- Citi forecasts Bitcoin at $143K and Ethereum at $4,304 in 12 months.

- Regulatory clarity and adoption drive institutional interest in crypto.

- Short-term risks, including bearish patterns, options expiry, and ETF outflows, still linger.

Citigroup has delivered one of the most upbeat outlooks from a major Wall Street institution on digital assets, forecasting strong upside for both Bitcoin and Ethereum over the next year.

The bank’s projections come at a time when crypto markets are navigating sharp short-term volatility while longer-term adoption trends continue to strengthen.

A bullish baseline with room to run

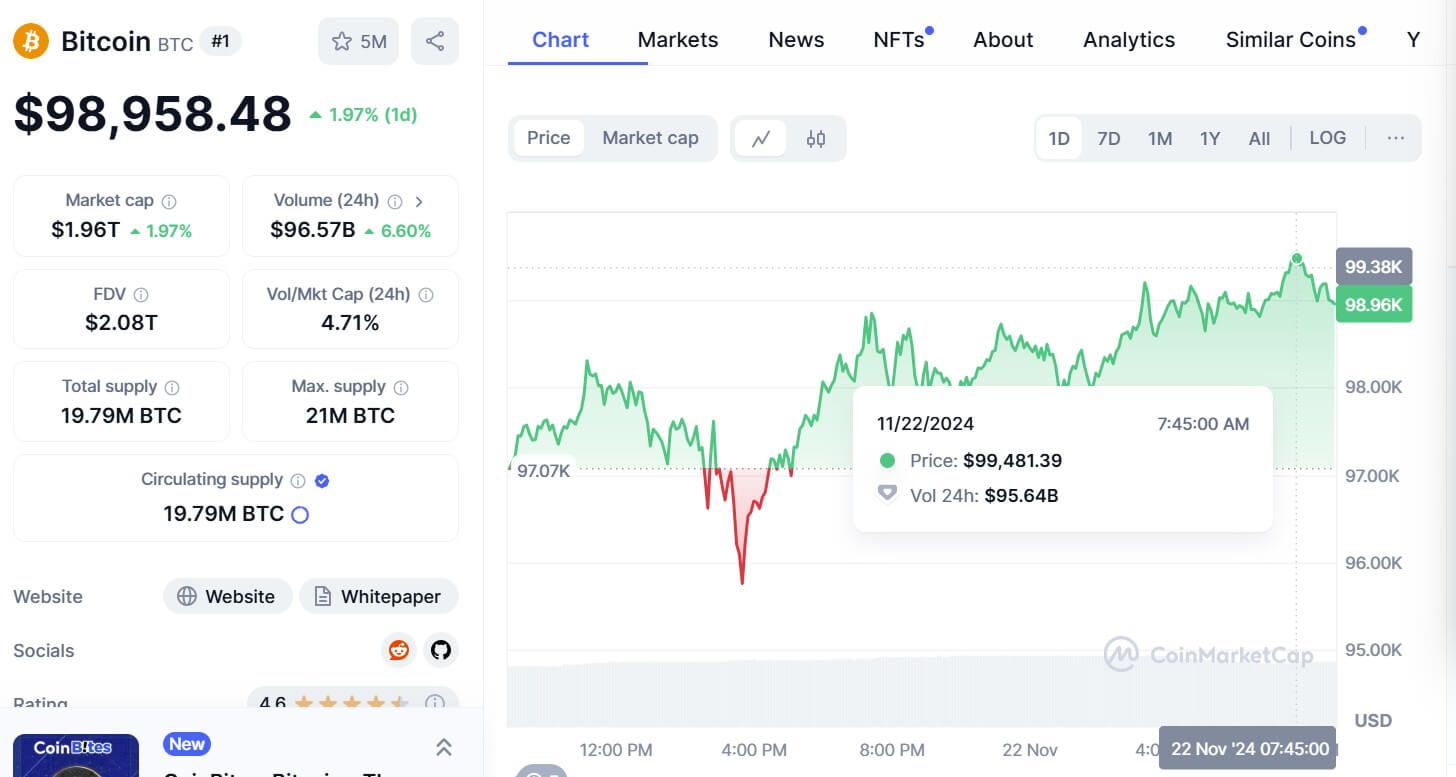

In a recent research note, Citigroup set a 12-month price target of $143,000 for Bitcoin, representing an upside of roughly 62% from levels near $88,000 at the time of the forecast.

The bank also gave Ethereum a favourable outlook, with a target price of $4,304, implying potential gains of about 46% from around $2,950.

The bank said its forecasts reflect improving market conditions after recent drawdowns, arguing that crypto prices are now closer to measures of value tied to actual user activity.

Citi framed its base case as a recovery scenario rather than an aggressive speculative call, noting that valuations have adjusted following the pullback from October highs.

Beyond its baseline projections, Citi also outlined a wide range of possible outcomes.

In a bullish scenario, the bank sees Bitcoin climbing as high as $189,000 and Ethereum reaching $5,132.

Under a bearish case, however, Bitcoin could slide to $78,000, while Ethereum may fall toward $1,270, underscoring the asset class’s persistent volatility.

Regulation shifts from risk to catalyst

Citi identified regulatory developments as the central driver behind its constructive stance.

The bank pointed to a noticeable shift by US authorities toward clearer, more tailored frameworks for digital assets, replacing years of regulatory uncertainty with defined rules.

Several enforcement actions and lawsuits against major crypto platforms have been dismissed, a change Citi believes could encourage institutional investors to re-engage with the sector.

The bank also highlighted President Donald Trump’s pro-digital-asset rhetoric, which has coincided with broader acceptance of cryptocurrencies within traditional finance.

According to Citi, these policy shifts have the potential to unlock renewed capital inflows, particularly from institutions that previously stayed on the sidelines.

The firm expects regulatory clarity to support adoption across spot markets, ETFs, and tokenised financial products over the coming year.

Volatility clouds the near-term forecasts

Despite the optimistic outlook, Citi acknowledged that recent market turbulence remains a significant headwind.

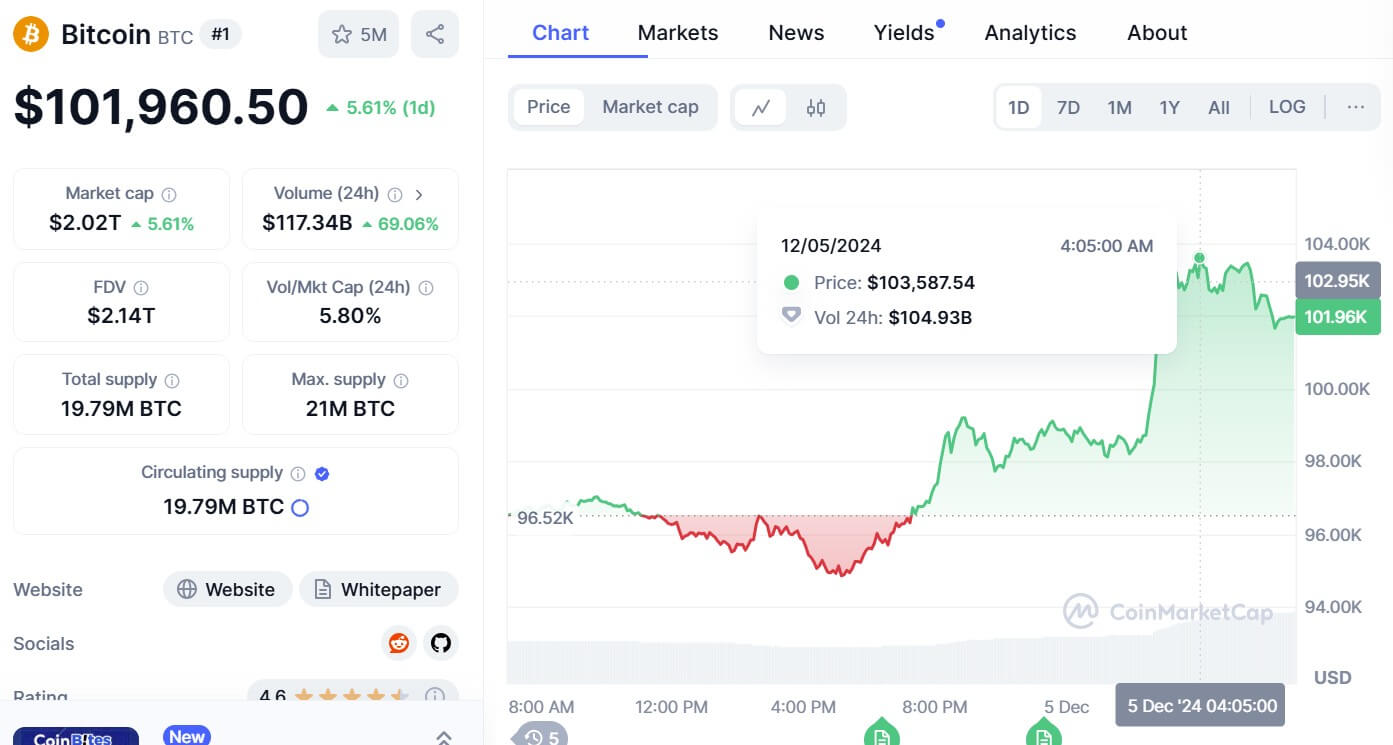

Bitcoin fell to multi-month lows in November as investors reduced exposure to risk assets amid concerns over elevated technology stock valuations.

Market sentiment has weakened further in December after Strategy, formerly known as MicroStrategy and the largest corporate holder of Bitcoin, cut its 2025 earnings forecast.

Strategy cited Bitcoin’s prolonged weakness, drawing heightened attention given its outsized exposure to the cryptocurrency.

Short-term technical signals also suggest caution, seeing that Bitcoin has formed a bearish flag pattern on the daily chart and remains below key moving averages and the Supertrend indicator.

Analysts warn that the price could dip toward $87,341, or even $85,188.