On March 9, United States President Joe Biden issued a quite comprehensive executive order that directs no less than two dozen cabinet members, departments and agencies in the government to study the benefits and detriments of blockchain technology for various aspects of the American economy. There has been a considerable amount already written about the implications of the executive order. I will add to this discourse and also offer some predictions, which few have done, on what the industry might expect to arise from the various governmental studies and reports over the next year.

Powers On… is a monthly opinion column from Marc Powers, who spent much of his 40-year legal career working with complex securities-related cases in the United States after a stint with the SEC. He is now an adjunct professor at Florida International University College of Law, where he teaches a course on “Blockchain & the Law.”

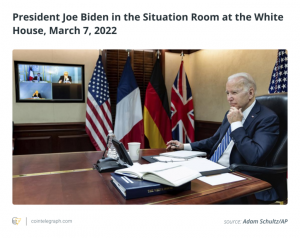

President Biden issued his executive order in a surprising act of executive power. No one quite expected it to occur the way it did, with most thinking that legislative action would be proposed sometime this year. I do not recall reading anywhere that an executive order, particularly without legislative action, would be proposed. Rather, our president instantly outtrumped — pardon the poorly crafted pun — former Vice President Al Gore, who under President Bill Clinton in the 1990s became a point man in the administration’s adoption and support of the internet. By the very act of issuing the executive order, President Biden will forever be recognized as the U.S. president who materially advanced the technology and its various use cases.

An overarching theme running through the executive order is the direction that various government departments and agencies coordinate, and that they do so in a relatively tight time frame by way of presenting reports. The president even ordered that each of the various governmental bodies investigate specific topics to be covered in the report. For example:

“Within 180 days of the date of this order, the Secretary of the Treasury, in consultation with the Secretary of State, the Attorney General, the Secretary of Commerce, the Secretary of Homeland Security, the Director of the Office of Management and Budget, the Director of National Intelligence, and the heads of other relevant agencies, shall submit to the President a report on the future of money and payment systems, including the conditions that drive broad adoption of digital assets; the extent to which technological innovation may influence these outcomes; and the implications for the United States financial system, the modernization of and changes to payment systems, economic growth, financial inclusion, and national security.”

Remarkably, we also see an official acknowledgment of concern over, and a direction that the report consider, the fact that China has been seeking to disrupt the U.S. dollar’s global dominance as the world’s reserve currency with its digital yuan projects over the past several years. The executive order requests that the report discuss ways “foreign CBDCs could displace existing currencies and alter the payment system in ways that could undermine United States financial centrality [emphasis added].” In other words, what should the U.S. be doing to protect the dollar’s reserve currency status?

The president also encourages the chairman of the Board of Governors of the Federal Reserve System, Jay Powell, to continue to research and report on CBDCs and develop “a strategic plan […] that evaluates the necessary steps and requirements for the potential implementation and launch of a United States CBDC [emphasis added].” Then, in consultation with the attorney general and the secretary of the Treasury, Powell is asked to within 180 days offer “an assessment of whether legislative changes would be necessary to issue a United States CBDC.” If this does not make clear that this administration wants action in implementing an American CBDC — and in short order — then nothing will. As my friend Troy Paredes, a former SEC commissioner, observed during Inveniam’s excellent “Data 3.0 For Web 3.0” conference in Miami this month, the executive order not only recognizes the risks of digital assets but also the benefits of blockchain technology.

The executive order directs certain cabinet members and agencies to study and report on relevant issues under their jurisdiction. The attorney general is to report on the role of law enforcement agencies in detecting, investigating and prosecuting criminal activity related to digital assets. The Federal Trade Commission is to consider the effects the growth of digital assets could have on competition policy, privacy interests and consumer protection measures. The Securities and Exchange Commission and Commodity Futures Trading Commission — in consultation with the Fed chair, comptroller of the currency and Federal Deposit Insurance Corporation — are encouraged to consider the extent to which investor and market protection measures within their respective jurisdictions may be used to address the risks of digital assets and “whether additional measures may be needed.” You can be sure current SEC Chair Gary Gensler will have plenty to say and recommend in this regard.

The Financial Stability Oversight Council — which is comprised of various agencies, including the SEC, CFTC, CFPB and federal banking agencies — is to produce a report within 210 days “outlining the specific financial stability risks and regulatory gaps posed by various types of digital assets and providing recommendations to address such risks.” Here, too, expect the SEC to be front and center in new proposals.

The final item in the executive order to mention is what the Biden administration sees as the core principles and policies that are to guide the government’s further actions. These include:

“Strong steps to reduce the risks that digital assets could pose to consumers, investors, and business protections; financial stability and financial system integrity; combating and preventing crime and illicit finance; national security; the ability to exercise human rights; financial inclusion and equity; and climate change and pollution.”

This hits me as sound. The executive order identifies a very thoughtful, systematic, comprehensive set of factors to inform policies that a government would or should be concerned about, and would or should like about, the use of blockchain technology, digital assets and currencies. I would not be surprised if a significant and comprehensive piece of legislation regarding blockchain, its regulation and a U.S. CBDC is proposed by the administration within the next 12 to 18 months. Even more comprehensive than SOX of 2002 ( mostly related to public companies) and Dodd-Frank legislation of 2010 (seeking to reign in excessive risk taking which led to the financial crisis) in ways it will affect the U.S. economy and our daily lives. I have less confidence that such a sweeping law will actually pass. It seems more likely that individual parts of our government will propose and adopt new rules and regulations addressing the findings and issues in the various reports they are directed to produce for the president.

Marc Powers is currently an adjunct professor at Florida International University College of Law, where he is teaching “Blockchain & the Law” and “Fintech Law.” He recently retired from practicing at an Am Law 100 law firm, where he built both its national securities litigation and regulatory enforcement practice team and its hedge fund industry practice. Marc started his legal career in the SEC’s Enforcement Division. During his 40 years in law, he was involved in representations including the Bernie Madoff Ponzi scheme, a recent presidential pardon and the Martha Stewart insider trading trial.

The opinions expressed are the author’s alone and do not necessarily reflect the views of Cointelegraph nor Florida International University College of Law or its affiliates. This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice.