Impermanent loss is one of the most recognized risks that investors have to contend with when providing liquidity to an automated market maker (AMM) in the decentralized finance (DeFi) sector. Although it is not an actual loss incurred from the liquidity provider’s (LP) position — rather an opportunity cost that occurs when compared with simply buying and holding the same assets — the possibility of getting less value back at withdrawal is enough to keep many investors away from DeFi.

Impermanent loss is driven by the volatility between the two assets in the equal-ratio pool — the more one asset moves up or down relative to the other asset, the more impermanent loss is incurred. Providing liquidity to stablecoins, or simply avoiding volatile asset pairs, is an easy way to reduce impermanent loss. However, the yields from these strategies might not be as attractive.

So, the question is: Are there ways to participate in a high-yield LP pool and at the same time reduce as much impermanent loss as possible?

Fortunately for retail investors, the answer is yes, as new innovations continue to solve the existing problems in the DeFi world, providing many ways for traders to avoid impermanent loss.

Uneven liquidity pools help reduce impermanent loss

When talking about impermanent loss, people often refer to the traditional 50%/50% equal-ratio two-asset pool — i.e., investors have to provide liquidity to two assets at the same value. As DeFi protocols evolve, uneven liquidity pools have come into the picture to help reduce impermanent loss.

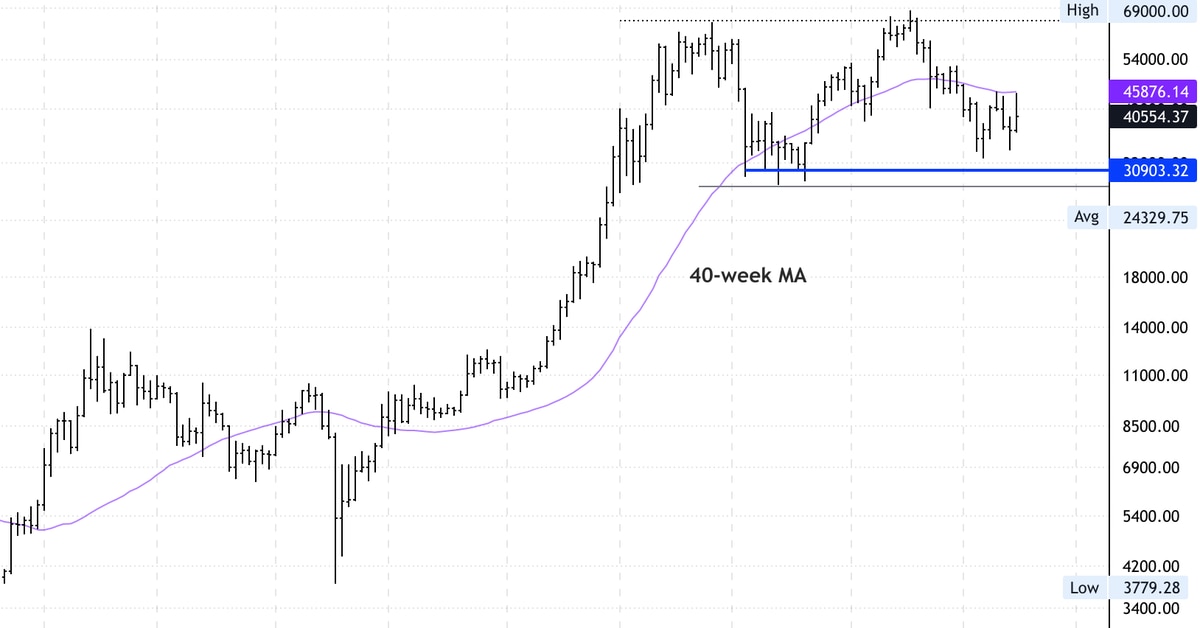

As shown in the graph below, the downside magnitude from an equal-ratio pool is much larger than an uneven pool. Given the same relative price change — e.g., Ether (ETH) increases or decreases by 10% relative to USD Coin (USDC) — the more uneven the ratio of the two assets, the less the impermanent loss.

DeFi protocols such as Balancer have made uneven liquidity pools available since as early as the beginning of 2021. Investors can explore a variety of uneven pools to seek out the best option.

Multi-asset liquidity pools are a step forward

In addition to uneven liquidity pools, multi-asset liquidity pools can also help reduce impermanent loss. By simply adding more assets to the pool, the diversification effects come into play. For example, given the same price movement in Wrapped Bitcoin (WBTC), the USDC-WBTC-USDT equal-ratio tri-pool has a lower impermanent loss than the USDC-WBTC equal-ratio pool, as shown below.

Similar to the two-asset liquidity pool, the more correlated the assets are in the multi-asset pool, the more the impermanent loss, and vice versa. The 3D graphs below display the impermanent loss in a tri-pool given different levels of the price change of Token 1 and Token 2 relative to the stablecoin, assuming one stablecoin is in the pool.

When the relative price change of Token 1 to the stablecoin (294%) is very close to the relative price change of Token 2 (291%), the impermanent loss is also low (-4%).

When the relative price change of Token 1 to stablecoin (483%) is very different and far away from the relative price change of Token 2 to stablecoin (8%), the impermanent loss becomes noticeably larger (-50%).

Single-sided liquidity pools are the best option

Although the uneven liquidity pool and multi-asset pool both help reduce impermanent loss from the LP position, they do not eliminate it completely. If investors do not want to worry about impermanent loss at all, there are also other DeFi protocols that allow investors to provide only one side of the liquidity through a single-sided liquidity pool.

One might wonder where the risk of impermanent loss is transferred if investors do not bear the risk. One solution provided by Tokemak is to use the protocol’s native token, TOKE, to absorb this risk. Investors only need to supply liquidity such as Ether to one side, and TOKE holders will provide TOKE on the other side to pair up with Ether to create the ETH-TOKE pool. Any impermanent loss caused by the price movements in Ether relative to TOKE will be absorbed by the TOKE holder. In return, TOKE holders take all swap fees from the LP pool.

Since TOKE holders also have the power to vote for the next five pools the liquidity will be directed to, they also get bribed by protocols who want them to vote for their liquidity pools. In the end, TOKE holders bear the impermanent loss from the pool and are compensated by the swap fees and bribe rewards in TOKE.

Another solution is to separate risks into different tranches so that risk-averse investors are protected from impermanent loss and that risk-seeking investors who bear the risk will be compensated with a high-yield product. Protocols such as Ondo offer a senior fixed tranche where impermanent loss is mitigated and a variable tranche where impermanent loss is absorbed but higher yields are offered.

Automated LP manager can reduce investors’ headaches

If all of the above seems too complicated, investors can still stick to the most common 50%/50% equal-ratio pool and use an automated LP manager to actively manage and dynamically rebalance the LP position. This is especially useful in Uniswap v3, where investors need to specify a range to which they want to provide concentrated liquidity.

Automated LP managers conduct rebalancing strategies to help investors maximize LP fees and minimize impermanent loss by charging a management fee. There are two main strategies: passive rebalancing and active rebalancing. The difference is that the active rebalancing method swaps tokens to achieve the amount required at the time of rebalancing, whereas passive rebalancing does not and only swaps gradually when the pre-set price of the token is hit (similar to a limit order).

In a volatile market where prices are constantly moving sideways, a passive rebalancing strategy works well because it doesn’t need to rebalance frequently and pay large amounts of swap fees. But in a trending market where price continues to move in one direction, active rebalancing works better because the passive rebalancing strategy could miss the boat and sit outside the LP range for a long time and fail to collect any LP fees.

To choose the right automated LP manager, investors need to find the one that suits their risk appetite. There are passive rebalancing strategies such as Charm Finance that aim to earn a stable return by using a wide LP range to reduce impermanent loss. There are also passive managers such as Visor Finance that use a very narrow LP range to earn high LP fees, but are also exposed to more potential impermanent loss. Investors need to select automated LP managers based on not only their risk appetite but also their long-term investment goals.

Although traditional equal-ratio LP profits could be eroded by impermanent loss when the underlying tokens move in very different directions, there are alternative products and strategies available for investors to reduce or completely avoid impermanent loss. Investors just need to find the right trade-off between risk and return to find the best-suited LP strategy.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.