- Bitcoin Dogs (0DOG) will list on Gate.io, MEXC and Unisat on Aug. 21.

- What does listing on the 3 crypto exchanges mean for 0DOG?

Bitcoin Dogs (0D0G) will be making its market debut with a bang as three major exchanges announce trading support.

Investors who have waited since the Bitcoin Dogs’ successful presale are excited as listings and token claims get a clearer timeline. But what does this milestone mean for 0DOG price?

Gate, MEXC to list Bitcoin Dogs

After making history as the world’s first BRC-20 token ICO on the Bitcoin network, 0DOG is poised to land on Gate.io, MEXC and Unisat. The cryptocurrency exchanges will list the play-to-earn and non-fungible token platform’s native token on Aug. 21, 2024.

🚨HUGE ANNOUNCEMENT, DAWGZ!🚨

Bitcoin Dogs is set to hit not one, but THREE EXCHANGES in just 6 days! 🐶🚀

$0DOG will officially list on @gate_io, @MEXC_Official, AND @unisat_wallet on the 21st August, 11AM UTC!

✅ Tier 1 exchange

✅ Billions in daily volume

✅… pic.twitter.com/paUiZ5ngT6— BitcoinDogsClub (@BitcoinDogsClub) August 15, 2024

This is a major milestone for the project, which secured more than $13.4 million in its presale.

In the next five days, 0DOG will be available across Gate.io, MEXC and UniSat – platforms that together have a combined trading volume of over $2.5 billion in daily trading volume. Gate.io and MEXC are top tier crypto exchanges with over $1 billion each in 24-hour volume.

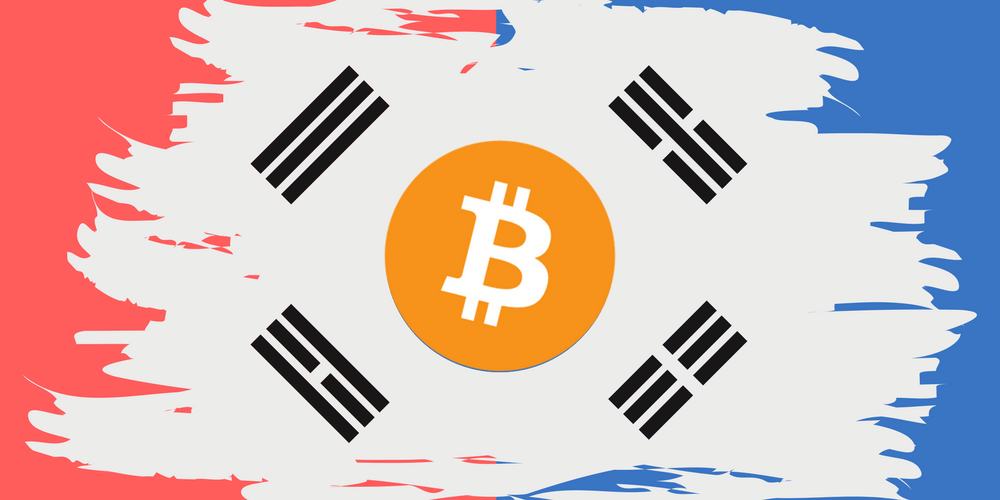

Bitcoin Dogs game via Telegram mini-app

News that Bitcoin Dogs will go live on exchanges in coming days has interest in the project back to levels seen during the ICO. This also comes as the team behind the BRC-20 project hit key roadmap landmarks, including developments on the P2E ecosystem, 10K Ordinals NFTs and staking.

In the upcoming game, aspects such as PvP battles, exclusive access and mobile/Telegram app support has Bitcoin Dogs poised to hit the market as recent hits such as Kombat Hamster and Notcoin.

Recently, Telegram introduced mini apps and the in-app browser features, opening up decentralized applications to millions of users. The instant messaging platform is currently a top destination for crypto tap-to-earn and play-to-earn games, which is an ecosystem that Bitcoin Dogs also targets with its Telegram integration.

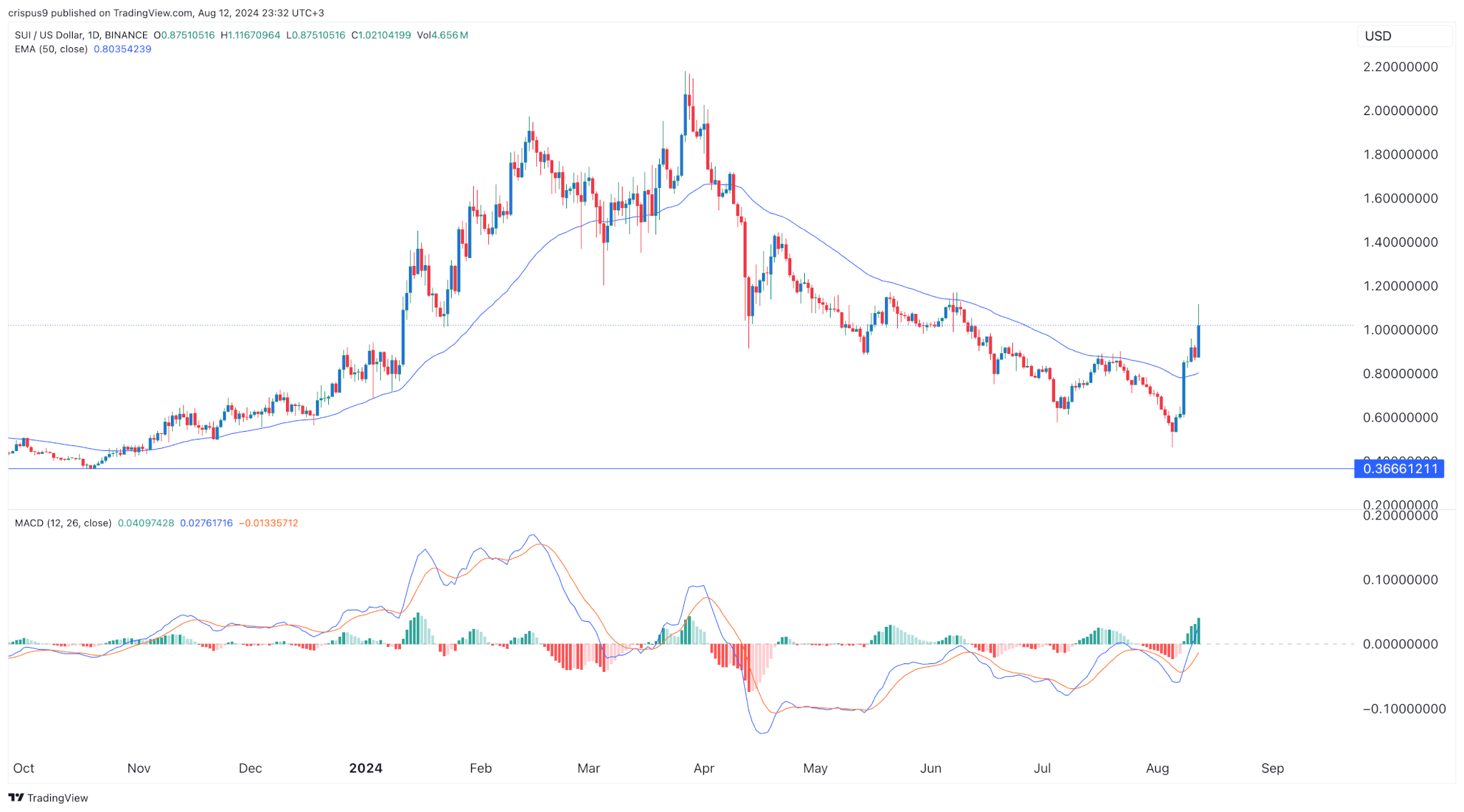

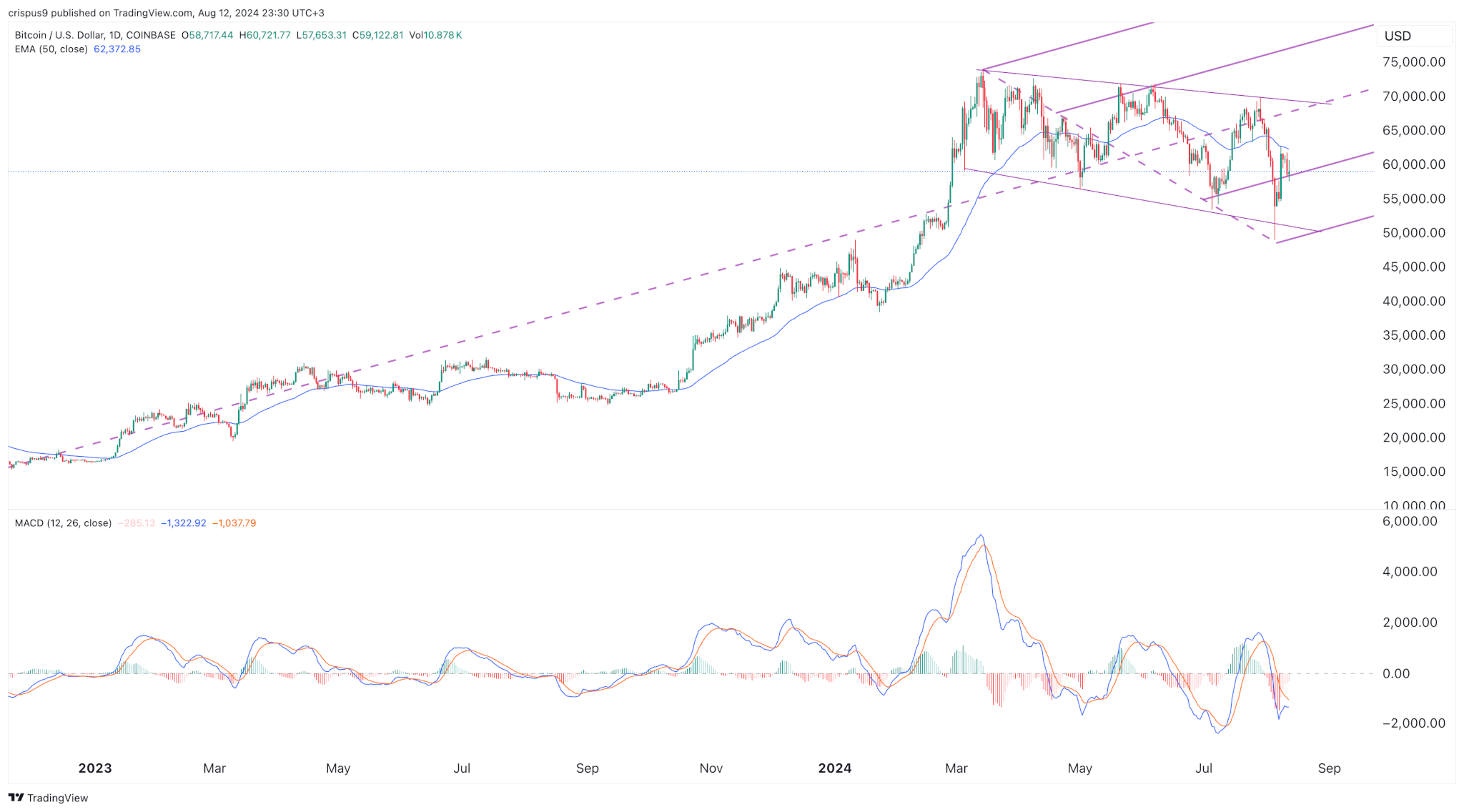

Bitcoin Dogs price forecast

Also helping Bitcoin Dogs price could be the overall developments within the Bitcoin layer-2 ecosystem. Multiple projects have interest in the decentralized finance (DeFi), gaming and metaverse market on the flagship blockchain network.

The gaming part will benefit from Bitcoin Dogs rollout of its game on Telegram.

Over 950 million monthly active users will have a chance to play the Bitcoin Dogs game via a Telegram mini-app, bringing the future of gaming to users. 0DOG will power this ecosystem and viral traction could be massive for the token’s value.

Analysts at Pantera Capital noted earlier in the year that the L2 market on Bitcoin could be a $500 billion market – a prediction that means Bitcoin Dogs’ first mover advantage puts it ahead of potential rivals.

The listing on Gate.io, MEXC and Unisat is a first major milestone that also adds to the positive catalysts for 0DOG. Savvy traders are likely to use the upcoming listing and the potential buy opportunity to add to their positions.

If interested in learning more about Bitcoin Dogs, visit the official website.