- The Federal Reserve has increased its benchmark rate from 0.25% to 5.25% over the past year.

- BitMEX co-founder believed that bondholders might seek more lucrative “risk assets,” such as Bitcoin.

- Bitcoin’s four-year cycles might be linked to central banks’ low-rate policies.

Challenging the conventional wisdom regarding the relationship between Bitcoin and interest rates, BitMEX co-founder and a well-known macro-analyst Arthur Hayes recently authored a blog post in which he argues that traditional economic logic would crumble under the immense debt burden of the US government.

Hayes said that “central banks and governments are grappling with the use of outdated economic theories to address the unique challenges of today.”

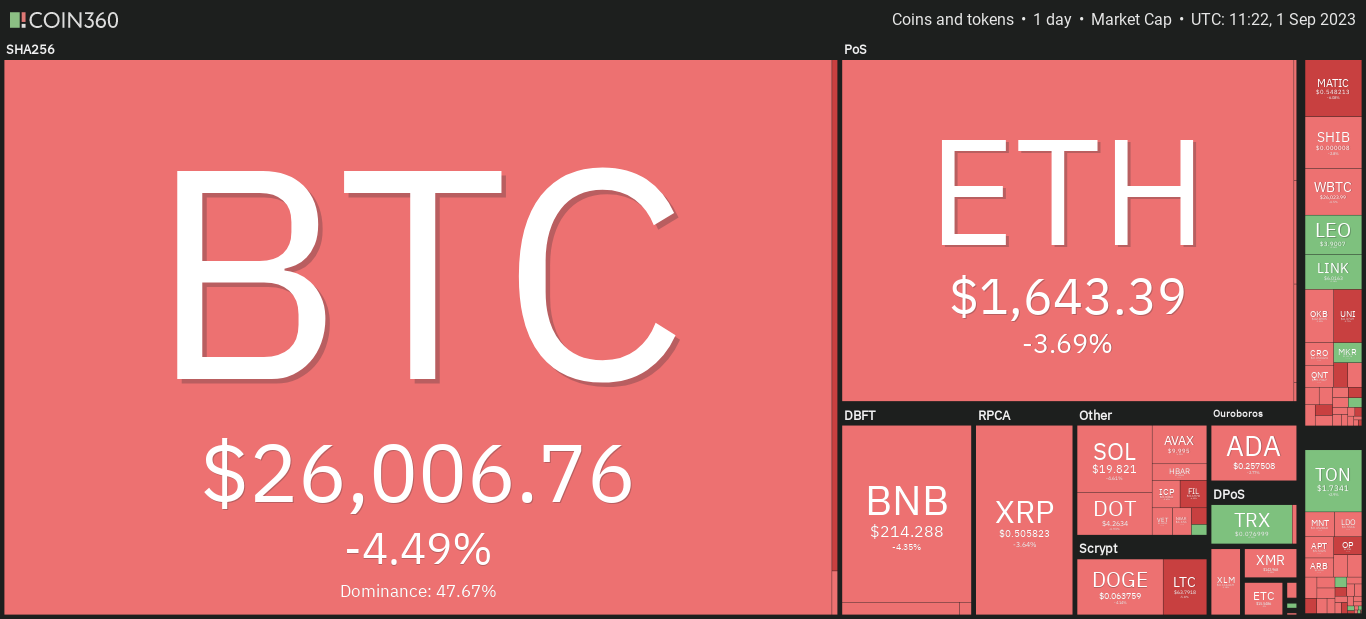

Hayes’ assertions come as the Federal Reserve increased its benchmark rate from 0.25% to 5.25% over the past year in an effort to curb inflation and maintain a 2% target. Although the Fed has succeeded in this endeavour, Hayes voiced concerns that inflation might persistently exceed expectations, given the substantial nominal GDP growth of 9.4% in Q3, contrasted with the 5% yield on 2-year US Treasury bonds.

GDP growth remains astonishingly high

In his analysis, Hayes highlighted that according to data from the Atlanta Fed’s GDPNow forecast, nominal GDP growth remained “astonishingly high.” Conventional economic theory would suggest that as the Fed raised rates, a credit-sensitive economy should falter. Indeed, this was evident in financial asset markets, including stocks and Bitcoin, which experienced a downturn in 2022, eroding government capital gains tax receipts.

However, this decline in tax revenue led to increased government deficits, which needed to be funded by issuing more bonds to repay existing debt. In the context of a high-interest-rate environment, this translated to higher interest payments to wealthy bondholders.

Hayes succinctly summarized this chain of events: “To summarize: as rates rise, the government pays more interest to the wealthy, the wealthy spend more on services, and GDP continues to grow.”

As long as the economy outpaces the government’s debt obligations, Hayes believed that bondholders might seek more lucrative “risk assets,” such as Bitcoin.

Efforts to combat inflation favour high-risk assets like Bitcoin

Hayes contended that the Federal Reserve’s efforts to combat inflation would ultimately favour “finite supply risk assets” like Bitcoin. In a recent blog post, Hayes argued that the Fed’s strategy was siphoning money from one part of the economy while injecting it into another. As long as the Fed’s approach to taming inflation remained uncertain, assets like Bitcoin were likely to experience long-term growth.

In a previous essay, Hayes had posited that Bitcoin would thrive in response to a tightening Fed, whose actions might inadvertently increase the money supply. He asserted, “If the Fed believes that it must raise interest rates and reduce its balance sheet to quell inflation, it’s essentially self-sabotaging.”

Generally, analysts perceive lower interest rates as beneficial for Bitcoin and other risk assets, as they create an environment where investors have room to speculate for potentially higher returns. In June, Coinbase analysts issued a report suggesting that Bitcoin’s four-year cycles might be linked to central banks’ low-rate policies.

Hayes acknowledged the positive influence of low rates on Bitcoin’s price, characterizing the asset’s relationship with central bank policy as a “positive convex relationship.” He concluded, “At the extremes, things become non-linear and sometimes binary. The US and the global economy are currently operating in such an extreme environment.”