- Bitcoin and COIN50 fall below 200-day moving averages.

- Venture capital remains 60% below 2021 levels despite mild rebound.

- Market may stabilise between mid and late Q2 2025, says Coinbase.

The risk of a renewed crypto winter is rising, Coinbase Research warned this week, as key technical and macroeconomic indicators suggest the digital asset market may be entering another prolonged downturn.

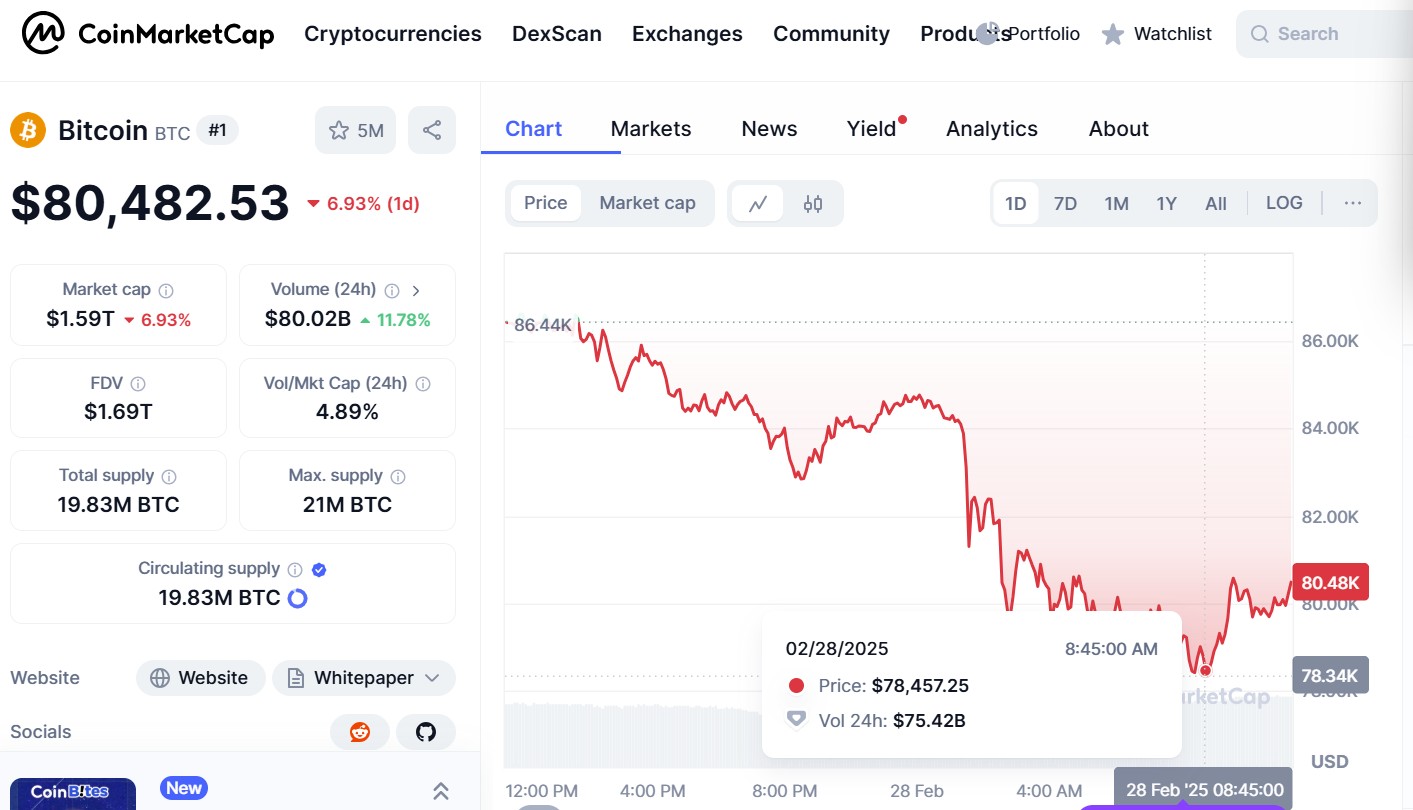

In a note published yesterday, Coinbase said Bitcoin has slipped below its 200-day moving average—a level widely seen as a bearish signal.

The COIN50 index, which tracks the top non-Bitcoin assets on the platform, has also fallen beneath its long-term support.

Adding to the market stress are surging global tariffs and prolonged fiscal tightening, both of which are weighing on investor sentiment and curbing inflows into crypto.

The situation echoes the 2022 crash, when over $2 trillion in market value was wiped out within 18 months.

Altcoins have been hit the hardest. Excluding Bitcoin, the total crypto market cap has dropped 41% since its December 2024 peak, falling to $950 billion.

That figure is lower than any level recorded between August 2021 and April 2022, a time when market turbulence was already high.

Altcoins fall 41%

According to Coinbase, the sustained drawdown in altcoins highlights the weakening appetite for riskier crypto investments.

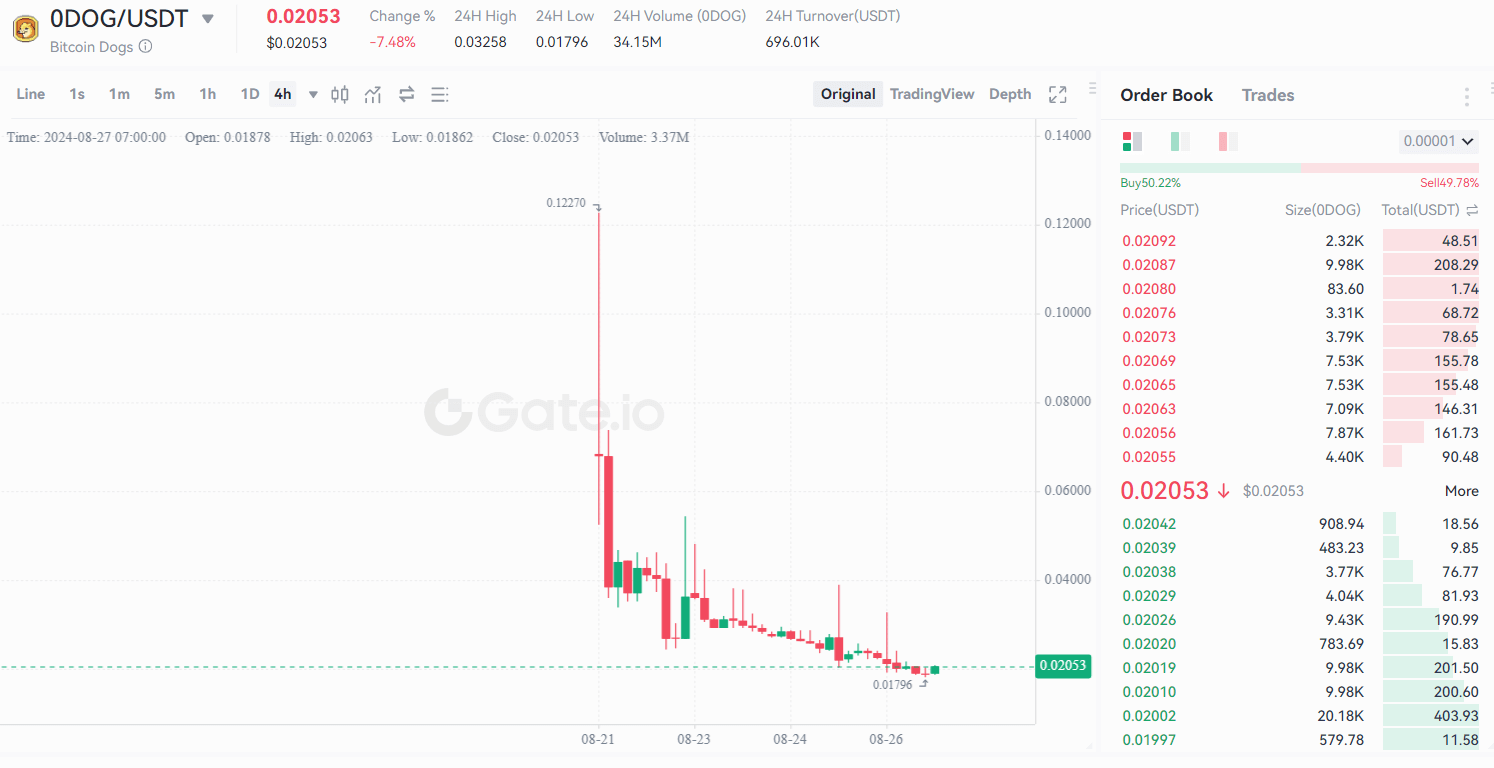

Tokens outside the Bitcoin ecosystem have seen sharp sell-offs amid thin liquidity and a lack of new capital.

The COIN50 index now trades well below its 200-day average, signalling broad technical weakness across the sector.

Retail interest has also declined, while institutional flows remain limited. This suggests that the bullish momentum seen in late 2024 has largely dissipated.

Many smaller projects are underperforming, particularly those in niche segments such as decentralised AI, Web3 gaming, and tokenised real-world assets.

Funding stays low

Coinbase’s report also points to stagnation in venture capital. Although investment volumes have picked up modestly since late 2024, they remain 50% to 60% below the highs recorded during the 2021–2022 cycle.

This has left many early-stage startups without the runway to scale, pushing some to pause development or downsize operations.

The absence of fresh capital has slowed innovation across key verticals.

Many in the industry had expected decentralised finance, metaverse applications, and crypto crowdfunding models to lead the next bull cycle. Instead, these areas have stalled.

Macro weighs on sentiment

Coinbase cited external economic pressures as a major reason for the recent slump.

Tighter monetary policy, high interest rates, and the escalation of global tariffs have all eroded investor confidence.

David Duong, head of institutional research, said the investment environment has become “paralysed” as both traditional and crypto markets face liquidity stress.

These macro headwinds have discouraged speculation and limited the flow of capital into digital assets.

Traders have pulled back, focusing instead on safe-haven assets as geopolitical risk and inflation remain elevated.

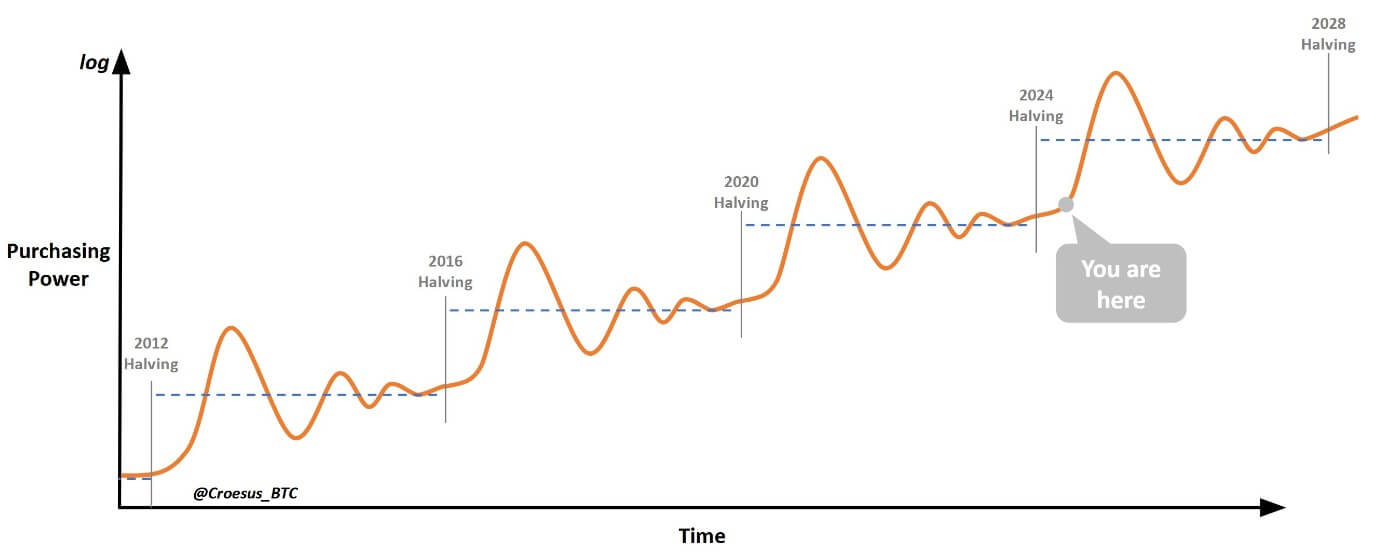

Recovery may follow

Despite the gloom, Coinbase believes the market may find a bottom between mid and late Q2 of 2025.

A stabilisation in macro conditions—particularly a slowdown in inflation or an easing of interest rates—could help revive capital flows.

Coinbase warns of a potential crypto winter as altcoins drop 41% and Bitcoin breaks key support. Market cap falls to $950b, mirroring 2022’s downturn.

According to Duong, sentiment may reset quickly once market stress subsides, opening the door to a recovery in the second half of the year.

The report stops short of making bullish predictions but says tactical positioning may be useful in the current environment. Analysts suggest keeping a close eye on liquidity trends and macro data as potential signals of a shift in momentum.