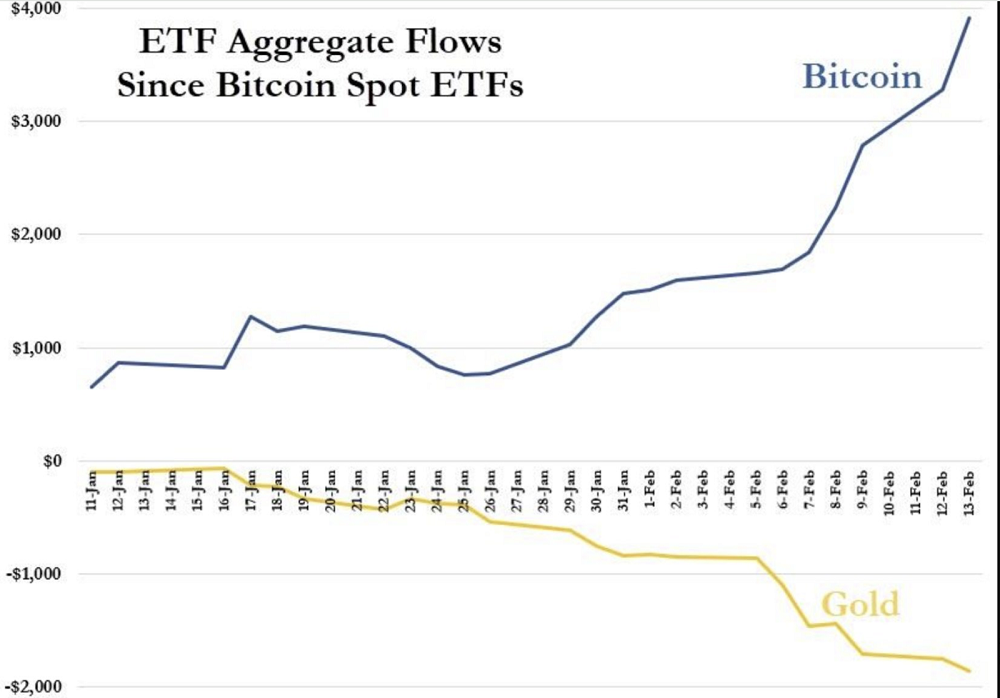

- BlackRock’s IBIT reached a new record in 211 days, surpassing iShares Core MSCI Emerging Markets ETF’s previous record of 1,253 days

- BlackRock’s new record comes two weeks after it hit $30 billion in net assets at the end of October

- BlackRock is now in the top 1% of all ETFs by assets and is bigger than all the ETFs launched in the past 10 years

BlackRock has done it again. This time its IBIT spot Bitcoin exchange-traded fund (ETF) has hit a record of over $41 billion in net assets in 211 days.

News of the milestone comes two weeks after BlackRock reached $30 billion in net assets in 293 days at the end of October.

Posting on X in October, Bloomberg analyst Eric Balchunas, said what BlackRock has achieved is an “all-time record,” adding “the old record was $JEPI which did it in 1,272 days. $GLD took 1,790 days. Unreal.”

With BlackRock’s new achievement, it’s surpassed the previous record of 1,253 days held by iShares Core MSCI Emerging Markets ETF, according to Balchunas.

In a post on X, he said: “[BlackRock’s] now in Top 1% of all ETFs by assets and at 10mo old it is bigger than all 2,800 ETFs launched in the past TEN years.”

JUGGERNAUT: $IBIT has hit the $40b asset mark (a mere two wks after hitting $30b) in a record 211 days, annihilating prev record of 1,253 days held by $IEMG. It’s now in Top 1% of all ETFs by assets and at 10mo old it is bigger than all 2,800 ETFs launched in the past TEN years. pic.twitter.com/WTATlpShUq

— Eric Balchunas (@EricBalchunas) November 13, 2024

Now, BlackRock holds more than 467,000 Bitcoin, valued at $41.8 billion, according to iShares data.

Reaching new heights

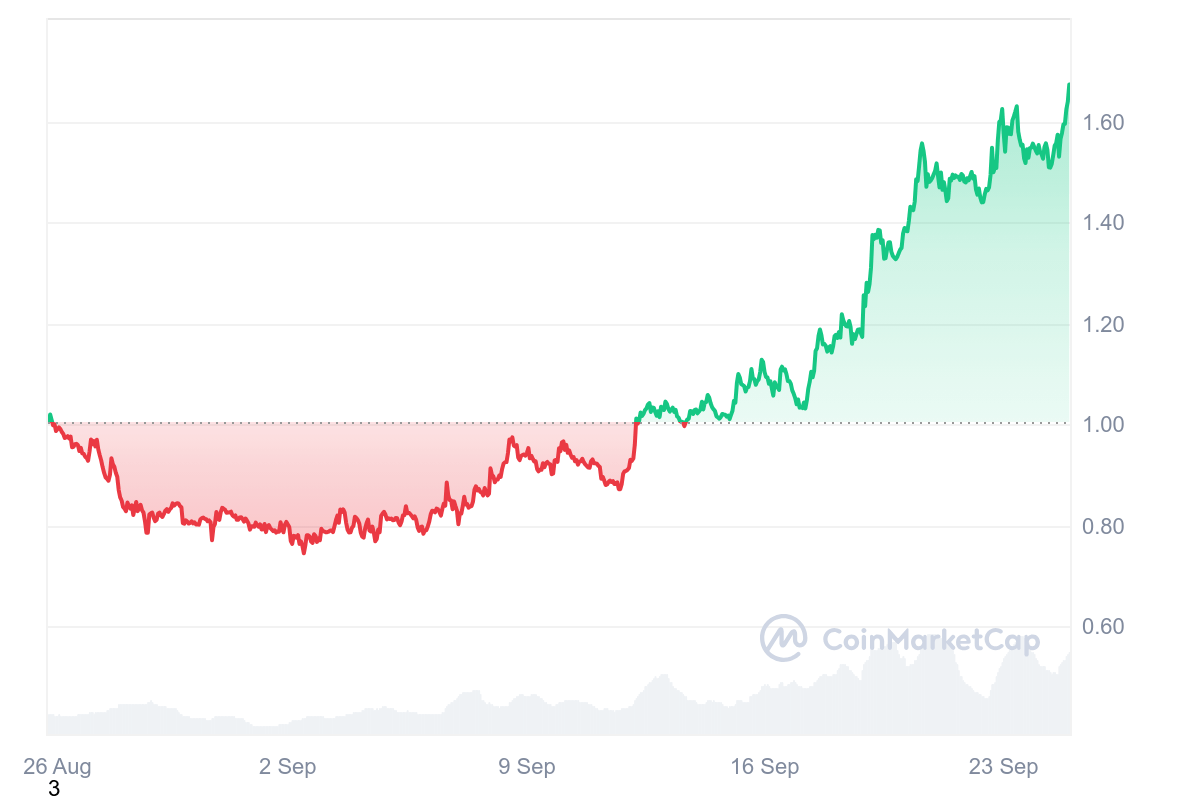

The new record comes as Bitcoin reached an all-time high of over $93,000 on November 13 in a continued rally that’s showing no signs of slowing.

The upward trajectory is partly due to Donald Trump being re-elected as US President earlier this month. Following news of his win, Bitcoin broke the $75,000 mark. It then passed $82,000, and continued to $84,000, before pushing to $87,000 earlier this week.

In September, Bernstein analysts predicted that Bitcoin would surge to between $80,000 and $90,000 if Trump won the US election. With that prediction having now passed, Bernstein analysts believe Bitcoin could reach $200,000 in 2025, urging investors to “buy everything they can.”

It remains to be seen how far Bitcoin will go, but for now, it’s showing no signs of slowing down.