Author: BTCLFGTEAM

-

Core Scientific the first buyer of Block’s 3nm Bitcoin mining ASICs

- Core Scientific buys Block’s 3nm Bitcoin ASICs in a major deal between the two companies.

- The deal boosts Core Scientific’s hash rate by 60%, enhancing efficiency and profitability.

- The deal between Block and Core Scientific aims to redefine Bitcoin mining standards, leveraging advanced ASICs.

Jack Dorsey’s financial services company Block has finalized a major deal with Core Scientific, marking the first sale of its highly anticipated 3 nanometer Bitcoin mining ASICs.

This deal marks one of the largest ASIC agreements ever signed in the history of Bitcoin mining, underscoring Block’s commitment to advancing mining technology and Core Scientific’s strategic expansion in the sector.

Block’s 3nm Bitcoin mining ASICs

Developed by Block’s Proto team, the 3nm mining ASICs represent a leap forward in efficiency and performance for large-scale Bitcoin mining operations.

By integrating cutting-edge technology into these chips, Block aims to significantly enhance the efficiency, reliability, and uptime of mining activities conducted by firms like Core Scientific.

The 3nm ASCIs provides Core with 15 exahashes per second (EH/s) worth of chips and are set to increase the mining firm’s energized hash rate by a remarkable 60% as of June 2024.

Core Scientific, a publicly traded Bitcoin mining giant, has emerged as a key player in the industry’s recovery following recent challenges. The company’s stock (CORZ) has surged, reflecting investor confidence in its ability to leverage advanced mining technologies to bolster operational capabilities and profitability.

Core Scientific’s decision to purchase Block’s 3nm Bitcoin mining ASICs comes amidst a broader industry trend towards greater efficiency and sustainability in cryptocurrency mining, driven by technological innovation and environmental considerations.

Block pioneering a new era in Bitcoin mining

According to Russell Cann, Chief Development Officer at Core Scientific, the collaboration with Block marks a pivotal moment in scaling Bitcoin mining operations.

Cann emphasizes that the new mining platform built around Block’s 3nm ASICs will not only optimize space and operational resources within their data centers but also contribute to the long-term vitality of the Bitcoin network.

The partnership underscores a shared vision to redefine industry standards and accelerate the adoption of advanced mining technologies globally.

The strategic alliance between Block and Core Scientific highlights the growing importance of technological innovation in sustaining and expanding Bitcoin mining capabilities.

As the cryptocurrency landscape continues to evolve, advancements in ASIC technology are expected to play a crucial role in enhancing the efficiency and profitability of mining operations.

With Core Scientific leading the charge as the first recipient of Block’s 3nm ASICs, the stage is set for further advancements that could shape the future of Bitcoin mining worldwide.

-

Binance to support Render token swap and rebranding, Solciety meme coin launches next week

- Binance will support Render’s RNDR to RENDER swap, suspending RNDR trades on July 22.

- Solciety (SLCTY) meme coin, merging politics and memes on Solana, launches June 18 with a 30-day presale.

- Solciety’s 30-day presale price is structured to increase from $0.000963 in the first stage to $0.002167 in the final stage.

Binance has announced its support for the token swap and rebranding of the popular altcoin Render (RNDR) to Render (RENDER).

Simultaneously, Solciety (SLCTY), a unique meme coin, is set to launch on the Solana network next week, promising to merge politics and memes for the “Degens.”

Binance pledges to supports Render token swap and rebranding

On July 22, 2024, Binance will suspend all RNDR deposit and withdrawal transactions. Additionally, all RNDR spot trading pairs, including RNDR/BTC, RNDR/USDT, and others, will be removed.

Users are advised to complete their RNDR deposits before this date to avoid any inconveniences. The new RENDER trading pairs will become available on July 26, 2024, ensuring a smooth transition for all trading activities.

Binance’s futures trading platform will close all RNDRUSDT perpetual futures positions on July 16, 2024. Similarly, margin pairs involving RNDR will be delisted, and all RNDR loan positions will be closed by July 17, 2024.

Furthermore, Binance Pay will cease support for RNDR gift cards, converting any unused ones to RENDER gift cards automatically.

The technical aspects of this token swap will be managed automatically by Binance, ensuring a smooth and efficient process for all users.

Render tokens will be converted to RENDER at a 1:1 ratio, simplifying the transition.

Upcoming Solciety (SLCTY) meme coin merges politics and memes

Scheduled to launch on June 18th, Solciety (SLCTY) is set to become a notable addition to the Solana blockchain.

By merging politics and memes, Solciety aims to cater to the “Degens,” individuals immersed in decentralized finance and internet culture.

This strategic choice of Solana as the foundation leverages its high-speed transactions and low fees, making it an ideal platform for innovative projects like Solciety.

At the heart of Solciety lies the Meme Campaigner, an innovative meme creation platform. This tool empowers users to generate and customize memes effortlessly, featuring over 200 traits, backgrounds, and fonts.

By integrating news and current events, the Meme Campaigner ensures that memes remain relevant and timely.

Additionally, the platform incentivizes community engagement by rewarding users with presale tokens for sharing their creations on social media, fostering a vibrant ecosystem of content creators and meme enthusiasts.

Solciety (SLCTY) will start with a 30-days token presale

The Solciety presale, commencing on June 18th, will last for 30 days, offering early adopters the opportunity to secure SLCTY tokens at progressively increasing prices.

The presale structure, with price increments every 72 hours, incentivizes early participation and rewards early supporters.

With a total supply of 3 billion SLCTY tokens, Solciety ensures a balanced distribution across various areas, including marketing, development, partnerships, and liquidity, to fuel the ecosystem’s growth and sustainability.

The presale is designed to encourage early participation by increasing prices every 72 hours, rewarding those who invest early.

Early investors can buy SLCTY tokens at $0.000963 during the first stage, with the final presale price projected to be $0.002167.

Solciety has a total supply of 3 billion SLCTY tokens allocated across presale, marketing, rewards, development, partnerships, treasury, and liquidity, ensuring a balanced distribution to support the ecosystem’s growth and sustainability.

-

Bitcoin retreats as German government selling intensifies

- Bitcoin (BTC) price fell to under $56,000 as the German government sold more BTC

- On-chain data shows Germany sent more than 16,000 BTC to exchanges on Monday – the largest transfers in a single day.

Bitcoin price fell below $56,000 again on Monday, dropping by about 2% at the time of writing as Germany took its BTC selling spree to a new level.

Per on-chain data tracking the Bitcoin held by the German government, Monday saw more than 16,000 BTC sent to crypto exchanges – the largest such dump by the government-controlled wallet in a single day.

The selling intensified amid transfers of 2,700 BTC, 5,200 BTC and 8,100 BTC in quick succession over a two hour period.

“The German Government sent another 5200 BTC ($297.3M) to Kraken, Bitstamp, Coinbase and 139Po right after we posted this tweet. That makes this the biggest day for them so far – over 16,000 BTC in total,” the Arkham team posted on X.

Bitcoin price dips amid sell-off

Bitcoin reaction to the selling, which has persisted over the last few weeks, saw Bitcoin price dip from intraday highs of $57,877 to around $55,130.

Germany seized 50,000 bitcoin from Movie2k earlier this year. Over the last few days, it has accelerated its selling to see the total holdings reduce rapidly to 23,787 BTC at the time of writing. The bitcoin’s value reached over $3.6 billion when BTC price skyrocketed to it’s all-time high in March.

However, with more than half sold and BTC price hovering around $55.8k, the total value of the BTC has dropped to $1.34 billion.

Bitcoin price has declined more than 10% in the past week.

-

CleanSpark acquires Bitcoin miner GRIID for $155 million

- CleanSpark announced on June 27 that it had acquired GRIID Infrastructure, a US-based Bitcoin miner for $155 million.

- The company expects the all-stock deal to close in Q3, 2024 subject to GRIID shareholder approval and other customary requirements.

Bitcoin miner CleanSpark announced today that it has entered an agreement to acquire GRIID Infrastructure in an all-stock transaction valued at $155 million.

According to a press release the merger agreement also saw the two Bitcoin mining companies seal an exclusive hosting agreement for all of GRIID’s currently available power. 20 MW of this power will immediately be allocated to CleanSpark.

“We are looking forward to welcoming the GRIID team into the CleanSpark family and we are excited to apply the CleanSpark way, carefully honed alongside the communities we operate in Georgia and Mississippi, to GRIID’s impressive pipeline in Tennessee,” CleanSpark CEO Zach Bradford said in a statement.

CleanSpark eyes 400 MW by 2026

CleanSpark, which has closed other deals before, expects to build out its operations in Tennessee over the next three years. This should see the miner reach operational capacity it managed in Georgia over the same period.

“That achievement was to build out over 400 MW of infrastructure backed by valuable, long-term power contracts,” Bradford noted.

The miner targets surpassing 100 MW in Tennessee by the end of this year, 200 MW in 2025 and over 400 MW in 2026.

Deal expected to close in Q3

Per the announcement, CleanSpark’s acquisition of GRIID has already received unanimous approval from the Boards of Directors of both companies.

As such, they expect the deal will close in Q3, 2024. However, this is still subject to approval by GRIID shareholders as well as other customary closing conditions.

CleanSpark’s acquisition of GRIID comes as another Bitcoin miner Riot Platforms’ plans to take over Bitfarms hit a snag. In the latest development around the saga, Riot has reportedly decided to go for an overhaul of the Bitfarms’ board by taking up three seats.

-

German’s BKA transfers more Bitcoin to exchanges including Kraken and Bitstamp

- German Government transferred 250 Bitcoin worth approx. $15.4M to Kraken and Bitstamp on June 26.

- The government has transferred a total of $150M in BTC to various addresses.

- The German Government BTC transfers and Mt. Gox repayments pile pressure on Bitcoin price.

The German Federal Criminal Police Office (BKA) has made additional Bitcoin transfers to different addresses, including Kraken and Bitstamp.

These moves have sparked considerable market speculation and concerns about their potential impact on Bitcoin’s price.

Recent Bitcoin transfers by the German Government

On June 26, a wallet reportedly controlled by the BKA transferred 750 BTC, valued at $46.35 million, to different adresses, marking another instance of the German government engaging in Bitcoin transactions.

These transfers are part of a larger series of activities following the seizure of 50,000 BTC from the film piracy site Movie2k in January.

According to Lookonchain, the German authorities sent 250 BTC, worth $15.41 million, to both Bitstamp and Kraken. Additionally, they transferred 500 BTC, valued at $30.9 million, to an unidentified address labeled “139Po,” which is potentially another exchange.

Today’s transfers come just a day after German authorities moved 400 BTC, valued at $24.3 million, to Coinbase and Kraken on June 25.

This activity is part of a broader trend observed over the past week, with the German government transferring approximately $150 million worth of seized Bitcoin to known exchange addresses, in addition to $147 million sent to the “139Po” address.

Despite these substantial transfers, the government still holds a significant amount of 45,609 BTC, valued at approximately $2.8 billion.

Earlier in June, the German authorities received 310 BTC, worth $20.1 million, from Kraken and smaller amounts totaling 90 BTC, worth $5.5 million, from Robinhood, Bitstamp, and Coinbase.

Potential impact on the crypto market

The large movements of bitcoins by the German government have had a noticeable effect on the market.

Notably, Bitcoin’s price has dropped about 6% during this period, reflecting market reactions to these substantial transfers.

Analysts are concerned that the government’s liquidation of its seized Bitcoin might push Bitcoin’s price below the critical $60,000 threshold. Recent market trends support this view, as Bitcoin has experienced an 11% decrease on the monthly chart and over 6% on the weekly chart, with its price standing at $61,065 per coin at the time of writing.

Market analyst Willy Woo suggests that Bitcoin might go through a correction phase lasting up to four weeks before resuming its price rally. He emphasizes the potential for a “cooling down” period in Bitcoin’s price action. Additionally, there might be further selling pressure in July as Mt. Gox plans to distribute repayments in Bitcoin and Bitcoin Cash to its creditors.

With over $9.4 billion worth of Bitcoin owed to approximately 127,000 Mt. Gox creditors, who have been waiting for over a decade, this repayment could substantially impact Bitcoin’s price.

The crypto community is closely monitoring these developments, particularly the sell-off pressure that might be triggered by the German government’s Bitcoin transfers and the upcoming Mt. Gox repayments.

Both events could significantly influence the Bitcoin market dynamics in the coming months.

-

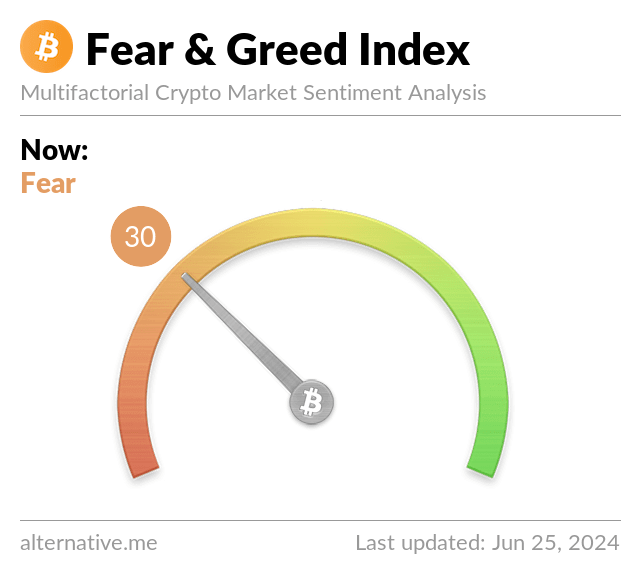

Crypto Fear and Greed Index hits 30, lowest level in 18 months

- Crypto Fear and Greed Index is currently in the “fear” zone with a score of 30.

- This is the lowest sentiment measure for Bitcoin (BTC) in nearly 18 months.

The Crypto Fear and Greed Index, a measure of market sentiment for Bitcoin (BTC) and the broader crypto market, has dropped to 30, the lowest score it has reached in over one and half years.

While BTC has traded lower during the current market cycle and the Crypto Fear & Greed Index has fallen into the “fear” zone, this is the first time it has done so since January last year.

Crypto Fear & Greed Index drop to 30

As Bitcoin price slipped below $60,000 on Monday, June 24, the index score nosedived more than 20 points to drop into the “fear” zone.

The decline means the Bitcoin Fear & Greed Index is currently trending at levels last seen in January 2023. At the time, Bitcoin price was trading around $17,000 after the market reaction to the industry’s most shocking collapse so far – the implosion of the FTX crypto exchange.

Crypto Fear & Greed Index score is 30, now in “Fear” zone. Source: Alternative.me In May this year, Bitcoin price fell to lows of $56,500 and the index’s score dipped from neutral to fear.

A bounce in price saw sentiment improve significantly to push the Fear & Greed Index to 74. “Greed” dominated then as Bitcoin broke above $71k, but that score flipped neutral and within hours on June 24, reached the 30 mark.

Mt. Gox repayments and German government selling

Catalysts for the latest declines include the Mt.Gox repayments news.

A notice on Monday indicated that the exchange will begin repaying customers who’ve waited since the 2014 hack. Mt.Gox customers will receive Bitcoin and Bitcoin Cash.

Over $8.5 billion worth of BTC is with the exchange’s trustee. In April, analysts at K33 Research warned that Mt.Gox’ Bitcoin repayments could impact prices.

Also attracting negative sentiment is the selling of Bitcoin by the German government. After sending 1,700 BTC to exchanges last week, including Coinbase and Kraken, Germany is at it again.

On Tuesday, Lookonchain shared on-chain data tracking wallets linked to the 50,000 BTC seizure the German government made early this year. The details show another 400 BTC deposited in CEXs.

-

Donald Trump receives $2M Bitcoin donation from Winklevoss twins

- Winklevoss twins donate $2M in Bitcoin to Donald Trump’s campaign.

- The Gemini founders cited Trump’s pro-business and pro-crypto stance as reasons for their support.

- Trump’s campaign recently announced that it would start accepting crypto donations.

The founders of Gemini, Cameron Winklevoss and Tyler Winklevoss, commonly referred to as the Winklevoss twins, have each donated $1 million worth of Bitcoin (BTC) to the campaign of former president Donald Trump.

The twins’ decision to donate such a substantial amount in Bitcoin marks a significant step in the intersection of technology, finance, and political fundraising. It underscores the growing influence of cryptocurrency in mainstream politics, where digital assets are increasingly becoming a viable form of campaign contributions.

Supporting Trump for his pro-crypto stance

Announcing his donation, Tyler Winklevoss articulated his support in a statement shared on X, emphasizing Trump’s favorable stance on crypto and business. He criticized the Biden Administration’s approach, accusing it of aggressive tactics against the crypto industry.

Similarly, Cameron Winklevoss echoed his brother’s sentiments, portraying Trump as a proponent of Bitcoin and cryptocurrencies, aligning with their business interests and regulatory concerns.

Trump’s position on cryptocurrency

Donald Trump’s acceptance of Bitcoin donations from the Winklevoss twins reflects his evolving stance on cryptocurrency.

While specifics on Trump’s cryptocurrency policies during his presidency were limited, his campaign’s acceptance of Bitcoin donations signals a willingness to engage with the digital asset community. This move contrasts with the cautious approach of the current administration to cryptocurrency regulation, indicating a potential shift in political strategy regarding digital finance.

Recently, Trump sat down with Bitcoin mining experts and executives at the Mar-a-Lago Club in Palm Beach, Florida, discussing how the U.S. needs to be at the forefront when it comes to Bitcoin issues.

With various government agencies scrutinizing digital assets, the Winklevoss twins’ donation to Trump may serve as a catalyst for discussions on how political candidates and parties perceive and integrate digital currencies into their campaigns.

-

Bitcoin stays above $65k as Bitbot unveils its Mini App UI

Key takeaways

- Bitcoin has been trading above the $65k level as the broader market stagnates.

- Bitbot has unveiled its Mini App UI to simplify DeFi trading for users

Bitcoin stays above $65k as market stagnates

Bitcoin, the leading cryptocurrency by market cap, has been underperforming over the last seven days. It has lost more than 3% of its value in the last seven days and is currently trading above $65k per coin.

The poor performance comes as whales sold over $1 billion worth of Bitcoins over the last few days. Altcoins have also been underperforming in recent days, with the total crypto market cap now below $2.4 trillion.

What is Bitbot?

The crypto market is still consolidating but new projects continue to roll out excellent products to their users. Bitbot is one of the new projects that has been unveiling exciting products and services.

Bitbot raised more than $4 million from investors and is using the funds to launch products for traders on Telegram. This Web3 project seeks to bring unique value propositions to traders in the cryptocurrency space.

It is a self-custodial Telegram trading bot that allows users to trade via their cold wallets on the app. Bitbot users will enjoy certain features available only to institutional investors, making it easier for traders to grow their trading portfolios.

Bitbot unveils its Mini App UI

With its presale now over, Bitbot is focusing on launching its products and listing its token on crypto exchanges.

In their recent X post, the Bitbot team unveiled their Mini App UI as one of the features available at launch and is crafted with user-friendliness at its core. This intuitive interface simplifies DeFi trading, making it accessible for newcomers.

Bitbot added that with a clean, responsive, and easy-to-navigate design, all users can fully leverage Bitbot’s capabilities without facing a steep learning curve.

The launch of the Mini App UI comes roughly two weeks after Bitbot unveiled its staking feature. With the staking feature, users who claim their tokens through the bot can stake them and earn a competitive Anual Percentage Yield.

Bitbot is also working on other security features such as Knightsafe, a solution that would help mitigate the typical risks associated with Telegram trading. The integration of anti-MEV and anti-rug solutions will further help users protect their assets.

The team also revealed some of the funds raised in the presale are already being directed towards integrating Ultra-flexible wallet management fuelled by non-custodial API technology.

Bitbot raised over $4m in presale

The Bitbot presale was successful, with the team raising over $4 million. In addition to developing its products, Bitbot is also currently working on the formation of its team, smart contract development, community formation, marketing drive, and alpha testing.

The team will proceed to get $BITBOT listed on crypto exchanges once these steps are concluded, with top influencer partnerships, and its Telegram Bot launch to come afterwards.

Per the whitepaper, the Bitbot development team will hold 20% of the total token supply and use it to fund ongoing development. An additional 14% is allocated to marketing & CEX listings while 3% is allocated to exchange liquidity provision.

Why buy the Bitbot token?

The presale is over and purchasing $BITBOT will only be possible once the token launches on crypto exchanges. It is tough to determine the listing price as token prices are usually volatile once they launch on crypto exchanges.

However, Bitbot could gain massive adoption if the team rolls out its products and services. The unique trading features Bitbot seeks to offer could make the project and it’s token a big winner in this current bullish cycle.