Starknet launches STRK Airdrop as OKX announces listing; Pullix Presale enters penultimate Stage

Starknet launches STRK token with 1.3M wallet Airdrop, OKX to list the token for trading. The first STRK trading pair on OKX will be STRK/USDT. Pullix (PLX) token price has increased from an initial price of $0.04 to $0.1 in its second-last presale stage. In a dynamic week for the crypto space, Starknet’s STRK token […]

5IRE token launches on Bybit, pioneering sustainable blockchain era

The 5ire token (5IRE) has successfully debuted on the Bybit exchange. With a community comprising entrepreneurs, developers, and sustainability advocates, 5ire emphasizes inclusivity and collaboration. 5IRE has inked strategic collaborations with governments, universities, and enterprises globally, including the Government of India’s NITI Aayog. In a groundbreaking move, the 5ire token (5IRE) has successfully entered the […]

Japan’s banking giant Nomura launches Bitcoin adoption fund

Japan’s financial giant Nomura launches Bitcoin adoption fund The Bitcoin Adoption Fund is offered by Laser Digital Asset Management, a subsidiary of $500 billion Nomura. Laser Digital’s new fund offers long-only exposure to Bitcoin (BTC). Nomura, a $500 billion Japanese investment banking giant, has launched a new Bitcoin fund for institutional investors. The new fund […]

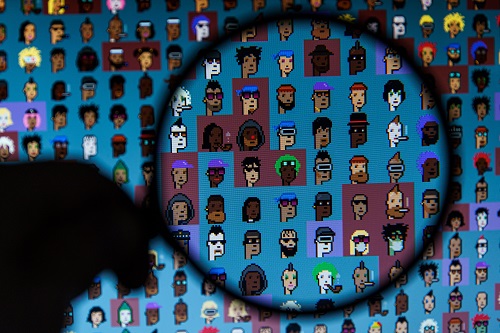

Magic Eden launches its Bitcoin NFT marketplace

Magic Eden has launched the first fully audited Bitcoin NFT marketplace. The marletplace has integrated two non-custodial wallets to support seamless transactions. Magic Eden now supports NFT marketplaces for Solana, Ethereum, Polygon and Bitcoin. Cross-chain NFT platform Magic Eden has added to the impetus around NFT Ordinals on Bitcoin by launching a fully audited Bitcoin […]

Felin Token launches its first collection of NFTs.

Source link

Polygon (MATIC/USD) defends support as the last testnet launches with a huge milestone

Polygon announced the second testnet before going live on mainnet MATIC has consolidated at $0.8 for the past week The token could resist bear pressure to rise toward $1 Polygon (MATIC/USD) traded at a support zone at $0.8 on Friday, a level it has held for a week. Although the consolidation is not positive for […]

ApeCoin (APE/USD) staking launches with a thud! Will bulls overcome relentless bears?

ApeCoin gained 3% on Friday and remains green over the week ApeCoin will start to issue staking rewards on December 12 The cryptocurrency faces resistance approaching the upper limit of descending channel ApeCoin (APE/USD) staking functionality is no longer a dream – it’s a reality. Staking rewards are set to begin on December 12. Apes are […]