- Bitcoin price remains range-bound amid long-term holder selling and falling demand.

- US Bitcoin ETFs inflows signal cautious institutional optimism.

- Macro uncertainty from the Fed and government shutdown keeps BTC under pressure.

Bitcoin (BTC) continues to navigate turbulent market conditions as macroeconomic uncertainty and institutional dynamics shape its near-term trajectory.

Despite renewed interest from investors and a notable surge in Bitcoin ETFs, the world’s largest cryptocurrency faces persistent pressure from long-term holder selling, cautious institutional sentiment, and a complex macro backdrop influenced by the Federal Reserve and ongoing government shutdown developments.

Analysts and strategists are watching closely as BTC balances between cyclical signals and broader market realities in November.

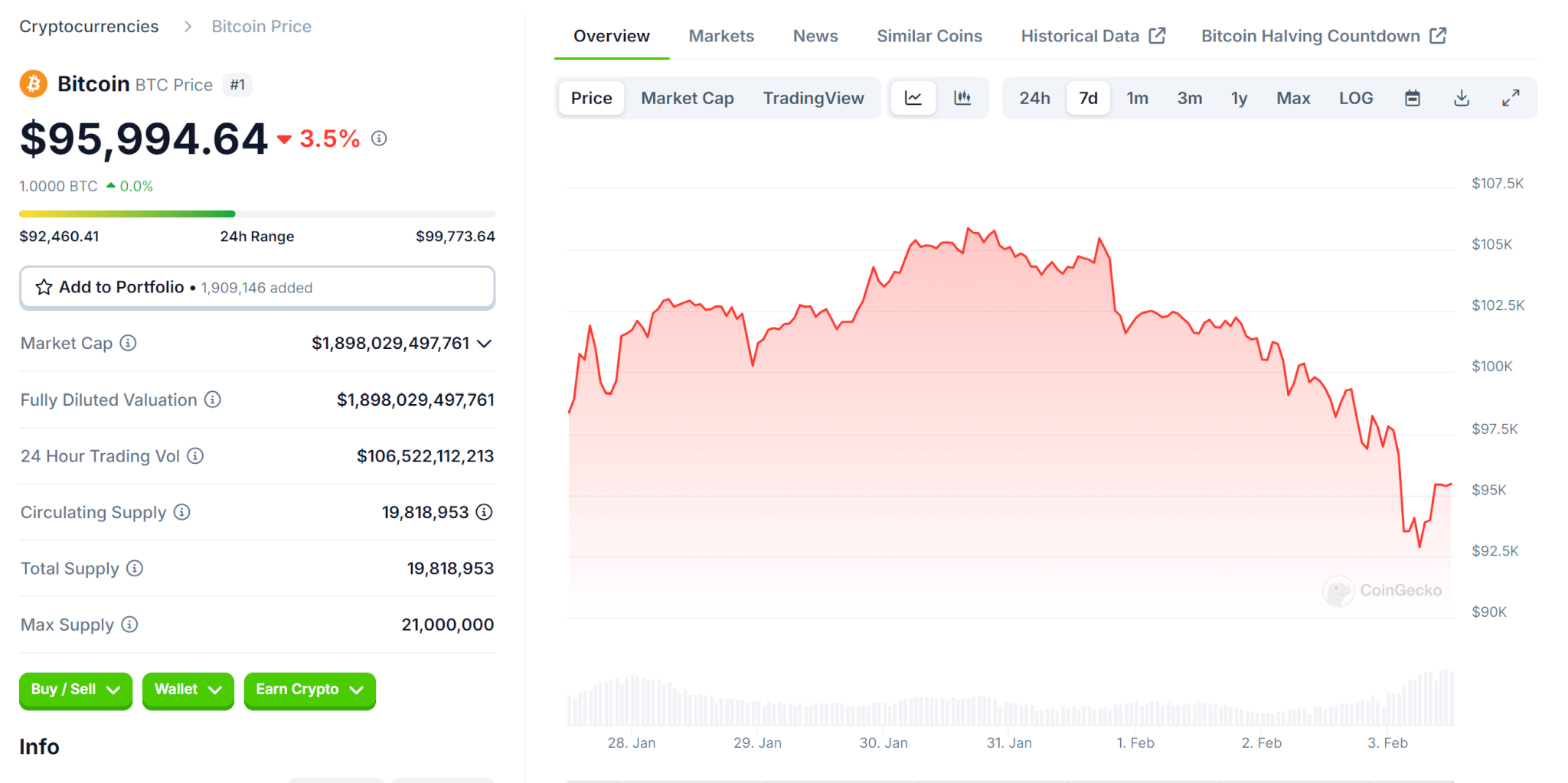

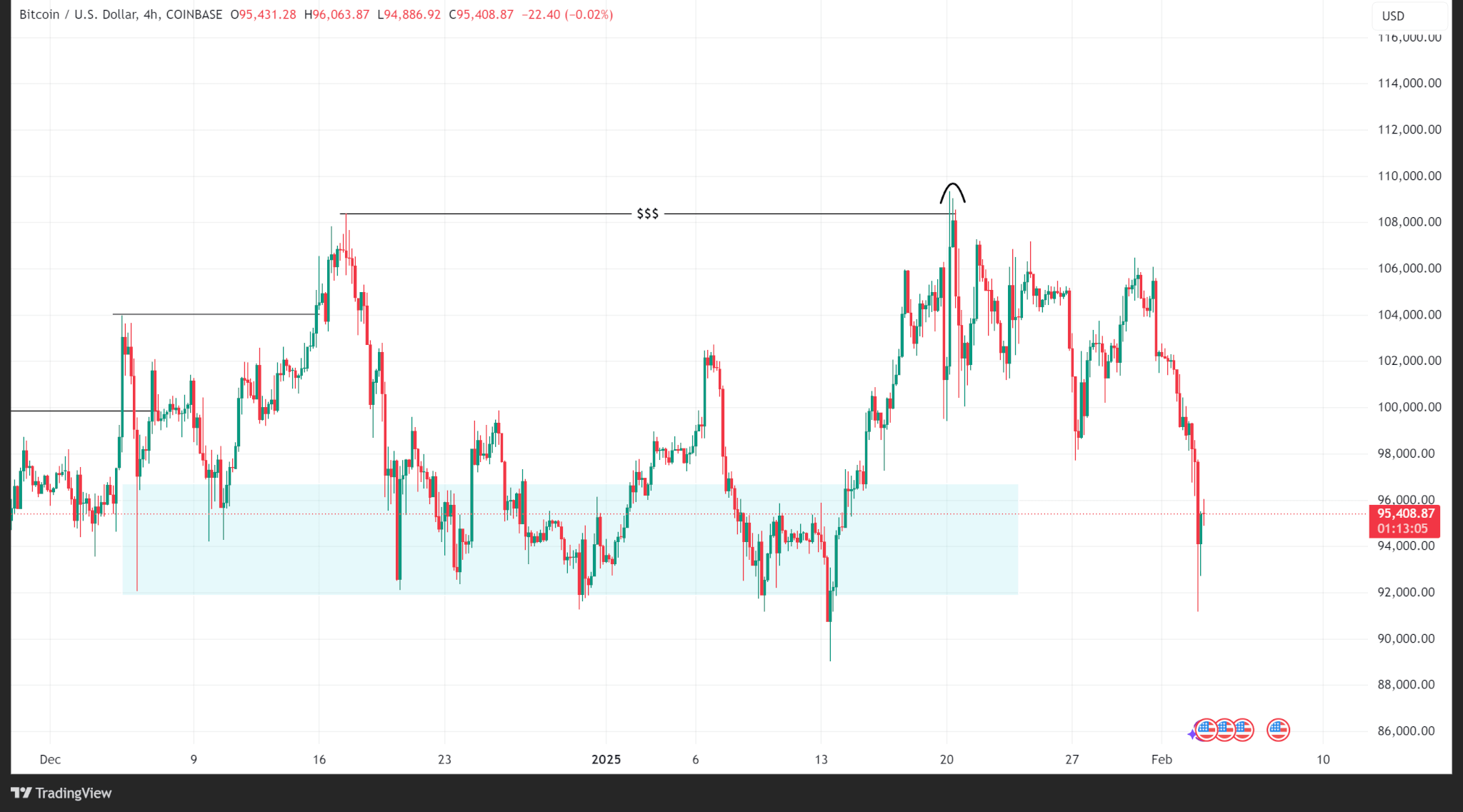

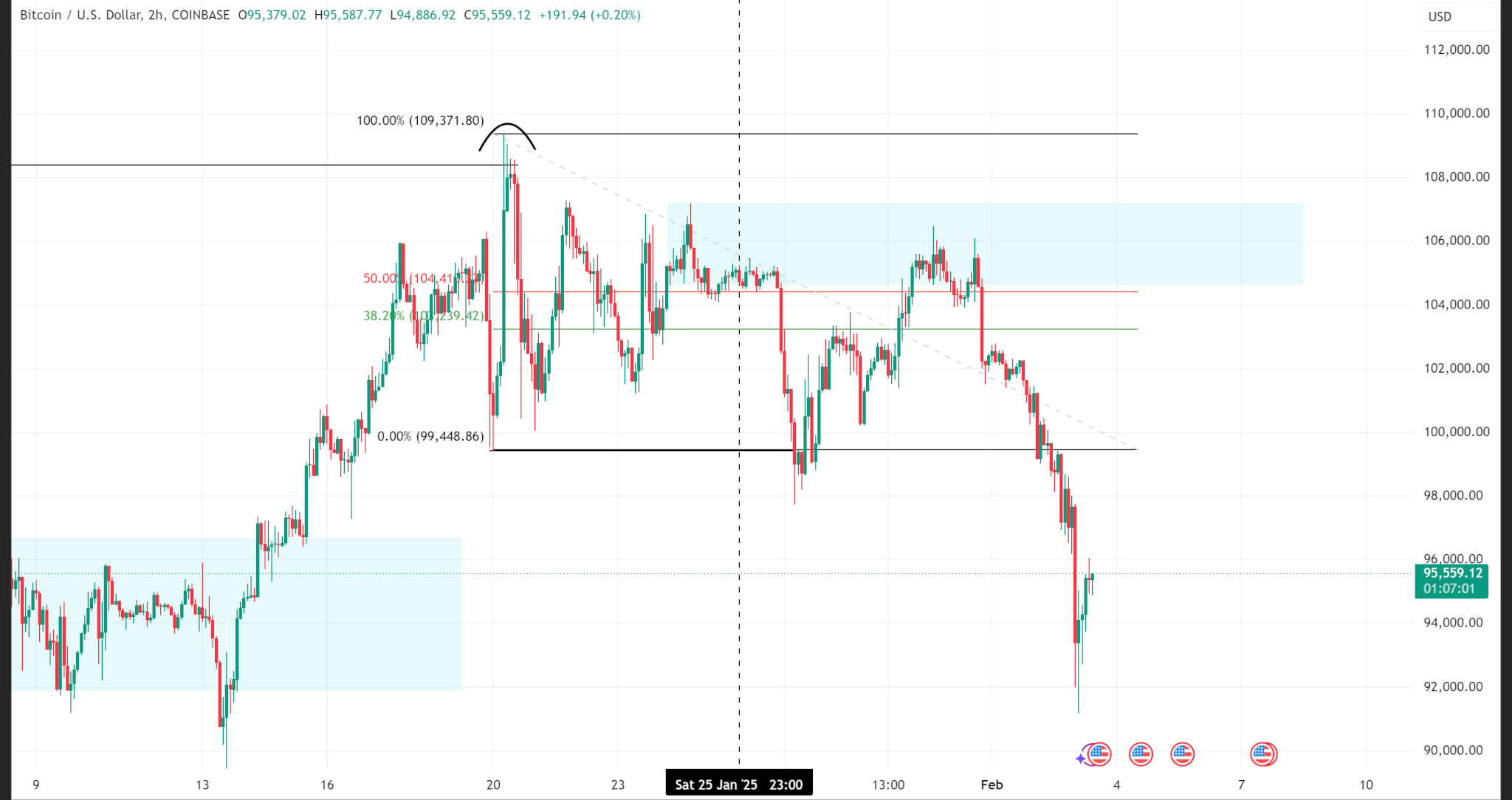

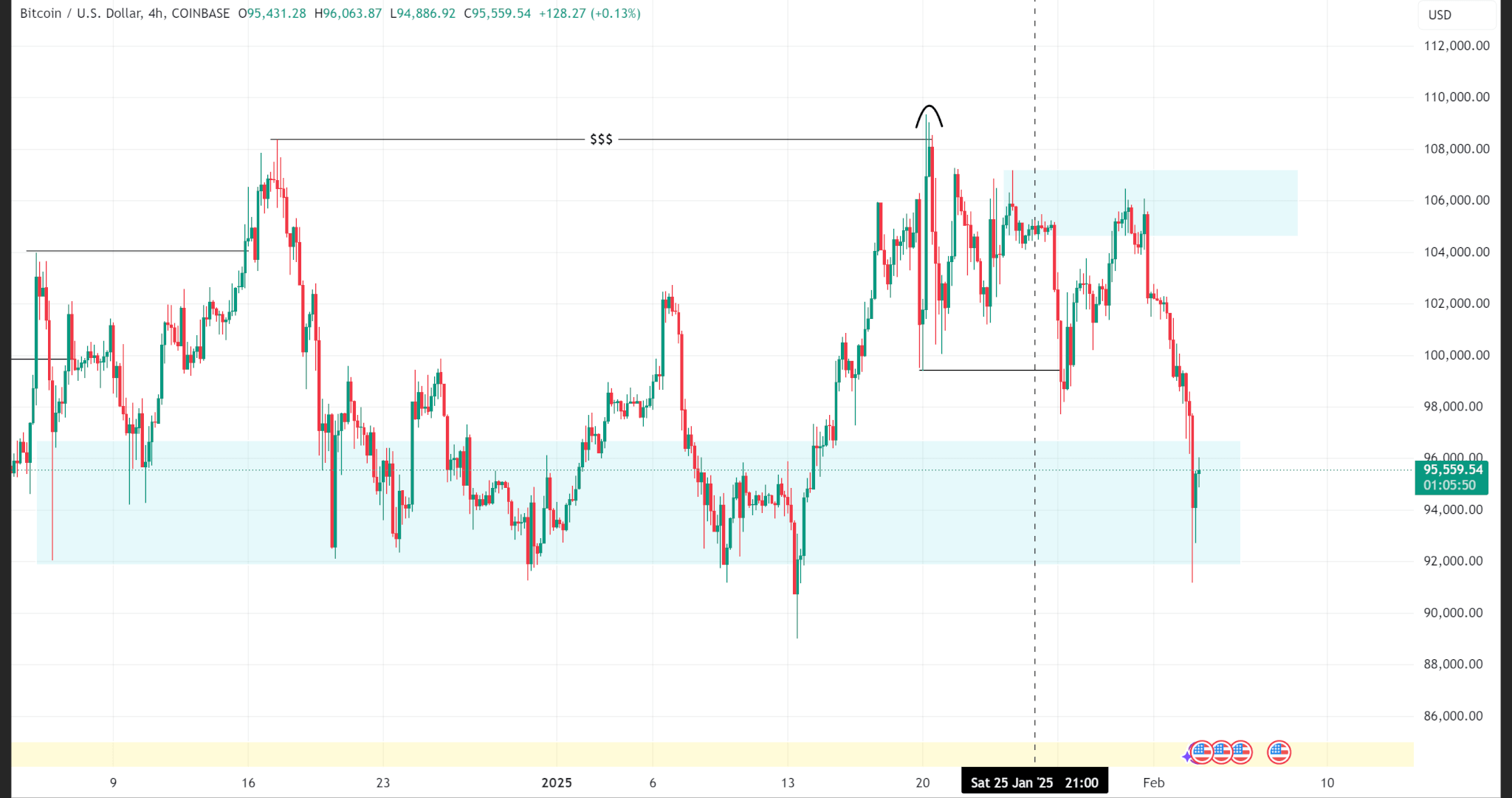

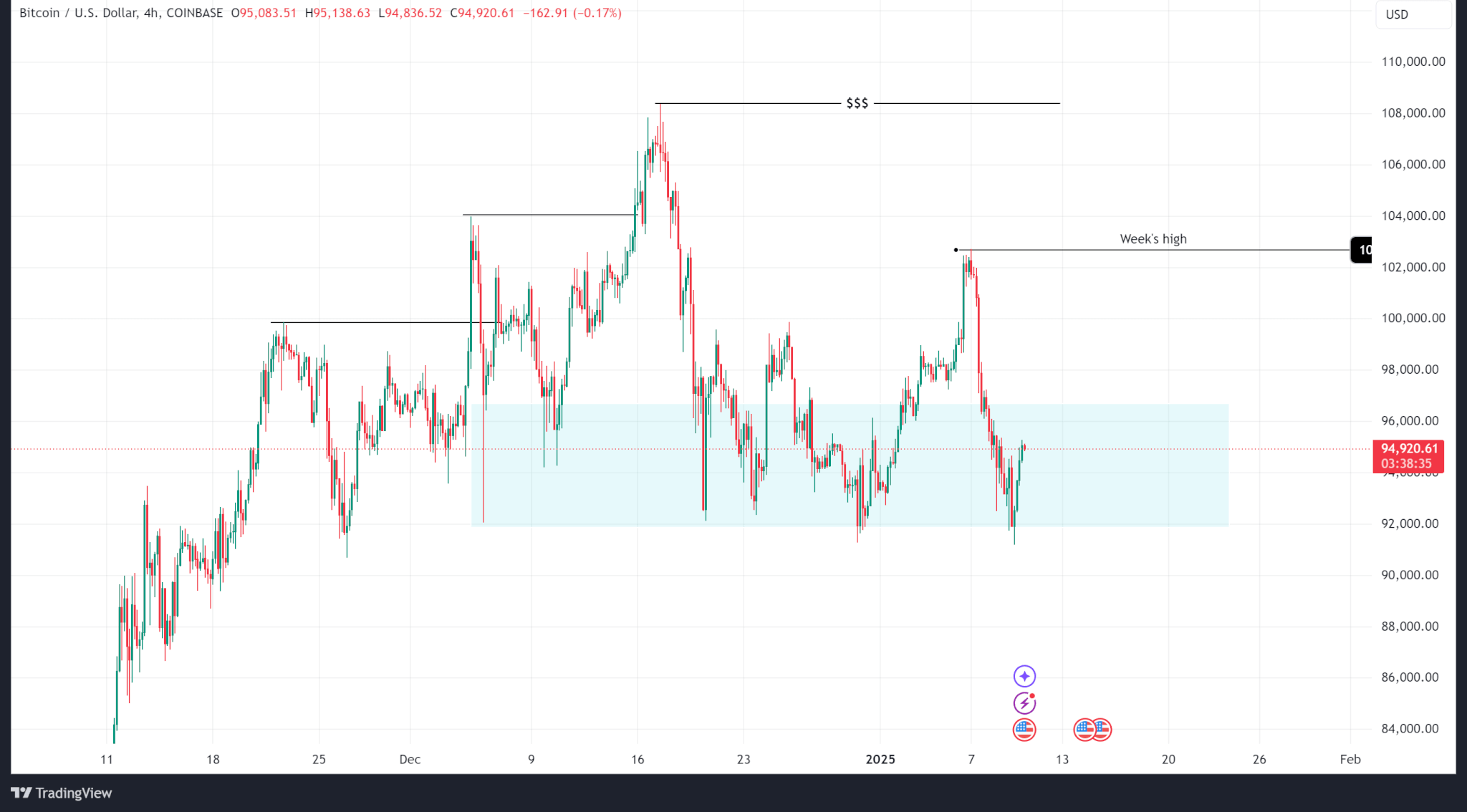

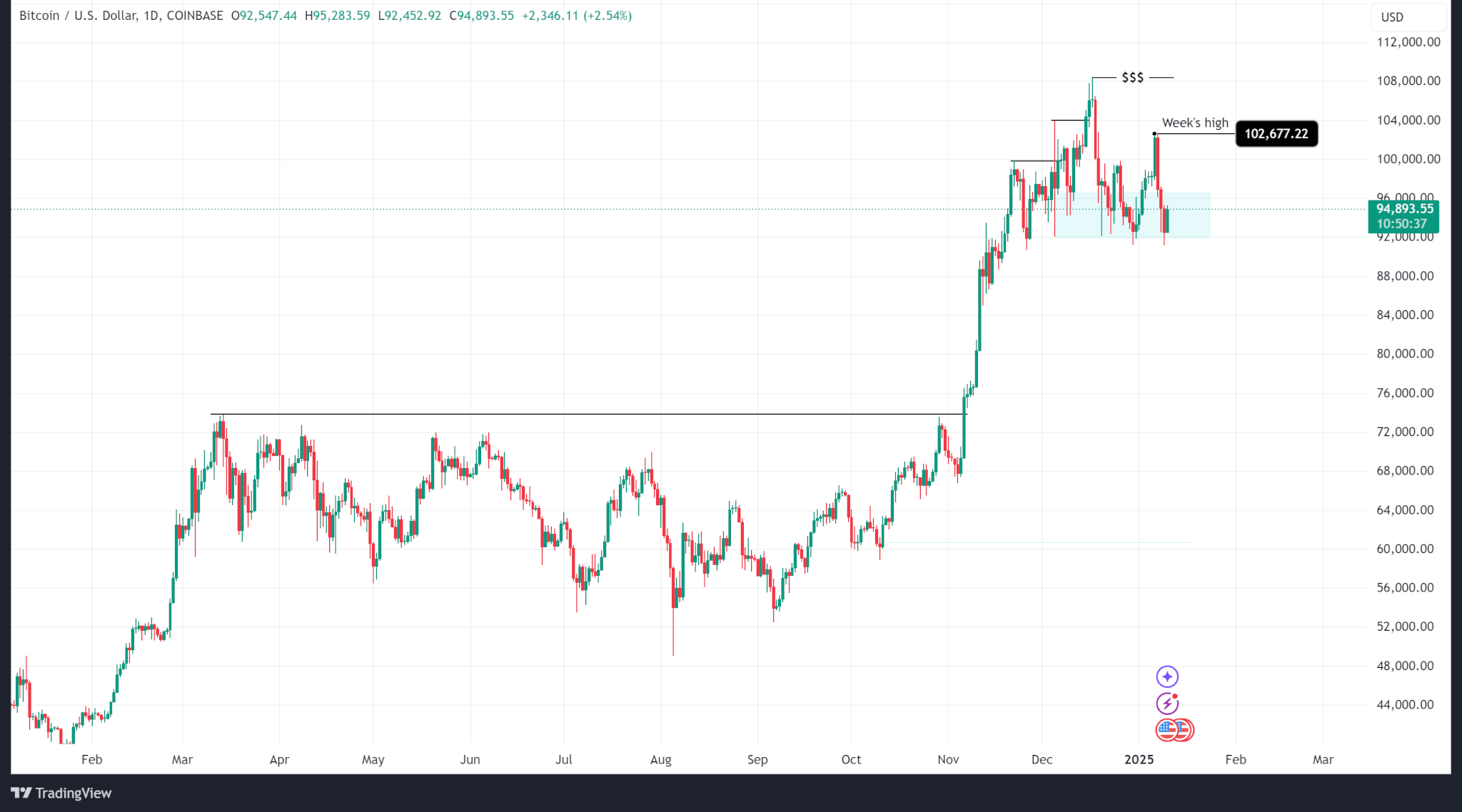

Bitcoin price struggles amid range-bound trading

Bitcoin price has remained largely trapped between $106,000 and $116,000 over the past two weeks, signalling a period of consolidation rather than upward momentum.

Long-term holders have accelerated their monthly distribution to roughly 104,000 BTC, marking one of the heaviest selling waves since mid-July, according to the recent Bitfinex report.

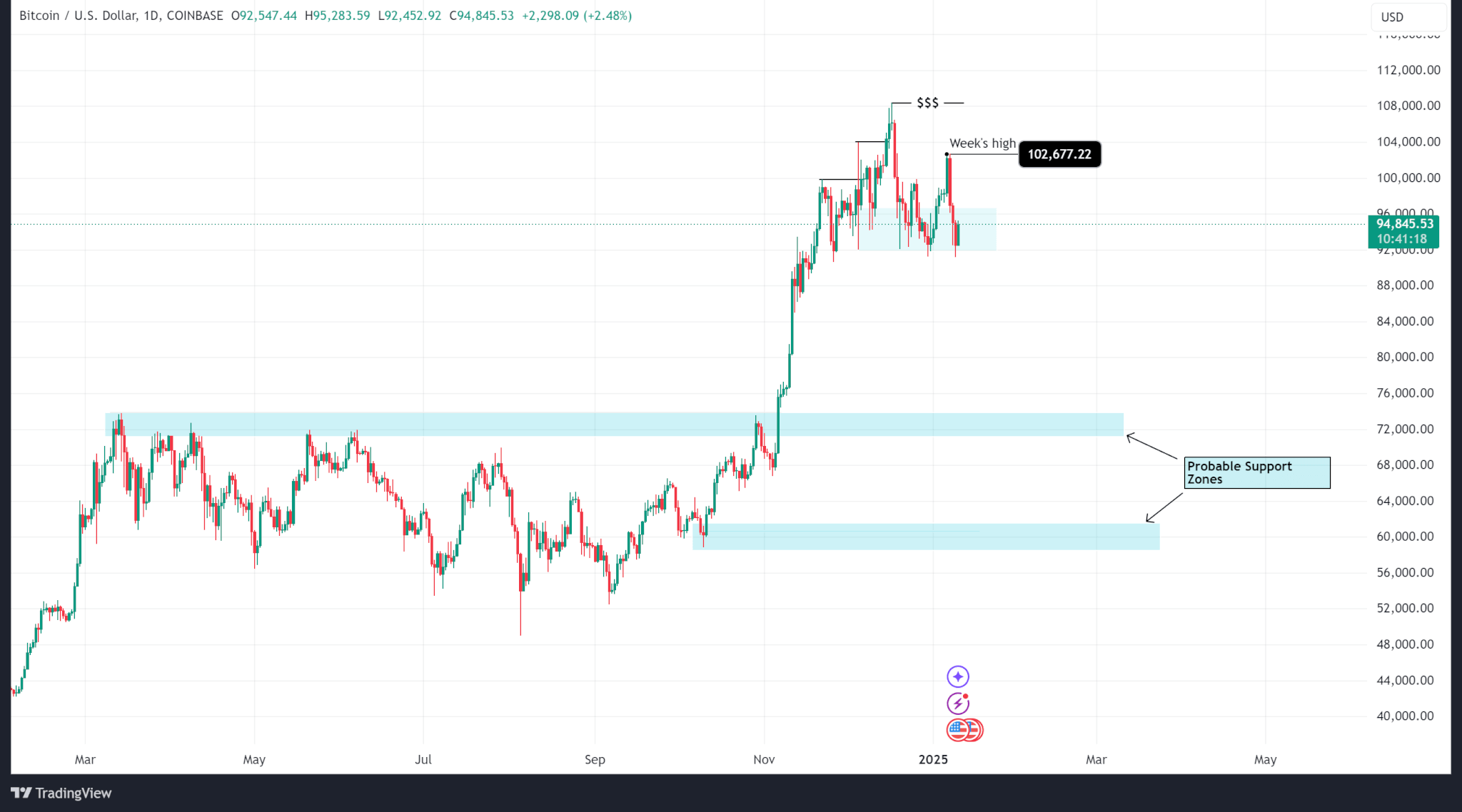

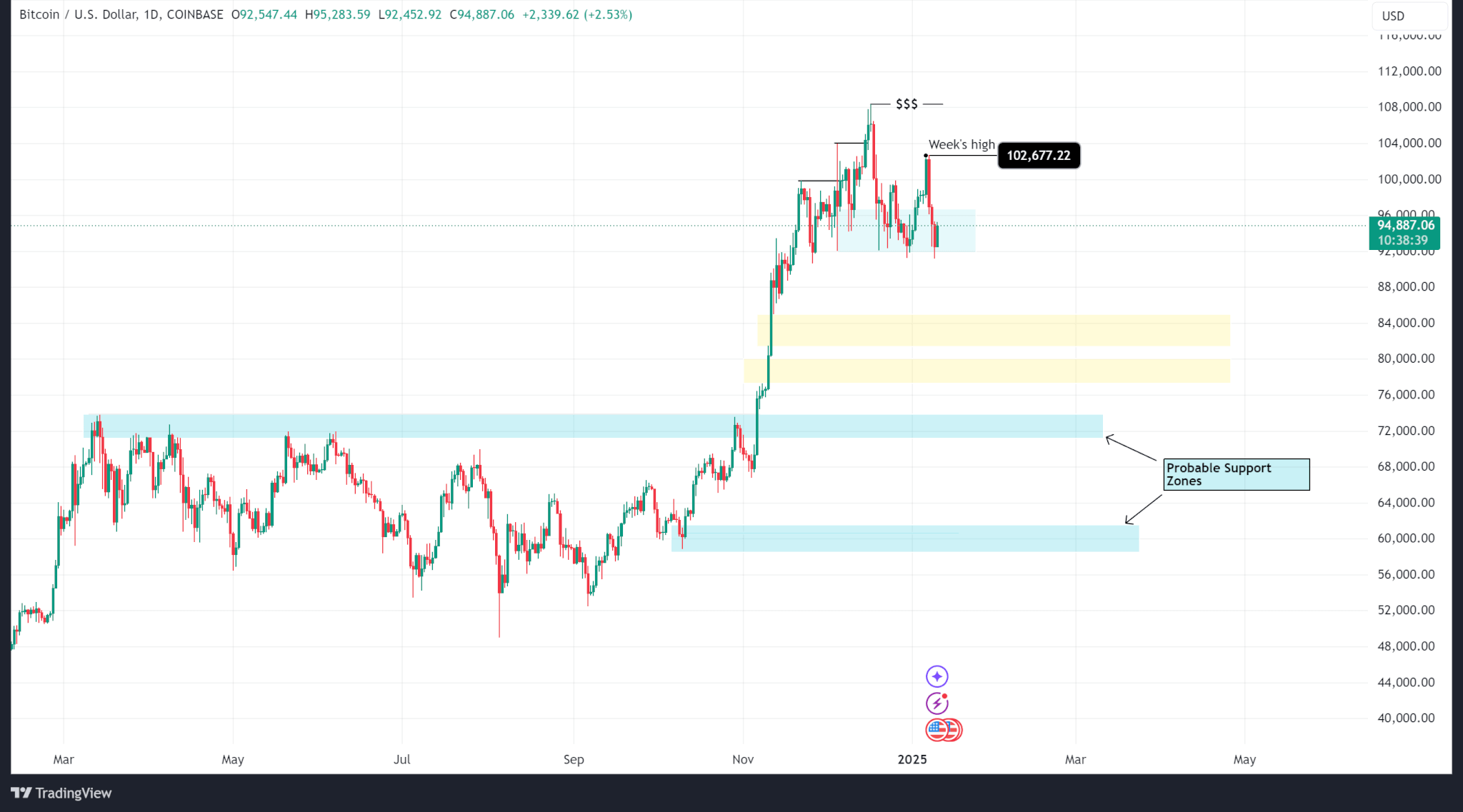

This persistent supply pressure is coinciding with muted institutional demand following October’s sharp liquidation event, leaving BTC caught in a sideways range with limited short-term catalysts.

Analysts warn that unless ETF inflows or new spot demand increase, the cryptocurrency could test support near $106,000, and a sustained breach of this level might open the path to $100,000.

ETF inflows signal cautious optimism

Despite these headwinds, Bitcoin ETFs have shown signs of recovery, injecting optimism into the market.

On November 11, US spot Bitcoin ETFs recorded $524 million in cumulative net inflows.

This return of demand, alongside smart money traders adding net long positions totalling over $8.5 million, highlights a growing, albeit measured, confidence among institutional participants.

Analysts have noted that sustained ETF inflows may signal an end to the broader de-risking phase observed after the market downturn, even as retail participation remains subdued.

Macro factors keep BTC on edge

Despite increased ETF inflows, macro conditions continue to weigh heavily on Bitcoin (BTC).

The Federal Reserve’s recent 25-basis-point rate cut and the formal end of its balance sheet runoff are tempered by internal division over the next steps, with some officials citing risks from persistent inflation and others warning of slowing labour markets.

Meanwhile, the Secured Overnight Financing Rate recently plunged to 3.92%, which financial analyst Shanaka Anslem described as indicative of market panic.

THE WORLD’S MOST IMPORTANT NUMBER JUST COLLAPSED

November 6, 2025: SOFR crashed to 3.92%. The lowest level in two years. The benchmark that controls $397 trillion in global contracts just signaled something catastrophic.

This is not a rate cut. This is a liquidity flood.

THE… pic.twitter.com/W5vmNRUXpq

— Shanaka Anslem Perera ⚡ (@shanaka86) November 9, 2025

These developments, combined with falling consumer confidence and cooling wage growth, have created uncertainty around near-term capital flows and investor appetite for risk assets like Bitcoin.

The ongoing government shutdown adds another layer of complexity.

While the Senate moves toward a potential resolution, analysts note that the relief may boost equities more than cryptocurrencies, as capital appears to rotate toward traditional financial markets while liquidity waits on the sidelines for normal economic data to resume.

These dynamics have contributed to continued downside pressure on BTC, even as technical and ETF-related signals point to potential stabilisation.

Bitcoin price outlook for November

Looking ahead, November may not deliver the historic rallies often seen in the penultimate month of the year, as Bitcoin (BTC) remains caught between conflicting forces.

While ETF inflows and smart money activity provide a foundation for renewed optimism, ongoing distribution by long-term holders, macro uncertainty, and cautious institutional behaviour continue to weigh on the Bitcoin price.