- The Bybit hack has increased fears over centralized exchange security vulnerabilities

- US President Donald Trump’s trade tariffs are increasing market uncertainty

- Trump’s crypto promises may have started as being great, but they could end up proving catastrophic

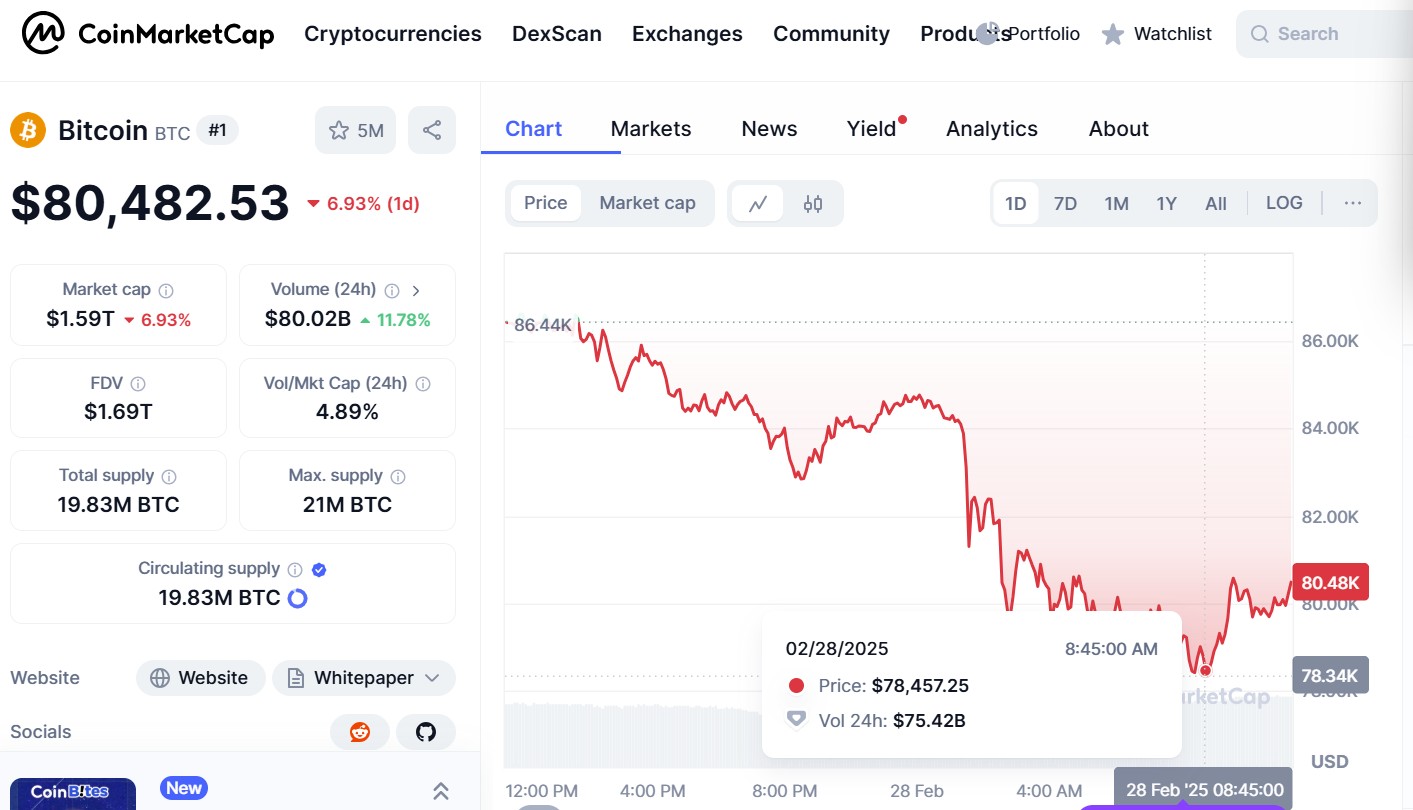

Three things are contributing to the drop in crypto prices, which has seen Bitcoin fall 7.50% over 24 hours to $78,000, according to Unity Wallet’s COO.

It’s a significant drop from Bitcoin’s all-time high, which reached $109,000 in January ahead of US President Donald Trump’s inauguration.

According to James Toledano, it feels like optimism around the crypto market post-election created a bubble and that the “reality post-inauguration is now setting in – and hard,” he said to CoinJournal.

In Toledano’s view, the Bybit hack at the crypto exchange last Friday—which resulted in the theft of nearly $1.5 billion worth of Ethereum—is one of the contributing factors affecting crypto prices.

Undermining investor confidence, it has led to panic withdrawals and a market-wide selloff across the board. While Bybit’s CEO, Ben Zhou, quickly responded to the hack, the situation has increased “fears about centralized exchange security vulnerabilities—which only solidifies the case for self-custodial services,” Toledano continued.

Dom Harz, co-founder of BOB (“Build on Bitcoin”), a hybrid Layer-2, said to CoinJournal the theft at Bybit is a “stark reminder of the industry’s fundamental issues,” adding:

“We’ve been hypnotized by price spikes, memecoin frenzies, and media spectacles, forgetting that crypto was meant to be a new financial system—one built on decentralized protocols that make finance accessible to everyone. Bybit just gave us a $1.5 billion reminder that we are nowhere near that reality.”

Trump’s tariffs

The continued market selloff follows Trump’s trade tariff announcement earlier this week.

During his election campaign, the US president made promises regarding crypto, stating that America will be the “crypto capital of the planet.”

Since entering the White House, he has appointed pro-crypto individuals to reshape government agencies, namely Paul Akins as the incoming chair of the US Securities and Exchange Commission (SEC).

Mark Uyeda is currently acting chair of the SEC.

Trump also signed an executive order to establish a crypto working group to provide regulatory clarity. It’s also expected that the working group will look into the potential of a national crypto stockpile.

Yet, despite these steps, Trump’s trade wars—which could soon hit the EU, the world’s largest trading bloc, with a 25% tariff—is increasing market uncertainty.

According to Toledano, Trump’s tariffs are “harming the global economy” and that many in the crypto space feel let down by the US president.

“The promise was great and the reality is potentially proving to be catastrophic,” he added. “It does make me wonder if Trump understands that financial verticals are interlinked and increasingly converging.”

Biggest economic risk

The third contributing factor affecting market prices—according to Toledano—are questions around the overall governance of the US.

An article by Chatham House suggests that the biggest economic risk from Trump’s presidency is a loss of confidence in US governance. It reads that while Trump’s policies may seem mild in the short term, steps that undermine the US and its international allies could have lasting effects.

“I rarely get spooked from the peaks and troughs that crypto presents but when I combine what’s happening with traditional equities volatility, I think there is cause for concern right now,” said Toledano.