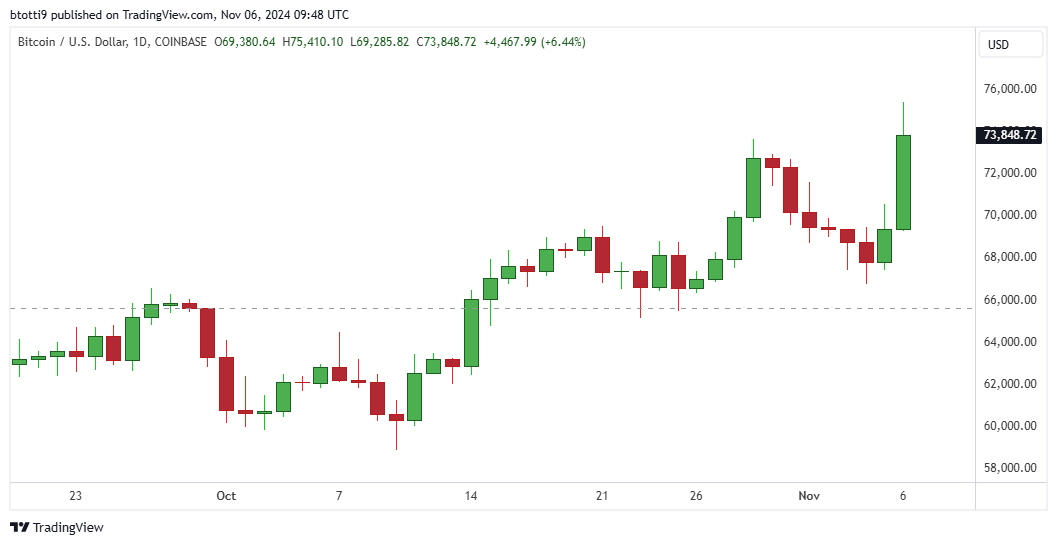

- Bitcoin spiked to above $75,400, a new all-time high.

- This came as Donald Trump clinched the US presidency, beating Kamala Harris.

Bitcoin rose to new all-time high above $75,000 as world leaders began to congratulate Donald Trump as the winner and president-elect in the 2024 US election.

As Trump took a decisive lead with key wins in Pennsylvania, Georgia and North Carolina, pushing his Electoral College votes past the 270 mark, Bitcoin price rocketed past $75k to hit a new all-time high above$75,400.

The flagship cryptocurrency has since retraced below $74k, but its sharp surge had over half a billion dollars liquidated. Per Coinglass, 124,734 traders saw their positions liquidated in the past 24 hours, with total liquidations at more than $557 million.

BTC liquidations stood at over $273 million, with more than 70% of that – $211 million – in shorts. Crypto is overall extremely bullish on a Trump presidency and analysts say dips in coming months will offer buy opportunities.

Trump’s pro-crypto stance

As the election cycle slowly comes to an end, key to the crypto industry is that the most “pro-crypto” candidate has won. World leaders, including Israeli Prime Minister Benjamin Netanyahu, India’s Narendra Modi and El Salvador President Nayib Bukele, have all congratulated Trump on his victory.

Dear Donald and Melania Trump,

Congratulations on history’s greatest comeback!

Your historic return to the White House offers a new beginning for America and a powerful recommitment to the great alliance between Israel and America.

This is a huge victory!

In true friendship,… pic.twitter.com/B54NSo2BMA

— Benjamin Netanyahu – בנימין נתניהו (@netanyahu) November 6, 2024

The US president-elect has also given a victory speech.

But while the market celebrates, what remains to be seen is whether he keeps the pledges he made during the campaign. These include two pledges for “day one” in office: fire US Securities and Exchange Commission Chair Gary Gensler and commute the sentence of Ross Ulbright.

Last night, Donald Trump pledged to commute my sentence on day 1, if reelected. Thank you. Thank you. Thank you.

After 11 years in prison, it is hard to express how I feel at this moment. It is thanks to your undying support that I may get a second chance.

— Ross Ulbricht (@RealRossU) May 26, 2024

He also said he’d make the US the world’s BTC mining hub, support a strategic Bitcoin reserve effort and never allow the creation of a central bank digital currency (CBDC).

Despite these pledges, industry experts say a Trump White House will be more supportive of crypto in general. The number of pro-crypto Senate and House Representaives has also increased significantly to suggest the road to regulatory clarity has likely opened up.