- Crypto Fear and Greed Index hit “greed” for the first time since the $19B October liquidation event.

- Bitcoin rallied to a two-month high above $97K, helping lift overall crypto market sentiment.

- On-chain data shows retail holders exiting, while declining exchange balances signal reduced sell pressure.

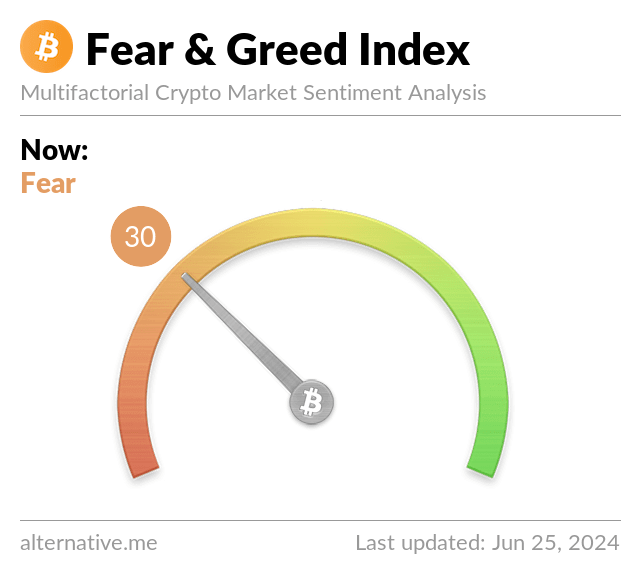

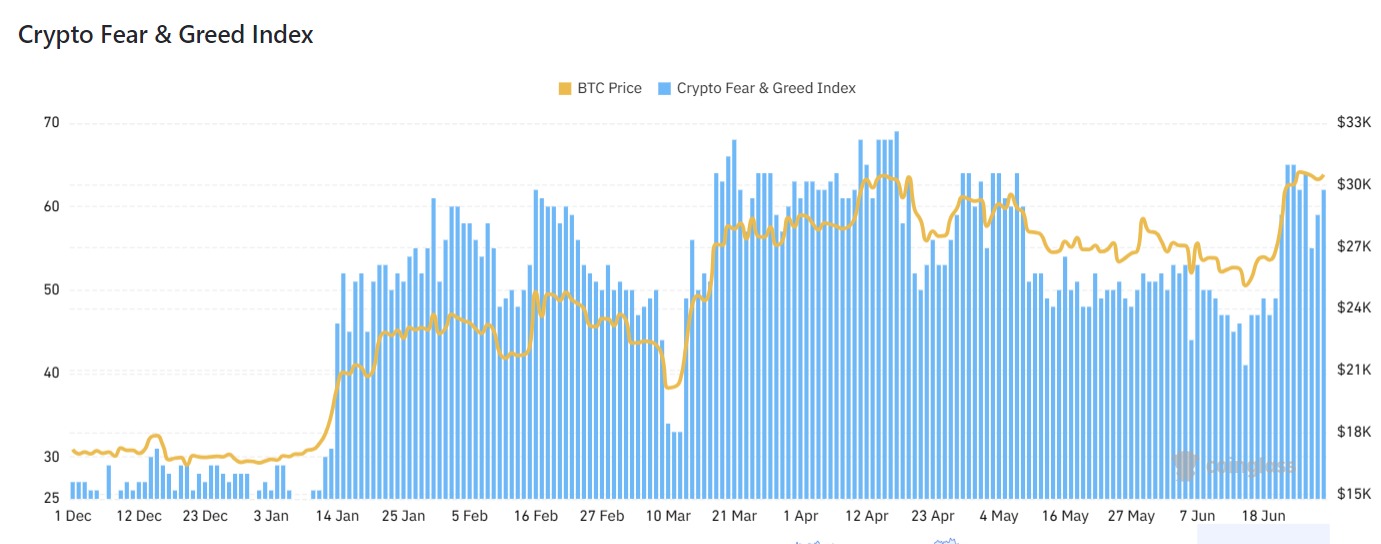

The Crypto Fear and Greed Index has moved back into “greed” territory for the first time since a $19 billion liquidation event in October rattled digital asset markets, signaling an improvement in investor sentiment as Bitcoin staged a strong recovery.

In an update on Thursday, the index posted a reading of 61, reflecting growing optimism after weeks spent in “fear” and “extreme fear.”

Just a day earlier, the index stood at 48, placing it in the “neutral” zone.

The shift marks a notable change in mood following months of heightened risk aversion among crypto traders.

Sentiment rebounds after October liquidation shock

Crypto investor sentiment collapsed on Oct. 11, when $19 billion was liquidated from the market, sending traders fleeing from altcoins and driving widespread pessimism.

In the weeks that followed, the Crypto Fear and Greed Index recorded some of its lowest readings on record, falling into the low double digits multiple times in November and December.

The index is closely watched by market participants as a barometer of sentiment, helping traders assess whether conditions favor buying, selling, or remaining on the sidelines.

It compiles data from several indicators, including price volatility of major cryptocurrencies, trading volume, market momentum, Google search trends, and overall sentiment on social media platforms.

The return to “greed” suggests that the sharp caution seen late last year has begun to ease, even though markets remain well below the levels that previously triggered euphoric sentiment.

Bitcoin rally lifts overall market mood

Improving sentiment has coincided with a strong rebound in Bitcoin prices.

Over the past seven days, Bitcoin has climbed from $89,799 to reach a two-month high of $97,704 on Wednesday, according to data from CoinGecko.

The move marks the first time Bitcoin has traded above $97,000 since Nov. 14.

At the time of writing, Bitcoin was trading at $96,218, up by 1% in the last 24 hours.

At that time, however, the Fear and Greed Index was firmly in “extreme fear” territory, as Bitcoin was sliding sharply from all-time highs.

The latest rally has helped stabilize broader market confidence, even as traders remain cautious about sustainability.

While the index’s return to “greed” indicates growing optimism, it remains well below levels typically associated with excessive risk-taking.

On-chain signals show retail exiting positions

Despite the improving price action, some on-chain indicators suggest that retail participation has declined in recent days. Analysts at market intelligence platform Santiment said in an X post on Wednesday that Bitcoin holders have been reducing their exposure.

According to Santiment, over the last three days, there has been a net drop of 47,244 Bitcoin holders, indicating that “retail had been dropping out due to FUD & impatience.”

“When non-empty wallets drop, it’s a sign that the crowd is dropping out, a good sign. Similarly, less supply on exchanges decreases the risk of a selloff,” the analysts said.

They added that “This price bounce has also been supported by a 7-month low 1.18 million Bitcoin on exchanges.”

A lower amount of Bitcoin held on exchanges is generally viewed as a bullish indicator, as it suggests investors are storing assets in private wallets and are less inclined to sell quickly.

Taken together, the rebound in sentiment, rising Bitcoin prices, and declining exchange balances point to a cautiously improving outlook for the crypto market, even as investors continue to weigh lingering risks.