- Core organizations have submitted a 70 million ADA tokens budget proposal.

- The goal is to fund key ecosystem integrations ahead of 2026

- ADA remains poised for remarkable breakouts despite short-term bearishness.

Cardano’s major organization has proposed a new budget, calling for 70 million ADA tokens in Treasury funding to supercharge delayed ecosystem upgrades and integration.

Announced yesterday, November 27, the proposal outlines a strategic plan to introduce innovative infrastructure needed for institutional access, cross-chain connectivity, and stablecoins.

BREAKING NEWS:

CARDANO SEEKS ₳70,000,000 FOR CRITICAL ECOSYSTEM UPGRADES 😱😱😱

A new Cardano Critical Integrations Budget has just been submitted requesting a massive ₳70 MILLION from the Treasury to supercharge the ecosystem with vital infrastructure.

According to the… pic.twitter.com/SDtzVXIWu0

— Mintern (@MinswapIntern) November 28, 2025

Named the Cardano Critical Integrations Budget, the plan received endorsement from key ecosystem organizations, including the Cardano Foundations, EMURGO, Input Output, the Midnight Foundation, and Intersect.

That reflects a unified approach to equip the ADA network with what it needs to thrive in the coming times.

The official blog highlighted:

Cardano needs a set of core infrastructure layers to unlock stablecoins, attract deeper liquidity, support institutional participation, and expand the possibilities for DeFi, RWAs, and DePIN. These integrations cannot be delivered in isolation. They require a shared, ecosystem-wide commitment that brings the right partners to Cardano in a structured and accountable way.

Trader attention remains on the ADA price amidst these developments. Are the coordinated efforts the catalyst that propels this altcoin to its predicted peaks?

Why is this budget crucial?

Cardano’s team is among the most active in the blockchain sector. Meanwhile, the project’s next growth phase now relies on mission or partially developed components.

They include functionalities like enterprise-level custody and wallets, pricing oracles, advanced stablecoin infrastructure, and cross-chain bridges.

The Cardano blockchain has struggled to unlock crucial utility without these elements.

For instance, stablecoins are essential for DeFi liquidity and day-to-day on-chain transactions.

Cross-chain support allows users to move tokens across the platform easily.

Moreover, institutional-grade analytics and custody are crucial for risk management and compliant offerings.

Indeed, Cardano’s long-term potential requires coordinated efforts to unleash.

Therefore, core organizations have been negotiating with top-notch integration partners recently, and their conversations have reached a mature phase, inviting the community to participate in the next steps.

ADA price outlook

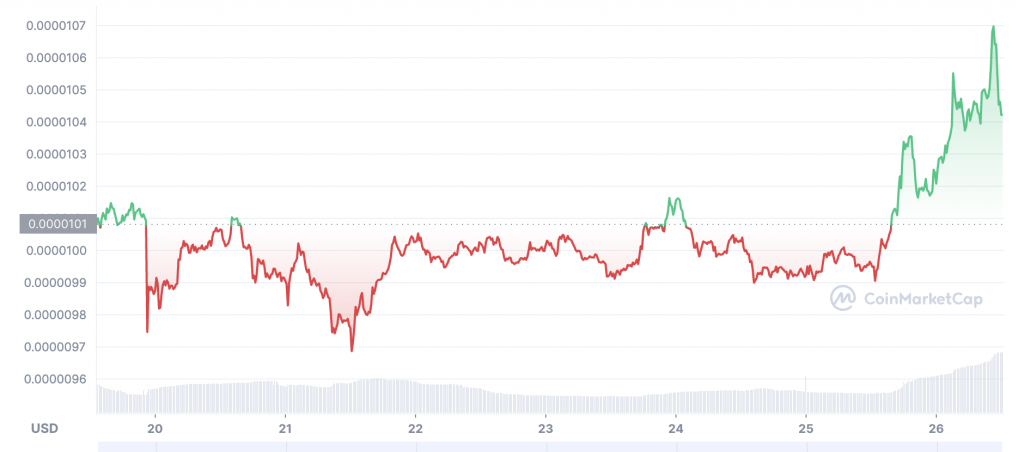

Cardano is trading at $0.4311 after gaining more than 6% the last seven days.

The token remained relatively muted the past day, losing a mere 0.08% of its value.

Meanwhile, the 20% slump in 24-hour trading volume signals prevailing selling pressure.

Robust developer activity, especially with the 70 million ADA budget approved, and broad-based recoveries could trigger massive breakouts for ADA.

However, buyers should overcome key resistance at $0.45 and $0.70 and reclaim the psychological level at $1 to shift Cardano’s short-term outlook to bullish.

Surpassing $1.50 would confirm solid reversals and clear the path for higher targets.

ADA can skyrocket to $2 and extend toward $2.20. That would mean a more than 400% rally from the current market price.

On the other hand, continued selling pressure could trigger a roughly 40% decline to the support barrier at $0.25.

A breakdown here would erase all bullish momentum and drag ADA prices to the historical foothold at around $0.18.