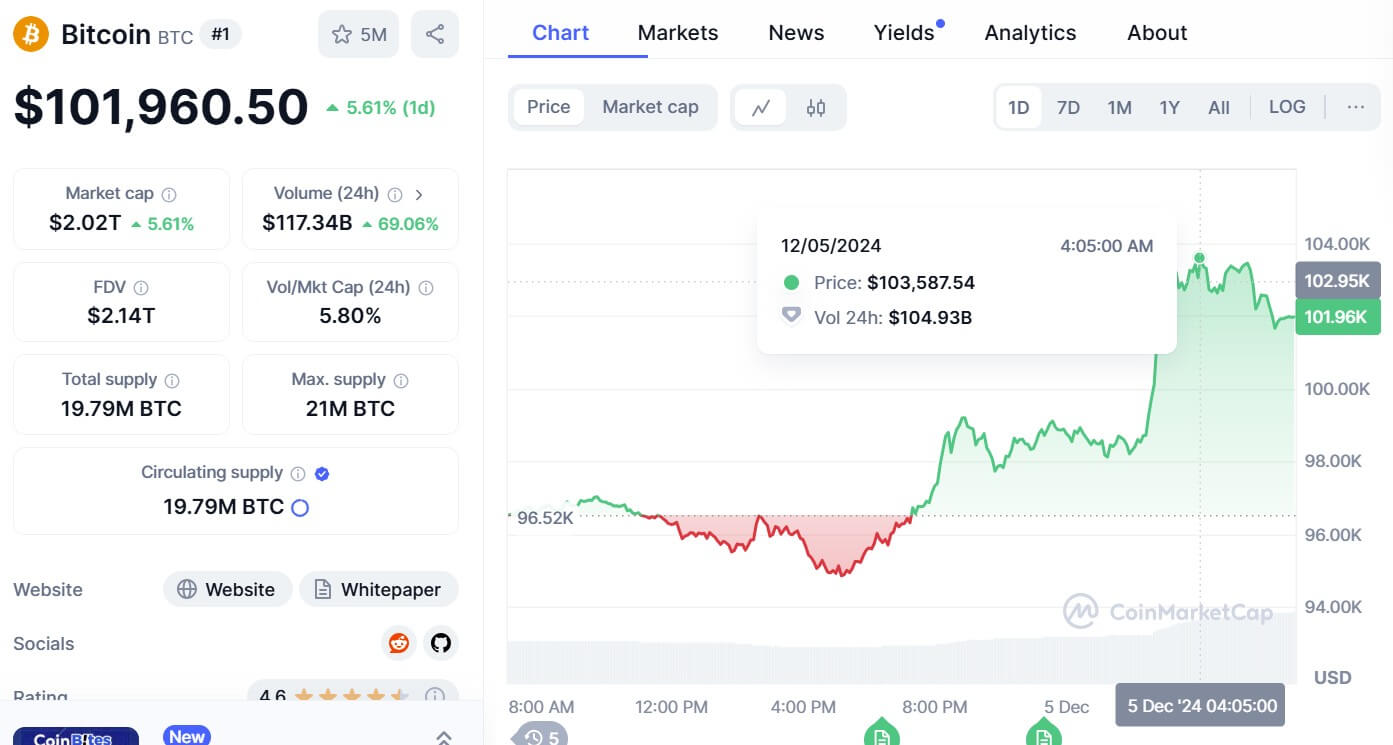

- Bitcoin briefly fell to $100,000 after a sharp market-wide sell-off.

- Over $1.6 billion in leveraged long positions were liquidated in 24 hours.

- The crash was fueled by “risk-off” sentiment and Fed rate cut uncertainty.

The cryptocurrency market was rocked by a wave of forced selling late Monday, triggering a sharp downturn that saw Bitcoin briefly touch the $100,000 level and erased more than $1.6 billion in leveraged bullish positions.

The sudden deleveraging event, one of the largest since September, sent a shockwave across the digital asset space, with major altcoins like Ether, Solana, and XRP posting heavy losses as renewed macroeconomic fears spooked investors.

The core of the market’s turmoil was a massive cascade of liquidations. In the last 24 hours, more than $2 billion in crypto futures contracts were forcibly closed, with long traders—those betting on higher prices—accounting for nearly 80% of the losses at $1.6 billion, according to CoinGlass data.

This automatic selling pressure occurs when traders using borrowed funds see their positions move sharply against them, forcing exchanges to sell the assets to cover losses.

Macro headwinds and risk-off sentiment

The sell-off was fueled by a broader “risk-off” mood spreading across financial markets.

Analysts pointed to a combination of factors that are making investors nervous and prompting them to shed speculative assets.

“Recent speculation that the FOMC may pass on another rate cut this year, as well as concerns over tariffs, credit market conditions, and equity valuations, helped drive markets lower,” Gerry O’Shea, head of global market insights at Hashdex, said in an email to CoinDesk.

He added that Bitcoin’s price has also been affected by profit-taking from long-term holders, which he described as “an expected phenomenon as the asset matures.”

Bitcoin at a crossroads: a test of support

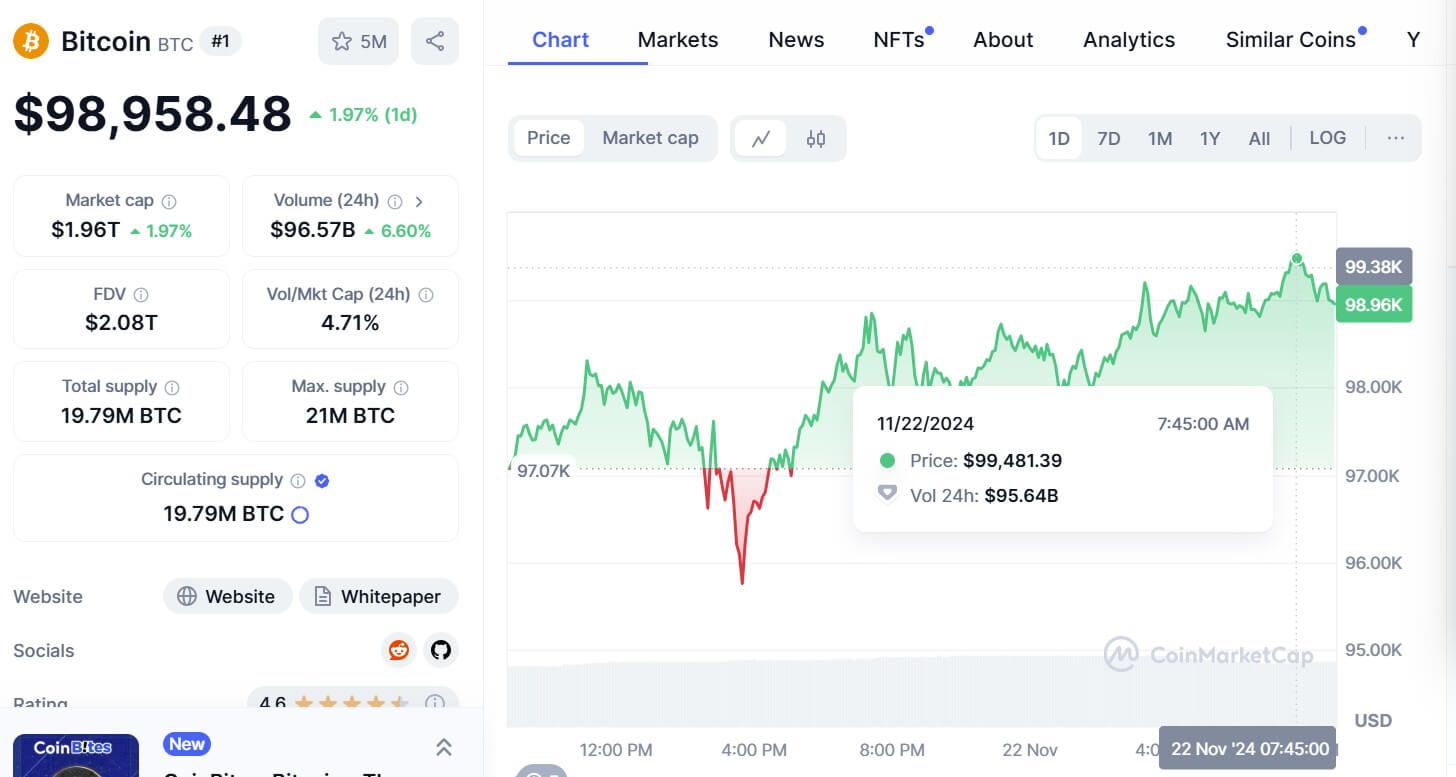

Following the plunge, Bitcoin staged a modest rebound to trade around $101,000. However, the token remains down 5.5% over the past day and more than 10% for the week.

The pain was more severe for altcoins, with Ether dropping 10%, while Solana and BNB lost 8% and 7% respectively.

Despite the sharp downturn, some analysts believe the long-term picture for Bitcoin remains positive.

“While $100,000 may be a psychologically important support level, we do not view today’s price action as a sign of a weakening long-term investment case for Bitcoin,” O’Shea said.

With the Federal Reserve’s next move uncertain and global risk appetite fragile, the coming days will be a crucial test for the market, determining whether Bitcoin can hold its current level or if another wave of forced selling is on the horizon.