- BSV surged 71% in 24 hours on positive sentiment and ETF anticipation.

- Shiba Memu (SHMU) gains traction for its AI-driven marketing and interactive dashboard.

- Bitcoin’s outlook remains promising with expected ETF approval but demands a cautious approach.

Bitcoin SV (BSV) has witnessed a remarkable surge, with its price climbing an astounding 71% in just 24 hours. This meteoric rise in BSV’s value has caught the attention of both crypto enthusiasts and investors.

In this article, we’ll delve into the factors contributing to this surge and explore The Bitcoin SV price prediction. We will also touch upon an intriguing newcomer in the crypto world, Shiba Memu, currently in the midst of an exciting presale.

Bitcoin SV soars: a 71% price surge

In recent hours, Bitcoin SV has experienced an astonishing price surge. At the time of writing, the cryptocurrency is trading at $53.89, marking a substantial 71% increase over the past 24 hours. This surge has positioned Bitcoin SV among the top-performing assets in the crypto market.

This remarkable price movement has drawn significant attention to BSV, raising questions about the driving forces behind this impressive surge.

What’s behind the surge in Bitcoin SV price?

The surge in Bitcoin SV’s price can be attributed to several factors:

- Market Sentiment: Positive sentiment has been permeating the cryptocurrency market, primarily influenced by the anticipation of the approval of a Bitcoin Exchange Traded Fund (ETF) by the U.S. Securities and Exchange Commission (SEC). This optimism has spilled over to altcoins like Bitcoin SV, as investors seek opportunities for growth.

- Resurgence of Bitcoin: Bitcoin’s recent price gains have contributed to the overall bullish sentiment in the market. As Bitcoin continues to perform well, it positively influences the prices of other cryptocurrencies, including Bitcoin SV.

Bitcoin SV price prediction

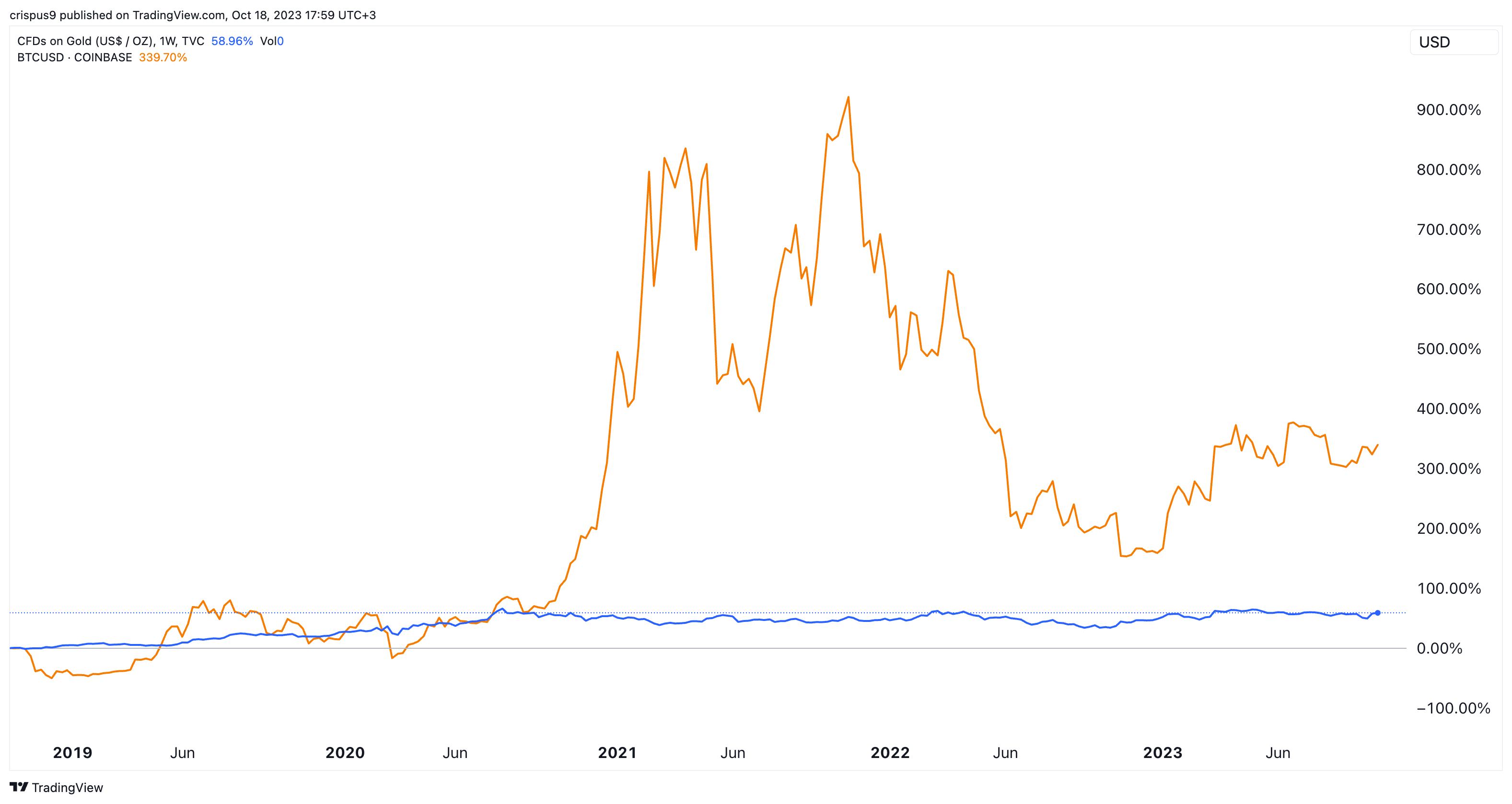

While Bitcoin SV’s recent surge is impressive, what about Bitcoin’s future price movement?

The cryptocurrency market is abuzz with speculation, primarily fueled by the potential approval of a Bitcoin ETF by the SEC. The sentiment has been further bolstered by the SEC’s decision not to appeal the Grayscale lawsuit.

If the agency proceeds to approve a Bitcoin Spot ETF, it is expected to trigger a substantial wave of institutional investment in the United States. This could have a profound impact on the price of Bitcoin and other cryptocurrencies.

The current Bitcoin SV bullish trend started on October 16 coinciding with an MA crossover. Adding to the MA crossover, the past three daily candlesticks have also formed a “Three White Soldiers,” further solidifying the bullish trend.

The moving average convergence divergence (MACD) indicator is also signalling a Bull Run

If the current daily candlestick closes above $54, Bitcoin SV could attempt going for $60 before the end of the week.

However, there could be a pullback as the market tries to let off the selling pressure accumulated over the past three bullish days. If this occurs, the token could see a drop to the resistance at $40.

It’s important to note that cryptocurrency markets are highly volatile and subject to rapid price fluctuations. While the optimism is palpable, investors should approach the market with caution, conduct their own research, and be aware of the associated risks.

A unique meme token rises with the Bitcoin SV surge

As Bitcoin SV and the entire crypto market rise after the fake news of a Bitcoin ETF approval by the SEC, a new AI-powered meme coin called Shiba Memu is also gaining traction in the crypto space.

Shiba Memu (SHMU) is a unique meme token with self-sufficient marketing capabilities driven by AI technology. It is currently in the midst of a presale, which has generated significant interest. It’s important to note that this newcomer is challenging the status quo in crypto marketing.

Shiba Memu stands out as a pioneering project in the crypto space, thanks to its cutting-edge AI technology that powers its marketing capabilities. Unlike other meme tokens that rely on human teams for marketing efforts, Shiba Memu takes a different approach. It autonomously creates marketing strategies, generates PR content, and promotes itself across various forums and social networks.

The AI technology behind Shiba Memu generates a staggering amount of content, disseminating it through press releases and marketing materials on forums and social media platforms. The AI system also monitors and analyzes the performance of its marketing campaigns, making real-time adjustments to optimize results. Moreover, it offers users the unique opportunity to interact with a robot meme dog marketing genius through an AI-powered dashboard. This innovation has captured the imagination of investors and crypto enthusiasts alike.

In conclusion, Bitcoin SV’s recent price surge, Shiba Memu’s innovative marketing approach, and Bitcoin’s promising outlook are capturing the attention of the cryptocurrency community. With positive market sentiment and the potential approval of a Bitcoin ETF, the crypto space continues to be a focal point for investors seeking opportunities in this dynamic and ever-evolving landscape.

Share this article

Categories

Tags