- Aptos price rose to highs of $5.07 as trading volume jumped 189% to over $643 million.

- Data shows Aptos stablecoin supply nearing $1.2 billion.

- Aptos Labs and Jump Crypto have introduced Shelby, a decentralized storage protocol, enhancing Aptos’ appeal for web3 applications.

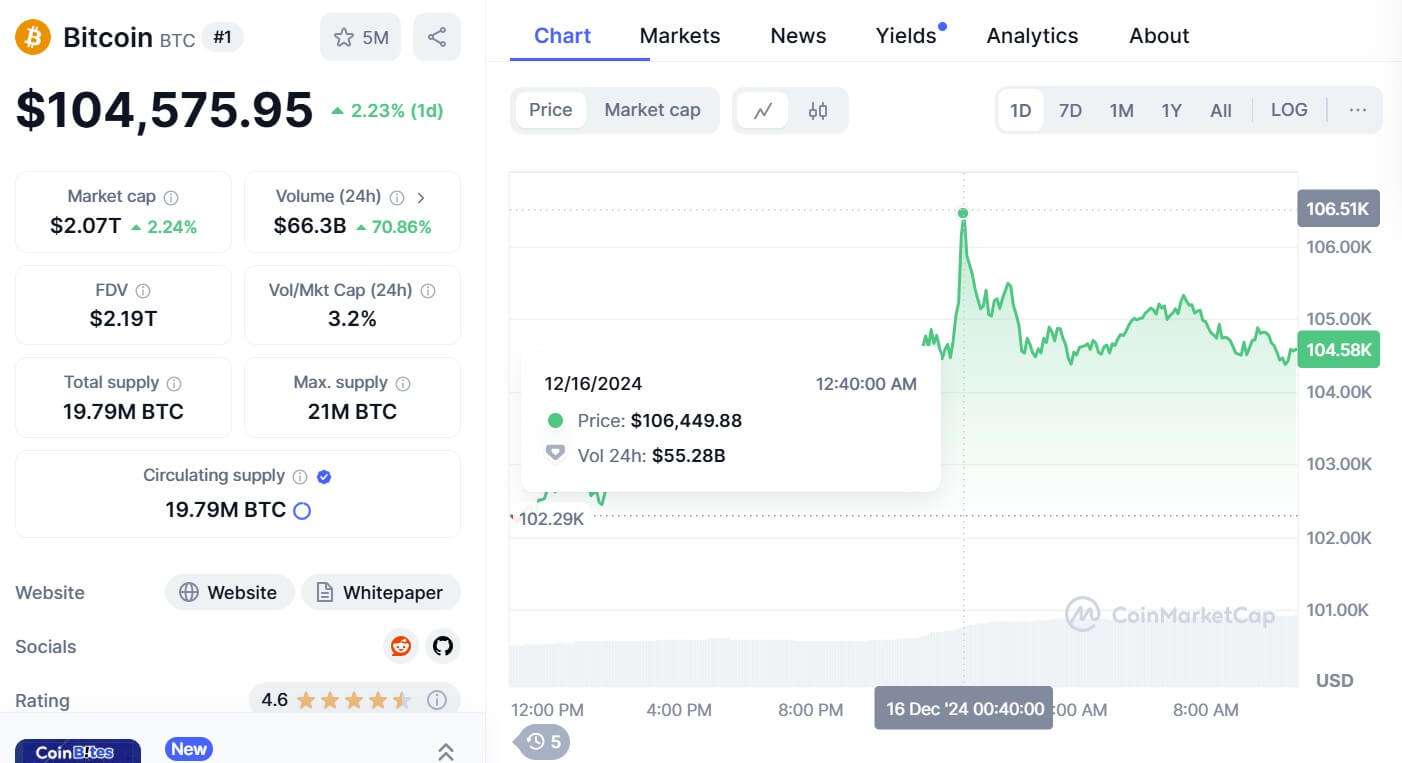

The Aptos blockchain, a leading Layer-1 platform, has seen its native token, APT, experience a significant price surge. As Bitcoin recovered to above $106k, APT price climbed nearly 17% in the past 24 hours to highs of $5.07. Trading volume increased 189% to $643 million.

The uptick in APT price coincides with the platform’s stablecoin supply approaching an all-time high of approximately $1.2 billion, reflecting growing adoption and liquidity within the Aptos ecosystem.

According to industry analysts, the surge in stablecoin supply highlights Apts’ increasing prominence in decentralized finance (DeFi).

Aptos stablecoin supply nears $1.2 billion

While overall market sentiment has played a part in Aptos token’s bounce, network related growth appears to a main catalyst.

Per details shared by Token Terminal, Aptos’ stablecoin supply has grown from $430 million in December 2024 to near the all-time high of $1.2 billion.

The metric last reached this milestone in May 2025, signaling robust network activity. Leading stablecoins Tether (USDT) and USDC (USDC) have driven this surge in liquidity.

ICYMI: Stablecoin supply on @Aptos is close to all-time highs at ~$1.2 billion. Average transaction fee on Aptos hovers around ~$0.0005. pic.twitter.com/NENHThCzFg

— Token Terminal 📊 (@tokenterminal) June 24, 2025

Notable gains for APT have also come after Wyoming picked Aptos’ blockchain for the state’s WYST stablecoin pilot.

This momentum suggests potential for further price gains if adoption continues, which also ties in with the latest Aptos related news.

Meanwhile, the average transaction fee on Aptos has fallen to around $.0.0005.

Jump Crypto and Aptos Labs to launch Shelby

Adding to the bullish sentiment, Aptos Labs, in collaboration with Jump Crypto, have announced the upcoming launch of Shelby, a decentralized hot-storage protocol designed for high-frequency web3 workloads.

Announced on June 24, 2025, Shelby leverages Aptos’ 600ms finality and ultra-low gas fees to offer cloud-speed storage for applications like streaming video, AI pipelines, and DePIN feeds.

Web3 wasn’t meant to run on Web2 infrastructure. Its potential to create value through data has been throttled. That ends now.@ShelbyServes is a decentralized hot storage protocol, designed to serve real-time data, and reward it.

✅ Sub-second access over dedicated fiber

✅… https://t.co/8LQbz9dlsB— Aptos Labs (@AptosLabs) June 24, 2025

The protocol is chain-agnostic, with planned support for Ethereum and Solana, and has attracted early interest from brands like Metaplex and Story Protocol.

According to Aptos Labs’ X account, Shelby aims to deliver web2 performance with web3 transparency, positioning Aptos as a leader in scalable infrastructure.

“Web3 wasn’t meant to run on Web2 infrastructure. Its potential to create value through data has been throttled. That ends now. ShelbyServes is a decentralized hot storage protocol, designed to serve real-time data, and reward it,” Aptos Labs wrote.

Shelby’s potential to drive cross-chain adoption could be crucial to Aptos, with a developer-focused devnet slated for Q4 2025.