Wow, what a week’s it’s been in crypto: Tether’s CEO says they’re not launching a blockchain, the State of Michigan holds over $10 million in spot Ethereum ETFs, the launch of the Global Dollar stablecoin, Bitcoin reaches a new all-time high of over $77,000, and BlackRock’s IBIT sets record daily inflows of $1.12 billion.

Let’s take a closer look at these and give you a recap on what happened this week in crypto.

Tether isn’t launching a blockchain

Paolo Ardoino, CEO of Tether, said that they’re not launching a Tether chain at the moment because “neutrality is very important to them.”

Posting on X, Ardoino said that “different independent L2 solutions are working to support $USDt for gas fees.” Rather than trying to centralize everything, he mentioned that Tether is interested in teaming up with companies and communities.

His announcement comes as Tether experienced a record-breaking milestone during the last quarter of 2024, resulting in $7.7 billion in profit over nine months.

Focusing its attention on Q4 2024, Ardoino said the outlook is “very positive” with the growth of on-chain wallets per quarter rising to more than 35 million new addresses.

The State of Michigan holds over $10 million in spot Ethereum ETFs

The State of Michigan pension fund disclosed that it now holds more than $10 million in spot Ethereum exchange-traded funds (ETFs).

According to a 13F filing, the State of Michigan Retirement System disclosed its holdings of the Grayscale Ethereum Trust (ETHE) and Ethereum Mini Trust ETF (ETH). Per the filing, the Michigan state pension holds 460,000 shares of ETHE worth about $10 million and 460,000 shares ETH (the mini trust ETF) worth roughly $1.1 million.

This news is significant because the State of Michigan pension fund has become the first such entity to disclose an ETH ETF holding. According to Bloomberg senior ETF analyst Eric Balchunas this is a “big win” for Ethereum.

In a post on X, he said: “Not only did Michigan’s pension buy Ether ETFs but they bought more then they did of Bitcoin ETFs, $10m vs $7m, this despite BTC being up a ton and Ether in the gutter. Pretty big win for Ether which could use one.”

The Global Dollar stablecoin launches

The Global Dollar (USDG) stablecoin has launched, aiming to boost global stablecoin adoption.

Initial partners of the Global Dollar Network include Anchorage Digital, Bullish, Galaxy Digital, Kraken, Nuvei, Paxos, and Robinhood. Pegged to the US dollar and issued out of Singapore by Paxos, the USDG stablecoin comes at a time when there is tough competition in the stablecoin market.

At present, Tether’s USDT and Circle’s USDC stablecoins make up a majority of the stablecoin market. In September, it was reported that USDT accounted for more than 75%. However, it’s this “lack of competition” in the stablecoin market that’s stopping the “industry from reaching its full potential,” according to Arjun Sethi, Co-CEO at Kraken, adding:

“USDG upends this dynamic with a more equitable model that will bring mainstream participants into the ecosystem and accelerate new stablecoin use cases.”

Bitcoin achieves new all-time high above $77,000

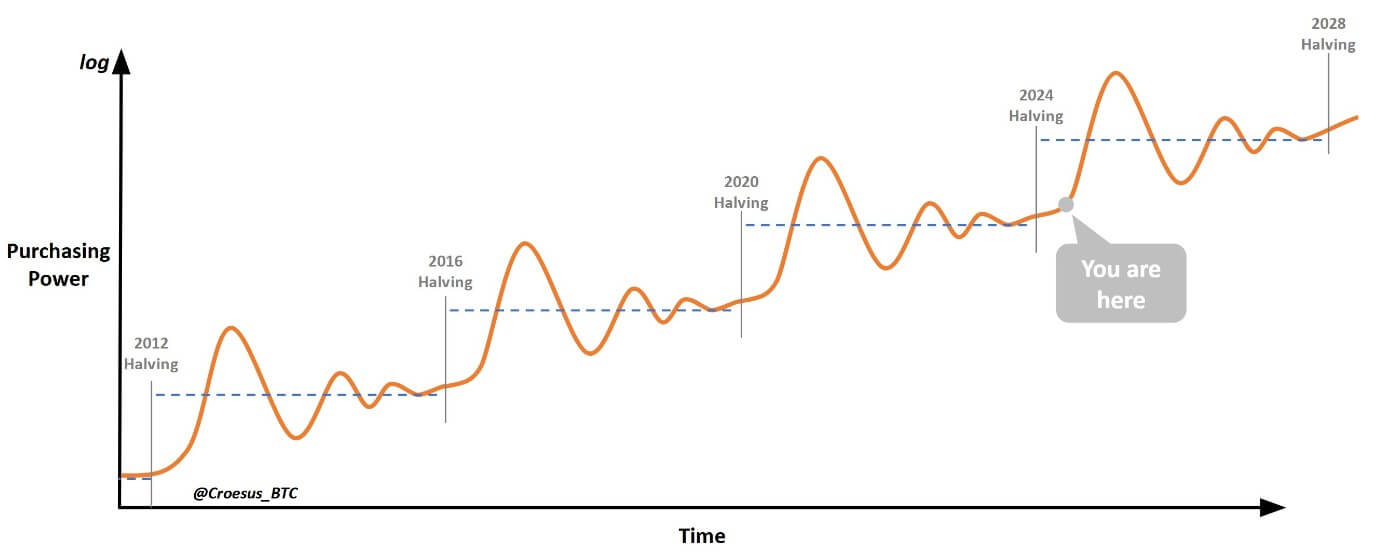

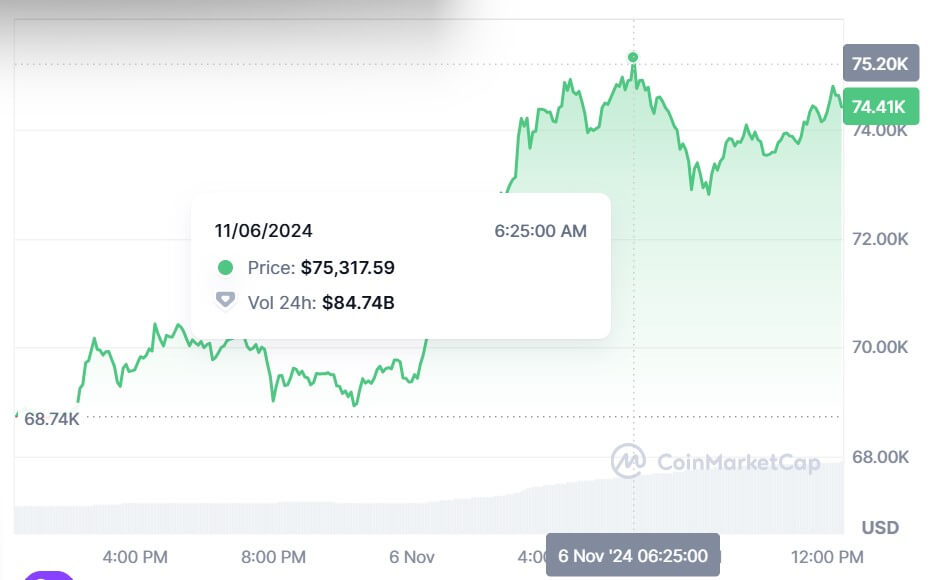

Bitcoin has reached another new high, topping $77,000, continuing from its upward trajectory following Donald Trump’s presidential win.

Earlier in the week, Bitcoin achieved a new high of $75,315 as the results signalled a Trump win for the White House. Bitcoin’s last all-time high took place in March when it reached $73,000.

However, Bitcoin wasn’t done there.

It then pushed higher, topping over $76,000 across major exchanges on November 7. The news of Bitcoin’s new all-time high came as the US Federal Reserve announced it was cutting interest rates by 25 basis points.

It remains to be seen how far Bitcoin will continue rising to; however, according to Bernstein analysts, Bitcoin could reach between $80,000 and $90,000 by the end of 2024 following Trump’s win.

BlackRock’s IBIT sets record daily inflows of $1.12 billion

BlackRock’s iShares Bitcoin Trust (IBIT) exchange-traded fund (ETF) set a new record for inflows, reaching $1.12 billion, topping its previous record of $872 million.

BlackRock’s IBIT net assets now account for $34.29 billion, significantly pushing it ahead of its competitors. The new record follows an October milestone, which saw the company reaching $30 billion in total assets in 293 days.

Speaking to CoinJournal, Dary McGovern, COO of Bitcoin native Xapo Bank, said that Bitcoin’s new record suggests a “broader shift in institutional confidence, with notable market movements such as BlackRock’s record net inflows into its iShares Bitcoin Trust (IBIT).”

A new record was also seen across the 12 US spot Bitcoin ETFs, reaching $1.38 billion since launching in January.

Share this article

Categories

Tags