- Ethereum price is at $3,640 amid some profit-taking deals.

- Despite some whales selling, institutional interest remains high and demand is absorbing the dump.

- Analysts say the ETH bull market remains intact.

Ethereum has retreated slightly from its highs of $3,856 as it dips nearly 4% in the past 24 hours amid some profit-taking moves.

But while the top altcoin changes hands at $3,640 at the time of writing, analysts maintain Ethereum is on a bullish course and that ETH still has room to explode.

ETH sees strategic profit taking

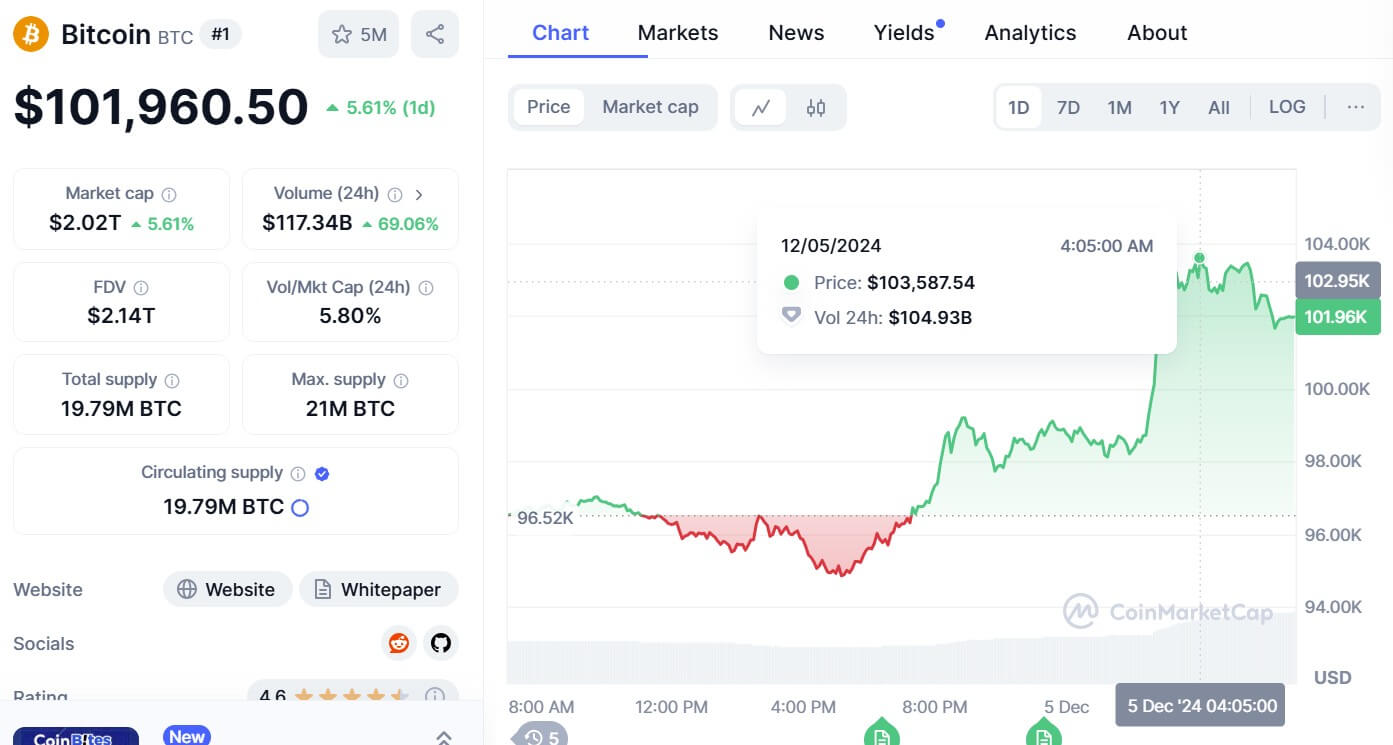

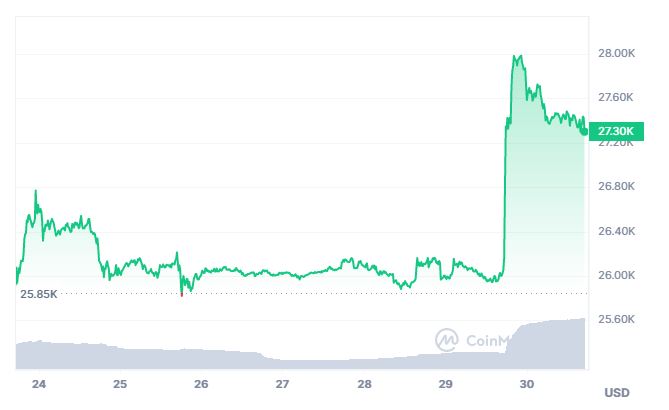

The $4,000 mark remains elusive for Ethereum in 2025, with the highs of $3,856 marking a key peak since the declines from $4,000 in December 2024.

It means Ethereum price has lagged as Bitcoin climbed to multiple new highs.

Selling pressure at current levels alludes to likely struggles in the short term, analysts at Glassnode have noted.

The outlook is down to the Cost Basis Distribution Heatmap of Ethereum, which Glassnode analysts say shows buyers are cashing out gains.

This strategic profit-taking is calculated towards securing profits after ETH posted strong upward moves these past weeks.

Sellers have included whales. Lookonchain shared on X that one whale has sold 8,000 ETH for over $30 million.

Ethereum price forecast: here’s why bull case remains intact

Despite the profit-taking, Glassnode highlights a fascinating scenario with equilibrium emerging.

$ETH Cost Basis Distribution Heatmap shows profit-taking from buyers around $2,520 – visible in the fading red band from around July 1. But they still hold nearly 2M ETH. Takeaways: 1) strategic profit taking, 2) expecting more upside, 3) new demand is absorbing supply. pic.twitter.com/GPMONKKv2x

— glassnode (@glassnode) July 22, 2025

Notably, data shows new demand is steadily absorbing the supply hitting the market, with selling pressure yet to overwhelm buyer interest.

It’s a resilient market structure for ETH that suggests pullback action is likely to dissipate as bulls take control.

While some whales sell, others have accumulated. Also, institutional holders like SharpLink Gaming have been aggressive.

The company has acquired a massive chunk of ETH in recent weeks.

Helping buyers is overall market sentiment that sees open interest in ETH futures soar to all-time highs. OI currently sits around $58 billion per Coinglass, which indicates interest is elevated.

Ethereum is also sporting gains amid staking explosion, spot ETF inflows and regulatory developments. The ETH spot ETF inflows for Ethereum reached 588,000 ETH last week – higher than recent peak.

Last week, #Ethereum spot ETFs saw inflows of over 588K $ETH – nearly 17x the historical average and more than double the previous record. pic.twitter.com/FipYT0HrQZ

— glassnode (@glassnode) July 22, 2025

Traders will eye potential corrections for buy opportunities, with consolidation in the near term allowing for a retest of key supply zone areas.

On the flipside, sellers may be encouraged by weakening on-balance volume and extended cashing out.

The $3,500 remains important and robust support may be around $3,000.

Yet, the RSI on the daily chart is not overextended as it hovers just below the overbought territory.

The MACD also still boasts a bullish case scenario. The $4,000 threshold is therefore one to watch.