It’s been another busy week in the crypto market: Virgin Voyages accepts Bitcoin, Donald Trump selects Paul Atkins as next US SEC chair, Coinbase won’t work with anti-crypto law firms, Michael Saylor urges Microsoft to accept Bitcoin, and Bitcoin hits over $100,000 for the first time.

Let’s look at these and recap what happened this week in crypto.

Virgin Voyages accepts Bitcoin

Sir Richard Branson’s cruise line, Virgin Voyages, now accepts Bitcoin as a payment option for bookings.

In an announcement, Virgin Voyages said passengers can use Bitcoin to pay for cruises across its fleet, including its highly anticipated Annual Pass. Virgin Voyages’ Annual Pass, which provides various exclusive benefits to frequent travelers, is also the first cruise product to accept cryptocurrency payments.

The company’s move comes as the crypto industry experiences heightened interest from retail and institutional investors, pushing prices to all-time highs. Virgin Voyages is also hoping to attract younger, tech-savvy travelers and digital asset enthusiasts who increasingly use crypto in their everyday lives.

Donald Trump selects Paul Atkins as next US SEC chair

US President-elect Donald Trump has nominated pro-crypto Paul Atkins to become the next chair of the US Securities and Exchange Commission (SEC).

Gary Gensler, the current SEC chair, will step down on January 20 when Trump re-enters the White House. News of Atkins filling the role marks a significant step in fulfilling Trump’s campaign promises to bring regulatory clarity to the crypto industry.

Atkins, who served as an SEC commissioner under President George W. Bush, has been an outspoken supporter of the crypto industry. The selection of Atkins signals a strong push toward crypto-friendly regulations, something the industry has been lacking under Gensler’s leadership.

Coinbase won’t work with anti-crypto law firms

Brian Armstrong, CEO of Coinbase, has said the crypto exchange won’t work with law firms if they hire people who worked against the crypto industry during their time in government.

In a post on X, Armstrong said it was an “ethics violation” to “try and unlawfully kill an industry while refusing to publish clear rules.”

We’ve let all the law firms we work with know, that if they hire anyone who committed these bad deeds in the (soon to be) prior administration, we will no longer be a client of theirs.

Senior partners at these law firms seem unaware of the crypto industry’s position on this.… https://t.co/k8R6NtfTV1 pic.twitter.com/RT0k408i9f

— Brian Armstrong (@brian_armstrong) December 3, 2024

Armstrong made his comments after Milbank, an international law firm, recently hired Gurbir S. Grewal as a partner in its New York office’s litigation and arbitration practice. Before, Grewal was the US Securities and Exchange Commission’s (SEC) enforcement head.

As director of the SEC’s enforcement division, Grewal was responsible for overseeing investigations, enforcement action, and litigation conducted by the SEC. During his time at the SEC, the agency brought over 100 enforcement actions targeting non-compliance in the crypto space.

Armstrong added: “I don’t believe in permanently cancelling people, but we as an industry should not be putting money in their pocket after the abuse.”

Michael Saylor urges Microsoft to accept Bitcoin

The CEO of MicroStrategy has told Microsoft that Bitcoin is the best asset a company should own, claiming it represents the “greatest digital transformation of the 21st century.”

In a three-minute video on X, Saylor tagged Satya Nadella, Microsoft’s chair and CEO, and its board of directors, saying:

“Microsoft can’t afford to miss the next technology wave, and Bitcoin is the next wave. Bitcoin represents the greatest digital transformation of the 21st century; it represents digital capital.”

My 3-minute presentation to the $MSFT Board of Directors and @SatyaNadella, articulating why the company should do the right thing and adopt #Bitcoin. pic.twitter.com/aHp91V9Slz

— Michael Saylor⚡️ (@saylor) December 1, 2024

Saylor added that if Microsoft wants to outperform, it’s going to “need Bitcoin,” adding:

“You’ve surrendered hundreds of billions of dollars of capital over the past five years, and you’ve just amplified the risks that your own shareholders face. If you want to escape that vicious cycle, you’re going to need an asset without counterparty risk.”

In Saylor’s opinion, that lies with Bitcoin.

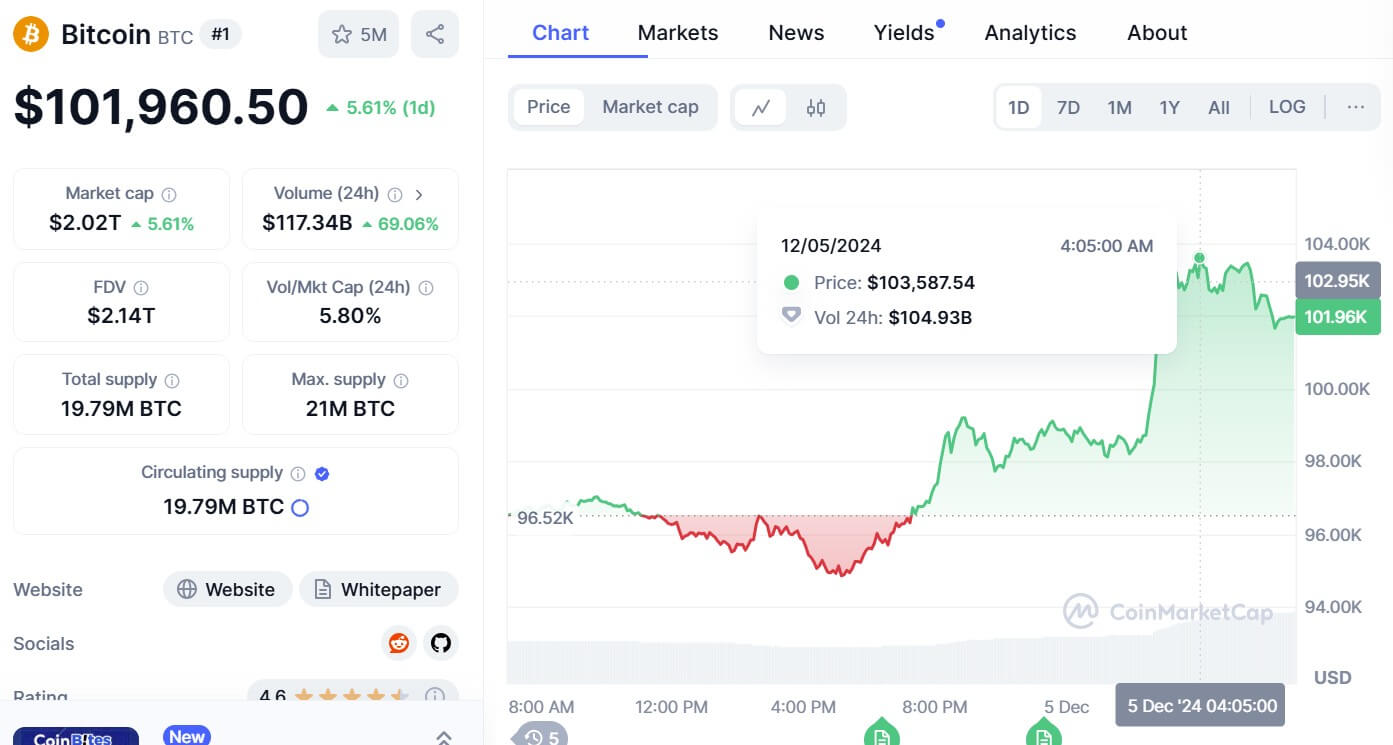

Bitcoin hits over $100,000 for the first time

On December 5, Bitcoin reached the psychological level of $100,000 for the first time, continuing its bull run since the beginning of November.

The last time it got within touching distance of the landmark level was on November 22 when it topped more than $99,000. Data from CoinMarketCap showed it reached a high of $103,500.

Factors pushing Bitcoin to new heights included President-elect Donald Trump nominating pro-crypto Paul Atkins as the next US SEC chair.

At the same time, Ethereum broke past $3,900. Crypto analyst Miles Deutscher says Ethereum will lead utility coins up. He also sees Bitcoin’s rally as great news for altcoins.

“The higher #Bitcoin goes, the bigger the altcoin run will be,” the analyst noted.