Haven Protocol (XHV) showed signs of returning to its bullish form as its price doubled in just five days of trading.

What’s pumping Haven Protocol?

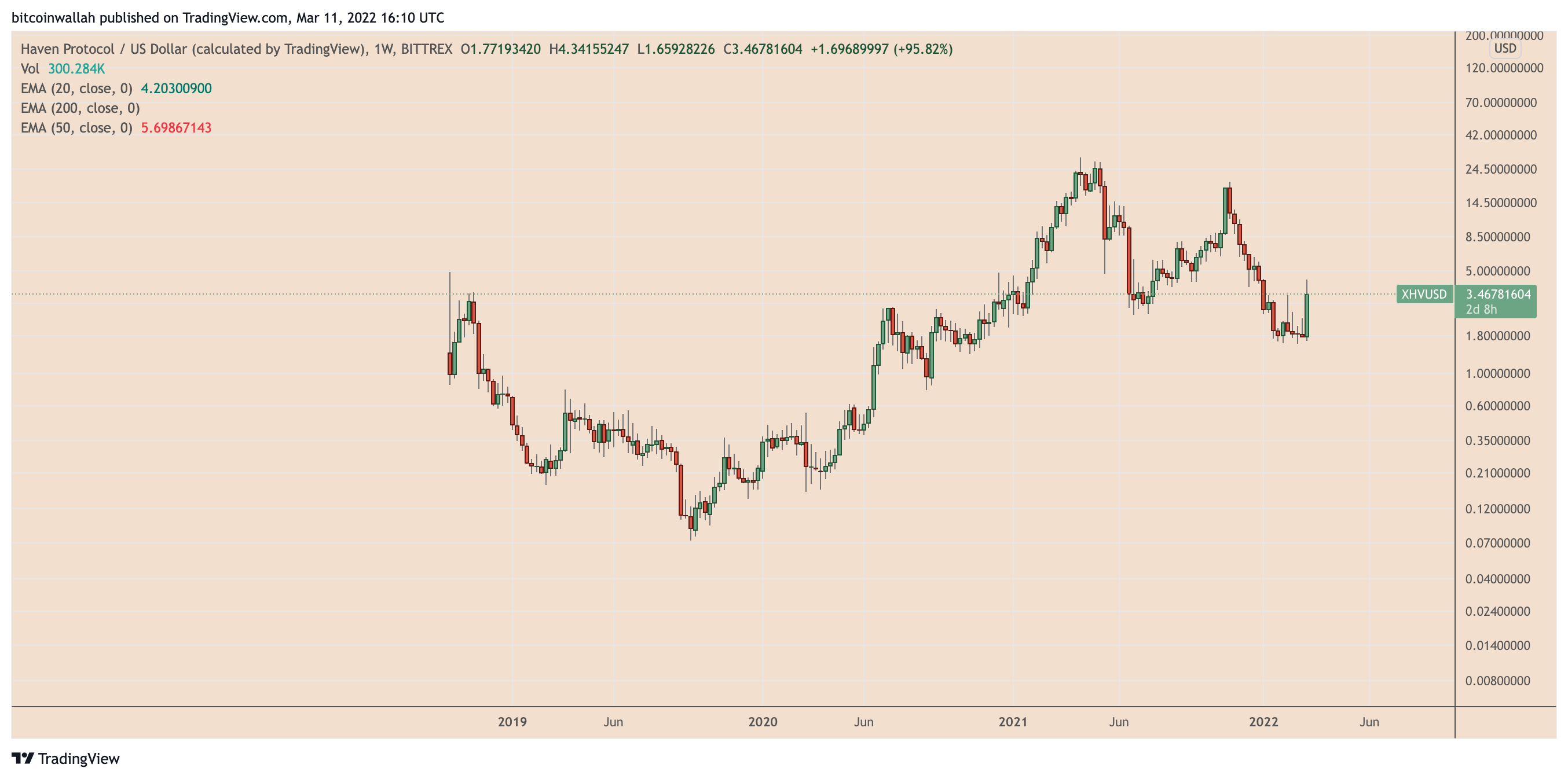

XHV’s price surged by up to 107% week-to-date to climb above $3.60 on March 11, its highest level in more than three months. Interestingly, the move upside followed a period of aggressive selloffs that saw XHV’s value dropping from nearly $20 in November 2021 to as low as $1.60 in early February 2022 — an approximately 90% decline.

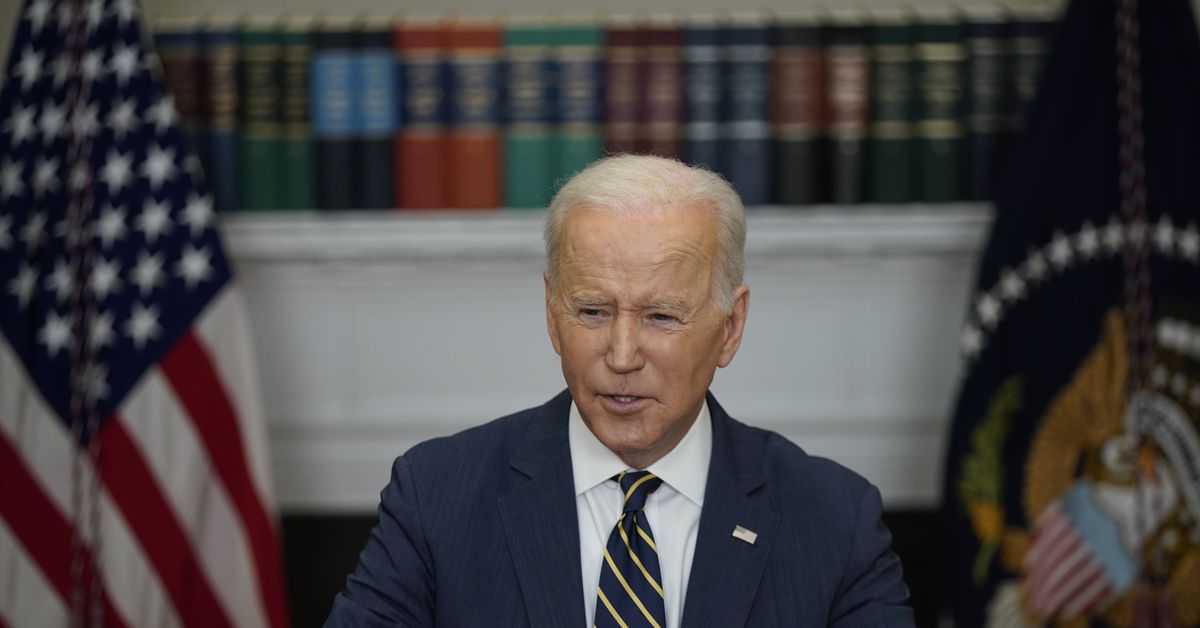

Traders started returning to the Haven Protocol market against the prospects of two macroeconomic scenarios: U.S. President Joe Biden’s executive order that focuses on cryptocurrencies and hardline western sanctions on Russian oligarchs amid an escalating military standoff between Ukraine and Russia.

In the order titled “Ensuring Responsible Development of Digital Assets,” President Biden directed federal agencies to submit reports on cryptocurrencies and consider introducing new regulations for the sector.

Meanwhile, western powers decided to cut Russia out of the Swift global banking system while imposing targeted sanctions on some of the country’s wealthiest individuals.

Crypto investors priced in the effects of these two updates, deciding to bid up the prices of privacy-enabled digital assets that promise to secure financial transactions from regulatory watchdogs.

As a result, Monero (XMR), Kyber Network (KNC), Tornado Cash (TORN) and other privacy coins outperformed the crypto market massively this week.

Privacy coins have surged, with #Monero posting +26% gains over the last 24-hours to lead the top-100.

During times of unprecedented censorship in the crypto world, no wonder that the price of privacy coins, like $XMR, is surging. #XMR

— Weiss Crypto (@WeissCrypto) March 9, 2022

Haven Protocol, a fork of the Monero blockchain that promotes itself as an “offshore bank,” appears to have rallied on similar sentiment.

Fractal suggests more gains for XHV

The recent bout of buying in the Haven Protocol market may have also emerged owing to a multi-month technical support level.

Related: FBI director: Russia overestimates its ability to bypass US sanctions using crypto

XHV’s price rebounded after failing to close below its descending channel support on multiple attempts, as shown in the chart below.

Notably, the token’s last 90% drop towards the same price floor in 2021 led to a sharp upside retracement from around $2.50 in June to around $20 in November.

XHV’s price hints at undergoing a similar, extended upside recovery after its latest bounce. In doing so, the Haven Protocol token might retest the resistance trendline of its descending channel setup — around $10.

Conversely, a pullback risk declines below XHV’s previous support lines inside the $1.00–1.50 range.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.