It’s been another busy week in the crypto market: Bitcoin tops $107,000, FTX is to begin customer repayments in early 2025, CyberKongz receives “concerning rhetoric” in Wells notice from the SEC, US lawmakers cancel vote to renominate SEC Commissioner Caroline Crenshaw, and Injective and Sonic partner to build first cross-chain AI agent hub.

Bitcoin tops $107,000 for the first time

Earlier this week, Bitcoin reached new heights, topping above $107,000. At the same time, the defunct crypto exchange Mt. Gox moved around 1,620 Bitcoin to an unknown wallet. The value of the Bitcoin transfer stood at over $172.5 million.

The Bitcoin movement followed a transfer made two weeks ago by Mt. Gox. Then, the platform moved 24,000 Bitcoin to unknown wallets. According to Arkham, the bankrupt exchange transferred 1,619.6 Bitcoin in two transfers: one of 1,427.9 and the other of 191.7 to two new addresses.

Before hitting $107,000, Bitcoin reached $106,000 following news that President-elect Donald Trump is considering plans to create a US Bitcoin strategic reserve. Investors believe Bitcoin reaching $120,000 by the end of 2024 is achievable.

FTX to begin crypto repayments in early 2025

Collapsed crypto exchange FTX has announced that it will start its customer distribution in early January. Its court-approved Chapter 11 bankruptcy reorganization will be effective on January 3, 2025.

FTX is to work with crypto custodian BitGo and crypto exchange Kraken to distribute assets to retail and institutional investors. In November, it was reported that FTX was to start distributions by March 2025.

FTX collapsed in November 2022, with five of the top executives jailed or sentenced to time served. This includes former CEO Sam Bankman-Fried who was sentenced to 25 years in prison in March.

CyberKongz receives Wells notice from the SEC

CyberKongz, a non-fungible token (NFT) platform, received a Wells notice from the US Securities and Exchange Commission (SEC).

In a post on X, CyberKongz said that they have “been suffering in silence for the last two years, ever since we first received contact from the SEC,” adding that it had received some “concerning rhetoric” that an ERC-20 token can’t be issued with a blockchain game without being registered as a security.

By issuing a Wells notice, the SEC believes there may be securities law violations and is preparing to take action against the platform. One of the issues the SEC has with CyberKongz is the “sale” of its Genesis Kongz NFTs in April 2021; however, CyberKongz said this was a contract migration and not a sale.

Earlier this year, crypto exchange Coinbase received a Wells notice from the SEC followed by OpenSea, an NFT marketplace, and blockchain gaming platform Immutable.

US lawmakers cancel vote to renominate SEC Commissioner Caroline Crenshaw

A US Senate vote to renominate Democrat Caroline Crenshaw for a second term at the US Securities and Exchange Commission (SEC) was canceled this week.

The original vote was scheduled for December 11; however, Sherrod Brown, the Senate Banking Committee Chair, postponed it within minutes of starting, due to issues between the Democrats and Republicans.

Brown later released a statement saying that corporate special interests are running a “disgusting smear campaign against Caroline Crenshaw.”

Yet, with Congress stopping on December 20 for the holidays, Crenshaw was not renominated before President-elect Donald Trump’s administration re-enters the White House in January.

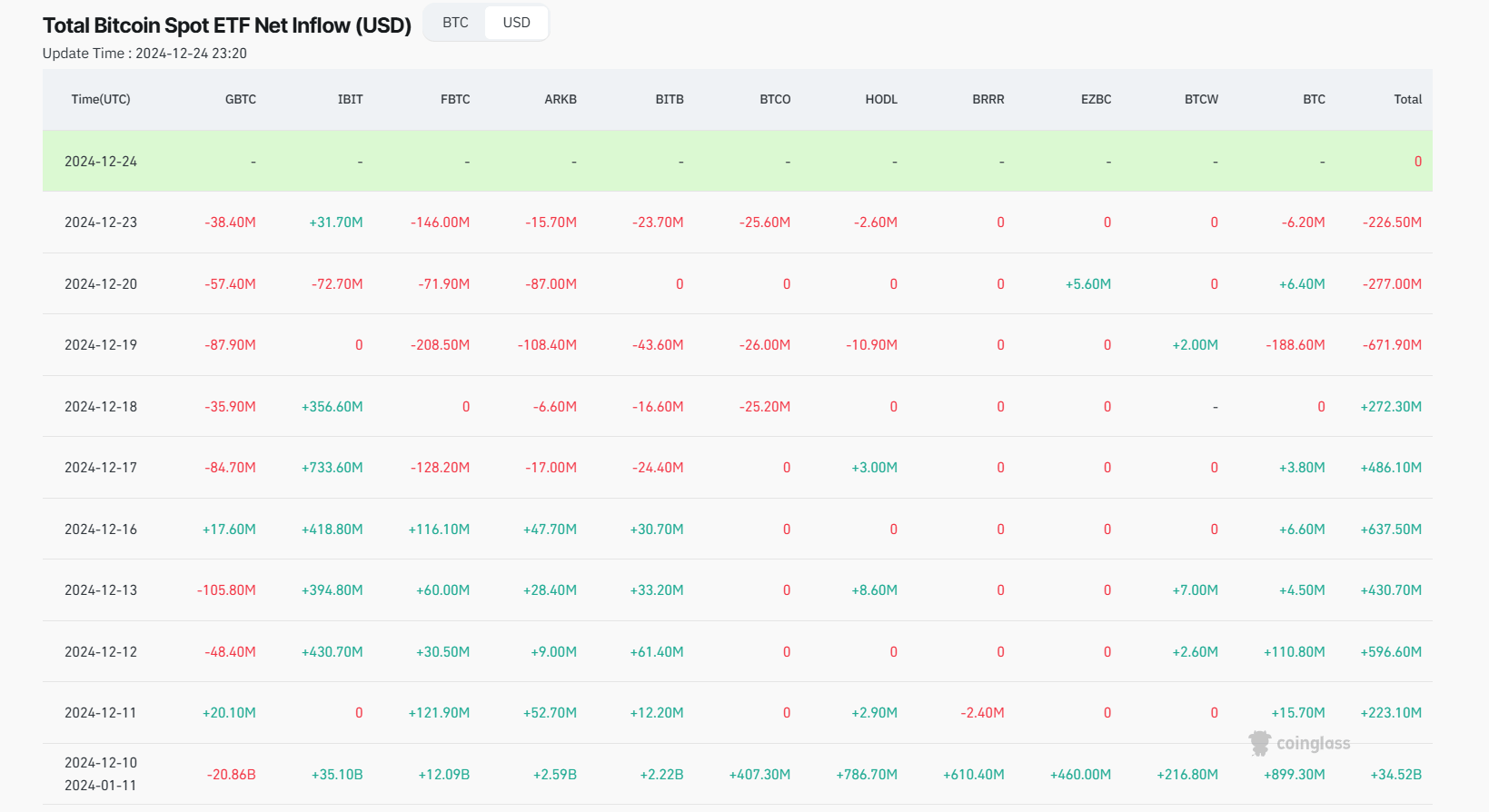

Following the news of Crenshaw’s reappointment, Brian Armstrong, CEO of Coinbase, took to X to say: “She tried to block the Bitcoin ETFs, and was worse than Gensler on some issues (which I didn’t think was possible).”

Injective and Sonic partner to build the first cross-chain AI agent hub

Injective and Sonic are working together to create the first cross-chain artificial intelligence (AI) agent platform.

The two crypto platforms said the new AI agent hub will leverage Sonic’s HyperGrid technology to integrate Solana and Injective ecosystems. The Smart Agent Hub will also leverage the Inter-Blockchain Communication Protocol (IBC), an open-source protocol enabling blockchain interoperability.

According to Injective Labs, the AI agent hub will offer developers the tools to create, deploy, and monetize AI agents across the decentralized ecosystem.

Share this article

Categories

Tags