- Bitcoin falls below $104K amid heavy ETF outflows.

- Key resistance at $106K–$107K amid rebound attempts.

- Whale selling is on the rise as retail buys surge.

Bitcoin (BTC) has started June on the back foot, dipping below $104,000 to a low of $103,833.57 on June 2 as investors react to a fresh wave of ETF outflows and technical uncertainty.

Despite closing May with its highest monthly close ever near $105,700, the market mood has quickly shifted, driven by signs of distribution from whales and institutional sellers.

Bitcoin ETF outflows outweigh inflows

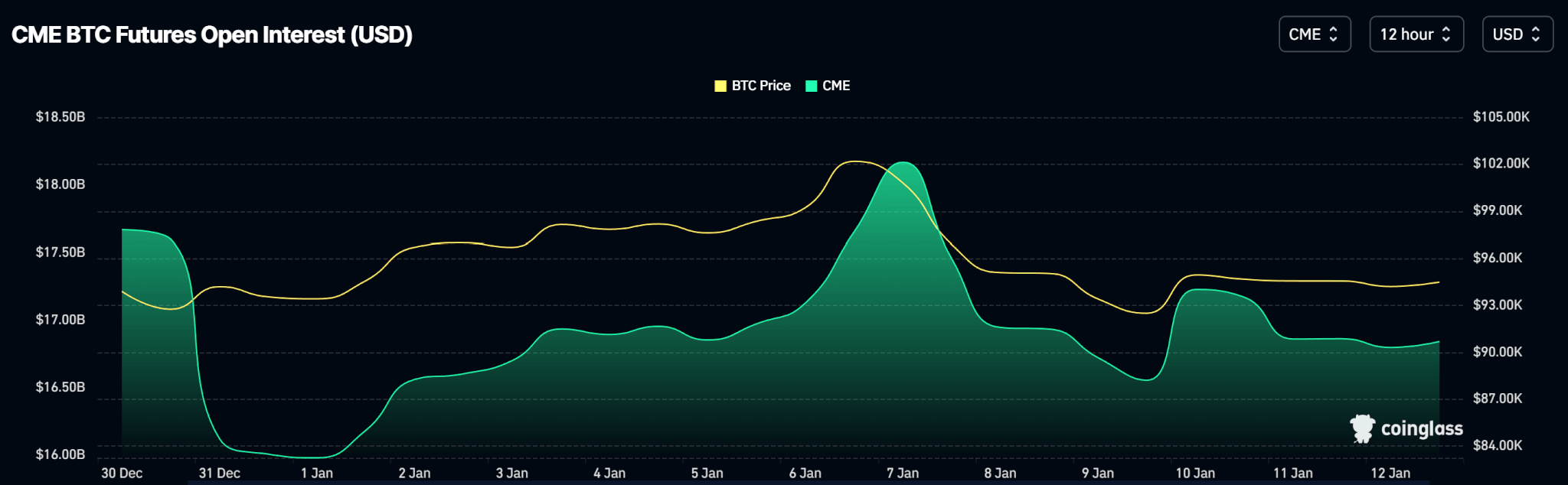

The six-week streak of inflows into US spot Bitcoin ETFs came to an abrupt end on May 30, when funds collectively recorded a staggering $616.22 million in outflows according to Coinglass data.

This reversal marks a sharp deviation from previous weeks, where ETF flows had reinforced the bullish narrative and contributed to Bitcoin’s 11% monthly gain.

BlackRock’s IBIT, the largest fund in the cohort, leads the exit with $430.82 million in withdrawals, even though it still maintains over $69 billion in assets under management.

Fidelity’s FBTC and ARK 21Shares’ ARKB follow suit with $113.71 million and $120.14 million in outflows, respectively, underscoring the broad-based nature of the sell-off.

Although the total cumulative inflows across all ETFs remain positive at $44.37 billion, the sudden withdrawal suggests that investors are now acting cautiously amid growing macroeconomic and technical risks.

Bitcoin price pullback

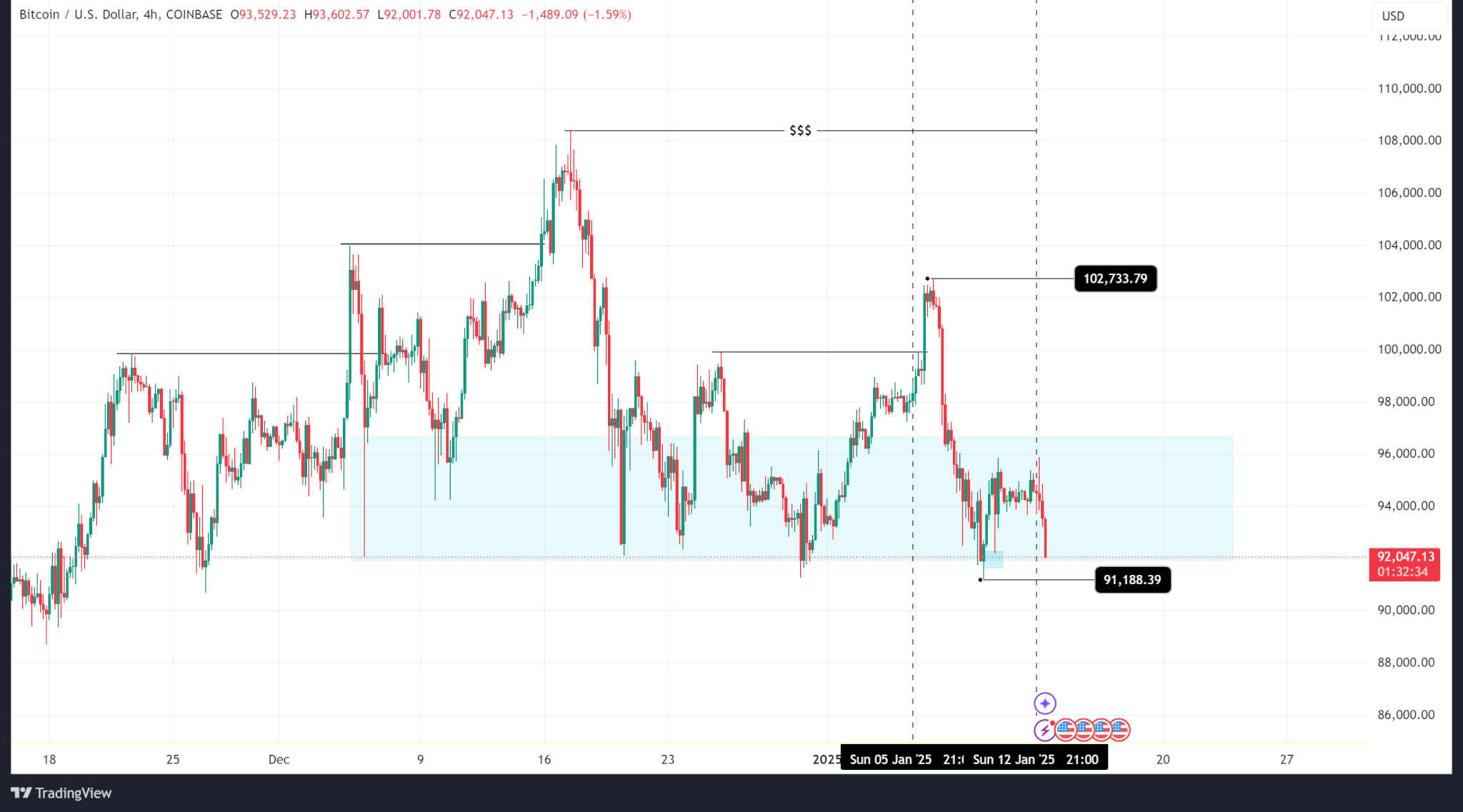

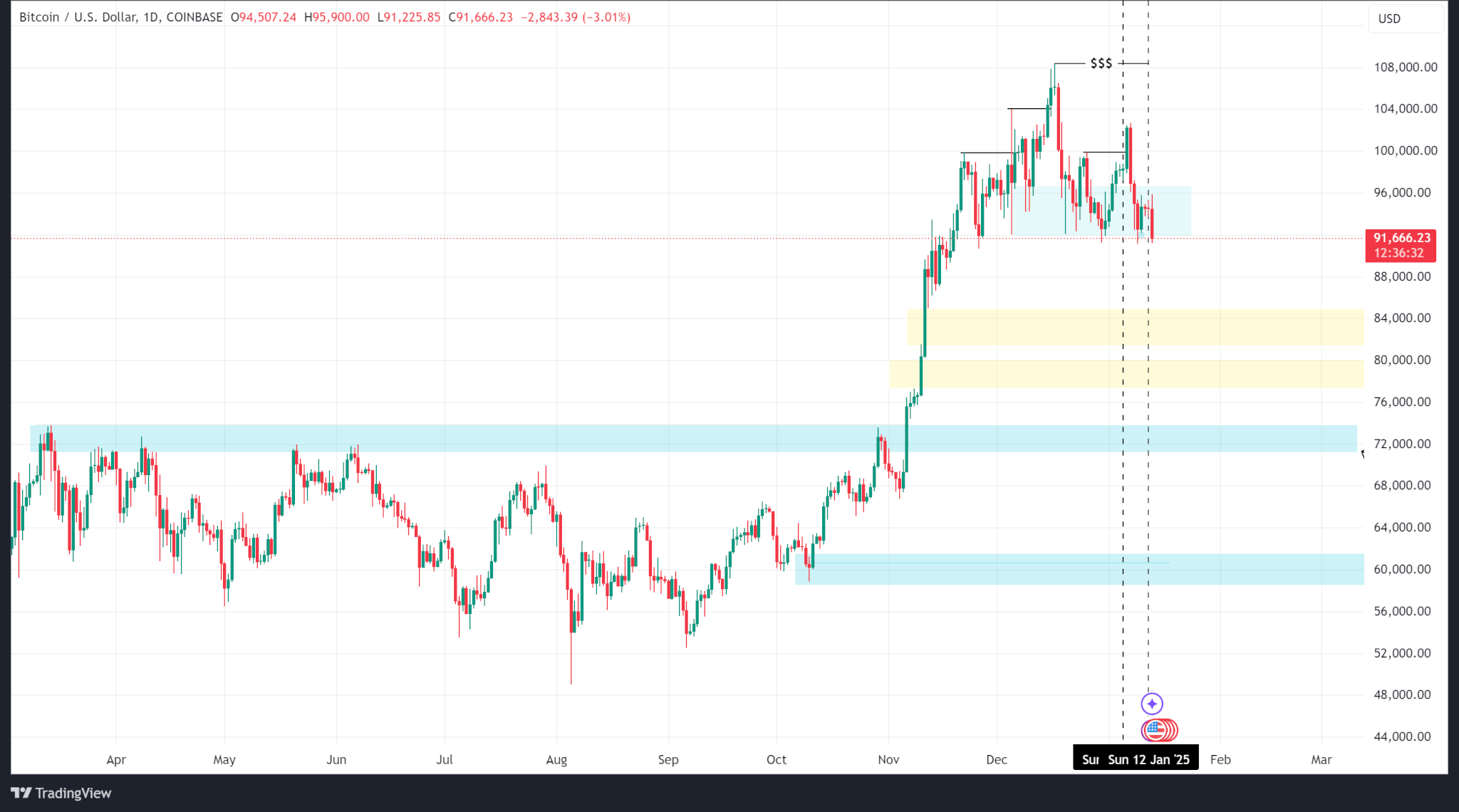

On the price charts, Bitcoin’s recent pullback from $109,000 to $103,833 has brought it below the 0.786 Fibonacci retracement of the rally to its all-time high of $112,000.

That dip reflected heavy profit-taking into the end of May, exacerbated by the rising influence of bearish technical patterns such as the death cross on the 4-hour chart.

During Monday’s European session, BTC briefly rebounded to $105,500 but quickly stalled near $105,800 — a zone that combines the 0.618 Fibonacci level with the 100 EMA, forming a critical confluence of resistance.

While the 20 EMA has been reclaimed, the price continues to struggle beneath the 50 EMA at $106,000, reinforcing the view that bulls face an uphill task in regaining upward momentum.

If Bitcoin fails to break through the resistance between $106,000 and $107,000, the downside pressure could intensify, possibly dragging the asset back to the recent low near $103,200.

Adding to the volatility is James Wynn, the controversial high-leverage trader who once again opened a $100 million BTC long at 40X leverage on Hyperliquid, with a liquidation price precariously close at $101,999.

Just these for now

Hoping BTC pulls lower but i don’t see it pic.twitter.com/wd9751v27t

— James Wynn (@JamesWynnReal) May 30, 2025

Wynn’s repeated attempts to go long on BTC have not only ended in substantial floating losses but have also fueled wider speculation-driven activity on the Hyperliquid platform.

After another failed attempt by the market to liquidate him, Wynn has announced that he has decided to give perp trading a break, further amplifying concerns of exaggerated leverage in the market.

I’ve decided to give perp trading a break.

Thank you @HyperliquidX for your hospitality. Your service, impeccable. Your platform exquisite.

Its been a fun ride. Approx $4m into $100m and then back down to a total account loss of $17,500,000.

The time has come for me to…

— James Wynn (@JamesWynnReal) June 2, 2025

On-chain metrics are sending diverging signals

Meanwhile, on-chain metrics show a divergence in behaviour between whales and retail traders, with large holders reducing exposure steadily since BTC crossed $81,000.

Retail participants, by contrast, are showing signs of buying the top, a dynamic that historically aligns with periods of short-term market corrections.

Santiment flagged increased whale activity around the May 22 peak, noting that similar past patterns typically signal local tops rather than sustainable breakouts.

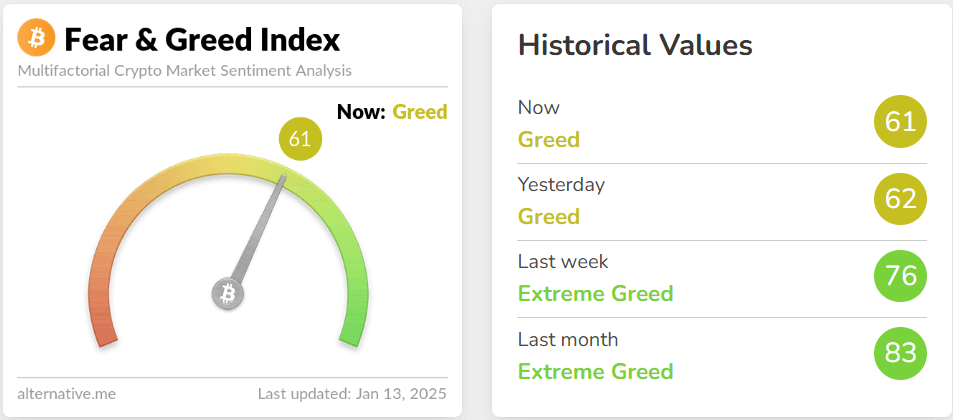

Even though Bitcoin remains up 11% over the past month, relative strength index (RSI) signals have turned bearish, flashing clear divergence as price attempts to recover above key resistance zones.

At the same time, broader macro conditions continue to cast a shadow, with traders watching closely for signals from the Federal Reserve amid slowing job growth and cooling inflation.

The falling US Dollar Index could provide a short-term tailwind for Bitcoin, but analysts remain divided on whether current levels represent a springboard for a fresh rally or a prelude to further losses.

Data from Glassnode’s MVRV ratio shows BTC is trading between critical bands that historically precede local tops, with the +1σ level near $119,400 acting as a psychological ceiling for many profit-takers.

While some traders anticipate a bounce from the $100K support to as high as $113K, the risk of a deeper correction continues to dominate sentiment across both spot and derivative markets.

As June unfolds, all eyes will remain fixed on ETF flows, macro indicators, and whether Bitcoin can decisively reclaim the $106,000–$107,000 band to avoid slipping further into bearish territory.