- The whale sold over 150k Injective (INJ) tokens worth over $3.29 million.

- According to Lookonchain, the whale acquired 2.44 million Lido DAO (LDO) worth over $3.05 million.

- INJ price dipped slightly while LDO rose

A whale has sold a significant amount of Injective (INJ) and bought more Lido DAO (LDO) tokens.

On Wednesday, Sept. 25, Lookonchain shared on-chain details that showed the whale dumped 150,428 INJ valued at $3.29 million. The whale swapped the INJ for 2.44 million LDO valued at more than $3.05 million.

Per Lookonchain, the whale sold their INJ for LDO via crypto liquidity provider Cumberland.

A whale sold 150,428 $INJ($3.29M) and bought 2.44M $LDO($3.05M) via #Cumberland in the past 30 hours.https://t.co/4L8vFWcIng pic.twitter.com/ESXmWIGoFJ

— Lookonchain (@lookonchain) September 25, 2024

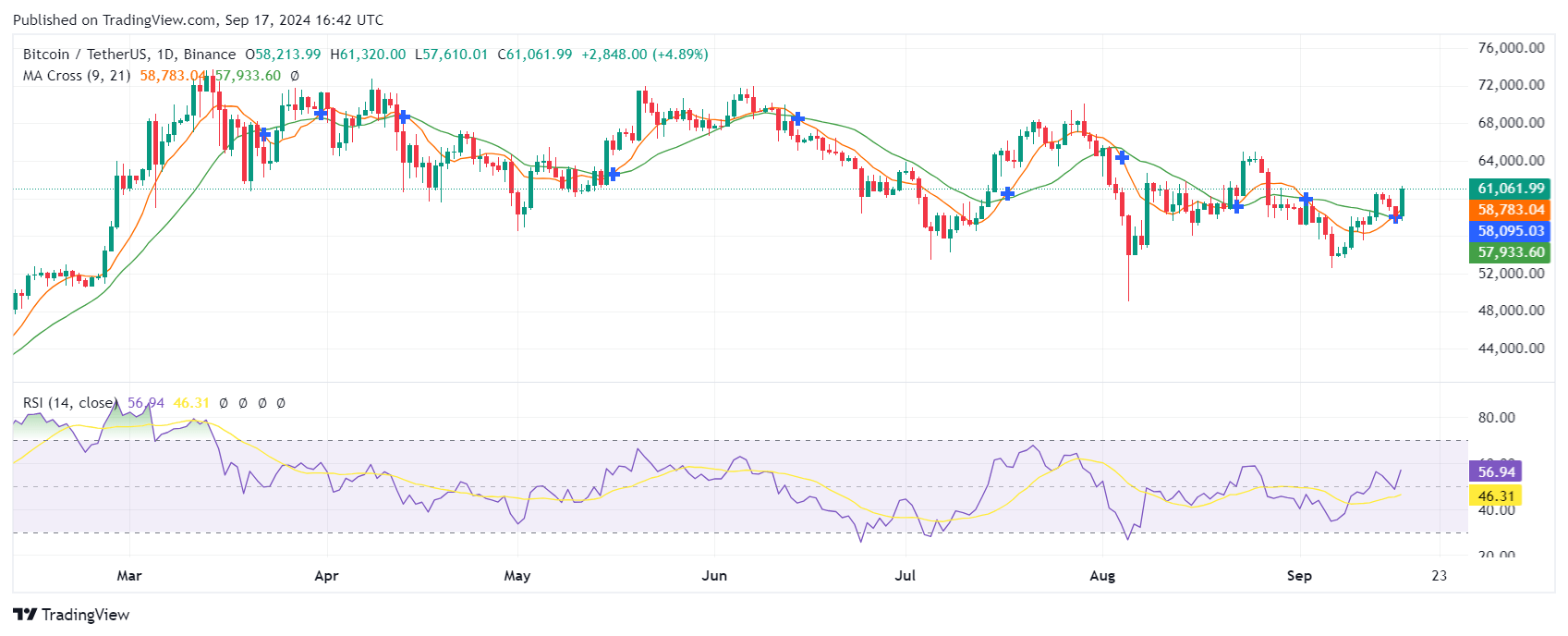

Injective price

Injective (INJ) is layer 1 blockchain decentralized finance applications. The Binance and Mark Cuban-backed interoperable L1 blockchain currently ranks as the 49th largest cryptocurrency by market at $2.1 billion.

The price of Injective’s native token fell 3% to trade near $21.24. INJ trading lower also saw weekly gains shrink to around 14%, while Injective is now down 1.4% in the past month. Notably, INJ reached highs of $22.70 on Tuesday, hitting the resistance level seen on August 24.

INJ price however reached $52.62 on March 14, 2024 and its currently positioned nearly 59% off that level.

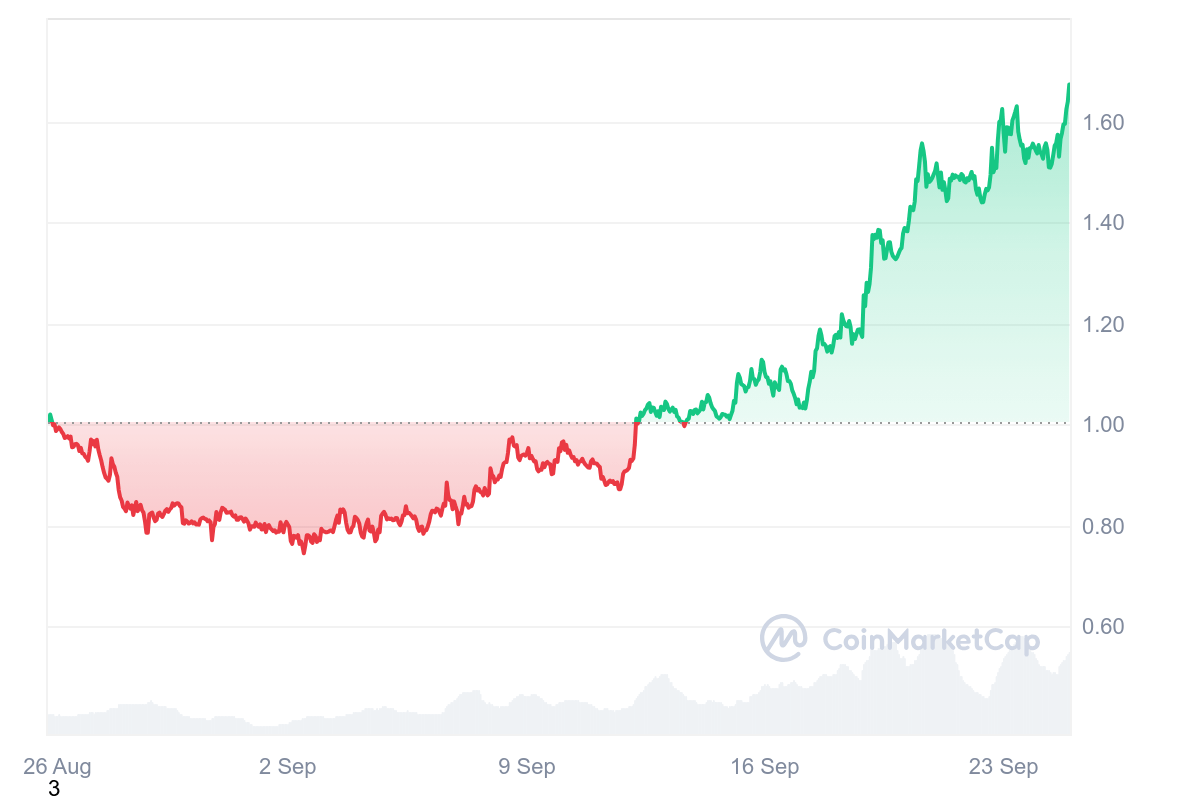

Lido DAO price

With the LDO purchase, the whale’s showing their bullish projection for Lido. Growth for the decentralized finance platform – a market leader in Ethereum staking – may be among catalyst.

The Lido DAO price was up 2.6% in the past 24 hours to change hands at highs of $1.29 earlier in the day. LDO is among the top gaining tokens with +29.7% this past week.

LDO price was at $1.26 at the time of writing.