- Bitcoin plunged 8.4% as liquidity collapsed across exchanges.

- Oracle glitches triggered cross-liquidations and temporary de-pegs.

- The crash exposed major vulnerabilities in crypto infrastructure.

On 10–11 October 2025, the cryptocurrency market experienced one of its sharpest collapses in years — an event the community has dubbed Crypto Black Friday.

In just a few hours, more than $19.5 billion in leveraged positions were wiped out, sending Bitcoin down by 8.4% and shaking investor confidence worldwide.

What began as a reaction to the US’s 100% tariff announcement on Chinese goods quickly revealed much deeper cracks in the system — showing how automated trading, thin liquidity, and structural weaknesses combined to trigger a chain reaction across exchanges.

What triggered the sell-off?

The first signs of the crash appeared after President Trump confirmed steep new tariffs on Chinese imports, fuelling fears of higher inflation and tighter Federal Reserve policy.

Traders rushed to unwind risky positions, leading to rapid liquidations in Bitcoin (BTC), Ethereum (ETH), Wrapped Beacon ETH (WBETH), and Binance-Smart-based Solana (BNSOL).

But geopolitical panic alone doesn’t explain how billions disappeared so quickly. Analysts say technical and structural factors amplified the event.

Liquidity across exchanges was unusually low, and some Binance users reported frozen accounts during the sell-off.

High-leverage looped loans and a temporary de-pegging of the USDE stablecoin made matters worse, creating a cascade of forced sales. Binance later confirmed system issues and offered compensation to affected users.

How technical flaws magnified the collapse

According to a BeinCrypto report, during the sell-off, CoinGlass — a popular analytics site — faced a sophisticated proxy attack that briefly disabled access to its data and services.

This interruption added to market confusion just as traders were scrambling for real-time information.

At the same time, a series of unusually large transactions occurred moments before several oracle updates.

These oracles — the systems that feed real-world prices into blockchain smart contracts — briefly mispriced certain assets, triggering automatic liquidations across multiple trading pairs.

The mispricing also caused some stablecoins to lose their peg temporarily, creating brief windows where arbitrage bots and high-frequency traders could profit.

Within minutes, millions of dollars moved between exchanges as automated systems responded to the volatility, deepening the market crash.

Was it a coordinated attack?

Not everyone believes this was an organic crash. Some analysts argue that the patterns of trades and timing of oracle updates suggest deliberate manipulation.

Data showed that the most extreme de-pegs affected pairs with known update schedules, while large-scale short positions were placed just before liquidation cascades began.

This has led to speculation that certain market actors may have exploited the structure of the crypto market itself — using automated systems and leverage mechanisms to engineer volatility.

The idea is that, rather than hacking wallets or stealing funds, attackers could manipulate the market by exploiting predictable behaviours in oracles, exchanges, and algorithms.

Still, other experts maintain that this was simply an overleveraged market reacting to stress.

When traders take on too much debt and sentiment shifts suddenly, cascading liquidations can happen without any external interference.

The synchronised nature of the event across multiple exchanges, however, continues to fuel debate.

What the crash revealed about crypto markets

Crypto Black Friday has exposed how fragile the digital asset ecosystem remains despite its growing size.

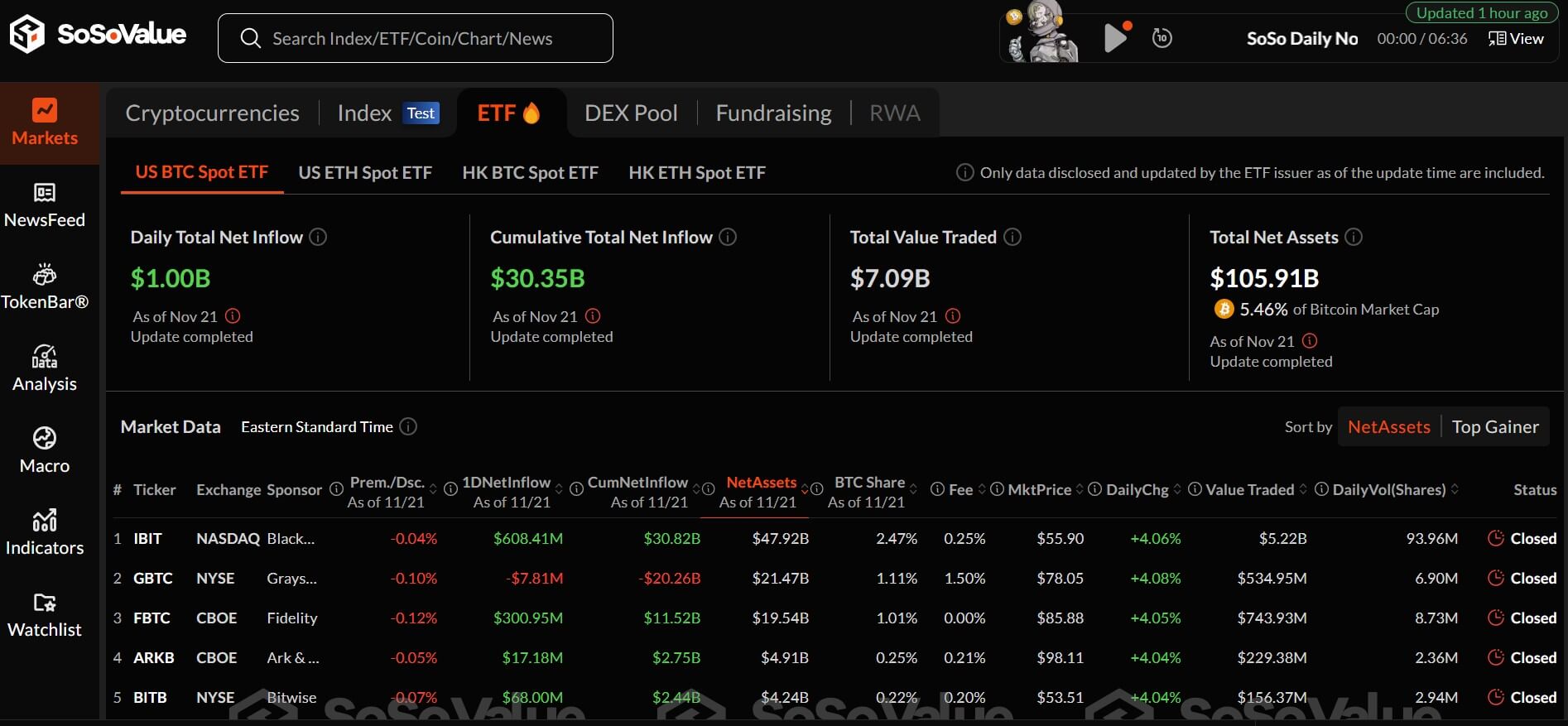

With $19.5 billion wiped out in hours, the event showed how quickly risk can spread when systems rely heavily on leverage, automated trading, and opaque liquidity pools.

Exchanges such as Binance have since launched internal audits and pledged to improve transparency, but experts warn that these are short-term fixes.

The real challenge lies in redesigning core systems — including how leverage is managed, how oracles feed data, and how liquidity is distributed across markets.

The incident has renewed calls for better on-chain oversight and global standards for crypto risk management.

For a trillion-dollar market to mature, analysts say it must balance innovation with stronger safeguards against both systemic shocks and sophisticated manipulation.