Key Takeaways

- Bitcoin volatility is the highest point since July 2022

- Liquidity is extremely thin which is pushing volatility higher and accentuating price moves

- $4.2 billion of options expire Friday, with bull set to profit following the recent surge up to $28,000

Yesterday, I wrote a piece looking at how the correlation between Bitcoin and the stock market, notably tech stocks, has come back up. The relationship had loosened amid the banking turmoil that struck financial markets, triggered by the collapse of Silicon Valley Bank.

As well as rising correlation, the market is also swinging wildly – the volatility is as high as it has been since July 2022, around the time Celsius sent evaporated into thin air and sent the market into mayhem.

Why is volatility rising?

The volatility spike is not surprising in light of the glut of liquidity currently in the markets. We crafted up a piece on this earlier this week, assessing how 45% of stablecoins had flowed out of exchanges in the last four months, with the balance now at the lowest point since October 2021.

It gives context to the recent Bitcoin price rise. With less liquidity in the markets, moves are naturally more violent, and Bitcoin has surged up to $28,000, now up 68% on the year.

While the move to the upside has been exacerbated by this thin liquidity, the opposite also holds true: the downside risk is elevated when markets are so thin.

It paints a picture of high risk for an asset that already oscillates wildly at the best of times.

Derivatives add to volatility

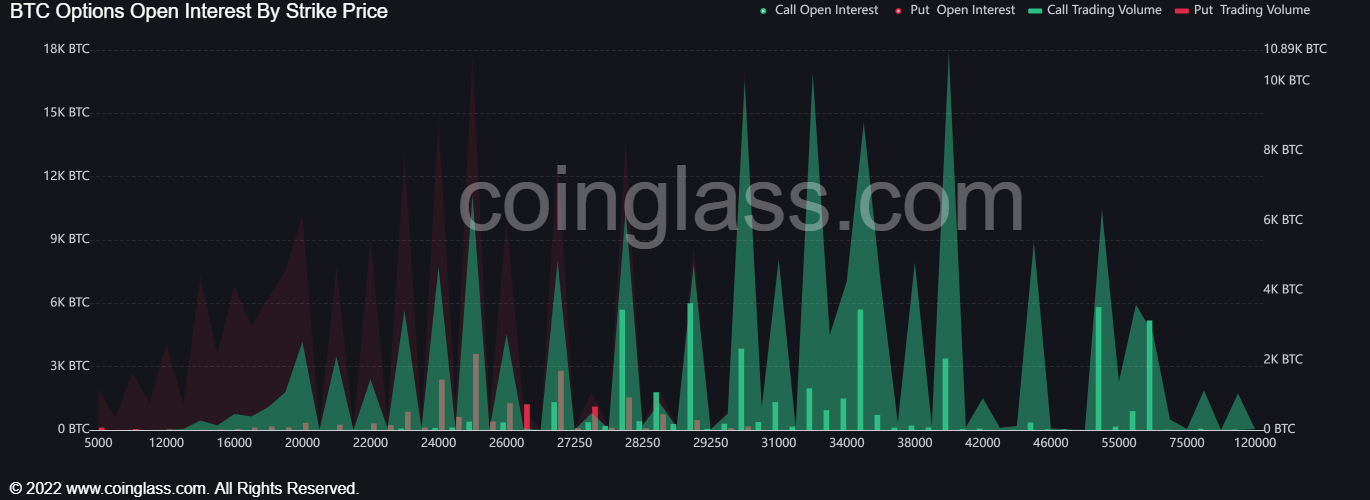

Another factor? Derivatives open interest is absolutely soaring, with the below chart from Coinglass showing that options open interest is at its highest point since November 2021.

As I write this on March 31st, a mammoth $4.2 billion of Bitcoin options are set to expire. The below chart also shows the strike prices of the options – with a call/put ratio of 2.09 and Bitcoin currently trading close to $28,000, it will be a profitable day for many traders.

Digging into the numbers, there are 97,300 call options expiring at a strike price of $28,000 or less, compared to 24,500 put options. The dollar split is over $2 billion in favour of calls.

Looking at strike prices of the next level up, it is pretty much all call options. Between $28,000 and $32,000 there are 48,000 call options against 400 put options with a $1.4 billion split in favour of calls.

After a year of bears dominating, there will finally be some bulls primed to profit.

Indeed, looking at the Bitcoin spot holdings, it is showing more positive news all across the market. In December, the majority of Bitcoins were in loss-making positions, when comparing the market price to the price at which they last moved.

Today, however, 74% of the supply is in profit when using the same metric.

With interest rate policy expectations softening, Bitcoin has finally been allowed room to run. However, with thin liquidity and high volatility comes risk, although when it comes to Bitcoin, risk is hardly a foreign concept.