- Arthur Hayes says the crypto autumn rally will be catalysed by Chinese traders.

- According to the BitMEX co-founder, a weakening of the yuan amid massive credit issuance will drive capital into crypto markets.

- He notes that “Hong Kong will be the conduit through which Chinese capital is allowed to own crypto.”

Arthur Hayes, the co-founder and former CEO of crypto exchange BitMEX, believes the next crypto market rally will be shaped by the Chinese trader.

In an opinion laid out in his latest blog post, Hayes highlights that the US Securities and Exchange Commission (SEC)’s current crackdown on crypto might be a negative trigger. The crypto market is likely to freak out and crater even further due to this.

However, according to the entrepreneur, it is not the US but China that could hold the baton as crypto heads into the next bull market. And the one catalyst to watch out for would be the “return of the Chinese trader” amid the weakening of the Chinese yuan.

“The return of the Chinese crypto trader through the financial pipes of Hong Kong will reignite the market at the same time the broke-ass American mass affluent are effectively shut out,” Hayes wrote in the blog post published June 16.

Hayes explains how China leads the next bull rally

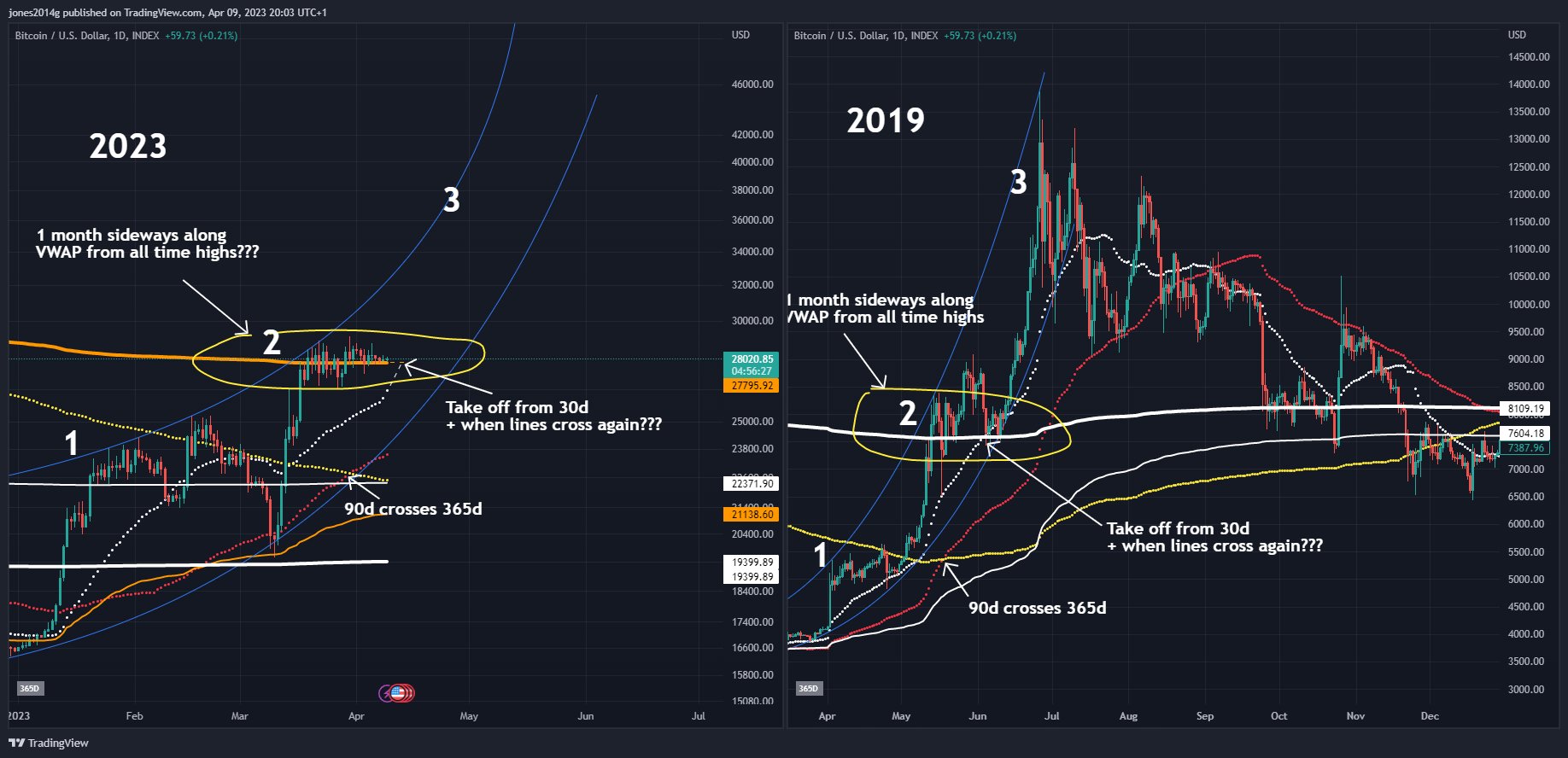

The current market setup is much like the summer of 2015, that “nuclear bear market” whose catalyst was the implosion of Mt. Gox.

Just as then, the 2022 bear market that included the implosion of FTX has volatility and trading volumes dried up and the sideways price action excruciatingly boring. Indeed, compared to 2015 when Bitcoin price traded near $200 for a long time, 2023 is seeing this with prices ranged below $30k since the breakdown in November 2022.

“But in August of 2015, the PBOC suddenly sparked a rally in China’s interest for Bitcoin with a “shock” devaluation vs. the USD. From August to November of 2015, the price of Bitcoin tripled, with Chinese traders driving the market higher. I believe something similar could happen in 2023,” Hayes noted.

According to the BitMEX co-founder, the above is an outlook he sees materializing as the world’s second-largest economy embarks on an insane credit issuance spree. On why selling now amid concerns around the US regulatory environment “is misplaced.” Why?

“At some point, the selling will stop, and then we get the dreaded sideways. The boring sideways price action will reign until something jump starts the degen spirits of crypto traders.”

That trigger, he says, will be a slowdown in China’s economy and the subsequent money printing spree that will weaken the yuan and see massive inflows into crypto. He explained:

“The less the Chinese economy grows, the more credit will be issued. Then the currency will weaken, capital will be allowed to “flee” into appropriate vehicles, and finally, the crypto capital markets will be provided with the spark to hopefully start the autumn rally.”

To weaken the currency, Hayes says the Peoples Bank of China (PBOC) will look to encourage credit growth sectors of the economy deemed “good.” These areas include semiconductors, artificial intelligence (AI), clean energy, and property. The central bank will allow these “good” sectors to access higher loan quotes, with banks “instructed to lend a certain amount of yuan to these sectors.”

The weakening of the yuan, and the focused approach to attracting crypto and blockchain in Hong Kong are going to be key factors, he added. It is a trajectory that best suits HODLers. The crypto bull summed up his market outlook:

“I have predicted before and continue to believe that Hong Kong will be the conduit through which Chinese capital is allowed to own crypto financial assets.”