- Memecoin price rose 29% in 24 hours to hit highs above $0.0023.

- Daily volume spiked 600% as MEME jumped amid a technical breakout.

- Altcoins are bullish and an anlyst says MEME price could surge 690%.

Memecoin (MEME), a meme token of the Memeland platform, has surged by 29% in the past 24 hours.

This sudden price surge, which has come amid a notable spike in trading volume, has MEME trading at levels that might see bulls take further control.

While profit taking remains a potential setback, bullish momentum is largely in place as the broader cryptocurrency market gets a boost from institutional demand and regulatory support.

Memecoin’s surge is also not isolated in the meme token ecosystem.

Pepecoin, DOGS and Pump.fun are among those seeing a significant upside amid a backdrop of bullish projects for altcoins.

Dogecoin, Shiba Inu and TRUMP have also signaled resilience.

Volume spikes as MEME token surges 29%?

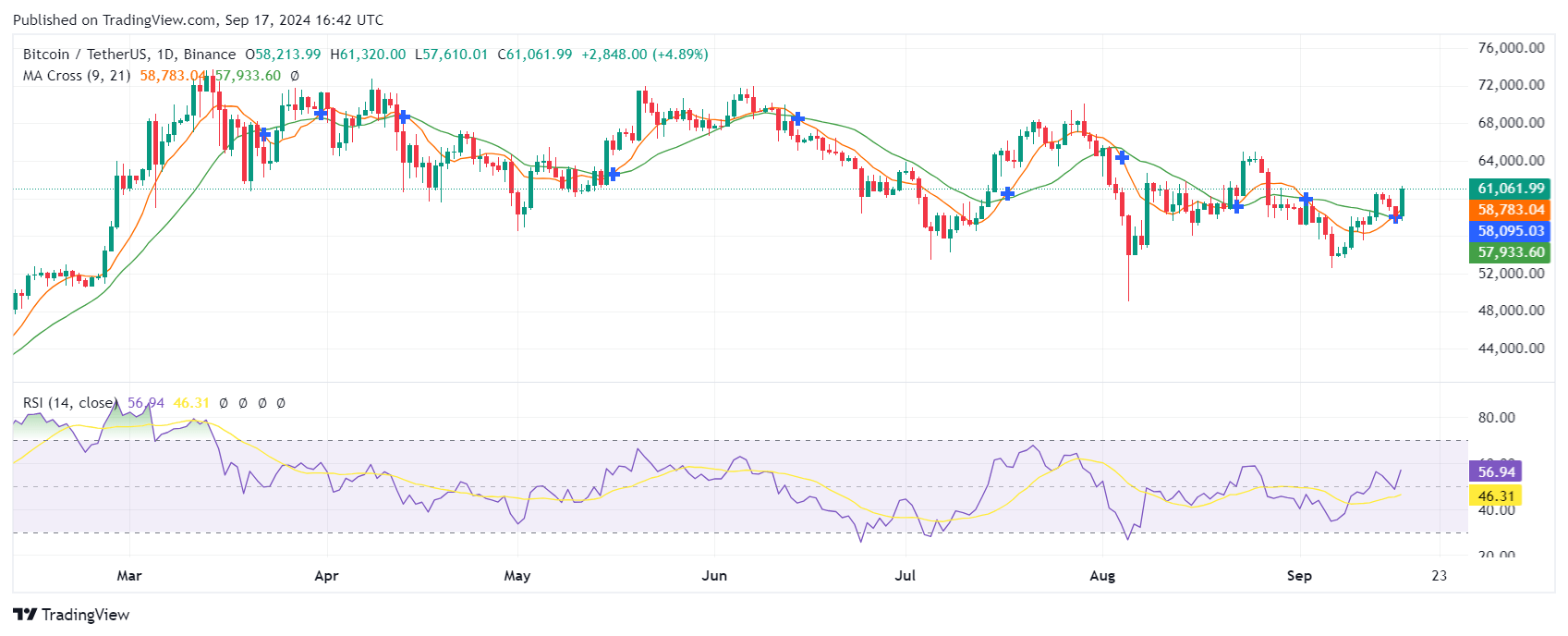

MEME’s price jump follows a technical breakout and overall flip in memecoins.

With a 29% spike in 24 hours, this token’s value is back at $0.0023 levels seen in May.

The gains also mean the price has increased 75% from lows of $0.0012 seen in June.

Daily volume has also jumped 600% to over $170 million, notable activity as the token benefits from speculative buying on launchpad sentiment.

In recent months, tokens such as PUMP and RAY have exploded on launchpad anticipation and adoption.

However, the MEME price remains well over 95% down since reaching its all-time highs of $0.081 in November 2023.

What’s next for Memecoin price?

Crypto analysts point to Memecoin’s uptick amid a breakout from a large falling wedge pattern.

In the market, a falling wedge breakout is a technical formation that usually suggests a reversal from a downtrend.

The token is showing a regular bull divergence, to signal bullish strength.

According to analyst Javon Marks, MEME could be poised for a significant upward movement.

The forecast aligns with the analyst’s earlier predictions from July 12, 2025, when Marks identified a falling wedge breakout.

“MEME (Memecoin) is currently showing MAJOR STRENGTH and with prices still being broken out of a large Falling Wedge as well as coming off of a huge Regular Bull Divergence, there can be significantly more bullish action coming!,” noted crypto analyst Javon Marks.

According to the analyst, MEME prices are likely to skyrocket if bulls take control.

The memecoin’s price could target $0.018, a level that would represent a staggering 690% upside.

Conversely, a failure to maintain momentum might see prices retreat, testing lower support levels. Likely, these will be at $0.0016 and $0.0014.