Key takeaways

The cryptocurrency market is having a positive end to the week, with prices of most coins and tokens in the green zone. Bitcoin could be heading towards the $28k level soon as market sentiment improves.

Furthermore, Shiba Memu’s presale is now closing in on the $3.5 million milestone as more investors troop into the project.

Bitcoin could surge towards the $28k level soon

The cryptocurrency market is ending the week in a positive manner, with the prices of most coins and tokens currently up by more than 2%. Bitcoin has added more than 2% to its value in the last 24 hours. At press time, the price of Bitcoin stands at $27,094.

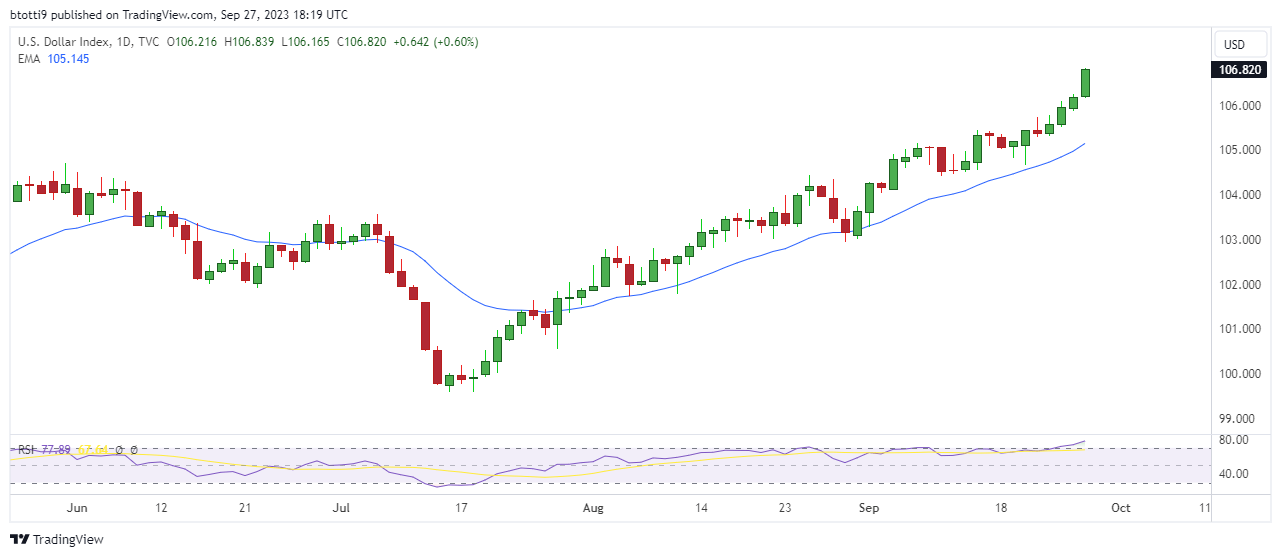

The positive performance comes as oil prices and US Treasury yields recorded a dip in prices, resulting in a weaker US Dollar. If the trend should continue, Bitcoin could see its price rally higher and reach the next major resistance level above $28k in the coming days.

What is Shiba Memu?

Shiba Memu has been gaining interest from investors over the past few months thanks to its unique proposition. This Web3 project seeks to combine the powers of blockchain technology and artificial intelligence to make it easier for individuals and entities to carry out market campaigns.

In their whitepaper, the team explained that Shiba Memu can handle a wide range of marketing activities, including content creation, marketing, social media advertisement, and creative advertisement.

Since Ahiba Memu will be AI-powered, the software can work 24/7, finding the best creative adverts, consuming them and generating superior content marketing.

By launching as a meme token, Shiba Memu is riding the popularity wave of meme coin projects in recent years. This is strengthened by the fact that within two years, meme coins saw their market caps grow from practically $0 to $20 billion in 2022.

Shiba Memu is differentiating itself from other meme coins by serving as more than just a speculation tool. Shiba Memu is launching with real-world use cases and would allow users to create marketing strategies, roll out PR schedules, and promote campaigns on relevant forums and social media platforms.

The Shiba Memu project will be available to users on the Ethereum and BNBChain blockchains.

Shiba Memu’s presale closes in on the $3.5m milestone

The broader crypto market is currently bullish, and Shiba Memu is not left out as its presale looks set to hit a new milestone. The presale has been going on for three months now, and the team has raised more than $3.4 million.

The funds generated via the presale would be used to develop some of Shiba Memu’s products and services. The Shiba Memu AI technology will be the primary product of this project.

In their whitepaper, the team said the platform would come with a robotastic dashboard, allowing users to interact with the AI, provide feedback, make suggestions, ask questions, and more.

Click here to find out more about Shiba Memu’s presale event.

Shiba Memu price prediction

It is hard to predict Shiba Memu’s price in the medium to long term since the project is still in its presale stage. At the moment, 1 SHMU = 0.030475 USDT. The token’s price increases every day at 6 pm GMT and is set to trade at 0.030700 USDT per token in a few hours.

At the beginning of the presale, SHMU was trading at $0.011125, and it has seen a remarkable increase in price since then. The SHMU token can be purchased using Ethereum, USDT, BNB and BUSD

Should you buy Shiba Memu today?

Shiba Memu could become one of the leading meme token projects thanks to the utility it intends to offer users. By combining AI and blockchain technologies, Shiba Memu could gain massive adoption in the marketing world.

The project is still in its early stages, making its token a discount for investors. With the right level of adoption, SHMU’s price could rally over the next few months and years.