- Bitcoin surged past $87,700, fueled by a weakening US dollar and potential US Treasury buybacks.

- Arthur Hayes predicts Treasury buybacks could be a “bazooka,” pushing BTC past $100K (“last chance” below).

- Weak dollar (lowest since March 2022) and rising gold correlation support Bitcoin’s appeal.

Bitcoin’s recent climb, momentarily cresting $87,700, is drawing significant attention, with prominent analysts pointing towards macroeconomic shifts and potential government actions as key drivers that could propel the cryptocurrency well beyond the $100,000 threshold.

The convergence of a weakening US dollar, anticipated US Treasury debt buybacks, and sustained institutional interest is painting an increasingly bullish picture for the digital asset.

Macro tailwinds: dollar dips, treasury ‘bazooka’ eyed

A primary factor supporting Bitcoin’s ascent is the declining value of the US dollar, which recently touched lows not seen since March 2022.

As the dollar weakens, assets like Bitcoin often become more appealing to global investors seeking a hedge against fiat currency devaluation.

Adding potent fuel to this narrative is the prospect of the US Treasury repurchasing its own debt.

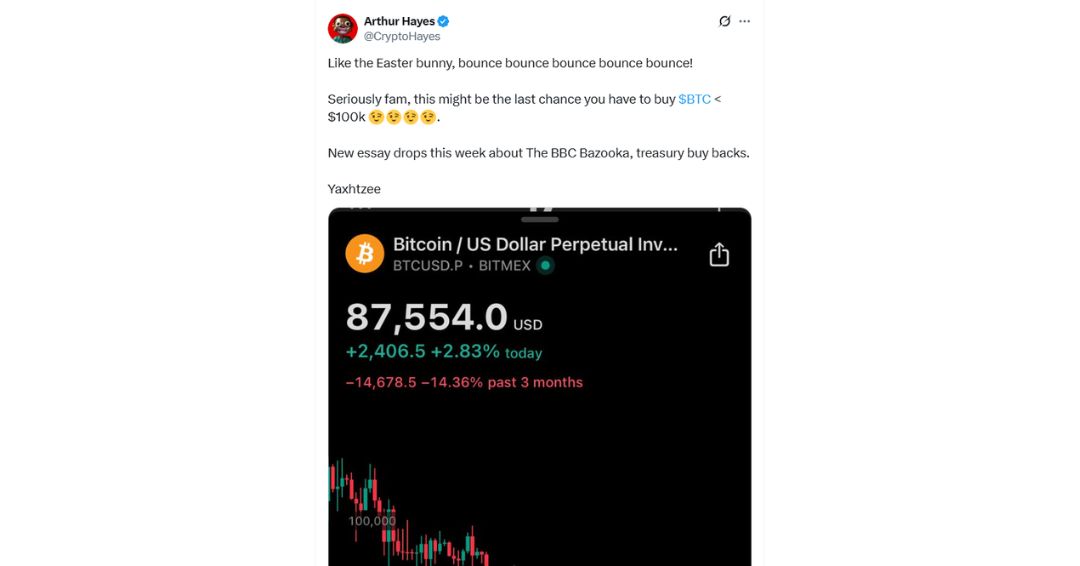

Arthur Hayes, the influential co-founder of BitMEX and current CIO of Maelstrom, has highlighted this potential move as a significant catalyst.

He posited that upcoming Treasury buybacks could inject substantial liquidity into the financial system, effectively acting as a “bazooka” for Bitcoin’s price.

Hayes went so far as to suggest this period might represent the “last chance” for investors to acquire Bitcoin below the $100,000 mark, anticipating that these buybacks could easily push the price past that psychological barrier.

Technical signals and institutional trust bolster case

The bullish sentiment finds resonance in technical analysis and continued institutional adoption.

Ryan Lee, Chief Analyst at Bitget Research, noted that Bitcoin’s price chart recently completed a “descending wedge breakout,” a technical pattern often interpreted as supportive of further upward movement.

This technical picture is complemented by Bitcoin’s growing correlation with gold, another traditional safe-haven asset, which itself has surged nearly 30% this year.

Furthermore, global institutional appetite for Bitcoin appears unwavering despite recent price volatility.

Reports indicate that investment firms, notably from Japan and the UK, have maintained their commitment, channeling capital into the cryptocurrency.

This sustained institutional inflow signals enduring confidence in Bitcoin’s long-term value proposition.

Analysts eye six-figure targets amid fiat expansion

As Bitcoin tests resistance levels nearing $90,000, some analysts are setting their sights considerably higher.

Jamie Coutts of Real Vision forecasts that expanding fiat money supply (M2) could drive Bitcoin to as high as $132,000 by the end of the year.

This projection finds company with analysis from economist Timothy Peterson, who, citing historical market patterns, suggests Bitcoin could potentially reach $138,000 within the next three months.

Political pressures add fuel to the fire

The intricate macroeconomic picture is further complicated by the political landscape.

President Donald Trump’s public calls for the removal of Federal Reserve Chair Jerome Powell have intensified market expectations of potential interest rate cuts.

Such cuts, aimed at stimulating the economy, would likely exert further downward pressure on the US dollar, potentially creating an even more favorable environment for Bitcoin’s price appreciation.

A note of caution amidst the bullish chorus

Despite the confluence of positive indicators, some market observers urge caution regarding short-term price action.

Analyst Michaël van de Poppe warned that weekend rallies can sometimes prove ephemeral and that Bitcoin might face a pullback before decisively conquering key resistance zones.

The $91,000 level is widely seen as the next significant hurdle.

Until Bitcoin firmly establishes itself above this mark, the possibility of short-term corrections remains.

Nonetheless, the combination of weakening fiat dynamics, anticipated liquidity injections via Treasury buybacks, robust institutional support, and supportive technical patterns creates a compelling narrative for Bitcoin’s continued ascent towards, and potentially well beyond, the $100,000 milestone.