Key Takeaways

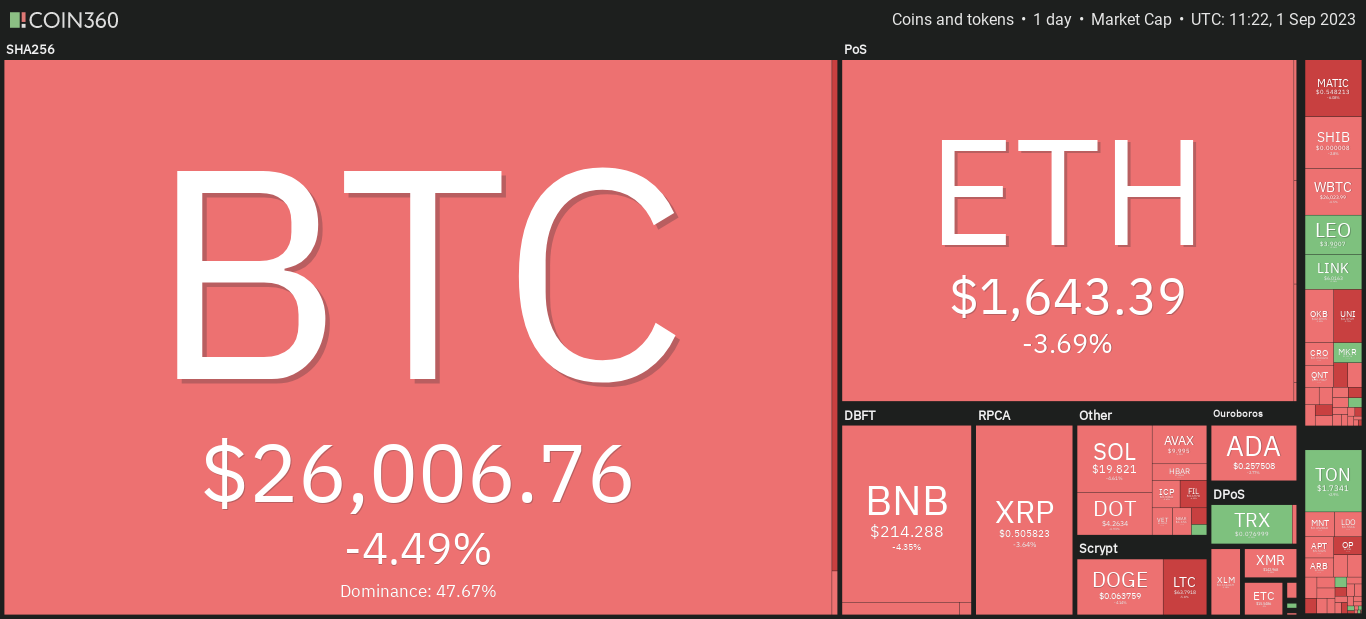

- Bitcoin has surged beyond $26,000 as interest rate expectations flip

- Inflation reading provides further impetus as investors dream of return to lower interest environment and surging crypto prices

- There are reasons to be hesitant here, however, writes our Analyst Dan Ashmore

- Shutdown of three crypto banks will hurt industry, while there has been nothing but bearish developments since the start of the year

- The decoupling from other risk assets is also unusual and has not been seen to the upside since 2021

I don’t really make predictions because what would be the point? I’m just a boy hitting keys on a laptop, and I know better than to fool myself into thinking I know enough to predict the market.

However, the speed of this Bitcoin run-up surprises me. Not that you should put any weight at all into that – if you’re in the habit of trusting people’s words on the Internet, I suspect your bank wallet is already hurting, anyway – but let me explain what is confusing me.

What is happening to Bitcoin?

First, let us surmise what has happened in the last week to kick this rally off.

We saw the startling collapse of Silicon Valley Bank (SVB) last week, followed by Silvergate, which sent shockwaves throughout the market. This had particular implications for crypto for a couple of reasons.

The first was USDC, the second biggest stablecoin on the market. Revealed to have 8.25% of its reserves held in SVB, the market feared for the solvency of the stablecoin. Of course, this fear all settled down when the US administration stepped in to shore up the crisis and guarantee deposits would be made whole.

This shored up the panic and crypto began rebounding. But that is not all that happened. The fact that the banking sector wobbled so drastically shifted market expectations surrounding the future path of interest rate hikes.

With such creaking evident, the market has moved to betting that the Fed is more or less done with interest rate hikes. Fed futures currently imply a 72% chance of no hike at next week’s Fed meeting. Just last week, this was 0%, with the baseline expectation (70%) expecting a 50 bps hike.

Looking further out at the long-term trajectory, the prognosis has shifted even more dramatically. There is now only a 1.6% chance of higher rates in July, compared to 100% last week, again looking at futures. There is even a 31% chance that rates will be lower in July than they are today. That is a remarkable flip.

This has sent Bitcoin aggressively upward, surging beyond $26,000 as I write this, for its highest level since last June. It has also been aided by the CPI reading this afternoon, coming in at 6%, its eighth consecutive decline and the lowest metric since September 2021.

Has Bitcoin risen too much?

But does this make sense?

While on the one hand, this is exactly what we would expect given the enormous flip in rate forecasts, I am confused as to the sheer level of the outperformance vs other risk assets. This is a divergence which we have not seen since the heyday of the bull market back in 2021.

That should provide thought. Of course, Bitcoin is capable of moves that other assets can only dream of matching, so maybe it’s just doing what it likes to do.

But then there is the implications arising out of losing three crypto-friendly banks – Silvergate, SVB and Signature. The environment in the US is now barren for crypto firms. Whether they can simply move abroad remains to be seen.

But even if so, the fact the world’s biggest economy is pushing these crypto firms out is not a good thing for the industry at large. Is it anything to do with Bitcoin specifically? No. But the market is driven by emotion, and there is also the fact that onramping is much harder now, and Bitcoin is still tied to the crypto industry as a whole.

The strict regulatory environment, with the clampdown headlined by the shutdown of BUSD last month, had already worsened significantly since the turn of the year. Throw in various bankruptcies that came post-FTX (led by Genesis and the demise of DCG) and there are plenty of bearish variables here regarding the long-term future of the crypto industry.

This is not to say that these can all be overcome. But for crypto to decouple from other risk assets to this extent, following the shutdown of three vital banks for the industry, does present food for thought. We haven’t seen $26,000 in a long time, and it feels – to my far-from-confident mind – like it is still a bit premature.

Time will tell I guess, but for now, it’s a nice change to see some green on the charts for a change.

Share this article

Categories

Tags