- IBIT’s new record comes as Bitcoin achieved a new all-time high of over $76,000 on November 7

- Dary McGovern, COO of Bitcoin native Xapo Bank, said to CoinJournal that Bitcoin’s new record indicates a “broader shift in institutional confidence” seen by BlackRock’s record net inflows

- The 12 spot Bitcoin ETFs recorded a daily total net inflow of $1.38 billion, a new record since listing in January

BlackRock’s iShares Bitcoin Trust (IBIT) exchange-traded fund (ETF) set a new record for inflows, reaching $1.12 billion, topping its previous record of $872 million.

The new record was noted on SoSoValue and comes when Bitcoin reached an all-time high of $76,677 across major exchanges on November 7. Earlier in the week, Bitcoin broke a new all-time high of $75,317 as voting results signalled a Donald Trump win for the White House.

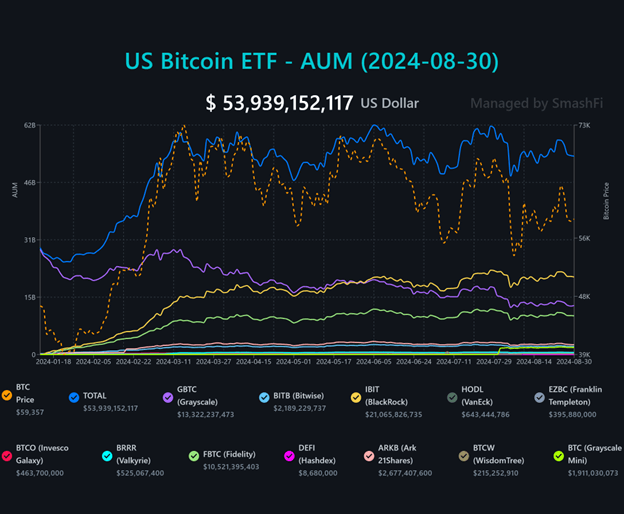

BlackRock’s IBIT net assets now account for $34.29 billion, significantly pushing it ahead of its competitors. In October, BlackRock set a new record when its total assets reached $30 billion in 293 days.

Dary McGovern, COO of Bitcoin native Xapo Bank, said to CoinJournal that Bitcoin’s new record suggests a “broader shift in institutional confidence, with notable market movements such as BlackRock’s record net inflows into its iShares Bitcoin Trust (IBIT),” adding:

“The growing institutional interest underscores Bitcoin’s increasing recognition as a trusted asset class, driven by rising global demand and mainstream adoption. As more investors seek exposure to digital assets, Bitcoin’s role as a store of value and a potential hedge against inflation becomes ever clearer.”

The 12 US spot Bitcoin ETFs recorded a daily total net inflow of $1.38 billion, also a new record since listing in January.

Nearing Satoshi’s wallet

Bloomberg ETF analyst Eric Balchunas noted BlackRock’s new record in a post on X, saying: “Even I am surprised it’s that big, by far biggest one day flow of any BTC ETF ever.”

Told y’all it was prob gonna be big, altho even I am surprised it’s that big, by far biggest one day flow of any btc etf ever. https://t.co/Q5MPDMrTYv

— Eric Balchunas (@EricBalchunas) November 8, 2024

Balchunas later added that the spot Bitcoin ETFs have taken in a combined $6.7 billion in the past month and $25.5 billion year to date, and are 93% of the way to passing Satoshi Nakamoto’s 1.1 million Bitcoin.

HOOVER CITY: Bitcoin ETFs took in a record-smashing $1.4b yesterday (the Trump effect). $IBIT alone was +$1.1b. That’s +$6.7b in past mo and $25.5b YTD. All told they feasted on about 18k btc in one day (vs 450 mined) and are now 93% of the way to passing Satoshi’s 1.1mil btc. pic.twitter.com/dNLoENlDB3

— Eric Balchunas (@EricBalchunas) November 8, 2024

“This confidence suggests that Bitcoin is now seen as a legitimate hedge and growth asset, particularly appealing amid traditional market uncertainties and as regulatory clarity improves,” said James Toledano, COO at Unity, a self-custody crypto wallet, to CoinJournal. “Just look at pension funds in both the UK and US investing in Bitcoin too. Sentiment has changed massively in such a short space of time.”

Grayscale’s GBTC, the second-largest by net assets at $16.80 billion, saw a net inflow of $7.31 million. Fidelity’s FBTC reported $190.92 million and Ark and 21Shares saw $17.61 million.