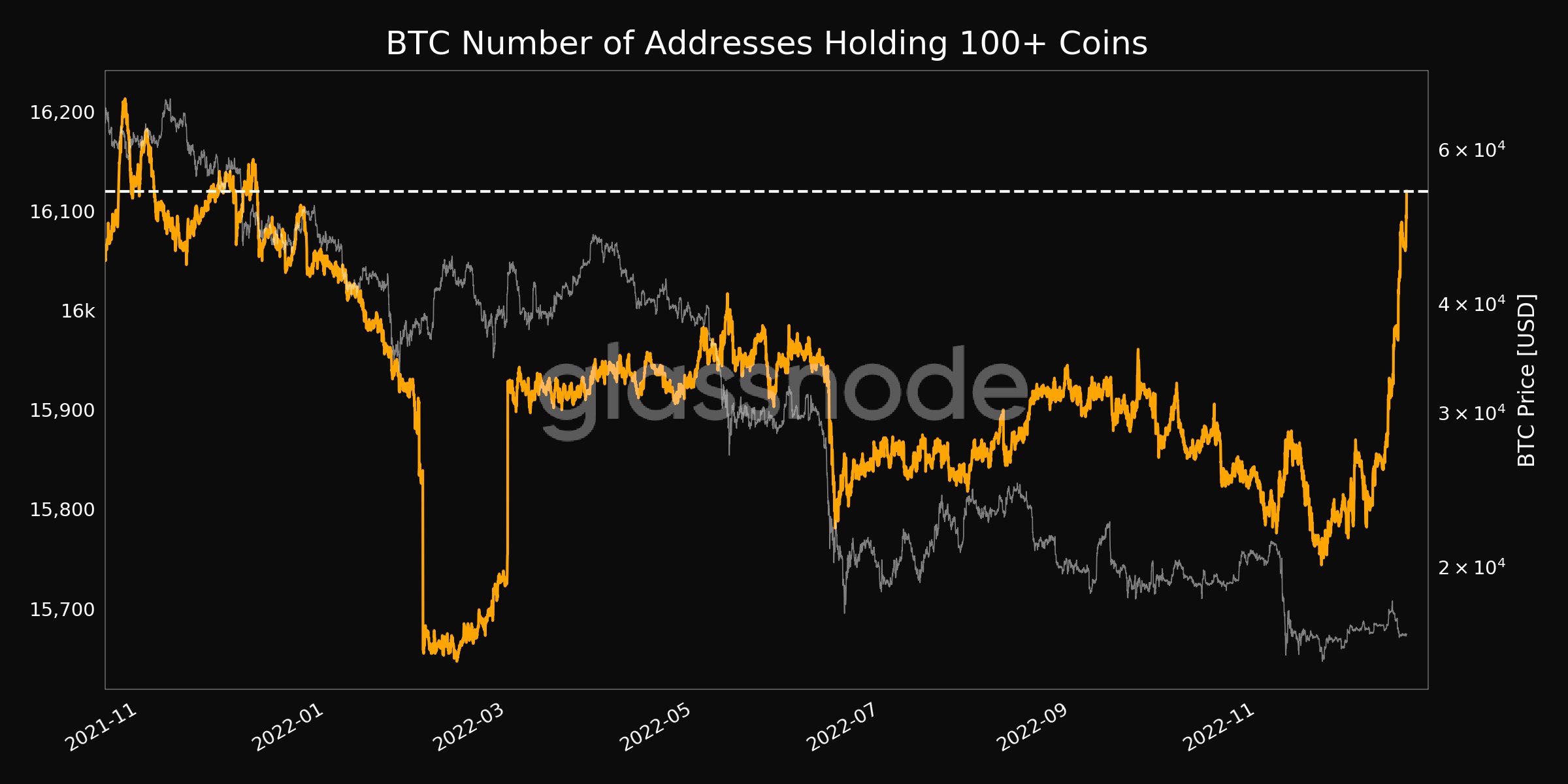

- Bitcoin addresses with 100 or more coins hit 16,120 on 19 December 2022.

- Each address is worth $1.67 million at current prices, increasing the number of Bitcoin millionaires to the highest level since December 2021.

- Data also shows hodling is on the rise despite crypto winter, with 46% of BTC last active in 2+ years and 1.6 million coins last active in 1-3 months.

Bitcoin continues to consolidate around $16,700 after weathering recent sell-off pressure. Bears remain very much in the picture, given last week’s jump to above $18,000 and then the sharp fall to current levels.

But there’s an opportunity in the midst of all the contagion – and that is what Bitcoiners are capitalizing on.

Addresses with 100+ coins hit 1 year high

According to the on-chain and exchange flows monitoring platform Glassnode, sharks and whales have aggressively added to their overall holdings in the past few days.

Indeed, as the flagship cryptocurrency’s price hovers above its notable base on Monday, on-chain alerts for BTC indicate that addresses with 100+ bitcoins now hold the most coins since last December. Per the data, large accounts with at least $1,670,000 worth of BTC as of 19 December 2022 had jumped to 16,120.

This is a new all-time high, with the last 1-year high being 16,106 addresses recorded on 23 December 2021.

Bitcoin addressed holding 100 or more BTC reach one year high. Source: Glassnode

Bitcoin addressed holding 100 or more BTC reach one year high. Source: Glassnode

46% of Bitcoin last active 2+ years

As large investors scoop Bitcoin on the cheap, the number of hodlers (people who buy Bitcoin and hold onto their assets long term regardless of market conditions) has also increased. As CoinJournal recently reported, whales have been busy, buying over $726 million worth of BTC despite the FTX contagion.

The latest data on this metric shows that the amount of BTC supply last active 2+ years has 46.3%, a 22-month high. According to Glassnode, 7.5 million BTC was being HODLed (the metric also counts lost coins) as Monday 19, December 2022. The last time the measure of hodled or lost BTC was this high was in January 2021.

Meanwhile, the number of coins last active 1-3 months is now more than 1,603,380 bitcoins. The moving average translates to a 3-month high for the number of coins that have not moved for the last 30 to 90 days.