Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

Crypto regulation has received approval from Ukrainian president Volodymyr Zelenskyy. The bill, titled “On Virtual Assets,” was signed by the president, opening the door to government oversight of the domestic cryptocurrency industry.

Ukraine’s Ministry of Digital Transformation said: “The signing of this law by the president is another important step towards bringing the crypto sector out of the shadows and launching a legal market for virtual assets in Ukraine.”

Among other details, the bill specifies that Ukraine’s National Securities and Stock Market Commission will govern the industry on multiple levels, such as digital asset-related licensing.

A significant European Union (EU) regulatory bill known as Markets in Crypto Assets (MiCA) has moved forward, leaving behind wording that essentially would have barred proof-of-work (PoW) crypto assets in the region.

An extensive bill pertaining to crypto regulation in the EU, MiCA had two drafts up for debate — one version that would essentially ban PoW mining and related cryptocurrencies, and another that hosted more favorable language concerning the technology. Long story short, the European Parliament’s Committee on Economic and Monetary Affairs voted for the option that did not ban PoW. The bill will now proceed through further approval processes.

It was a busy week for cryptocurrency exchanges, which earned regulatory approvals in multiple jurisdictions. Binance secured licensing in Dubai and Bahrain. FTX also received a Dubai license.

Thanks to the Virtual Asset Service Provider (VASP) license it secured in the region, Binance can now establish an office in Dubai, among other rights newly afforded by the license. Additionally, Binance received a virtual asset exchange (VAX) license in Dubai. FTX also unveiled that it received Dubai’s VAX this week.

Owners of Bored Ape Yacht Club (BAYC) NFTs stand to receive a considerable sum of ApeCoin (APE) — a new governance and utility token for the project. APE is an ERC-20 token.

If they do so within 90 days of March 17 (12:30 pm UTC time), BAYC owners can claim 10,000 APE, which totaled $72,000 in value at the time of Cointelegraph’s coverage in the article linked above. FTX, Gemini and other exchanges plan on listing APE.

Trading volume and pricing for BAYC NFTs saw turbulence surrounding the APE token news. Among other reported details, the token will have a supply of 1 billion.

Avery Ching and Mo Shaikh, two former Meta crypto division leads, are building a layer-1 blockchain with some of its roots based on Move — the Diem project’s programming language. Known as Aptos, the project led by Ching and Shaikh recently announced securing $200 million worth of funding, with names such as Coinbase Ventures and Andreessen Horowitz contributing. Aptos aims for its mainnet to go live in the latter half of 2022.

Publicized earlier in 2022, Facebook-turned-Meta’s stablecoin Diem essentially saw an end to its journey, with Silvergate Capital Corporation buying the project’s nuts and bolts (intellectual property, etc.) from Meta.

Winners and Losers

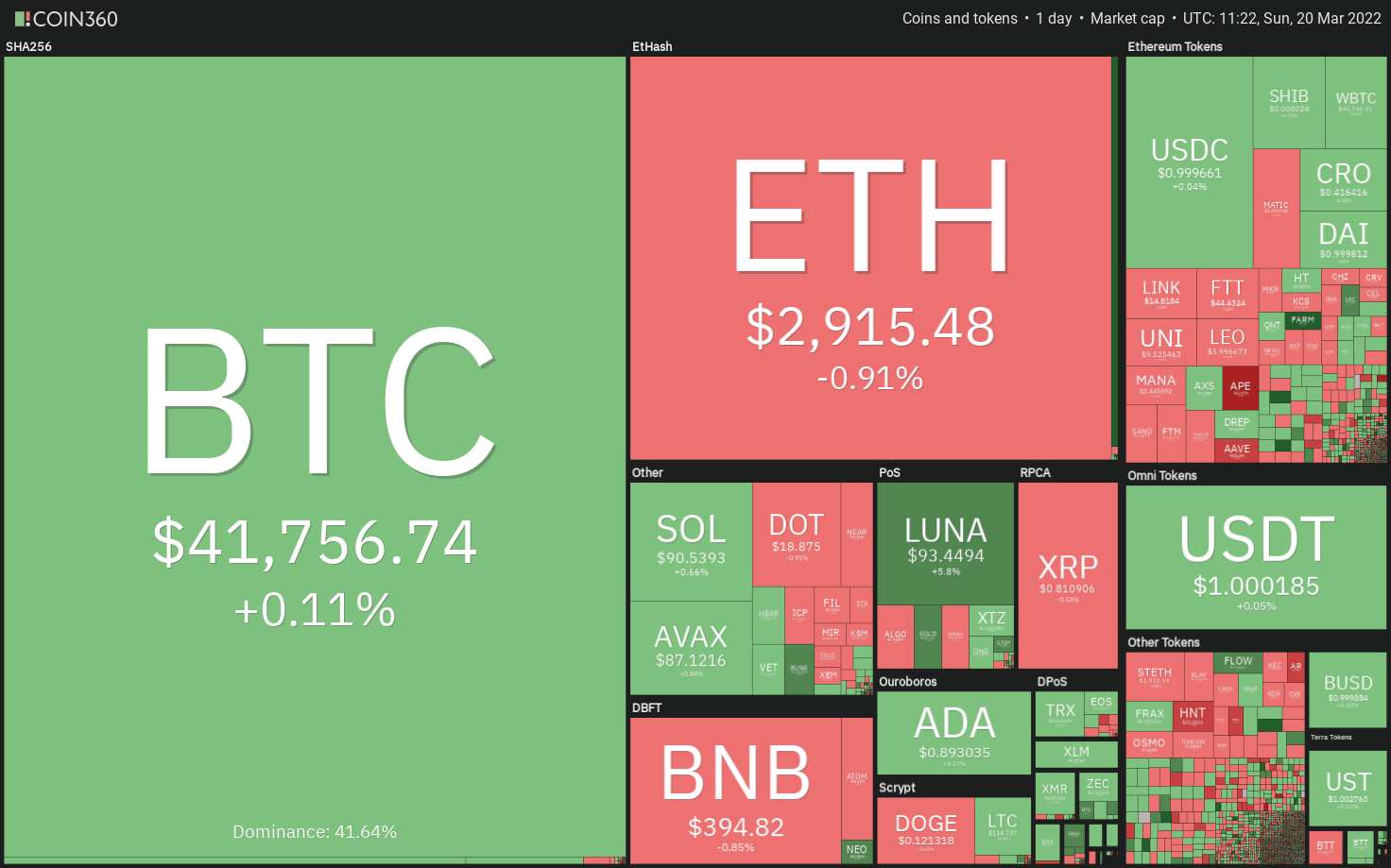

At the end of the week, Bitcoin (BTC) is at $41,727, Ether (ETH) at $2,936 and XRP at $0.79. The total market cap is at $1.87 trillion, according to CoinMarketCap.

At the end of the week, Bitcoin (BTC) is at $41,727, Ether (ETH) at $2,936 and XRP at $0.79. The total market cap is at $1.87 trillion, according to CoinMarketCap.

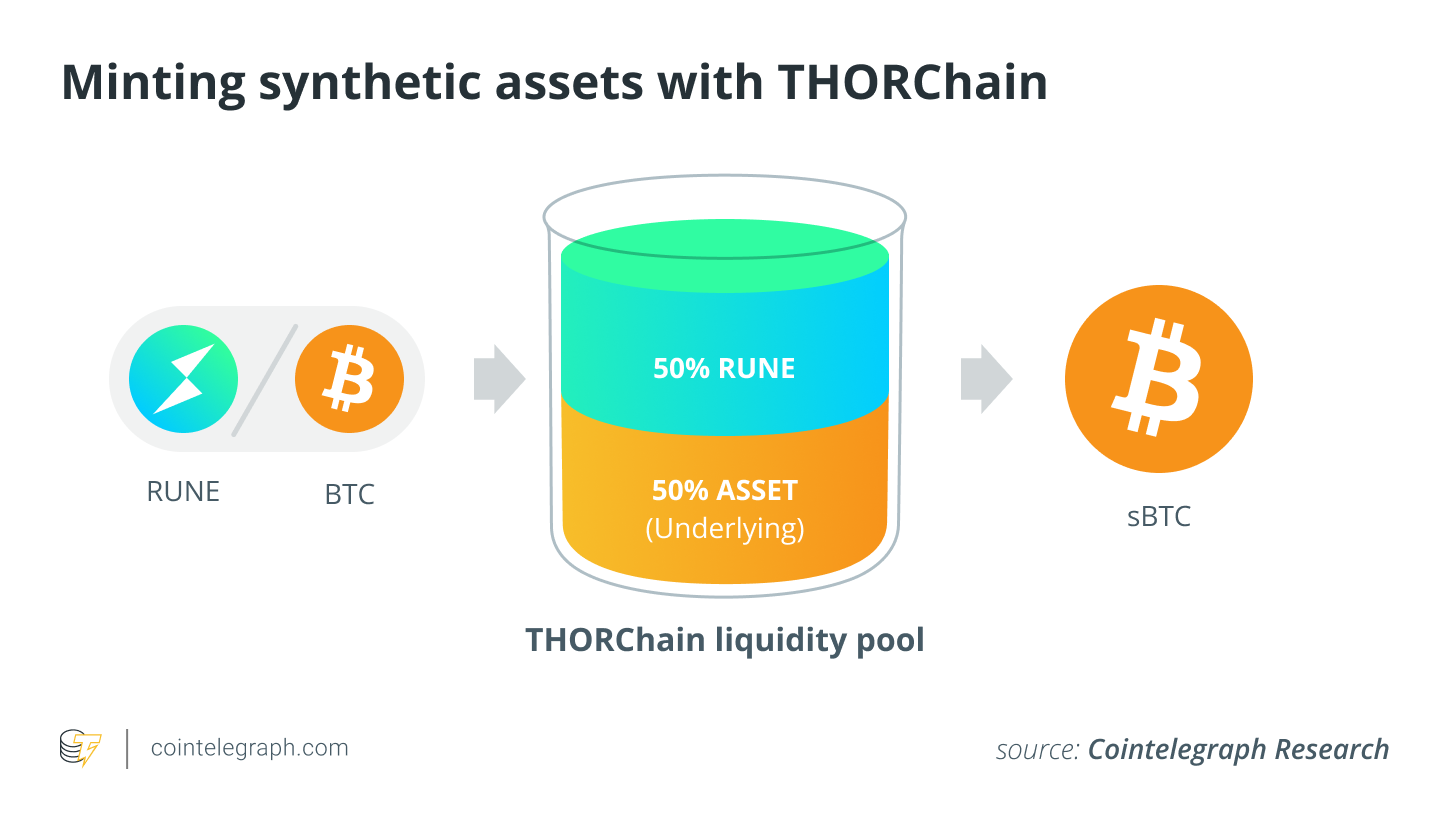

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are ApeCoin (APE) at 1,338.31%, Aave (AAVE) at 38.53% and THORChain (RUNE) at 37.67%.

The top three altcoin losers of the week are Anchor Protocol (ANC) at -19.20%, Stacks (STX) at -9.20% and Kadena (KDA) at -9.18%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“If you are an avid crypto trader like me, I am sure that the thought of who will inherit your crypto has come to mind.”

Jeetu Kataria, CEO of Digital Financial Exchange (DIFX)

“Orange pill your neighbor, your favorite shop, bar, cinema, start sharing your sats. It’s easy for them to learn from a known face like yours. Be that little pebble that you throw in the lake, and it will create ripples that coming generations will benefit.”

Paco de la India, Bitcoiner and runner

“Our hope is that when the government does this study [as established by the executive order], […] the conclusion they will reach is we will not compete against China — an authoritarian dictatorship — by also acting like an authoritarian dictatorship. Instead we will empower our private sector to come up with competitive solutions.”

Jake Chervinsky, head of policy for the Blockchain Association, regarding a United States central bank digital currency

“The creator is where the power begins, and that’s where the power should stay.”

Darryl McDaniels, founding member of Run-DMC

“My office has received numerous tips from crypto and blockchain firms that SEC Chair @GaryGensler’s information reporting ‘requests’ to the crypto community are overburdensome, don’t feel particularly… voluntary… and are stifling innovation.”

Tom Emmer, United States congressman

“There is no doubt that blockchain gaming is a revolutionary concept, but at the moment, I don’t think it will be enough to support me financially by itself. […] I think I will have enough courage to leave my job to pursue blockchain gaming once the P2E ecosystem has become mature and sustainable.”

Jesus Dawal Jr., Filipino gamer

“With proper research and understanding, regulators will find a much easier time regulating DeFi and preventing malicious behaviors compared to the legacy financial infrastructure.”

Eric Chen, co-founder and CEO of Injective Labs

“You should never define any technology by its worst uses. […] There’s more to crypto than ransomware, just like there’s more to money than money laundering.”

Ritchie Torres, United States representative

Prediction of the Week

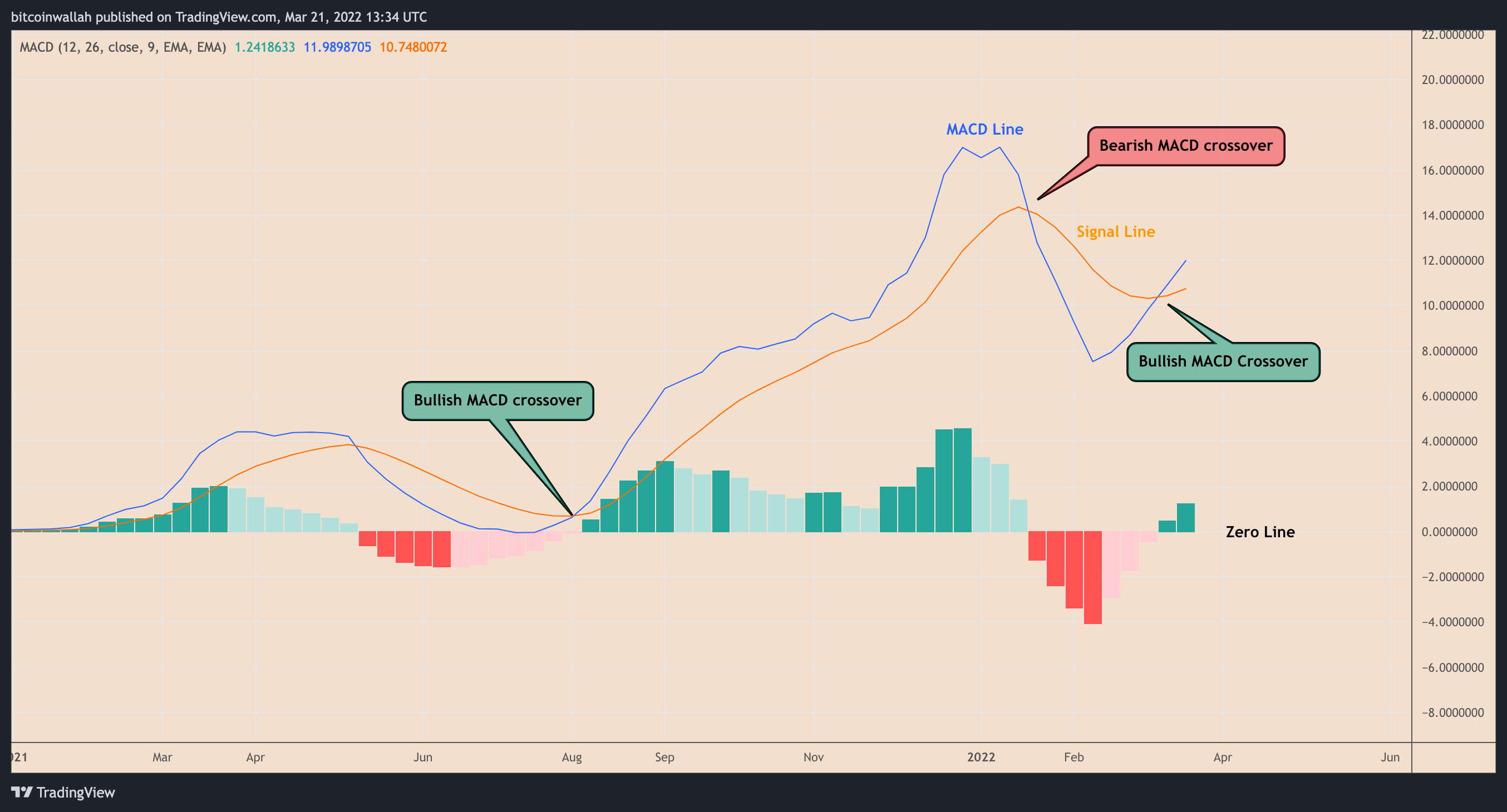

This past week, crypto’s largest asset, Bitcoin, traded both below $38,000 and above $41,000 inside the seven-day period, according to Cointelegraph’s BTC price index.

Based on global conditions, Bloomberg Intelligence’s Mike McGlone and former BitMEX brass Arthur Hayes both see Bitcoin ultimately coming out on top.

McGlone sees the current landscape as one that may help BTC along. “Facing the #FederalReserve, inflation and war, 2022 may be primed for risk-asset reversion and mark another milestone in #Bitcoin’s maturation,” McGlone tweeted.

Meanwhile, Hayes sees Bitcoin taking on a value of more than $1 million per coin based on the events currently unfolding, although he noted a decade-long time horizon with BTC suffering downward price action first.

FUD of the Week

Blockchain analytics outfit Elliptic has come across a crypto wallet that could be of particular interest that could potentially be connected to prominent sanctioned Russians. The wallet’s contents total millions of dollars in value, although further specifics were not given.

“It’s not proving out realistic that oligarchs can completely bypass sanctions by moving all their wealth into crypto,” Tom Robinson, Elliptic’s co-founder, told Bloomberg. “Crypto is highly traceable. Crypto can and will be used for sanctions evasion, but it’s not the silver bullet.”

Millions of crypto addresses have been traced to crime associated with Russia, with hundreds of digital asset services facilitating anonymous crypto swapping via the Russian ruble, based on Elliptic’s sleuthing.

India’s central bank, the Reserve Bank of India (RBI), expressed a desire to ban crypto assets, as per a statement published this week. The RBI fears that crypto adoption could undermine the usage and dominance of the rupee, India’s national currency, and cause other issues.

“Historically, private currencies have resulted in instability and therefore, have evolved into fiat currencies over centuries,” the RBI said in the statement. “The retrograde step back to private currencies cannot be taken simply because technology allows it […] without considering the dislocation it causes to society’s legal, social and economic fabric of society.”

Decentralized finance (DeFi) solutions Hundred Finance and Agave were exploited for $11 million by an attacker who managed to exploit a wrapped Ether (WETH) contract function on Gnosis Chain, a stable payments platform. Put simply, the attacker was able to drain more funds by continually borrowing against the same collateral they were posting.

The $11 million sum was stolen via a number of different crypto assets, including the aforementioned wETH, but also wrapped BTC (WBTC), Chainlink (LINK) and USD Coin (USDC). Agave and Hundred Finance both halted their protocols in tandem amid the investigation.

Best Cointelegraph Features

If you’ve never been angry about JPEGs you don’t need to be angry about JPEGs people can own.

African crypto experts and entrepreneurs explain why the CFA franc is an uncomfortable currency and why Bitcoin is making waves as a replacement.

Policymakers in Moscow are scrambling to rethink their approach to digital currency as one of several means of protecting the increasingly isolated economy.

At the end of the week, Bitcoin (

At the end of the week, Bitcoin (