- INJ soars to a new all-time high above $27, up 66% in two weeks and over $1,500% in the past year.

- What’s driving the Injective price higher? Catalysts include upcoming network upgrade, weekly token burn and Helix DEX activity.

The injective (INJ) token is one of the standout performers in the past week, rising more than 60% as its price broke above $20.

On December 12, the INJ price shot to highs of $27 across major crypto exchanges, touching a new all-time high as major altcoins looked to recoup losses seen on Monday.

As Injective looks for continued upside, one of the questions to ask is what has driven this token to its new ATH. Is this rally therefore likely to be sustainable, or will bears spoil the bulls’ Christmas party?

Why is Injective price surging?

The last 30 days have seen the price of Injective’s native token surge by more than 55%, while the steady upswing since the lows reached in December 2022 has included a parabolic rise of 1,570%. In recent weeks, positive ecosystem news have combined with the broader bullish sentiment to send INJ higher.

One of the catalysts this past few days has been Injective’s weekly token burn. The latest of these saw over $65,000 worth of INJ burned, permanently removing them from circulation.

Amid the burn auction, Injective has also witnessed a significant spike in total INJ staked. According to on-chain data, over $1 billion worth of the token has so far been staked.

Over $1 Billion worth of $INJ is now staked on chain.

That’s it. That’s the tweet.

— Injective 🥷 (@Injective_) December 12, 2023

This outlook has put pressure on Injective rising ahead of a recently announced upgrade dubbed Volan. According to the Injective team, this is going to be the largest mainnet upgrade in the layer-1 blockchain’s history.

Injective teased the Volan upgrade on November 30, and INJ price has skyrocketed more than 66% in the two weeks since. Network activity around Injective-based decentralized exchange (DEX) Helix has also contributed to the upward trajectory.

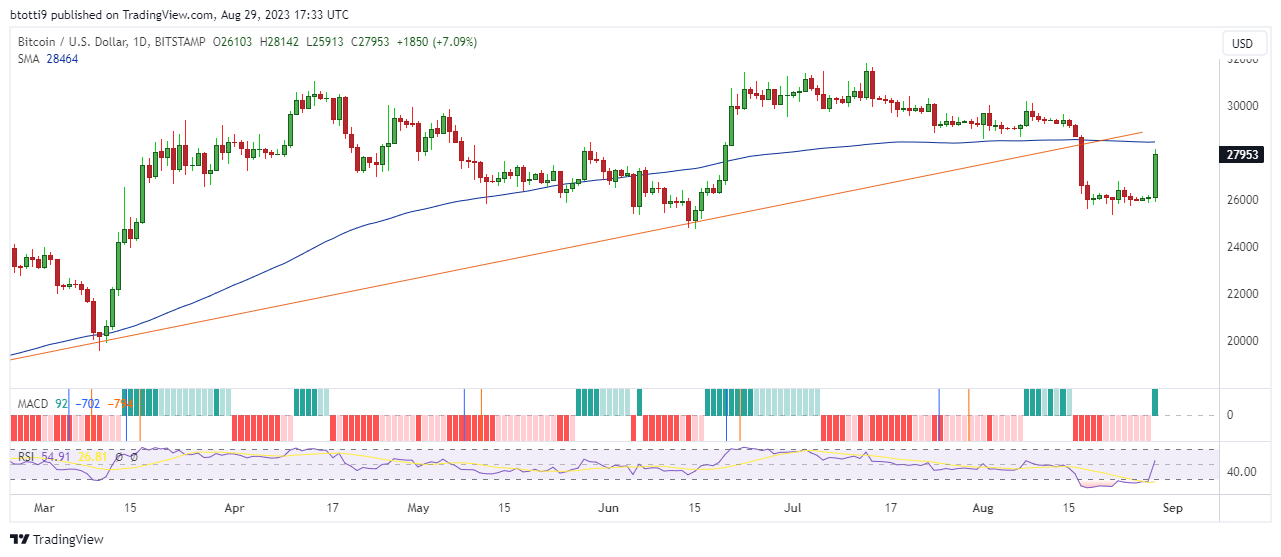

INJ price outlook

As INJ pares some of the intraday gains to trade around $26 at the time of writing, a bullish continuation could see buyer eye price beyond $30. A bearish flip amid broader market retreat could inform the potential slip to support in the $20-$18 range.