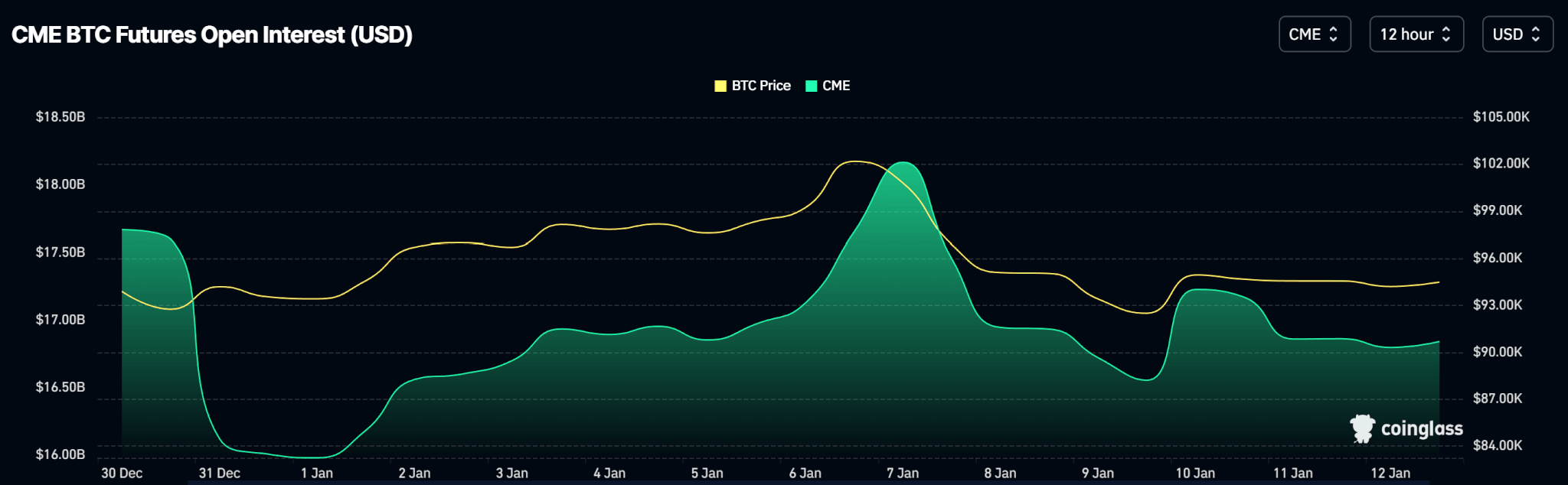

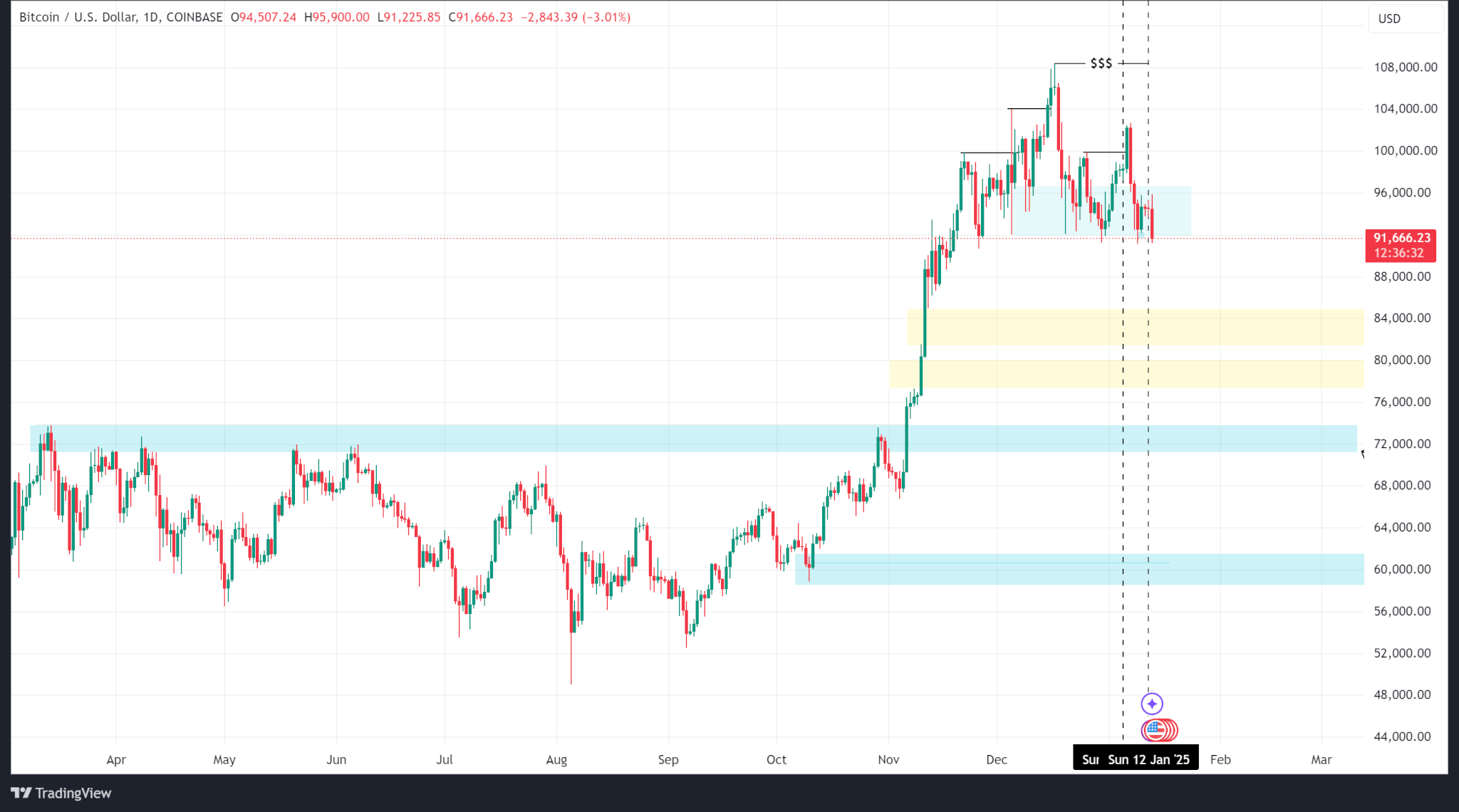

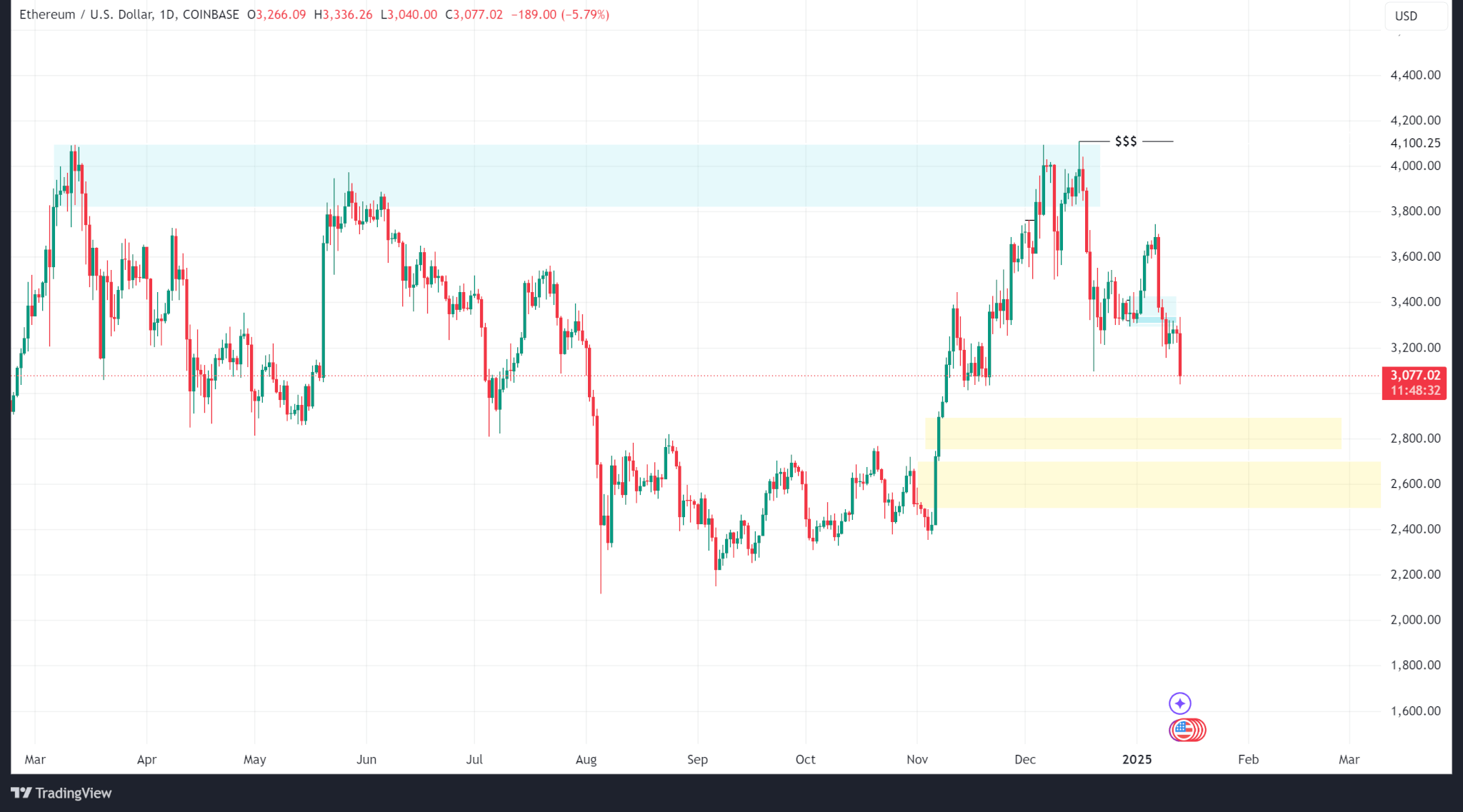

Since winning the US election in November, Trump has helped pushed market prices to new highs. In December, Bitcoin reached an all-time high of over $108,000. However, while some think Trump isn’t the only reason Bitcoin’s is rising, it’s certainly helping.

Speaking about this to CoinJournal, James Toledano, COO of Unity Wallet, said that “Bitcoin’s price ahead of inauguration day hinges on a mix of market sentiment and speculative optimism,” adding that “the real drivers of Bitcoin’s price include adoption, regulation, and macroeconomic factors.”

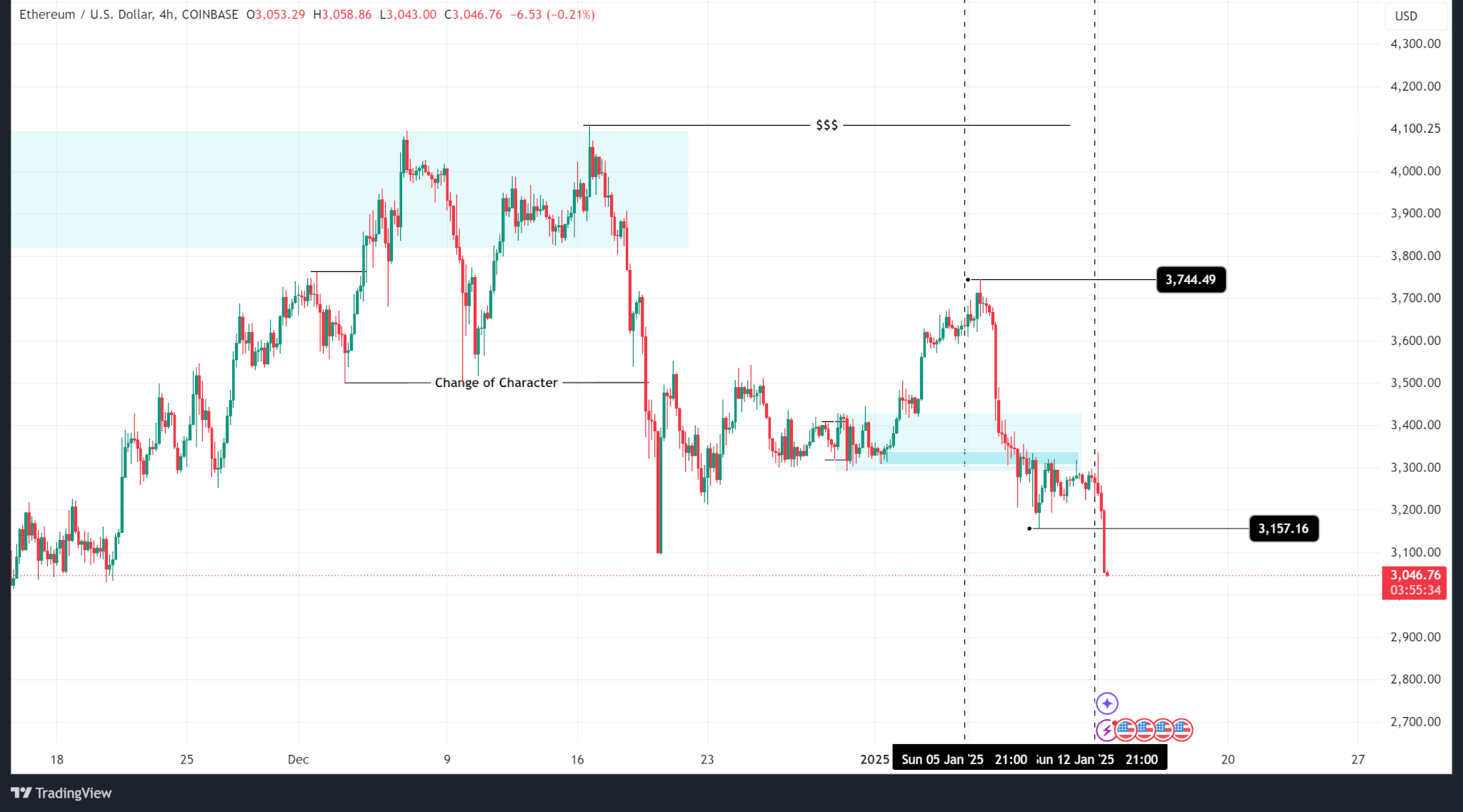

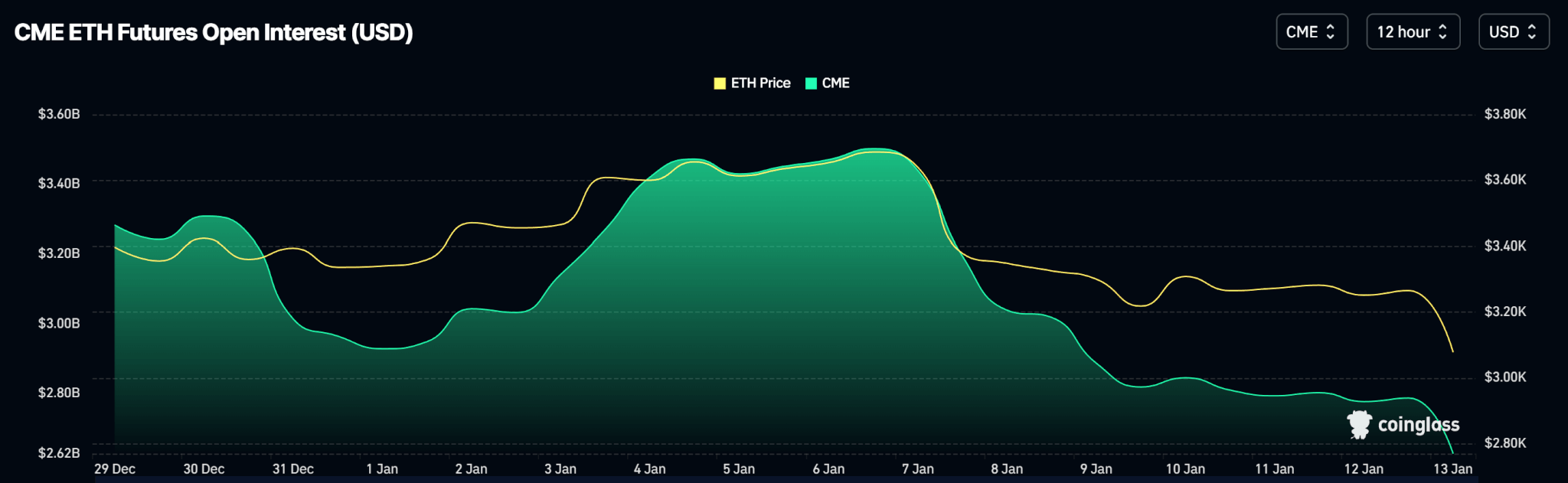

Earlier last week, it was reported that bleak economic expectations were driving the bearish sentiment within the crypto market. At the time, Bitcoin had dropped below $90,000 as Trump’s tariff plans, the US Federal Reserve’s cautious approach to interest rate cuts, and a strong dollar dampened crypto enthusiasm.

According to Toledano, following Trump’s inauguration, the rise of Bitcoin will be shaped by institutional adoption, increased regulatory clarity, and broader macroeconomic and geopolitical trends.

At the same time, “as pro-Bitcoin as Trump is, some other major geopolitical or macroeconomic event could knock 40%-50% off the value overnight and we’ve seen this before,” said Toledano.

Despite this, many are hopeful that positive changes are ahead.