- Bitcoin (BTC) is trading above $107K Thursday, up 0.7%, after a sharp rebound from below $100K earlier in the week.

- Markets pivoted from “flight-to-safety” on Mideast tensions to a “risk-on in full force” rally.

- US GDP and unemployment data this week, plus quarterly options/futures expiry, could bring more volatility.

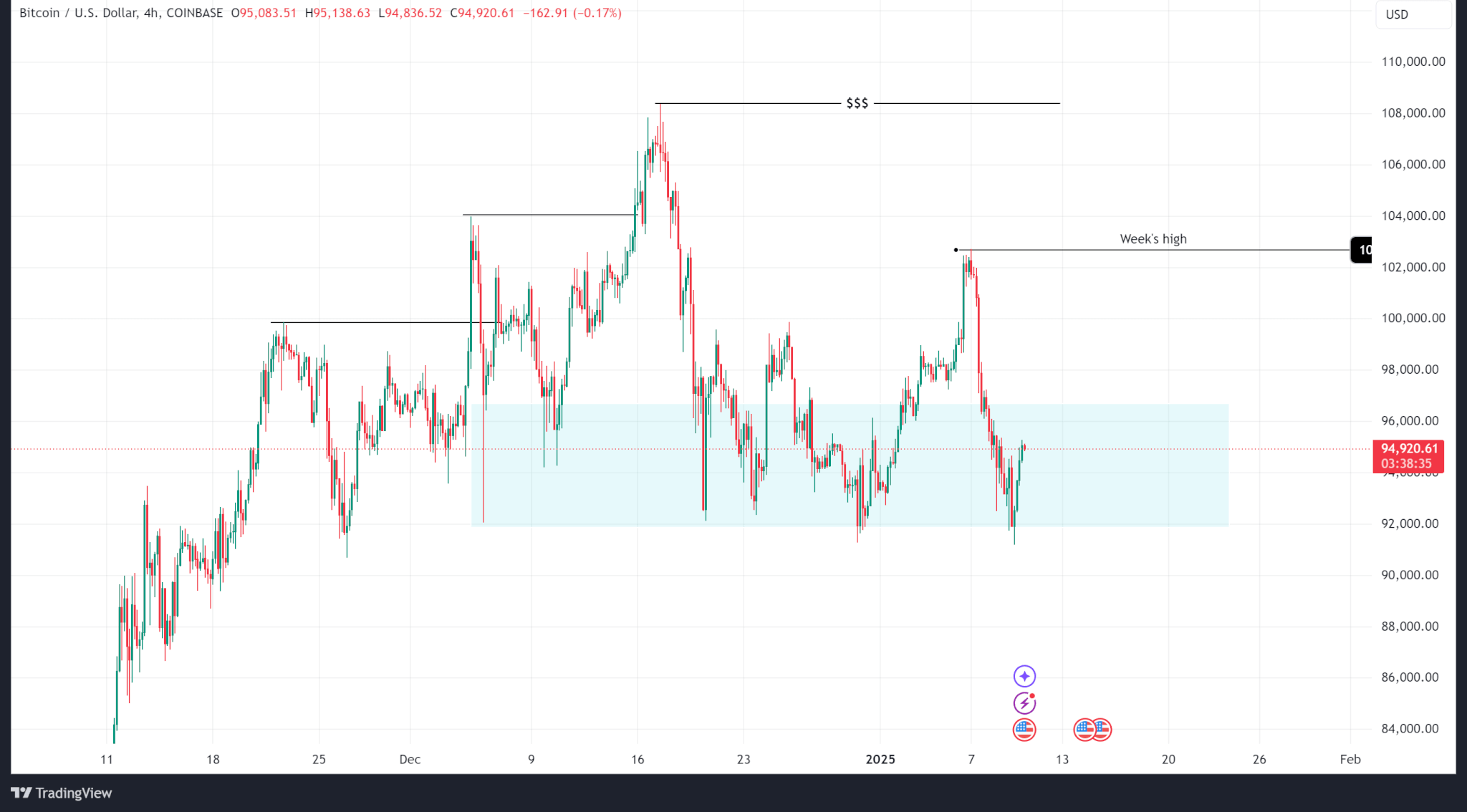

Bitcoin (BTC) is trading firmly above the $107,000 mark as the Asian trading day gets underway on Thursday, with the broader digital asset market also showing strength.

This impressive performance comes at the end of a tumultuous week that saw markets swing dramatically from fear over Middle East conflict to a powerful risk-on rally, lifting crypto, tech stocks, and broader market sentiment in tandem.

Looking back at the week’s events, what began as a sell-off driven by escalating tensions – with Israel and Iran trading rocket fire and a US bombing campaign on Iran’s nuclear facilities – has transformed into a textbook risk-on rally.

The initial anxiety has given way to a surge in investor confidence, seemingly brushing off the geopolitical dangers that loomed just days ago.

“War drums fade, risk appetite roars,” wrote the trading firm QCP Capital in its June 25 market note, perfectly capturing the sudden and dramatic shift in mood.

Traders appeared to have priced in a resolution or simply stopped waiting for one. Instead of flight-to-safety, the move was risk-on in full force.

This pivot was visible across multiple asset classes.

US equities surged, oil prices retraced back to their pre-conflict levels, and shares of crypto exchange Coinbase jumped 12% on positive regulatory news.

For Bitcoin, the strong rebound above $107,000 signals not just relief from the recent tension but a renewed sense of upward momentum, even as savvy investors keep one eye on the macroeconomic calendar and the other on potential global flashpoints.

Navigating the swings: key data and volatility ahead

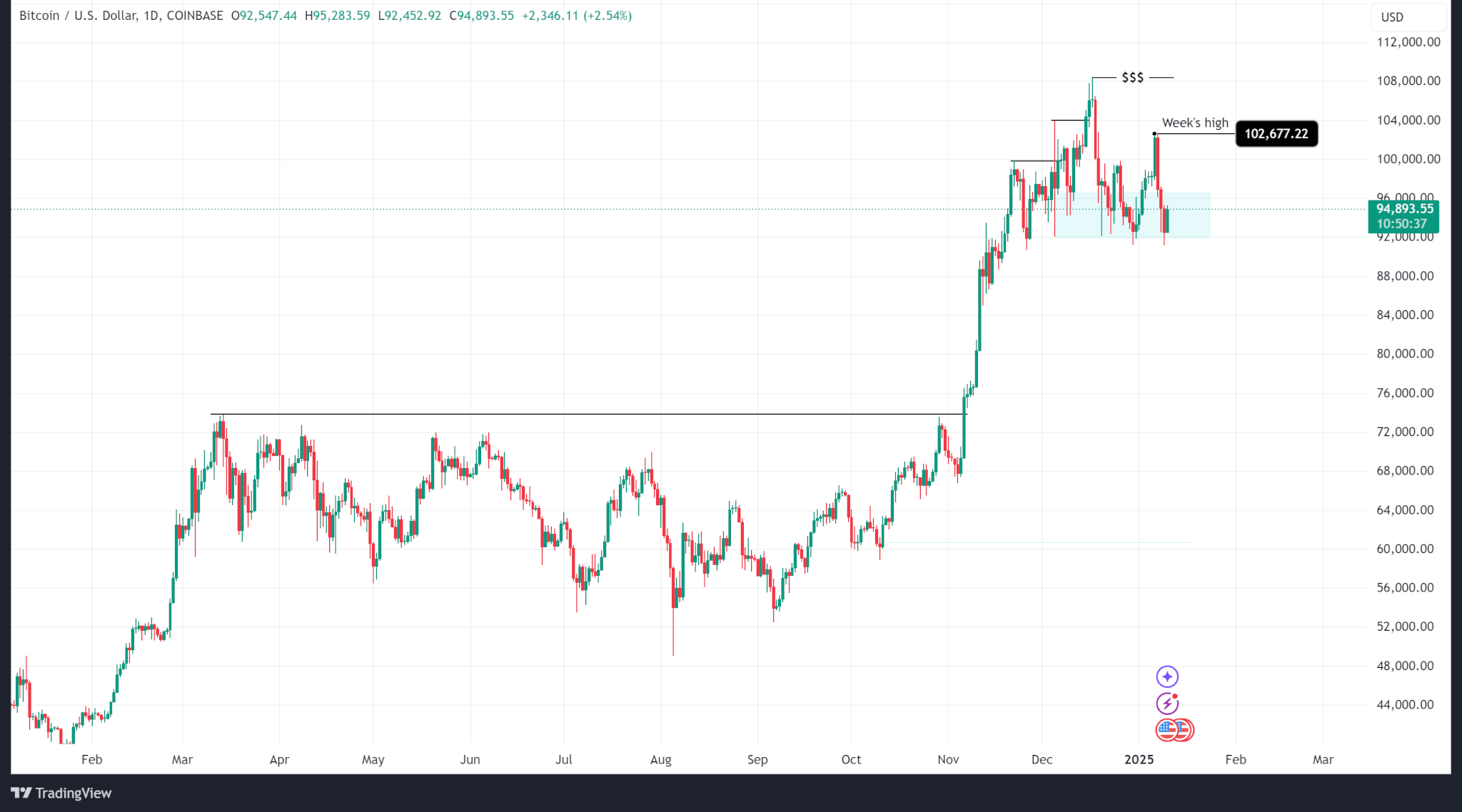

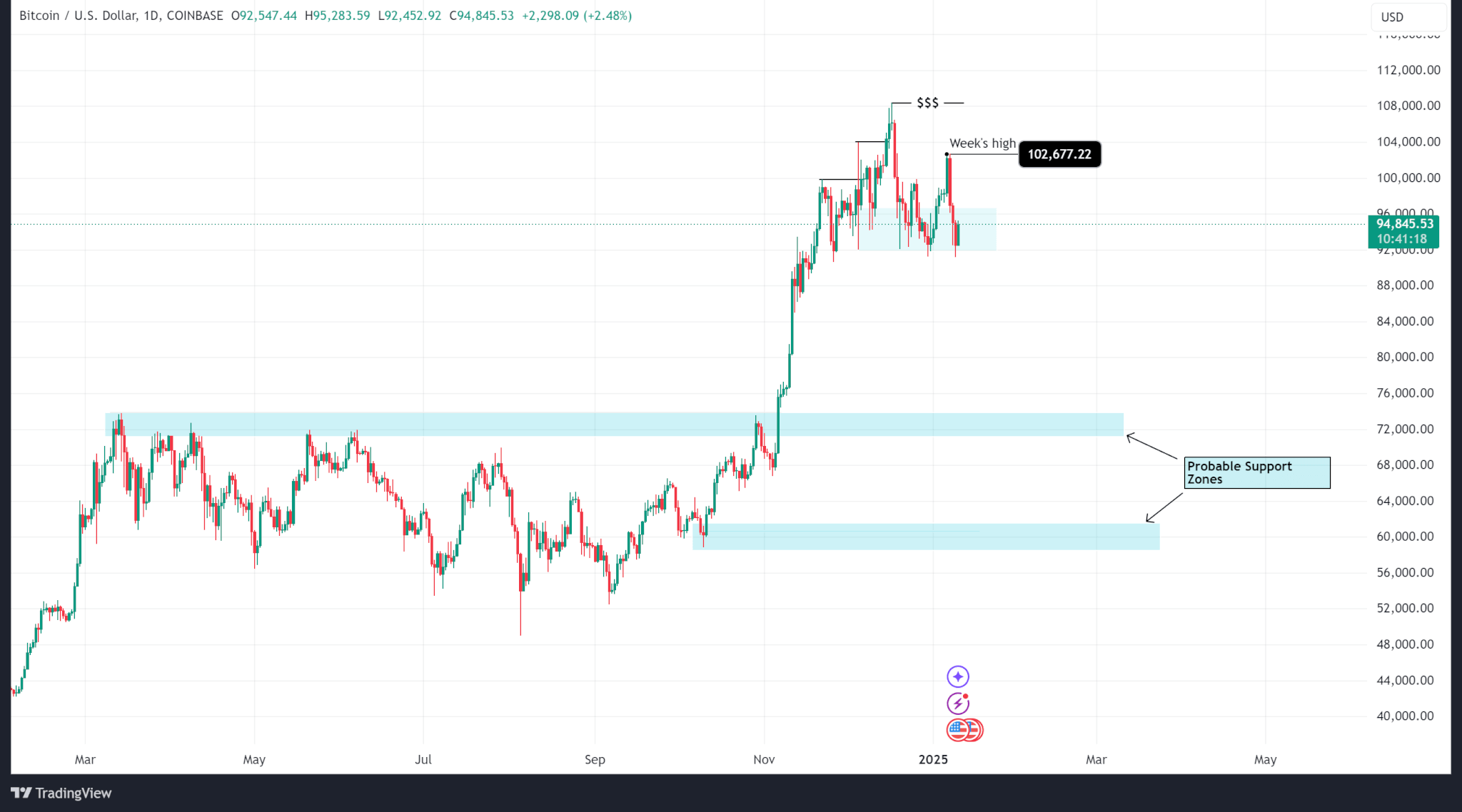

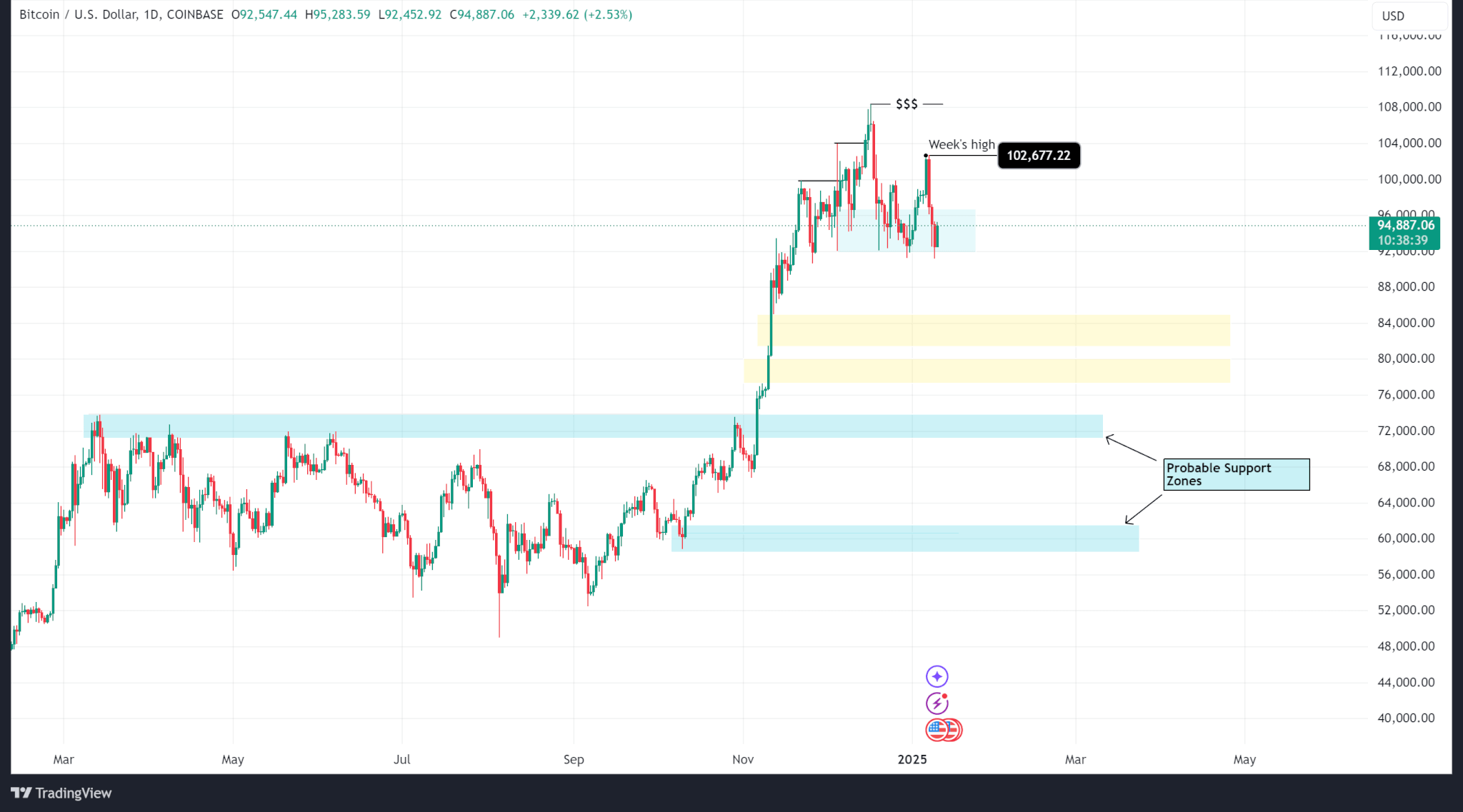

The recent price action has been nothing short of volatile. “It’s been a week of sharp swings in crypto,” commented Gracie Lin, CEO of OKX Singapore.

Bitcoin dipped below $100,000 earlier in the week when Middle East tensions rattled the markets, but rebounded quickly after news of a ceasefire – now trading just below its all-time high in a sharp reversal.

Lin points to a series of upcoming US economic data releases, including GDP figures and unemployment claims due later this week, as the next potential catalysts for Bitcoin’s price movement.

“Recent PMI numbers have held steady, but continued weakness in housing is raising questions about the broader economy,” she said.

If Thursday’s GDP or unemployment claims come in weaker than expected, bitcoin could benefit as investors look for hedges against traditional market weakness.

Adding another layer of potential turbulence, the quarterly expiration of Bitcoin futures and options is scheduled for June 27.

These events often bring increased price swings as traders close out or roll over their positions. “Another bout of volatility is expected,” Lin warned.

The bigger picture

While short-term volatility is expected, QCP Capital, in its analysis, is looking beyond the week’s sharp swings to spotlight the structural forces that are driving Bitcoin’s evolution into a recognized macro asset.

They point to significant institutional momentum, highlighted by events like ProCap’s $386 million BTC purchase and Coinbase’s recent regulatory win under the EU’s MiCA framework.

“If this accumulation trend persists,” QCP wrote, “bitcoin may not just rival gold as a macro hedge but potentially in total market capitalisation.”

This suggests a long-term bullish outlook underpinned by growing institutional adoption.

Still, QCP adds a crucial note of caution: “Geopolitics remains an ever-present undercurrent.”

While markets have largely shrugged off the recent Israeli strikes, new concerns are mounting over NATO–Russia tensions.

With Western nations increasing their defense budgets and President Trump set to attend the upcoming NATO summit, the next geopolitical shock may not originate from the Middle East.

For now, Bitcoin is riding the powerful wave of risk-on enthusiasm.

But just beneath the surface, the fundamental battle between short-term volatility and long-term conviction, between the fading sound of war drums and the steady rhythm of institutional buying sprees, continues to define this dynamic market.